Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide step by step method with formulas for all these five questions option is given in second image What is the expected return of

please provide step by step method with formulas for all these five questions

option is given in second image

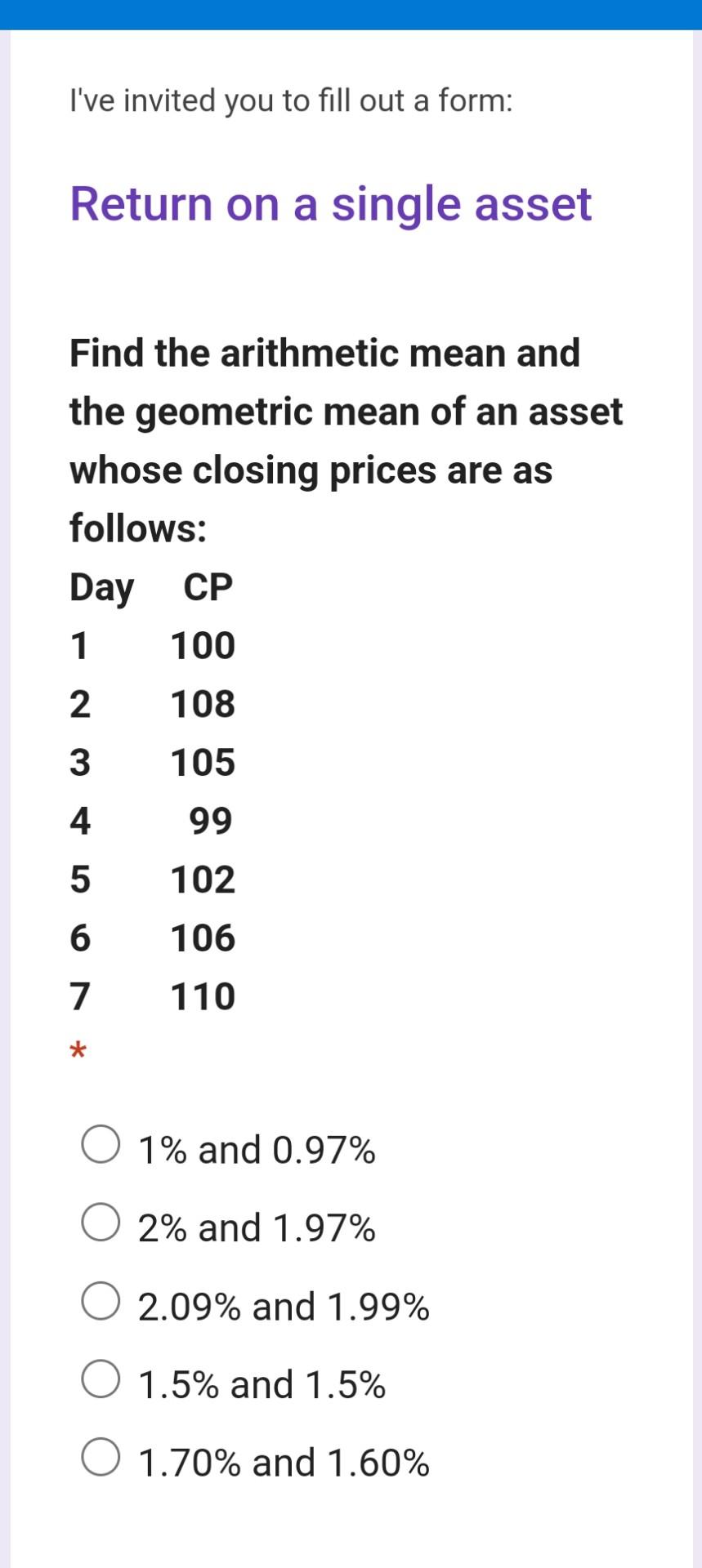

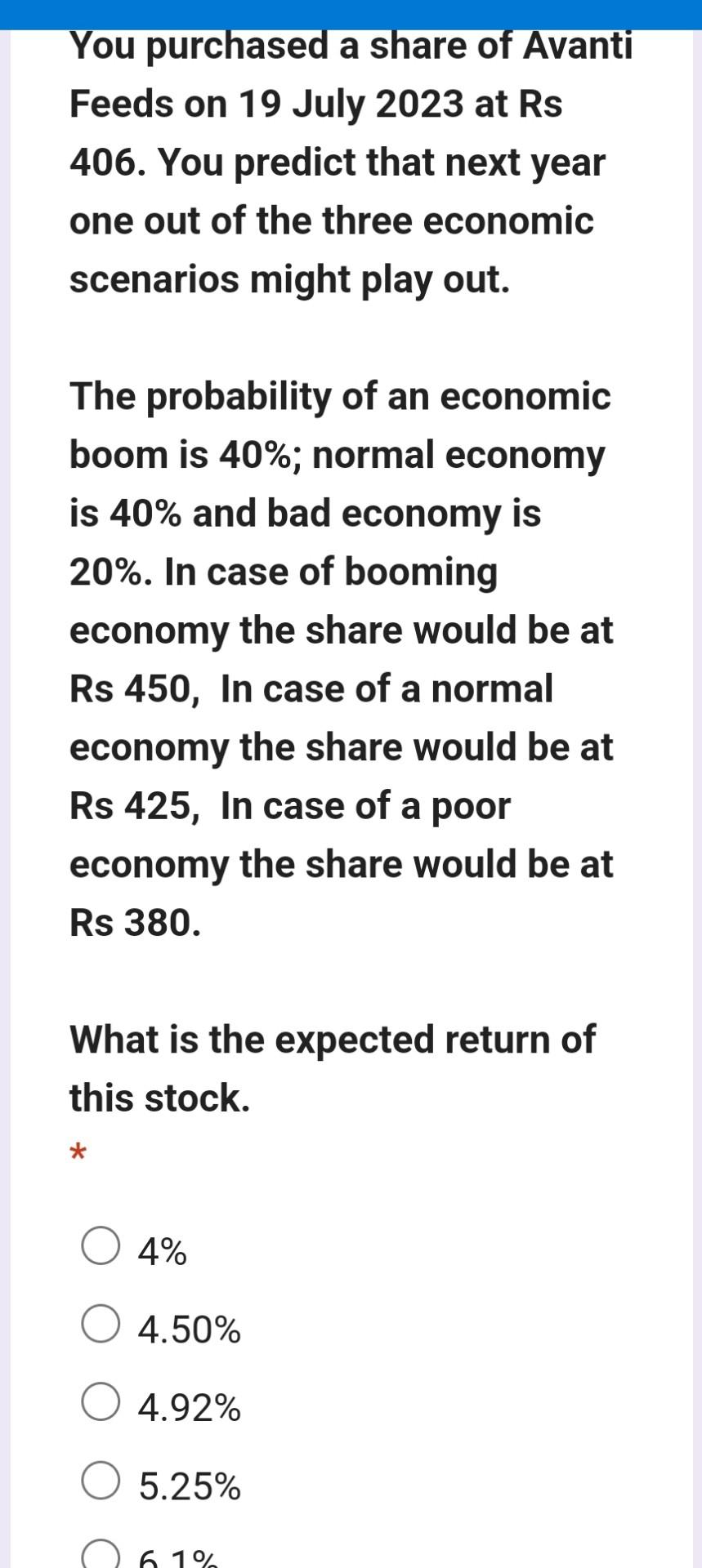

