Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Provide Solution for part c and d only. Question 7 In a CAPM world, the risk-free rate is 4% per annum and the expected

Please Provide Solution for part c and d only.

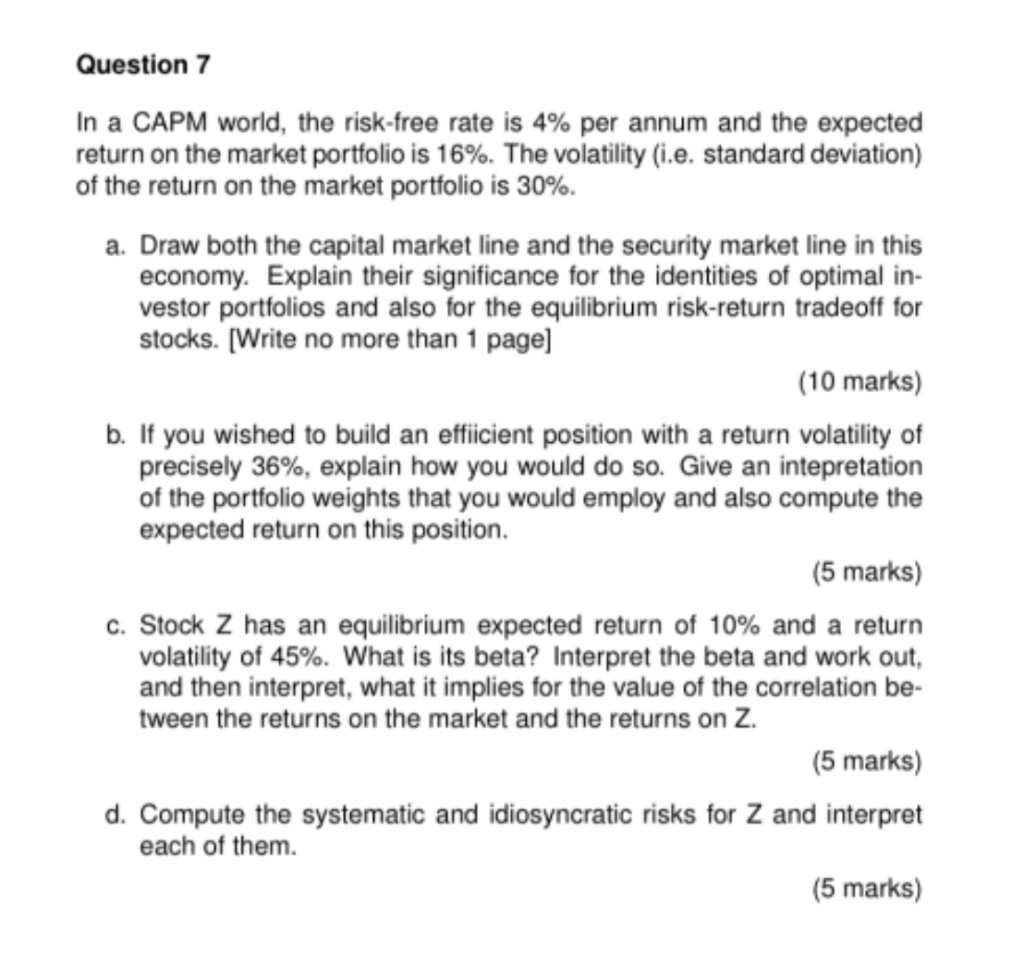

Question 7 In a CAPM world, the risk-free rate is 4% per annum and the expected return on the market portfolio is 16%. The volatility (i.e. standard deviation) of the return on the market portfolio is 30%. a. Draw both the capital market line and the security market line in this economy. Explain their significance for the identities of optimal in- vestor portfolios and also for the equilibrium risk-return tradeoff for stocks. [Write no more than 1 page] (10 marks) b. If you wished to build an efficient position with a return volatility of precisely 36%, explain how you would do so. Give an intepretation of the portfolio weights that you would employ and also compute the expected return on this position. (5 marks) c. Stock Z has an equilibrium expected return of 10% and a return volatility of 45%. What is its beta? Interpret the beta and work out, and then interpret, what it implies for the value of the correlation be- tween the returns on the market and the returns on Z. (5 marks) d. Compute the systematic and idiosyncratic risks for Z and interpret each of them

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started