Please provide reasoning for your answer.

Please provide reasoning for your answer.

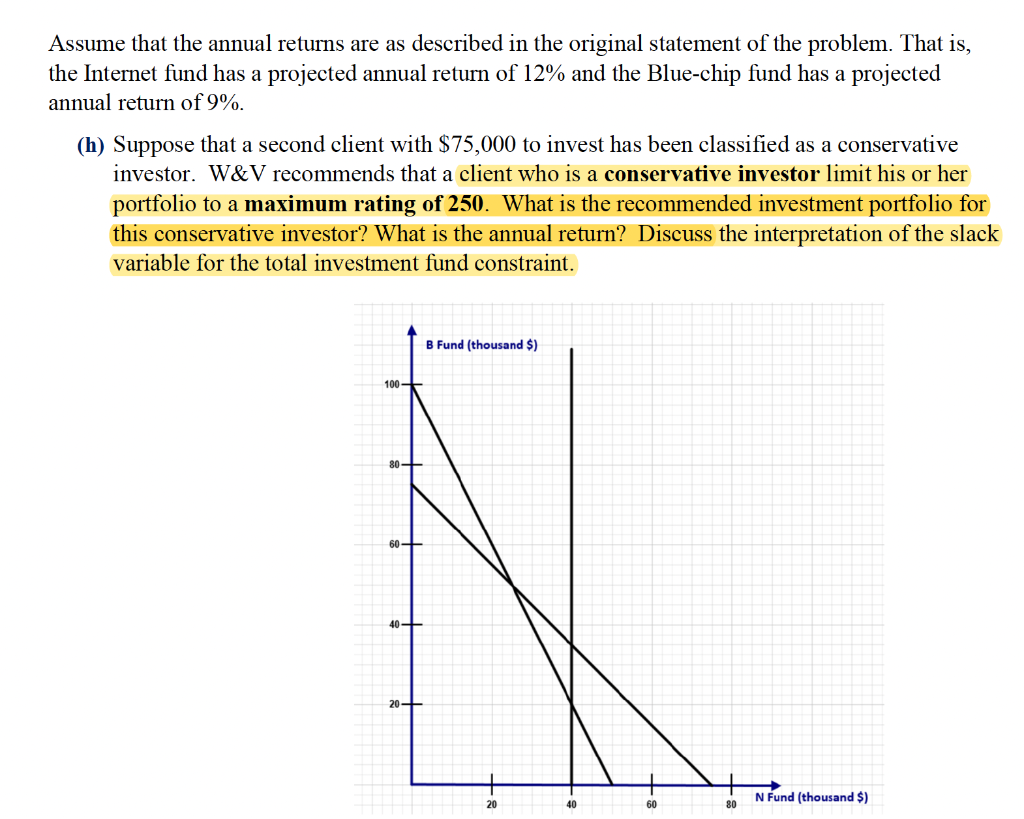

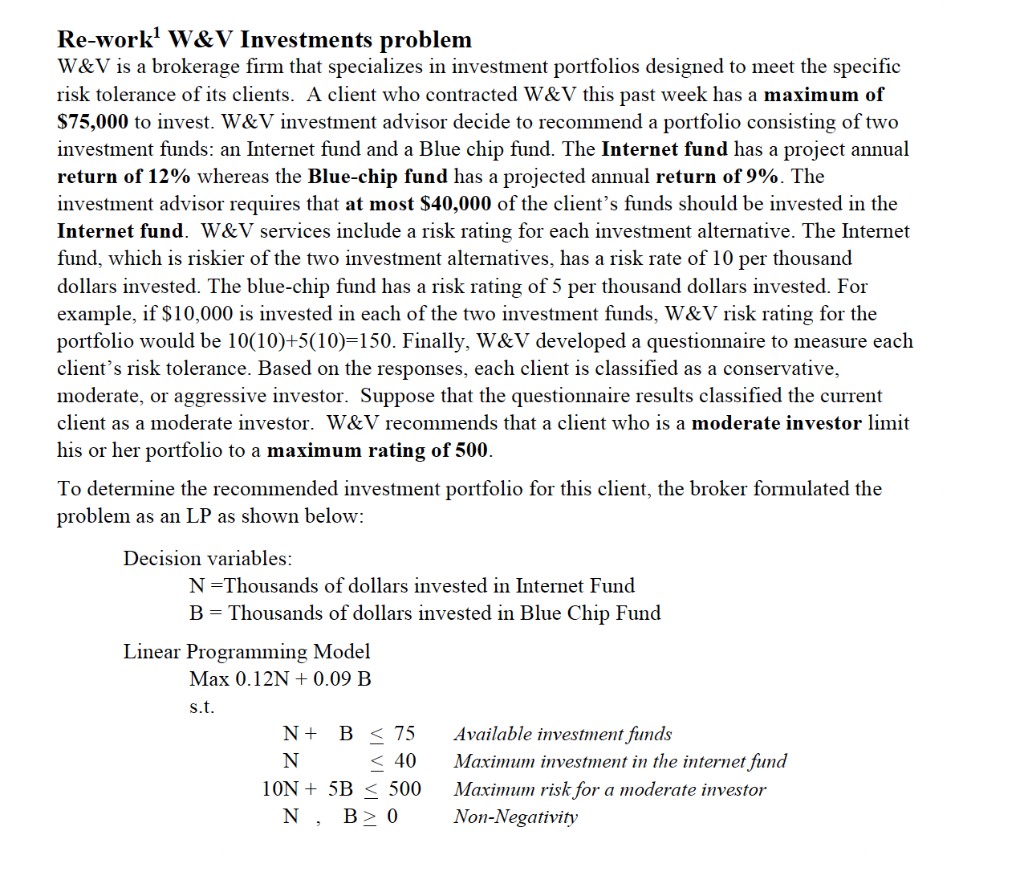

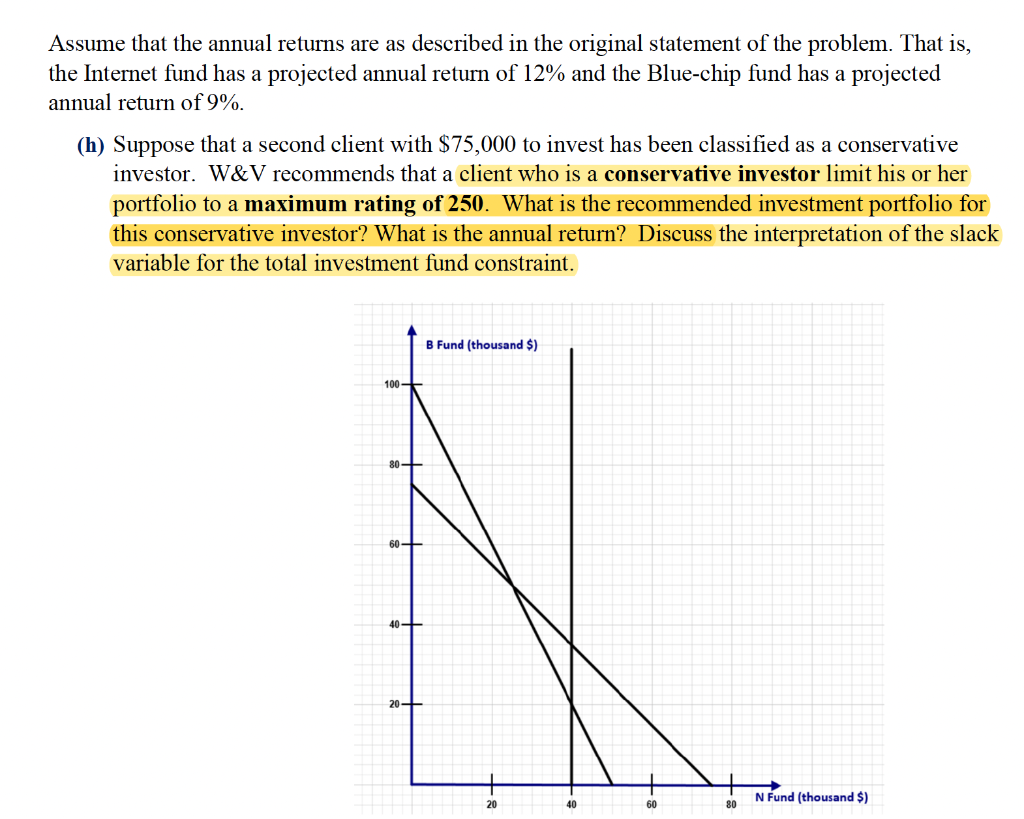

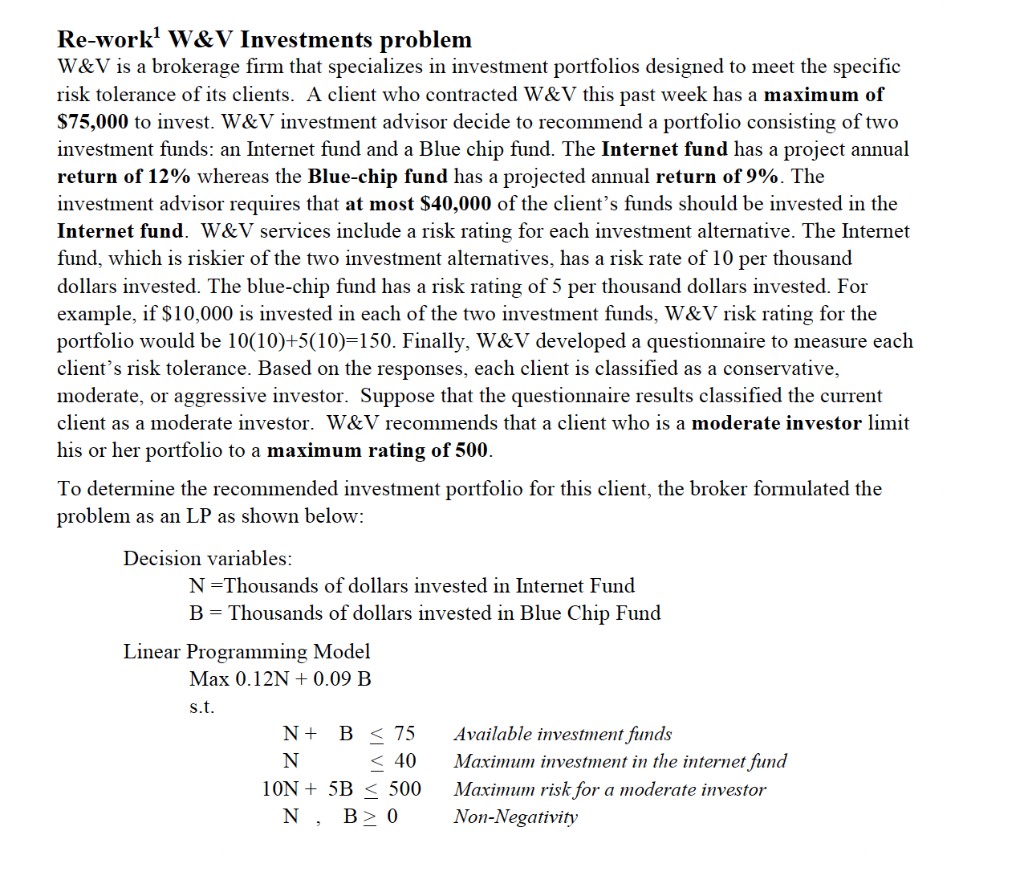

Assume that the annual returns are as described in the original statement of the problem. That is, the Internet fund has a projected annual return of 12% and the Blue-chip fund has a projected annual return of 9%. (h) Suppose that a second client with $75,000 to invest has been classified as a conservative investor. W\&V recommends that a client who is a conservative investor limit his or her portfolio to a maximum rating of 250. What is the recommended investment portfolio for this conservative investor? What is the annual return? Discuss the interpretation of the slack variable for the total investment fund constraint. Re-work 1 W\&V Investments problem W&V is a brokerage firm that specializes in investment portfolios designed to meet the specific risk tolerance of its clients. A client who contracted W&V this past week has a maximum of $75,000 to invest. W\&V investment advisor decide to recommend a portfolio consisting of two investment funds: an Internet fund and