Please provide solution for 5-8

Please provide solution for 5-8

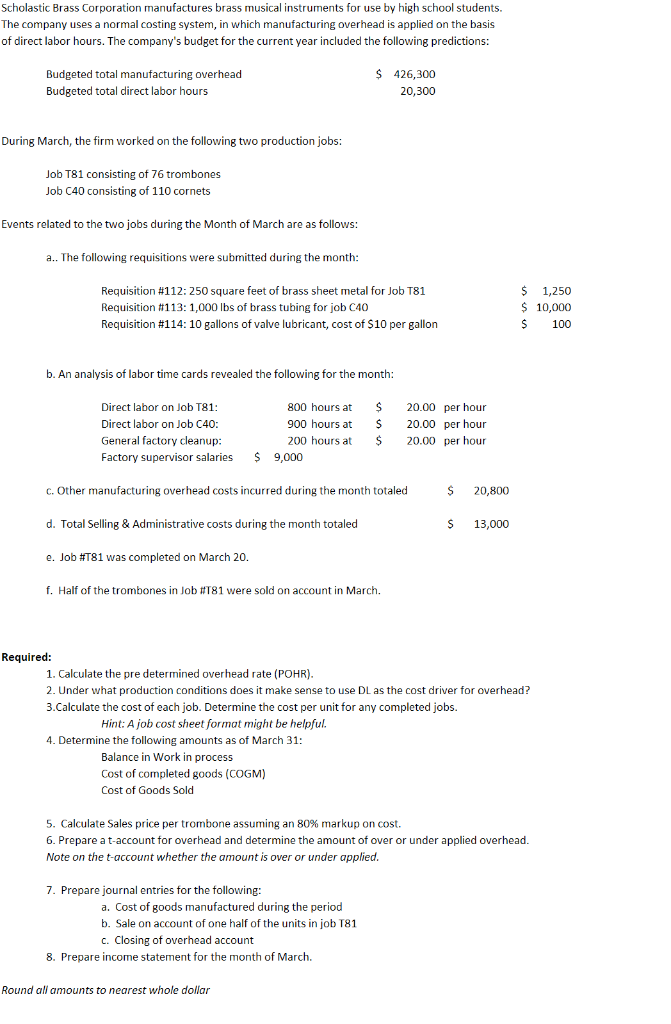

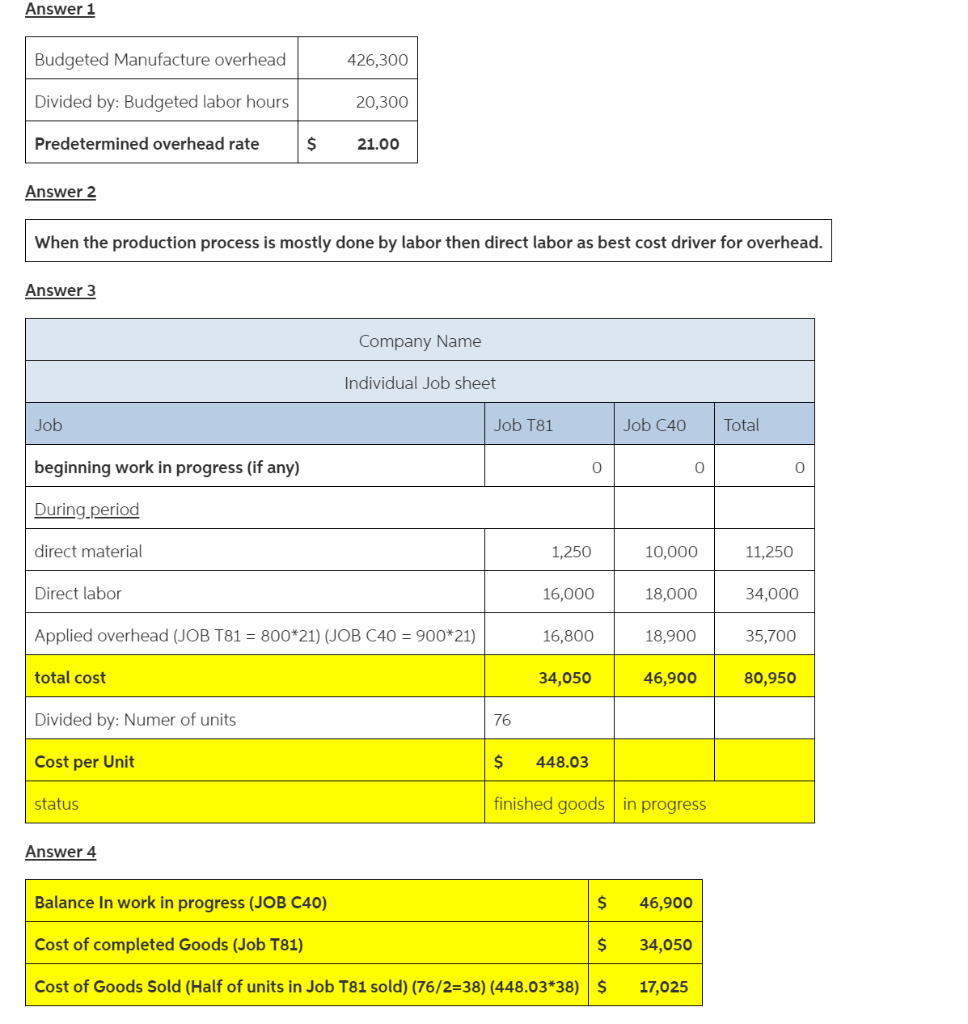

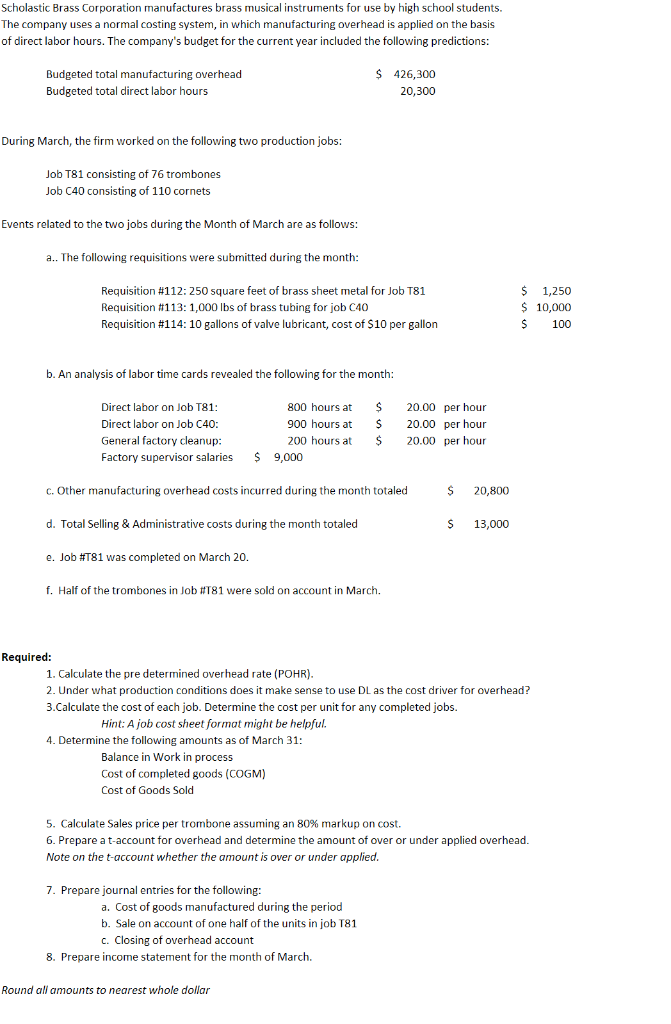

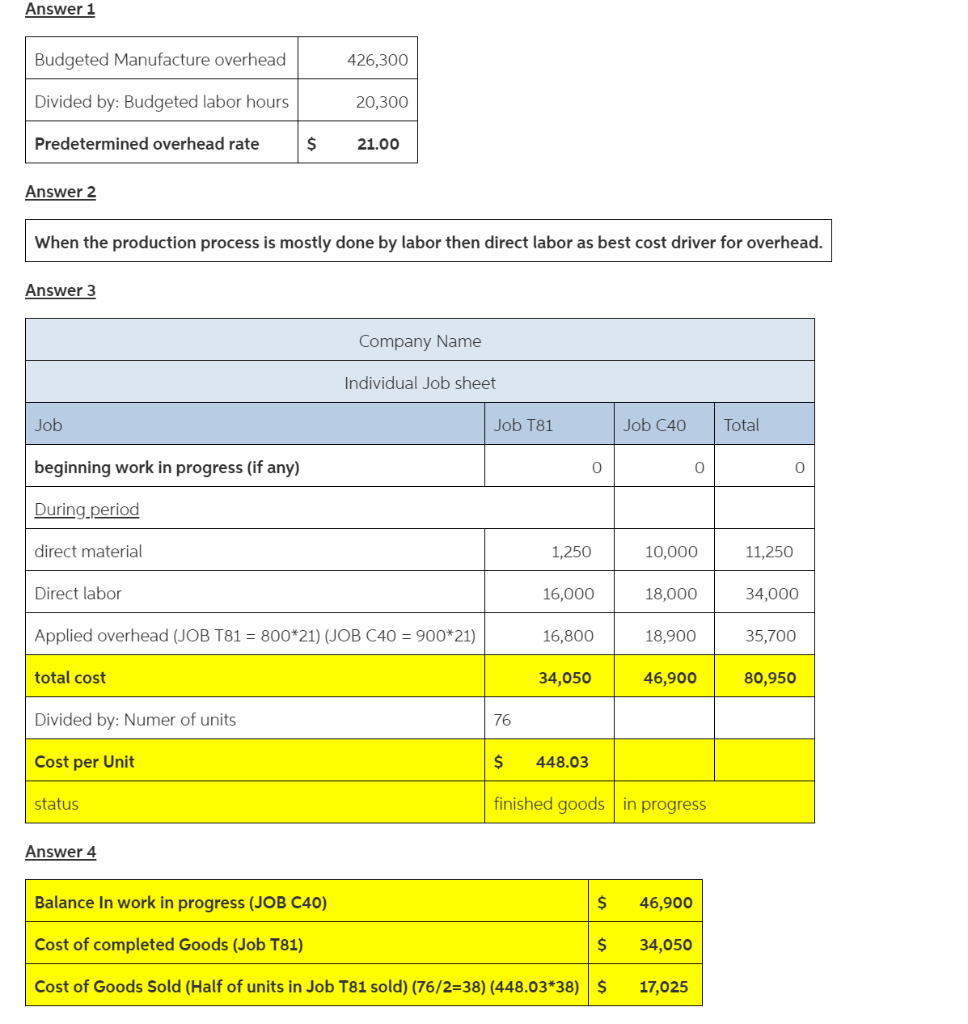

Scholastic Brass Corporation manufactures brass musical instruments for use by high school students. The company uses a normal costing system, in which manufacturing overhead is applied on the basis of direct labor hours. The company's budget for the current year included the following predictions: Budgeted total manufacturing overhead Budgeted total direct labor hours $426,300 20,300 During March, the firm worked on the following two production jobs: Job T81 consisting of 76 trombones Job C40 consisting of 110 cornets Events related to the two jobs during the Month of March are as follows: a.. The following requisitions were submitted during the month: Requisition #112: 250 square feet of brass sheet metal for Job T81 Requisition #113: 1,000 lbs of brass tubing for job C40 Requisition #114:10 gallons of valve lubricant, cost of S10 per gallon 1,250 $ 10,000 $100 b. An analysis of labor time