Answered step by step

Verified Expert Solution

Question

1 Approved Answer

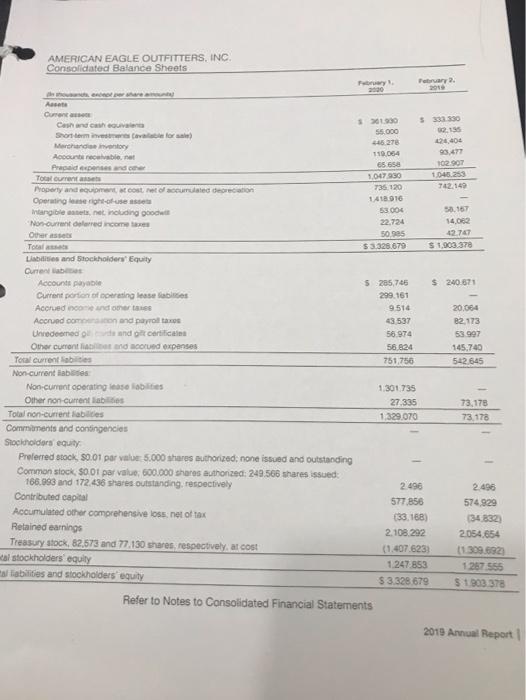

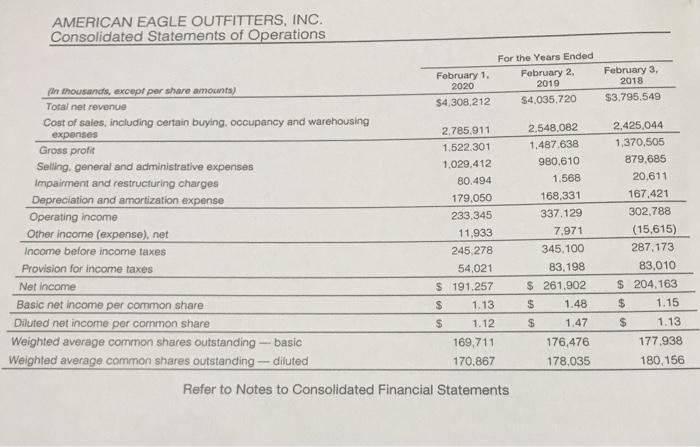

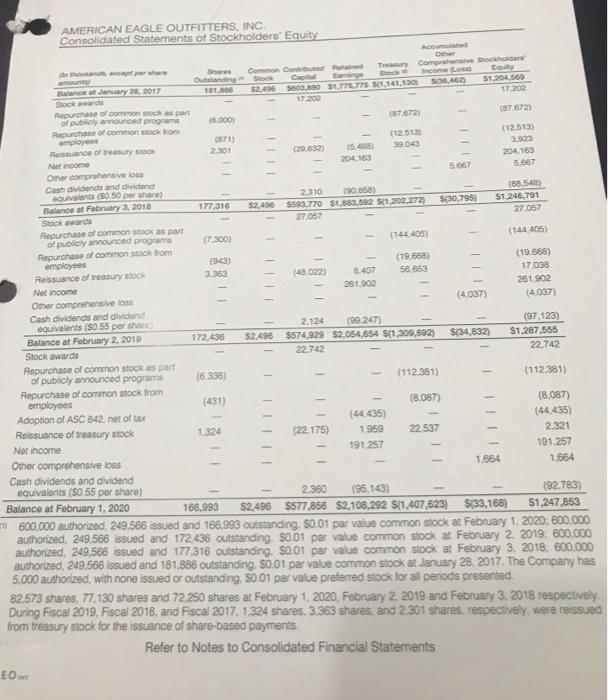

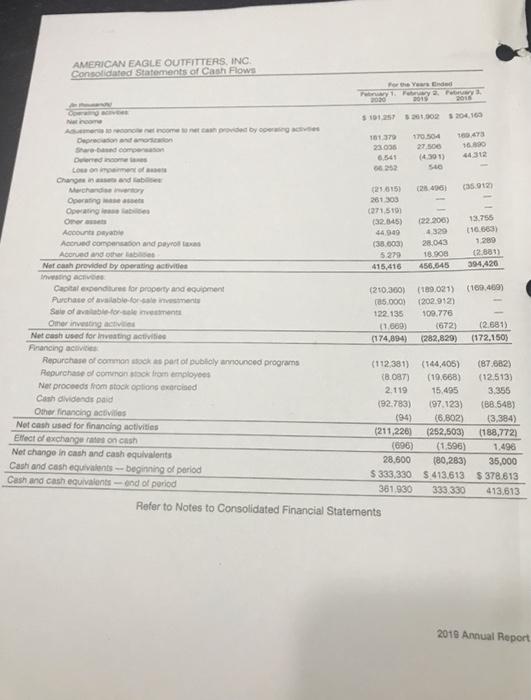

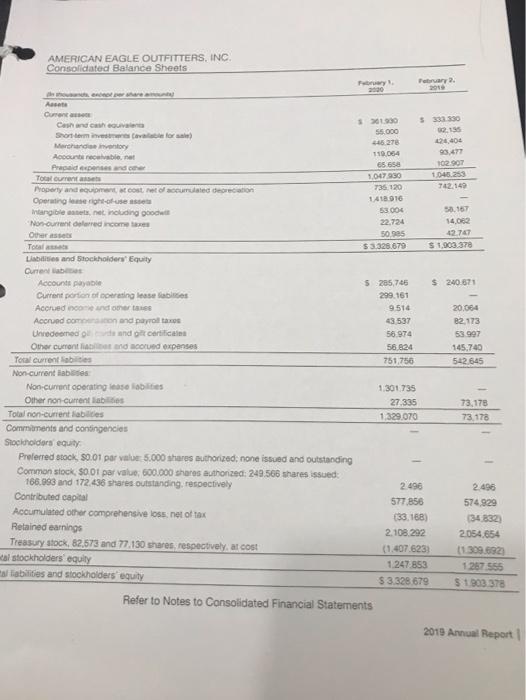

please provide ratios and Explain thank you! AMERICAN EAGLE OUTFITTERS, INC Consolidated Balance Sheets February 2000 15 1980 55.000 5278 11.064 6565 1.047930 735.120 1418916

please provide ratios and Explain thank you!