a Blue chip fund. The Internet fund has a project annual return of 12% whereas the Blue-chip fund has a projected annual return of 9%. The investment advisor requires that at most $40,000 of the client's funds should be invested in the Internet fund. W\&V services include a risk rating for each investment alternative. The Internet fund, which is riskier of the two investment alternatives, has a risk rate of 10 per thousand dollars invested. The blue-chip fund has a risk rating of 5 per thousand dollars invested. For example, if $10,000 is invested in each of the two investment funds, W\&V risk rating for the portfolio would be 10(10)+5(10)=150. Finally, W\&V developed a questionnaire to measure each client's risk tolerance. Based on the responses, each client is classified as a conservative, moderate, or aggressive investor. Suppose that the questionnaire results classified the current client as a moderate investor. W\&V recommends that a client who is a moderate investor limit his or her portfolio to a maximum rating of 500. To determine the recommended investment portfolio for this client, the broker formulated the problem as an LP as shown below: Decision variables: N= Thousands of dollars invested in Internet Fund B= Thousands of dollars invested in Blue Chip Fund Linear Programming Model Max s.t. Assume that the annual returns are as described in the original statement of the problem. That is, the Internet fund has a projected annual return of 12% and the Blue-chip fund has a projected annual return of 9%. (h) Suppose that a second client with $75,000 to invest has been classified as a conservative investor. W\&V recommends that a client who is a conservative investor limit his or her portfolio to a maximum rating of 250. What is the recommended investment portfolio for this conservative investor? What is the annual return? Discuss the interpretation of the slack variable for the total investment fund constraint. Re-work 1 W\&V Investments problem W&V is a brokerage firm that specializes in investment portfolios designed to meet the specific risk tolerance of its clients. A client who contracted W&V this past week has a maximum of $75,000 to invest. W\&V investment advisor decide to recommend a portfolio consisting of two investment funds: an Internet fund and a Blue chip fund. The Internet fund has a project annual return of 12% whereas the Blue-chip fund has a projected annual return of 9%. The investment advisor requires that at most $40,000 of the client's funds should be invested in the Internet fund. W\&V services include a risk rating for each investment alternative. The Internet fund, which is riskier of the two investment alternatives, has a risk rate of 10 per thousand dollars invested. The blue-chip fund has a risk rating of 5 per thousand dollars invested. For example, if $10,000 is invested in each of the two investment funds, W\&V risk rating for the portfolio would be 10(10)+5(10)=150. Finally, W\&V developed a questionnaire to measure each client's risk tolerance. Based on the responses, each client is classified as a conservative, moderate, or aggressive investor. Suppose that the questionnaire results classified the current client as a moderate investor. W\&V recommends that a client who is a moderate investor limit his or her portfolio to a maximum rating of 500. To determine the recommended investment portfolio for this client, the broker formulated the problem as an LP as shown below: Decision variables: N= Thousands of dollars invested in Internet Fund B= Thousands of dollars invested in Blue Chip Fund Linear Programming Model Max s.t

Please provide reasoning for your answer.

Please provide reasoning for your answer.