cards revealed the following for the month: Direct labor on Job T81 Direct labor on Job C40: General factory cleanup Factory supervisor salaries 800 hoursat 20.00 per hour 900 hours at 20.00 per hour 200 hours at 20.00 per hour $ 9,000 c. Other manufacturing overhead costs incurred during the month totaled d. Total Selling & Administrative costs during the month totaled e. Job #T81 was completed on March 20. $20,800 S 13,000 f. Half of the trombones in lob #181 were sold on account in March. Required 1. Calculate the pre determined overhead rate (POHR) 2. Under what production conditions does it make sense to use DL as the cost driver for overhead? 3.Calculate the cost of each job. Determine the cost per unit for any completed jobs. Hint: A job cost sheet format might be helpful. 4. Determine the following amounts as of March 31: Balance in Work in process Cost of completed goods (COGM) Cost of Goods Sold 5. Calculate Sales price per trombone assuming an 80% markup on cost. 6. Prepare a t-account for overhead and determine the amount of over or under applied overhead Note on the t-account whether the amount is over or under applied 7. Prepare journal entries for the tollowing: a. Cost of goods manufactured during the period b. Sale on account of one half of the units in job T81 c. Closing of overhead account 8. Prepare income statement for the month of March. Round all amounts to nearest whole dollar Answer 1 Budgeted Manufacture overhead Divided by: Budgeted labor hours Predetermined overhead rate 426,300 20,300 $21.00 Answer 2 When the production process is mostly done by labor then direct labor as best cost driver for overhead Answer 3 Company Name Individual Job sheet Job beginning work in progress (if any) During.period direct material Direct labor Applied overhead (JOB T81 800*21) (JOB C40 total cost Divided by: Numer of units Cost per Unit status Job T81 Job C40 Total 0 0 0 1,250 16,000 16,800 34,050 10,000 18,000 18,900 46,900 11,250 34,000 35,700 80,950 900*21) 76 $448.03 finished goods in progress Answer 4 Balance In work in progress (JOB C40) Cost of completed Goods (Job T81) Cost of Goods Sold (Half of units in Job T81 sold) (76/2-38) (448.03*38)17,025 $46,900 $ 34,050

Please provide solution for 5-8

Please provide solution for 5-8