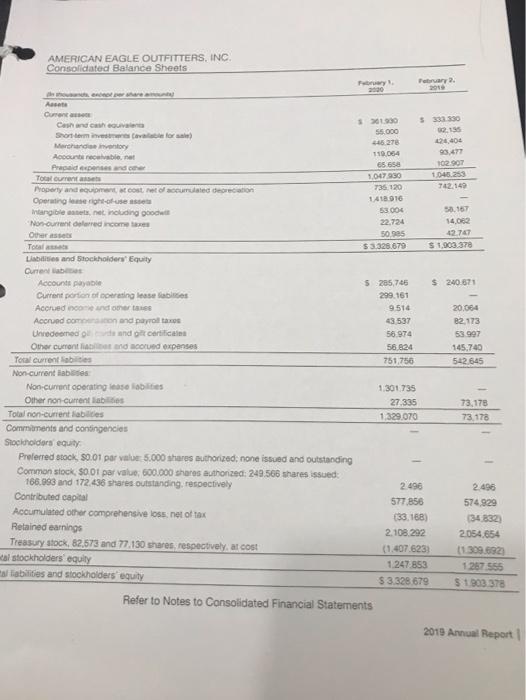

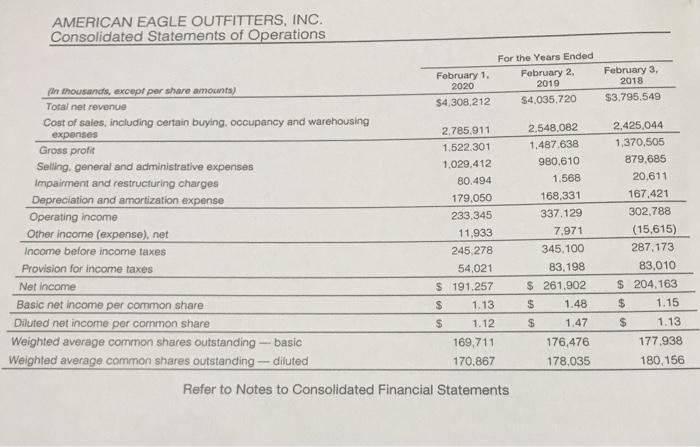

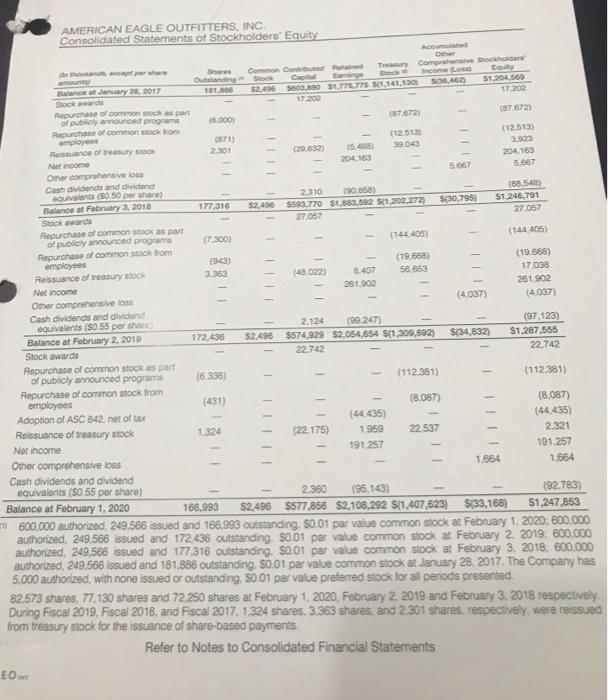

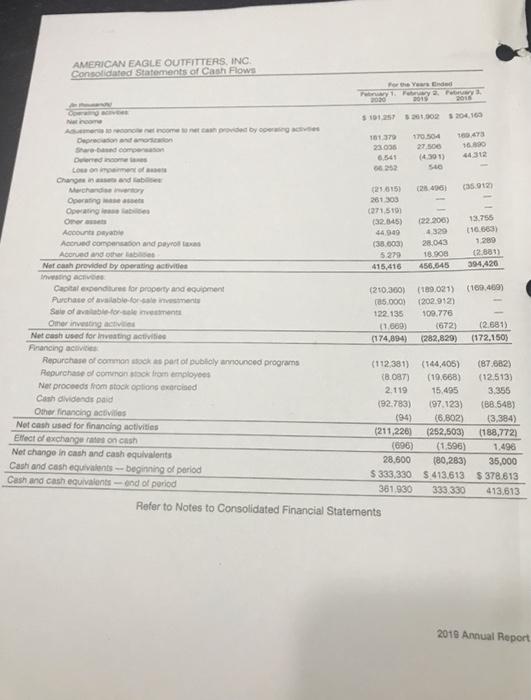

AMERICAN EAGLE OUTFITTERS, INC Consolidated Balance Sheets February 2000 15 1980 55.000 5278 11.064 6565 1.047930 735.120 1418916 53 004 22.724 50,905 $ 3.328.679 93.477 102.907 1045.253 142.149 42.70 $ 1.903.378 $ 240671 by seosa u Anete Corona Cash and chi Srodermie Covora) Merchandise inventory Accounts receivable.net Prepaid expenses and Totalcumentai Property and equipment cost of accumulated rection Operating for Intangibile nel nouding good Non-current arred income Other Total Libises and Stockholders' Equity Quebec Accounts paya Current portion of resing leases Accrued income and more Accrued common and payrols Unredeemed de and or certificama Other current and coued expenses Total Current Sites Non-current liabides Non-current operating lease las Other non current labis Total non-current liabilities Commitments and contingencies Stockholders equity Preferred stock, 30.01 par vals: 5.000 shares authorized: none issued and outstanding Common stock, 5001 par value, 600.000 shares authorized: 249.566 shares issued: 166.003 and 172.438 shares outstanding, respectively Contributed capital Accumulated other comprehensive loss, net of tax Retained earnings Treasury stock. 82,573 and 77.130 shares, respectively at cost al stockholders' equity alabilities and stockholders' equity $285,746 299.161 9514 43 537 56 974 58 824 751.750 20.064 82.173 53 997 145.740 542.645 1.301 735 27.335 1.329,070 73,178 73.178 2.496 577.856 133.188) 2.108,292 (1.407.623 1.247 853 $ 3.328 679 2.496 574929 34 832 2.054.654 1309.692) 1 287 555 $ 1303 378 Refer to Notes to Consolidated Financial Statements 2019 Annual Report February 3, 2018 $3.795.549 AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Operations For the Years Ended February 1. February 2, 2020 2019 On thousands, except per share amounts) Total net revenue $4.308,212 $4.035,720 Cost of sales, including certain buying occupancy and warehousing expenses 2.785.911 2,548,082 Gross profit 1.522.301 1.487.638 Selling, general and administrative expenses 1.029,412 980.610 Impairment and restructuring charges 80.494 1.568 Depreciation and amortization expense 179.050 168,331 Operating income 233.345 337.129 Other income (expense), net 11.933 7.971 Income before income taxes 245 278 345.100 Provision for income taxes 54,021 83,198 Net income $ 191.257 $ 261,902 Basic net income per common share $ 1.13 $ 1.48 Diluted net income per common share $ 1.12 S 1.47 Weighted average common shares outstanding -- basic 169,711 176,476 Weighted average common shares outstanding --- diluted 170.867 178,035 Refer to Notes to Consolidated Financial Statements 2,425.044 1,370,505 879.685 20.611 167.421 302.788 (15.615) 287,173 83,010 $ 204,163 $ 1.15 $ 1.13 177.938 180, 156 3923 5.667 5.687 AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Stockholders' Equity Como con Try Como con Outstanding Stock Earning Income Los Balance at January 20, 2017 181.50 306.4623 51264.560 52.465603.100 51.775.775 561.141.130) Sackwards Repurchase of common stock as part of publicly avunced programs 15.000 087672 Repurchase of common stock from (12513) Ressuance of treasury 2301 30045 Niat income 204,163 One comprehensive Cash dividends and dividend equivalents (50.50 per share 2310 190.656) (88.543) Balance at February 3, 2018 177.316 52,4965598,770 $1.888.592 $11.202.272) 5030,795) $1,248,791 Stock awards 27.057 27.057 Repurchase of common stock as part of publicy announced programs (7.300) (144.406) (144 405) Repurchase of common stock hom employees (1943) (19.668) Reissuance of treasury stock 3.363 8.407 56 653 17038 Net income 261 902 261.902 Other comprehensive (4,037) (4.037) Cash dividends and dividend equivalents (50.55 per sa 2.124 (29247 (97,123) Balance at February 2, 2019 172,436 S2.496 $574,929 $2,054,654 $11.309,692) $(34,832) $1,287,556 Stock awards 22.742 22.742 Repurchase of common stock as part of publicly announced programe (6.336) (112.381) (112.381) Repurchase of common stock from employees (431) 18.087) (8,087) Adoption of ASC 842, net of tax (44435) (44.435) Reissuance of treasury stock 1324 (22,175) 1959 22.537 2.321 Ner income 191 257 191.257 Other comprehensive loss 1.684 1,664 Cash dividends and dividend equivalents (50.55 per share) 2380 (95.143) 192.783) Balance at February 1, 2020 168.993 $2,496 S577,856 $2,108,292 $[1,407,623) $(33,168) $1.247,853 800.000 authorized, 249,568 issued and 166,999 outstanding. 50.01 par value common stock at February 1, 2020: 600.000 authorized, 249,566 issued and 172,436 outstanding. 50.01 par value common stock at February 2. 2019. 600,000 authorized. 249.566 issued and 177 316 outstanding. 50.01 par value common stock at February 3, 2018 600.000 authorized, 249,568 issued and 181.888 outstanding, 30.01 par value common stock at January 28, 2017. The Company has 5,000 authorized with none issued or outstanding. S001 par value preferred stock for all periods presented 82.573 shares, 77,130 shares and 72.250 shares at February 1, 2020. February 2 2019 and February 3, 2018 respectively During Fiscal 2019, Fiscal 2018, and Fiscal 2017, 1.324 shares. 3.363 shares, and 2.301 shares, respectively, were reissued from treasury stock for the issuance of share-based payments Refer to Notes to Consolidated Financial Statements 1 II :- EO AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Cash Flows Forever Ended 2013 35.91 Derendam 16137 170.504 23036 Dedem (4301) 44312 SO Change in and 125,6151 Operating 261 303 Operating (2715101 Omer (32.845) 122.206) 13.755 Acous 44.000 116.663) Acord compensation and payrol (38.000 28.043 1.289 Accrued and other 5270 18.908 12881) Not cash provided by operating active 415,416 456,645 394,420 Austing active Capital expenditures for property and equipment 1210,300) (169.021) (109.409) Purchase of available forcement (05.000 1202 912) Sale of vocalement 122.135 109.776 Oiner investing activ 11.600) 1672) (2.681) Net cash and for inviting av (174,894) (282.820) (172.150) Financing activi Repurchase of common stock as part of publicly announced programs (112 381) (144,405) (87.682) Repurchase of convonokrom employees 18.087) (19,688) (12513) Ner proceeds from stock options exercised 2.119 15.495 3.355 Cash dividends paid (82-783) 197.123) (BB.548) Other financing activities Netcash used for financing activities (6.802) (3,384) (211,2261 (252,503) Effect of exchange rates on cash (188,7721 (696) Net change in cash and cash equivalents (1.596) 1.496 28,600 Cash and cash equivalents -- Beginning of period (80,283) 35,000 Cash and cash equivalents - ond of period S 333,330 5.413.613 $378.613 381.930 333 