Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide solutions for boxes in blue, and provide the equations used to get the answers. and answer explanation of different outcome by translation methodology.

Please provide solutions for boxes in blue, and provide the equations used to get the answers. and answer explanation of different outcome by translation methodology.

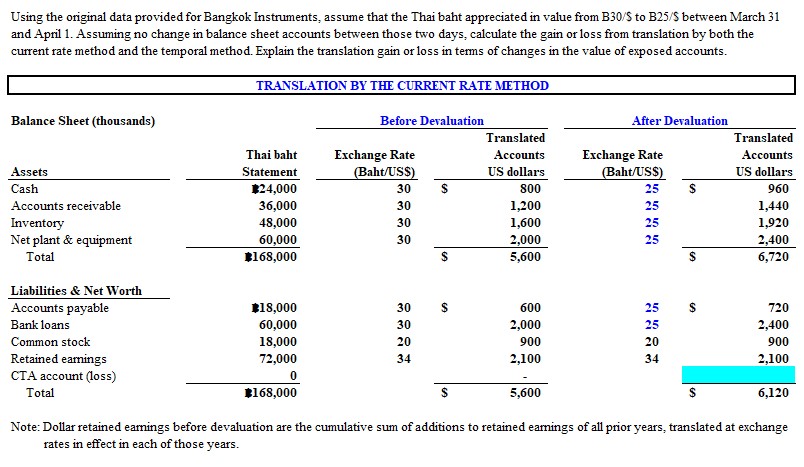

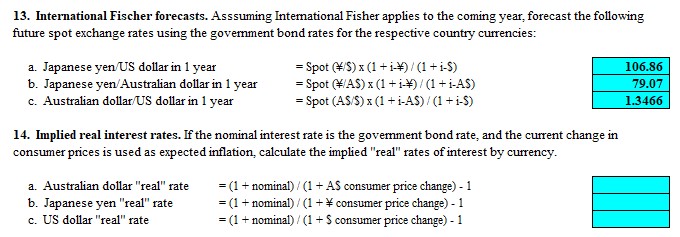

Using the original data provided for Bangkok Instruments, assume that the Thai baht appreciated in value from B30/S to B25/S between March 31 and April 1. Assuming no change in balance sheet accounts between those two days, calculate the gain or loss from translation by both the current rate method and the temporal method. Explain the translation gain or loss in terms of changes in the value of exposed accounts. Note: Dollar retained earnings before devaluation are the cumulative sum of additions to retained earnings of all prior years, translated at exchange rates in effect in each of those years. 13. International Fischer forecasts. Asssuming International Fisher applies to the coming year, forecast the following future spot exchange rates using the government bond rates for the respective country currencies: a. Japanese yen/US dollar in 1 year b. Japanese yen/Australian dollar in 1 year c. Australian dollar/US dollar in 1 year =Spot(=/S)(1+i=)/(1+iS)=Spot(=/AS)(1+i=)/(1+iAS)=Spot(AS/S)(1+iAS)/(1+iS) 14. Implied real interest rates. If the nominal interest rate is the government bond rate, and the current change in consumer prices is used as expected inflation, calculate the implied "real" rates of interest by currency. a. Australian dollar "real" rate b. Japanese yen "real" rate =(1+ nominal )/(1+ AS consumer price change )1 c. US dollar "real" rate =(1+ nominal )/(1+ consumer price change )1 =(1+ nominal )/(1+S consumer price change )1

Using the original data provided for Bangkok Instruments, assume that the Thai baht appreciated in value from B30/S to B25/S between March 31 and April 1. Assuming no change in balance sheet accounts between those two days, calculate the gain or loss from translation by both the current rate method and the temporal method. Explain the translation gain or loss in terms of changes in the value of exposed accounts. Note: Dollar retained earnings before devaluation are the cumulative sum of additions to retained earnings of all prior years, translated at exchange rates in effect in each of those years. 13. International Fischer forecasts. Asssuming International Fisher applies to the coming year, forecast the following future spot exchange rates using the government bond rates for the respective country currencies: a. Japanese yen/US dollar in 1 year b. Japanese yen/Australian dollar in 1 year c. Australian dollar/US dollar in 1 year =Spot(=/S)(1+i=)/(1+iS)=Spot(=/AS)(1+i=)/(1+iAS)=Spot(AS/S)(1+iAS)/(1+iS) 14. Implied real interest rates. If the nominal interest rate is the government bond rate, and the current change in consumer prices is used as expected inflation, calculate the implied "real" rates of interest by currency. a. Australian dollar "real" rate b. Japanese yen "real" rate =(1+ nominal )/(1+ AS consumer price change )1 c. US dollar "real" rate =(1+ nominal )/(1+ consumer price change )1 =(1+ nominal )/(1+S consumer price change )1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started