Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide required material for both. 2 one just common fixed expenses is needed. thank you, thumbs up will follow! Polaskl Company manufactures and sells

please provide required material for both. 2 one just "common fixed expenses" is needed. thank you, thumbs up will follow!

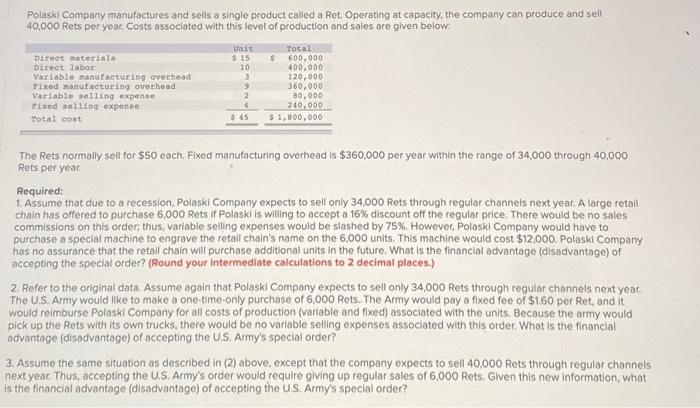

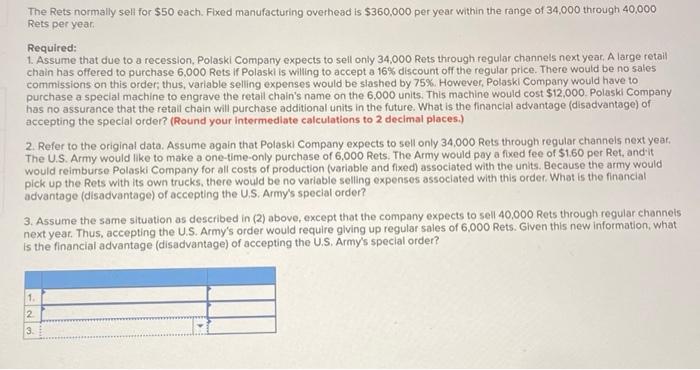

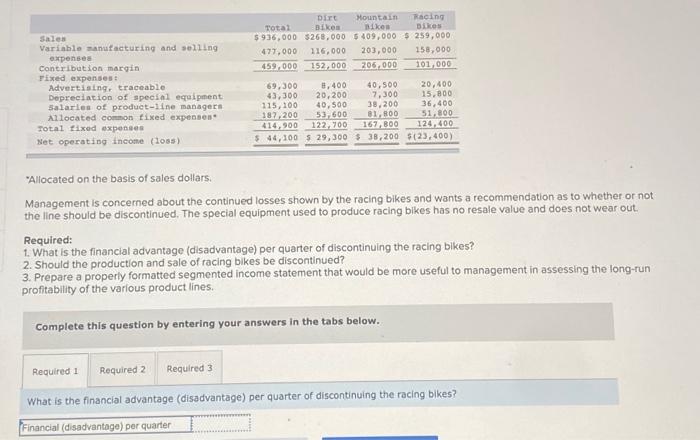

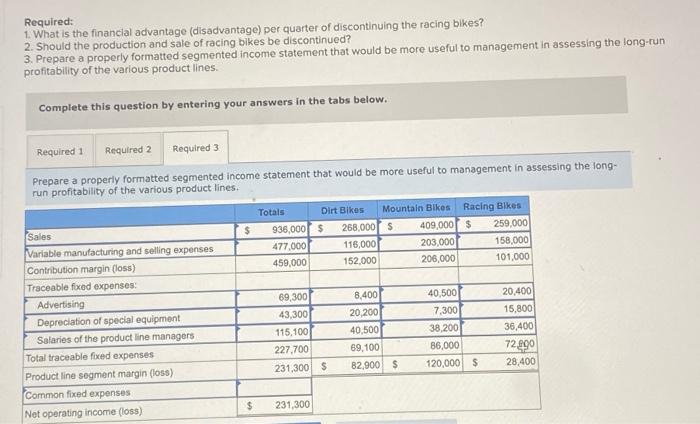

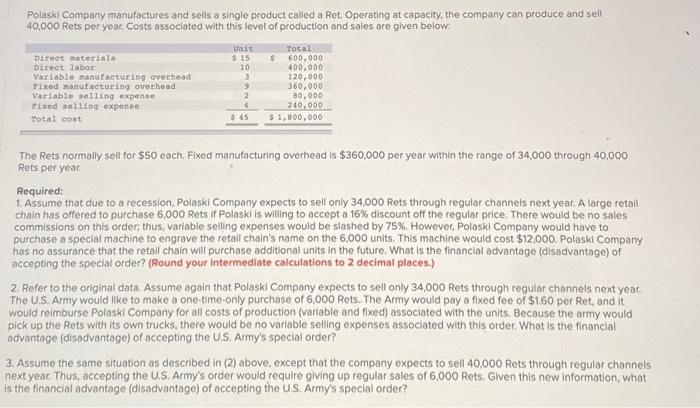

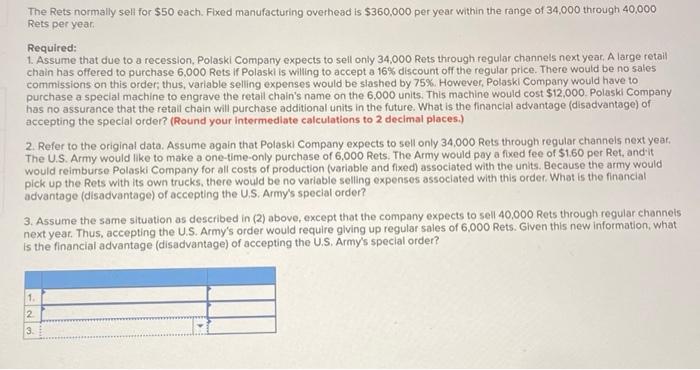

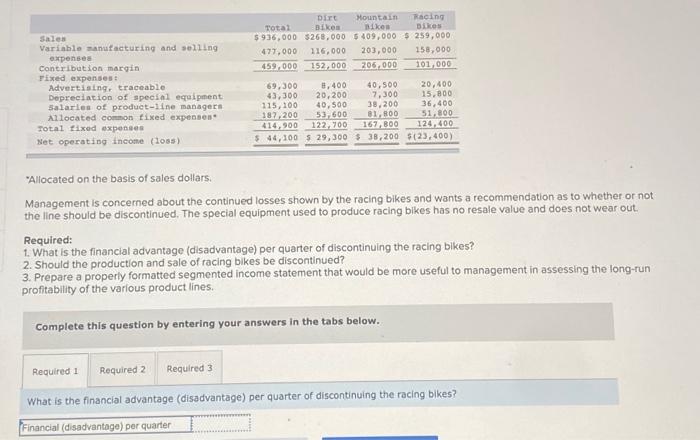

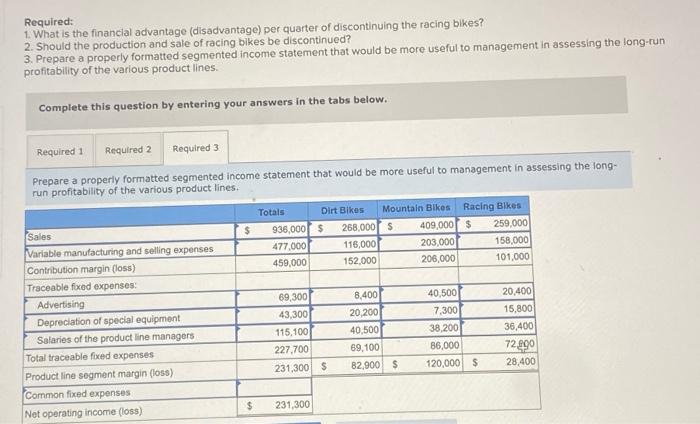

Polaskl Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 40,000 Rets per year. Costs associated with this level of production and sales are given below Unit Total Direct materials $ 15 $ 600,000 Direct labore 10 400,000 Variable manufacturing overhead 3 120,000 Pixed manufacturing overhead 360.000 Variable selling expense 80,000 Fixed selling expense 240.000 Total cost $ 1,800,000 9 2 6 $45 The Rets normally sell for $50 each. Fixed manufacturing overhead is $360,000 per year within the range of 34,000 through 40,000 Rets per year Required: 1. Assume that due to a recession, Polaski Company expects to sell only 34,000 Rets through regular channels next year. A large retail chain has offered to purchase 5,000 Rets if Poloski is willing to accept a 16% discount of the regular price. There would be no sales commissions on this order, thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to purchase a special machine to engrave the retail chain's name on the 6.000 units. This machine would cost $12,000. Polaski Company has no assurance that the retail chain will purchase additional units in the future. What is the financial advantage (disadvantage) of accepting the special order? (Round your intermediate calculations to 2 decimal places.) 