330 413.613 Refer to Notes to Consolidated Financial Statements 2019 Annual Report AMERICAN EAGLE OUTFITTERS, INC Consolidated Balance Sheets February 2000 15 1980 55.000 5278 11.064 6565 1.047930 735.120 1418916 53 004 22.724 50,905 $ 3.328.679 93.477 102.907 1045.253 142.149 42.70 $ 1.903.378 $ 240671 by seosa u Anete Corona Cash and chi Srodermie Covora) Merchandise inventory Accounts receivable.net Prepaid expenses and Totalcumentai Property and equipment cost of accumulated rection Operating for Intangibile nel nouding good Non-current arred income Other Total Libises and Stockholders' Equity Quebec Accounts paya Current portion of resing leases Accrued income and more Accrued common and payrols Unredeemed de and or certificama Other current and coued expenses Total Current Sites Non-current liabides Non-current operating lease las Other non current labis Total non-current liabilities Commitments and contingencies Stockholders equity Preferred stock, 30.01 par vals: 5.000 shares authorized: none issued and outstanding Common stock, 5001 par value, 600.000 shares authorized: 249.566 shares issued: 166.003 and 172.438 shares outstanding, respectively Contributed capital Accumulated other comprehensive loss, net of tax Retained earnings Treasury stock. 82,573 and 77.130 shares, respectively at cost al stockholders' equity alabilities and stockholders' equity $285,746 299.161 9514 43 537 56 974 58 824 751.750 20.064 82.173 53 997 145.740 542.645 1.301 735 27.335 1.329,070 73,178 73.178 2.496 577.856 133.188) 2.108,292 (1.407.623 1.247 853 $ 3.328 679 2.496 574929 34 832 2.054.654 1309.692) 1 287 555 $ 1303 378 Refer to Notes to Consolidated Financial Statements 2019 Annual Report February 3, 2018 $3.795.549 AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Operations For the Years Ended February 1. February 2, 2020 2019 On thousands, except per share amounts) Total net revenue $4.308,212 $4.035,720 Cost of sales, including certain buying occupancy and warehousing expenses 2.785.911 2,548,082 Gross profit 1.522.301 1.487.638 Selling, general and administrative expenses 1.029,412 980.610 Impairment and restructuring charges 80.494 1.568 Depreciation and amortization expense 179.050 168,331 Operating income 233.345 337.129 Other income (expense), net 11.933 7.971 Income before income taxes 245 278 345.100 Provision for income taxes 54,021 83,198 Net income $ 191.257 $ 261,902 Basic net income per common share $ 1.13 $ 1.48 Diluted net income per common share $ 1.12 S 1.47 Weighted average common shares outstanding -- basic 169,711 176,476 Weighted average common shares outstanding --- diluted 170.867 178,035 Refer to Notes to Consolidated Financial Statements 2,425.044 1,370,505 879.685 20.611 167.421 302.788 (15.615) 287,173 83,010 $ 204,163 $ 1.15 $ 1.13 177.938 180, 156 3923 5.667 5.687 AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Stockholders' Equity Como con Try Como con Outstanding Stock Earning Income Los Balance at January 20, 2017 181.50 306.4623 51264.560 52.465603.100 51.775.775 561.141.130) Sackwards Repurchase of common stock as part of publicly avunced programs 15.000 087672 Repurchase of common stock from (12513) Ressuance of treasury 2301 30045 Niat income 204,163 One comprehensive Cash dividends and dividend equivalents (50.50 per share 2310 190.656) (88.543) Balance at February 3, 2018 177.316 52,4965598,770 $1.888.592 $11.202.272) 5030,795) $1,248,791 Stock awards 27.057 27.057 Repurchase of common stock as part of publicy announced programs (7.300) (144.406) (144 405) Repurchase of common stock hom employees (1943) (19.668) Reissuance of treasury stock 3.363 8.407 56 653 17038 Net income 261 902 261.902 Other comprehensive (4,037) (4.037) Cash dividends and dividend equivalents (50.55 per sa 2.124 (29247 (97,123) Balance at February 2, 2019 172,436 S2.496 $574,929 $2,054,654 $11.309,692) $(34,832) $1,287,556 Stock awards 22.742 22.742 Repurchase of common stock as part of publicly announced programe (6.336) (112.381) (112.381) Repurchase of common stock from employees (431) 18.087) (8,087) Adoption of ASC 842, net of tax (44435) (44.435) Reissuance of treasury stock 1324 (22,175) 1959 22.537 2.321 Ner income 191 257 191.257 Other comprehensive loss 1.684 1,664 Cash dividends and dividend equivalents (50.55 per share) 2380 (95.143) 192.783) Balance at February 1, 2020 168.993 $2,496 S577,856 $2,108,292 $[1,407,623) $(33,168) $1.247,853 800.000 authorized, 249,568 issued and 166,999 outstanding. 50.01 par value common stock at February 1, 2020: 600.000 authorized, 249,566 issued and 172,436 outstanding. 50.01 par value common stock at February 2. 2019. 600,000 authorized. 249.566 issued and 177 316 outstanding. 50.01 par value common stock at February 3, 2018 600.000 authorized, 249,568 issued and 181.888 outstanding, 30.01 par value common stock at January 28, 2017. The Company has 5,000 authorized with none issued or outstanding. S001 par value preferred stock for all periods presented 82.573 shares, 77,130 shares and 72.250 shares at February 1, 2020. February 2 2019 and February 3, 2018 respectively During Fiscal 2019, Fiscal 2018, and Fiscal 2017, 1.324 shares. 3.363 shares, and 2.301 shares, respectively, were reissued from treasury stock for the issuance of share-based payments Refer to Notes to Consolidated Financial Statements 1 II :- EO AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Cash Flows Forever Ended 2013 35.91 Derendam 16137 170.504 23036 Dedem (4301) 44312 SO Change in and 125,6151 Operating 261 303 Operating (2715101 Omer (32.845) 122.206) 13.755 Acous 44.000 116.663) Acord compensation and payrol (38.000 28.043 1.289 Accrued and other 5270 18.908 12881) Not cash provided by operating active 415,416 456,645 394,420 Austing active Capital expenditures for property and equipment 1210,300) (169.021) (109.409) Purchase of available forcement (05.000 1202 912) Sale of vocalement 122.135 109.776 Oiner investing activ 11.600) 1672) (2.681) Net cash and for inviting av (174,894) (282.820) (172.150) Financing activi Repurchase of common stock as part of publicly announced programs (112 381) (144,405) (87.682) Repurchase of convonokrom employees 18.087) (19,688) (12513) Ner proceeds from stock options exercised 2.119 15.495 3.355 Cash dividends paid (82-783) 197.123) (BB.548) Other financing activities Netcash used for financing activities (6.802) (3,384) (211,2261 (252,503) Effect of exchange rates on cash (188,7721 (696) Net change in cash and cash equivalents (1.596) 1.496 28,600 Cash and cash equivalents -- Beginning of period (80,283) 35,000 Cash and cash equivalents - ond of period S 333,330 5.413.613 $378.613 381.930 333 330 413.613 Refer to Notes to Consolidated Financial Statements 2019 Annual Report

