Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide me the solution Question: Problem 4- Valuing a stock of an oil company in decl Problem 4-Kaluing a stock of an oil company

please provide me the solution

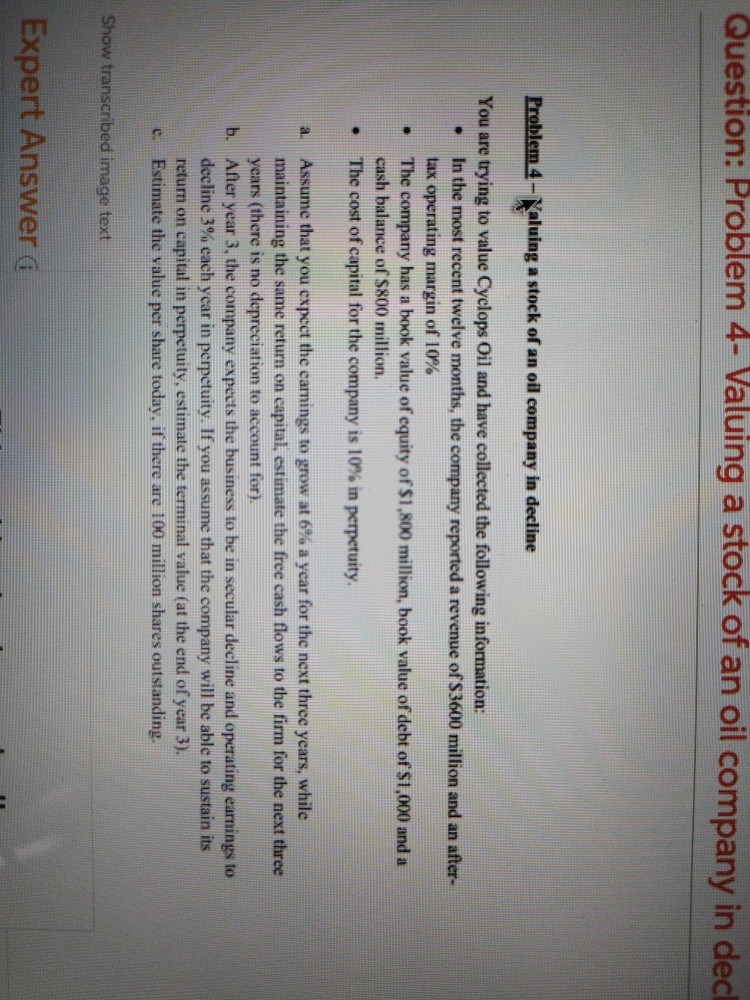

Question: Problem 4- Valuing a stock of an oil company in decl Problem 4-Kaluing a stock of an oil company in decline . You are trying to value Cyclops Oil and have collected the following information: In the most recent twelve months, the company reported a revenue of S3600 million and an after- tax operating margin of 10% The company has a book value of equity of $1,800 million, book value of debt of $1,000 and a cash balance of $800 million. The cost of capital for the company is 10% in perpetuity. . a Assume that you expect the earnings to grow at 6% a year for the next three years, while maintaining the same return on capital, estimate the free cash flows to the firm for the next three years (there is no depreciation to account for). b. After year 3, the company expects the business to be in secular decline and operating earnings to decline 3% each year in perpetuity. If you assume that the company will be able to sustain its retum on capital in perpetuity, estimate the terminal value (at the end of year 3). Estimate the value per share today, if there are 100 million shares outstanding. ci Show transcribed image text Expert Answer aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started