Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide Solutions for D,E, F & G Bubba Manufacturing Company provided the following information for the fiscal year to June 30, 2020: Inventories Direct

Please provide Solutions for D,E, F & G

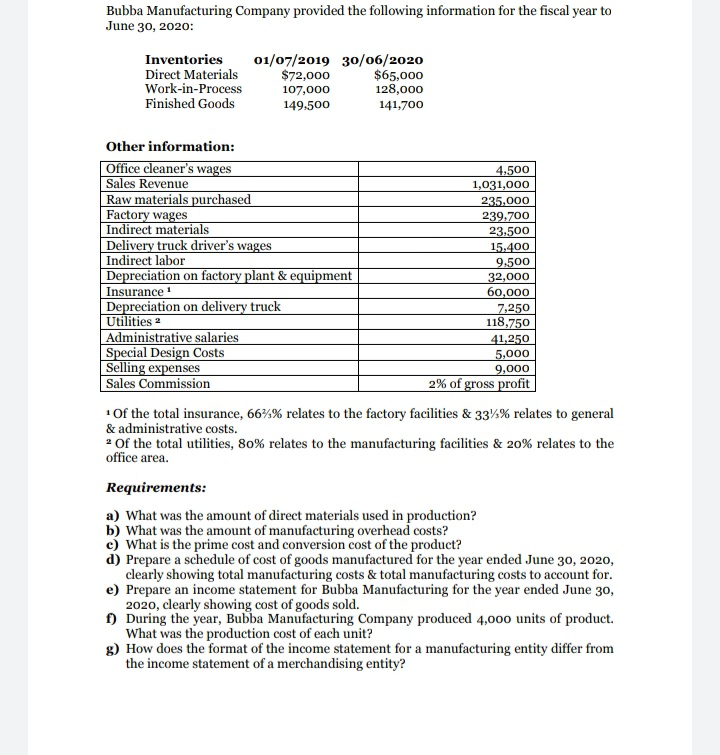

Bubba Manufacturing Company provided the following information for the fiscal year to June 30, 2020: Inventories Direct Materials Work-in-Process Finished Goods 01/07/2019 30/06/2020 $72,000 $65,000 107,000 128,000 149.500 141,700 Other information: Office cleaner's wages Sales Revenue Raw materials purchased Factory wages Indirect materials Delivery truck driver's wages Indirect labor Depreciation on factory plant & equipment Insurance Depreciation on delivery truck Utilities 2 Administrative salaries Special Design Costs Selling expenses Sales Commission 4,500 1,031,000 235,000 239,700 3.500 15.400 9.500 32,000 60,000 7,250 118,750 41,250 5,000 9,000 2% of gross profit of the total insurance, 66%% relates to the factory facilities & 33% relates to general & administrative costs. 2 of the total utilities, 80% relates to the manufacturing facilities & 20% relates to the office area. Requirements: a) What was the amount of direct materials used in production? b) What was the amount of manufacturing overhead costs? c) What is the prime cost and conversion cost of the product? d) Prepare a schedule of cost of goods manufactured for the year ended June 30, 2020, clearly showing total manufacturing costs & total manufacturing costs to account for. e) Prepare an income statement for Bubba Manufacturing for the year ended June 30, 2020, clearly showing cost of goods sold. f) During the year, Bubba Manufacturing Company produced 4,000 units of product. What was the production cost of each unit? g) How does the format of the income statement for a manufacturing entity differ from the income statement of a merchandising entityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started