2. Refer to the original data. Assume again that polask Company expects to sell only 34,000 Rets through regular channels next yeat. The U.S. Army would like to make a one-time-only purchase of 6,000 Rets. The Army would pay a fixed fee of $1.60 per Ret, and it would relmburse Polaski Company for all costs of production (variable and fixed) associated with the units. Because the army would pick up the Rets with its own trucks, there would be no variable selling expenses associated with this order. What is the financial advantage (disadvantage) of accepting the U.S. Army's special order? 3. Assume the same situation as described in (2) above, except that the company expects to sell 40,000 Rets through regular chonnels next year . Thus, accepting the U.S. Army's order would require giving up regular sales of 6,000 Rets. Given this new information what Is the financial advantage (disadvantage) of accepting the US Army's special order? The Rets normally sell for $50 each. Fixed manufacturing overhead is $360,000 per year within the range of 34,000 through 40,000 Rets per year Required: 1. Assume that due to a recession, Polaski Company expects to sell only 34,000 Rets through regular channels next year . A large retail chain has offered to purchase 6,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order, thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to purchase a special machine to engrave the retail chain's name on the 6,000 units. This machine would cost $12,000. Polaski Company has no assurance that the retail chain will purchase additional units in the future. What is the financial advantage (disadvantage) of accepting the special order? (Round your Intermediate calculations to 2 decimal places.) 2. Refer to the original data. Assume again that Poloski Company expects to sell only 34.000 Rets through regular channels next year. The U.S. Army would like to make a one-time-only purchase of 6,000 Rets. The Army would pay a fixed fee of $1.60 per Ret, and it would reimburse Poloski Company for all costs of production (variable and fixed) associated with the units. Because the army would pick up the Rets with its own trucks, there would be no variable selling expenses associated with this order. What is the financial advantage (disadvantage) of accepting the U.S. Army's special order? 