AMERICAN EAGLE OUTFITTERS, INC Consolidated Balance Sheets February 2000 15 1980 55.000 5278 11.064 6565 1.047930 735.120 1418916 53 004 22.724 50,905 $ 3.328.679 93.477 102.907 1045.253 142.149 42.70 $ 1.903.378 $ 240671 by seosa u Anete Corona Cash and chi Srodermie Covora) Merchandise inventory Accounts receivable.net Prepaid expenses and Totalcumentai Property and equipment cost of accumulated rection Operating for Intangibile nel nouding good Non-current arred income Other Total Libises and Stockholders' Equity Quebec Accounts paya Current portion of resing leases Accrued income and more Accrued common and payrols Unredeemed de and or certificama Other current and coued expenses Total Current Sites Non-current liabides Non-current operating lease las Other non current labis Total non-current liabilities Commitments and contingencies Stockholders equity Preferred stock, 30.01 par vals: 5.000 shares authorized: none issued and outstanding Common stock, 5001 par value, 600.000 shares authorized: 249.566 shares issued: 166.003 and 172.438 shares outstanding, respectively Contributed capital Accumulated other comprehensive loss, net of tax Retained earnings Treasury stock. 82,573 and 77.130 shares, respectively at cost al stockholders' equity alabilities and stockholders' equity $285,746 299.161 9514 43 537 56 974 58 824 751.750 20.064 82.173 53 997 145.740 542.645 1.301 735 27.335 1.329,070 73,178 73.178 2.496 577.856 133.188) 2.108,292 (1.407.623 1.247 853 $ 3.328 679 2.496 574929 34 832 2.054.654 1309.692) 1 287 555 $ 1303 378 Refer to Notes to Consolidated Financial Statements 2019 Annual Report February 3, 2018 $3.795.549 AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Operations For the Years Ended February 1. February 2, 2020 2019 On thousands, except per share amounts) Total net revenue $4.308,212 $4.035,720 Cost of sales, including certain buying occupancy and warehousing expenses 2.785.911 2,548,082 Gross profit 1.522.301 1.487.638 Selling, general and administrative expenses 1.029,412 980.610 Impairment and restructuring charges 80.494 1.568 Depreciation and amortization expense 179.050 168,331 Operating income 233.345 337.129 Other income (expense), net 11.933 7.971 Income before income taxes 245 278 345.100 Provision for income taxes 54,021 83,198 Net income $ 191.257 $ 261,902 Basic net income per common share $ 1.13 $ 1.48 Diluted net income per common share $ 1.12 S 1.47 Weighted average common shares outstanding -- basic 169,711 176,476 Weighted average common shares outstanding --- diluted 170.867 178,035 Refer to Notes to Consolidated Financial Statements 2,425.044 1,370,505 879.685 20.611 167.421 302.788 (15.615) 287,173 83,010 $ 204,163 $ 1.15 $ 1.13 177.938 180, 156 3923 5.667 5.687 AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Stockholders' Equity Como con Try Como con Outstanding Stock Earning Income Los Balance at January 20, 2017 181.50 306.4623 51264.560 52.465603.100 51.775.775 561.141.130) Sackwards Repurchase of common stock as part of publicly avunced programs 15.000 087672 Repurchase of common stock from (12513) Ressuance of treasury 2301 30045 Niat income 204,163 One comprehensive Cash dividends and dividend equivalents (50.50 per share 2310 190.656) (88.543) Balance at February 3, 2018 177.316 52,4965598,770 $1.888.592 $11.202.272) 5030,795) $1,248,791 Stock awards 27.057 27.057 Repurchase of common stock as part of publicy announced programs (7.300) (144.406) (144 405) Repurchase of common stock hom employees (1943) (19.668) Reissuance of treasury stock 3.363 8.407 56 653 17038 Net income 261 902 261.902 Other comprehensive (4,037) (4.037) Cash dividends and dividend equivalents (50.55 per sa 2.124 (29247 (97,123) Balance at February 2, 2019 172,436 S2.496 $574,929 $2,054,654 $11.309,692) $(34,832) $1,287,556 Stock awards 22.742 22.742 Repurchase of common stock as part of publicly announced programe (6.336) (112.381) (112.381) Repurchase of common stock from employees (431) 18.087) (8,087) Adoption of ASC 842, net of tax (44435) (44.435) Reissuance of treasury stock 1324 (22,175) 1959 22.537 2.321 Ner income 191 257 191.257 Other comprehensive loss 1.684 1,664 Cash dividends and dividend equivalents (50.55 per share) 2380 (95.143) 192.783) Balance at February 1, 2020 168.993 $2,496 S577,856 $2,108,292 $[1,407,623) $(33,168) $1.247,853 800.000 authorized, 249,568 issued and 166,999 outstanding. 50.01 par value common stock at February 1, 2020: 600.000 authorized, 249,566 issued and 172,436 outstanding. 