3. Assume the same situation as described in (2) above, except that the company expects to sell 40,000 Rets through regular channels next year. Thus, accepting the U.S. Army's order would require glving up regular sales of 6,000 Rets. Given this new information, what Is the financial advantage (disadvantage) of accepting the U.S. Army's special order? 1 2 3 Dirt Mountain Racing Total Bike Bikes Bikes $ 936,000 $268.000 5 409,000 $ 259,000 477,000 116,000 203,000 158,000 459.000 152,000 206.000 101000 Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses Total fixed expenses Net operating income (los) 69,300 8.400 40,500 20,400 43,300 20,200 17.300 15,800 115,100 40,500 38,200 36,400 182,200 53.600 81. BOD 51,800 414.900 122.700 167, BOO 124,400 $ 44,100 $ 29,300 $ 38,200 $123,400) "Allocated on the basis of sales dollars. Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the racing bikes? 2. Should the production and sale of racing bikes be discontinued? 3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run profitability of the various product lines. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the financial advantage (disadvantage) per quarter of discontinuing the racing bikes? Financial (disadvantago) per quarter Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the racing bikes? 2. Should the production and sale of racing bikes be discontinued? 3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run profitability of the various product lines. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long- run profitability of the various product lines. $ Totals Dirt Bikes Mountain Bikes Racing Bikes 936,000 $ 268.000 $ 409,000 $ 259,000 477,000 116,000 203,000 158,000 459,000 152.000 206,000 101,000 Sales Variable manufacturing and selling expenses Contribution margin (loss) Traceable foxed expenses: Advertising Depreciation of special equipment Salaries of the product line managers Total traceable fixed expenses Product line segment margin (loss) Common fixed expenses Not operating income (loss) 69,300 43,300 115.100 227,700 231,300 $ 8,400 20,200 40,500 69,100 B2,900 $ 40.500 7.300 38,200 86,000 120,000 $ 20,400 15,800 36,400 72290 28,400 $ 231,300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started