50.01 par value common stock at February 2. 2019. 600,000 authorized. 249.566 issued and 177 316 outstanding. 50.01 par value common stock at February 3, 2018 600.000 authorized, 249,568 issued and 181.888 outstanding, 30.01 par value common stock at January 28, 2017. The Company has 5,000 authorized with none issued or outstanding. S001 par value preferred stock for all periods presented 82.573 shares, 77,130 shares and 72.250 shares at February 1, 2020. February 2 2019 and February 3, 2018 respectively During Fiscal 2019, Fiscal 2018, and Fiscal 2017, 1.324 shares. 3.363 shares, and 2.301 shares, respectively, were reissued from treasury stock for the issuance of share-based payments Refer to Notes to Consolidated Financial Statements 1 II :- EO AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Cash Flows Forever Ended 2013 35.91 Derendam 16137 170.504 23036 Dedem (4301) 44312 SO Change in and 125,6151 Operating 261 303 Operating (2715101 Omer (32.845) 122.206) 13.755 Acous 44.000 116.663) Acord compensation and payrol (38.000 28.043 1.289 Accrued and other 5270 18.908 12881) Not cash provided by operating active 415,416 456,645 394,420 Austing active Capital expenditures for property and equipment 1210,300) (169.021) (109.409) Purchase of available forcement (05.000 1202 912) Sale of vocalement 122.135 109.776 Oiner investing activ 11.600) 1672) (2.681) Net cash and for inviting av (174,894) (282.820) (172.150) Financing activi Repurchase of common stock as part of publicly announced programs (112 381) (144,405) (87.682) Repurchase of convonokrom employees 18.087) (19,688) (12513) Ner proceeds from stock options exercised 2.119 15.495 3.355 Cash dividends paid (82-783) 197.123) (BB.548) Other financing activities Netcash used for financing activities (6.802) (3,384) (211,2261 (252,503) Effect of exchange rates on cash (188,7721 (696) Net change in cash and cash equivalents (1.596) 1.496 28,600 Cash and cash equivalents -- Beginning of period (80,283) 35,000 Cash and cash equivalents - ond of period S 333,330 5.413.613 $378.613 381.930 333 330 413.613 Refer to Notes to Consolidated Financial Statements 2019 Annual Report AMERICAN EAGLE OUTFITTERS, INC Consolidated Balance Sheets February 2000 15 1980 55.000 5278 11.064 6565 1.047930 735.120 1418916 53 004 22.724 50,905 $ 3.328.679 93.477 102.907 1045.253 142.149 42.70 $ 1.903.378 $ 240671 by seosa u Anete Corona Cash and chi Srodermie Covora) Merchandise inventory Accounts receivable.net Prepaid expenses and Totalcumentai Property and equipment cost of accumulated rection Operating for Intangibile nel nouding good Non-current arred income Other Total Libises and Stockholders' Equity Quebec Accounts paya Current portion of resing leases Accrued income and more Accrued common and payrols Unredeemed de and or certificama Other current and coued expenses Total Current Sites Non-current liabides Non-current operating lease las Other non current labis Total non-current liabilities Commitments and contingencies Stockholders equity Preferred stock, 30.01 par vals: 5.000 shares authorized: none issued and outstanding Common stock, 5001 par value, 600.000 shares authorized: 249.566 shares issued: 166.003 and 172.438 shares outstanding, respectively Contributed capital Accumulated other comprehensive loss, net of tax Retained earnings Treasury stock. 82,573 and 77.130 shares, respectively at cost al stockholders' equity alabilities and stockholders' equity $285,746 299.161 9514 43 537 56 974 58 824 751.750 20.064 82.173 53 997 145.740 542.645 1.301 735 27.335 1.329,070 73,178 73.178 2.496 577.856 133.188) 2.108,292 (1.407.623 1.247 853 $ 3.328 679 2.496 574929 34 832 2.054.654 1309.692) 1 287 555 $ 1303 378 Refer to Notes to Consolidated Financial Statements 2019 Annual Report February 3, 2018 $3.795.549 AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Operations For the Years Ended February 1. February 2, 2020 2019 On thousands, except per share amounts) Total net revenue $4.308,212 $4.035,720 Cost of sales, including certain buying occupancy and warehousing expenses 2.785.911 2,548,082 Gross profit 1.522.301 1.487.638 Selling, general and administrative expenses 1.029,412 980.610 Impairment and restructuring charges 80.494 1.568 Depreciation and amortization expense 179.050 168,331 Operating income 233.345 337.129 Other income (expense), net 11.933 7.971 Income before income taxes 245 278 345.100 Provision for income taxes 54,021 83,198 Net income $ 191.257 $ 261,902 Basic net income per common share $ 1.13 $ 1.48 Diluted net income per common share $ 1.12 S 1.47 Weighted average common shares outstanding -- basic 169,711 176,476 Weighted average common shares outstanding --- diluted 170.867 178,035 Refer to Notes to Consolidated Financial Statements 2,425.044 1,370,505 879.685 20.611 167.421 302.788 (15.615) 287,173 83,010 $ 204,163 $ 1.15 $ 1.13 177.938 180, 156 3923 5.667 5.687 AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Stockholders' Equity Como con Try Como con Outstanding Stock Earning Income Los Balance at January 20, 2017 181.50 306.4623 51264.560 52.465603.100 51.775.775 561.141.130) Sackwards Repurchase of common stock as part of publicly avunced programs 15.000 087672 Repurchase of common stock from (12513) Ressuance of treasury 2301 30045 Niat income 204,163 One comprehensive Cash dividends and dividend equivalents (50.50 per share 2310 190.656) (88.543) Balance at February 3, 2018 177.316 52,4965598,770 $1.888.592 $11.202.272) 5030,795) $1,248,791 Stock awards 27.057 27.057 Repurchase of common stock as part of publicy announced programs (7.300) (144.406) (144 405) Repurchase of common stock hom employees (1943) (19.668) Reissuance of treasury stock 3.363 8.407 56 653 17038 Net income 261 902 261.902 Other comprehensive (4,037) (4.037) Cash dividends and dividend equivalents (50.55 per sa 2.124 (29247 (97,123) Balance at February 2, 2019 172,436 S2.496 $574,929 $2,054,654 $11.309,692) $(34,832) $1,287,556 Stock awards 22.742 22.742 Repurchase of common stock as part of publicly announced programe (6.336) (112.381) (112.381) Repurchase of common stock from employees (431) 18.087) (8,087) Adoption of ASC 842, net of tax (44435) (44.435) Reissuance of treasury stock 1324 (22,175) 1959 22.537 2.321 Ner income 191 257 191.257 Other comprehensive loss 1.684 1,664 Cash dividends and dividend equivalents (50.55 per share) 2380 (95.143) 192.783) Balance at February 1, 2020 168.993 $2,496 S577,856 $2,108,292 $[1,407,623) $(33,168) $1.247,853 800.000 authorized, 249,568 issued and 166,999 outstanding. 50.01 par value common stock at February 1, 2020: 600.000 authorized, 249,566 issued and 172,436 outstanding. 50.01 par value common stock at February 2. 2019. 600,000 authorized. 249.566 issued and 177 316 outstanding. 50.01 par value common stock at February 3, 2018 600.000 authorized, 249,568 issued and 181.888 outstanding, 30.01 par value common stock at January 28, 2017. The Company has 5,000 authorized with none issued or outstanding. S001 par value preferred stock for all periods presented 82.573 shares, 77,130 shares and 72.250 shares at February 1, 2020. February 2 2019 and February 3, 2018 respectively During Fiscal 2019, Fiscal 2018, and Fiscal 2017, 1.324 shares. 3.363 shares, and 2.301 shares, respectively, were reissued from treasury stock for the issuance of share-based payments Refer to Notes to Consolidated Financial Statements 1 II :- EO AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Cash Flows Forever Ended 2013 35.91 Derendam 16137 170.504 23036 Dedem (4301) 44312 SO Change in and 125,6151 Operating 261 303 Operating (2715101 Omer (32.845) 122.206) 13.755 Acous 44.000 116.663) Acord compensation and payrol (38.000 28.043 1.289 Accrued and other 5270 18.908 12881) Not cash provided by operating active 415,416 456,645 394,420 Austing active Capital expenditures for property and equipment 1210,300) (169.021) (109.409) Purchase of available forcement (05.000 1202 912) Sale of vocalement 122.135 109.776 Oiner investing activ 11.600) 1672) (2.681) Net cash and for inviting av (174,894) (282.820) (172.150) Financing activi Repurchase of common stock as part of publicly announced programs (112 381) (144,405) (87.682) Repurchase of convonokrom employees 18.087) (19,688) (12513) Ner proceeds from stock options exercised 2.119 15.495 3.355 Cash dividends paid (82-783) 197.123) (BB.548) Other financing activities Netcash used for financing activities (6.802) (3,384) (211,2261 (252,503) Effect of exchange rates on cash (188,7721 (696) Net change in cash and cash equivalents (1.596) 1.496 28,600 Cash and cash equivalents -- Beginning of period (80,283) 35,000 Cash and cash equivalents - ond of period S 333,330 5.413.613 $378.613 381.930 333 330 413.613 Refer to Notes to Consolidated Financial Statements 2019 Annual Report

please provide ratios and Explain thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started