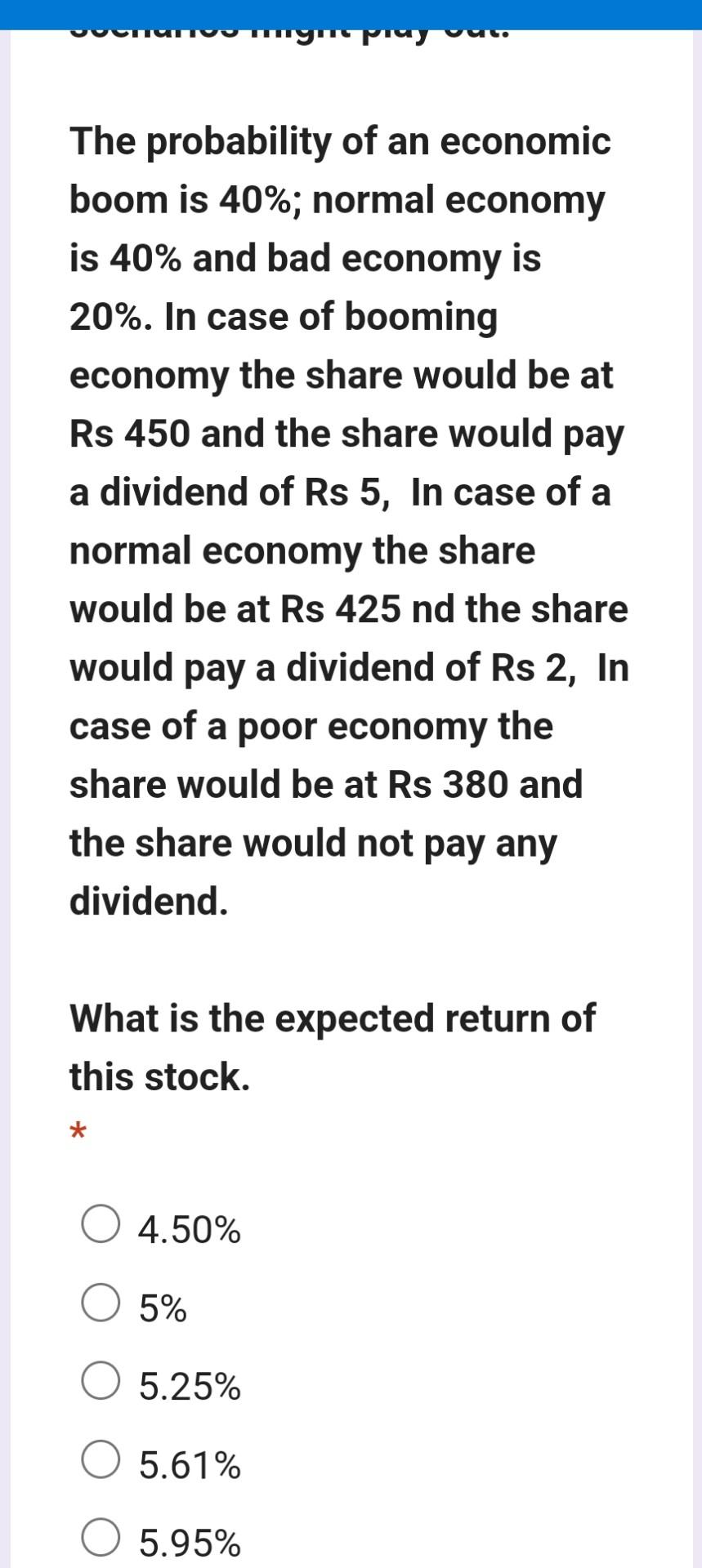

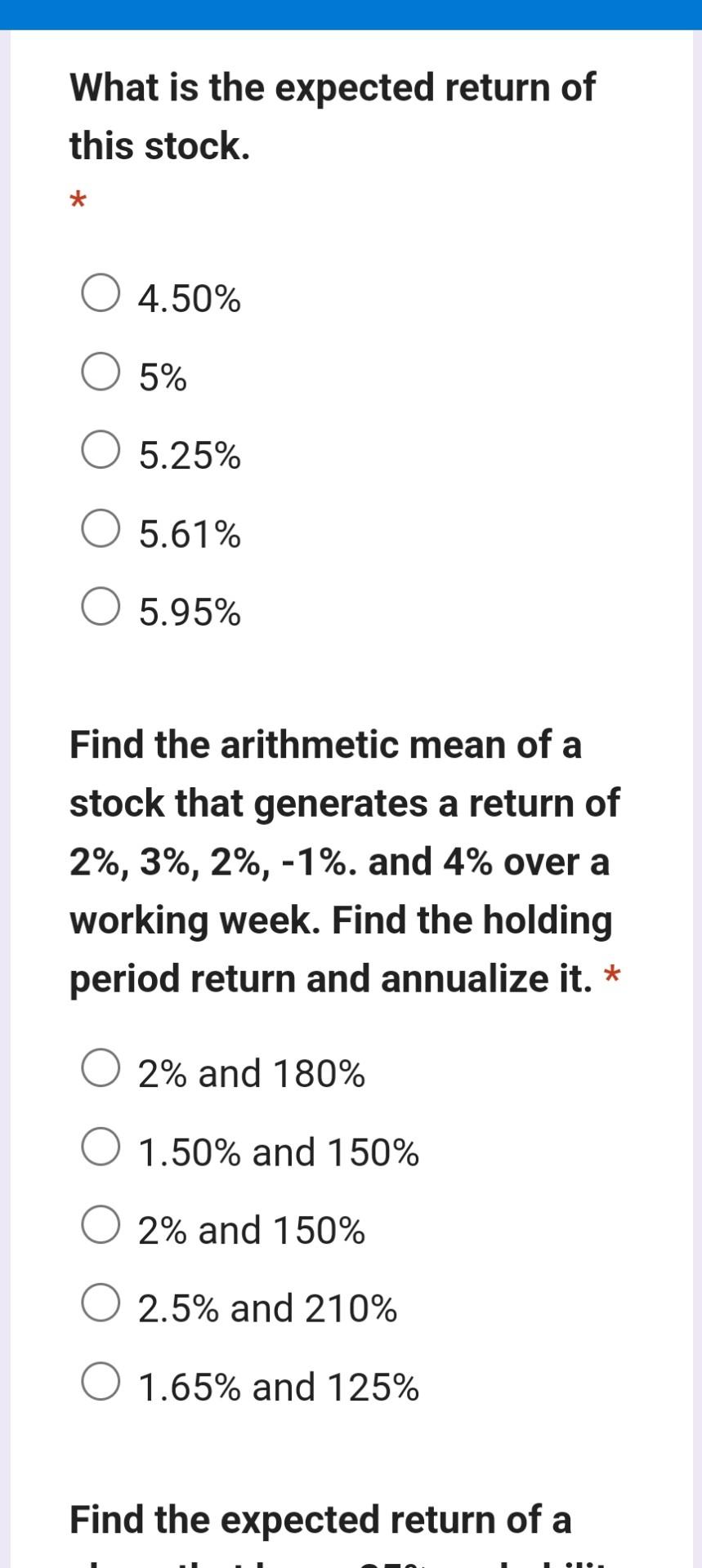

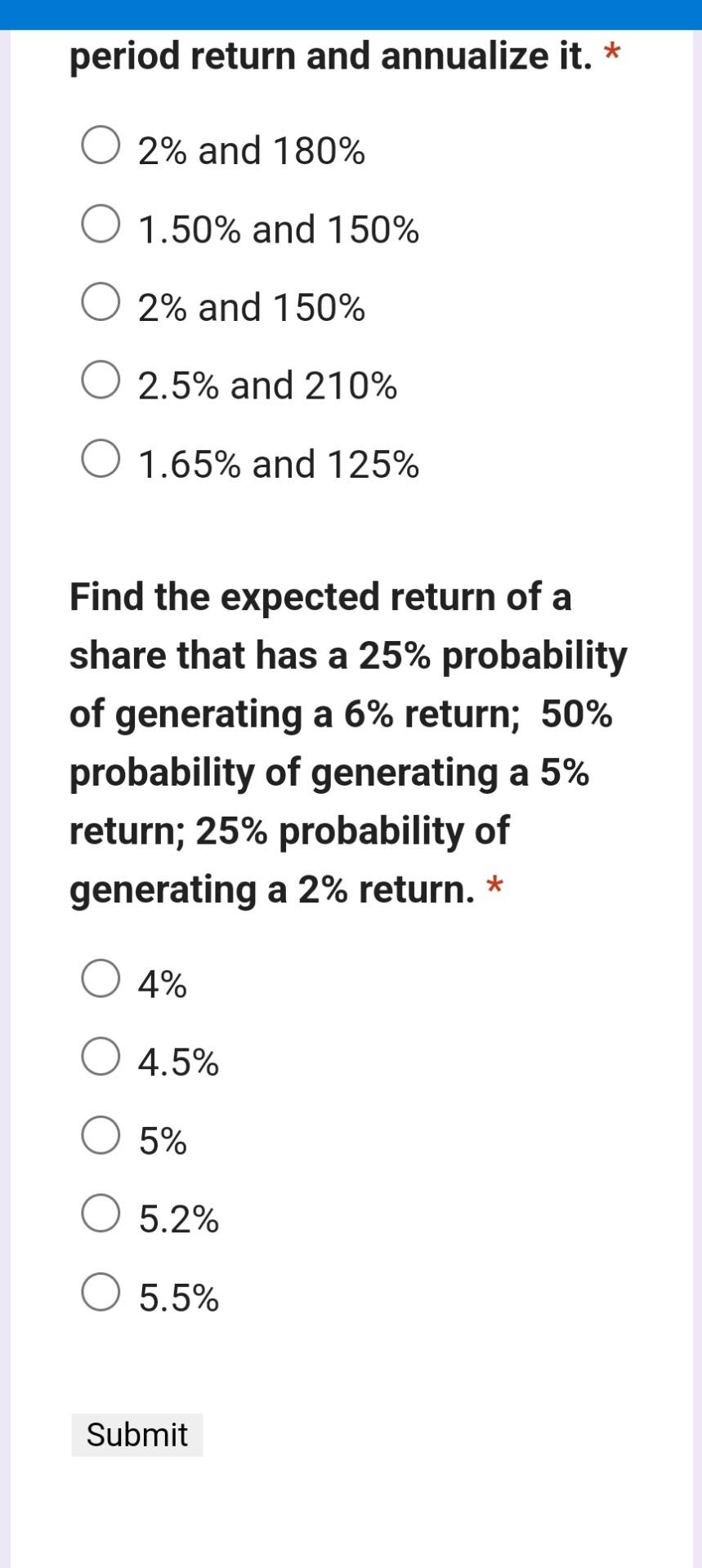

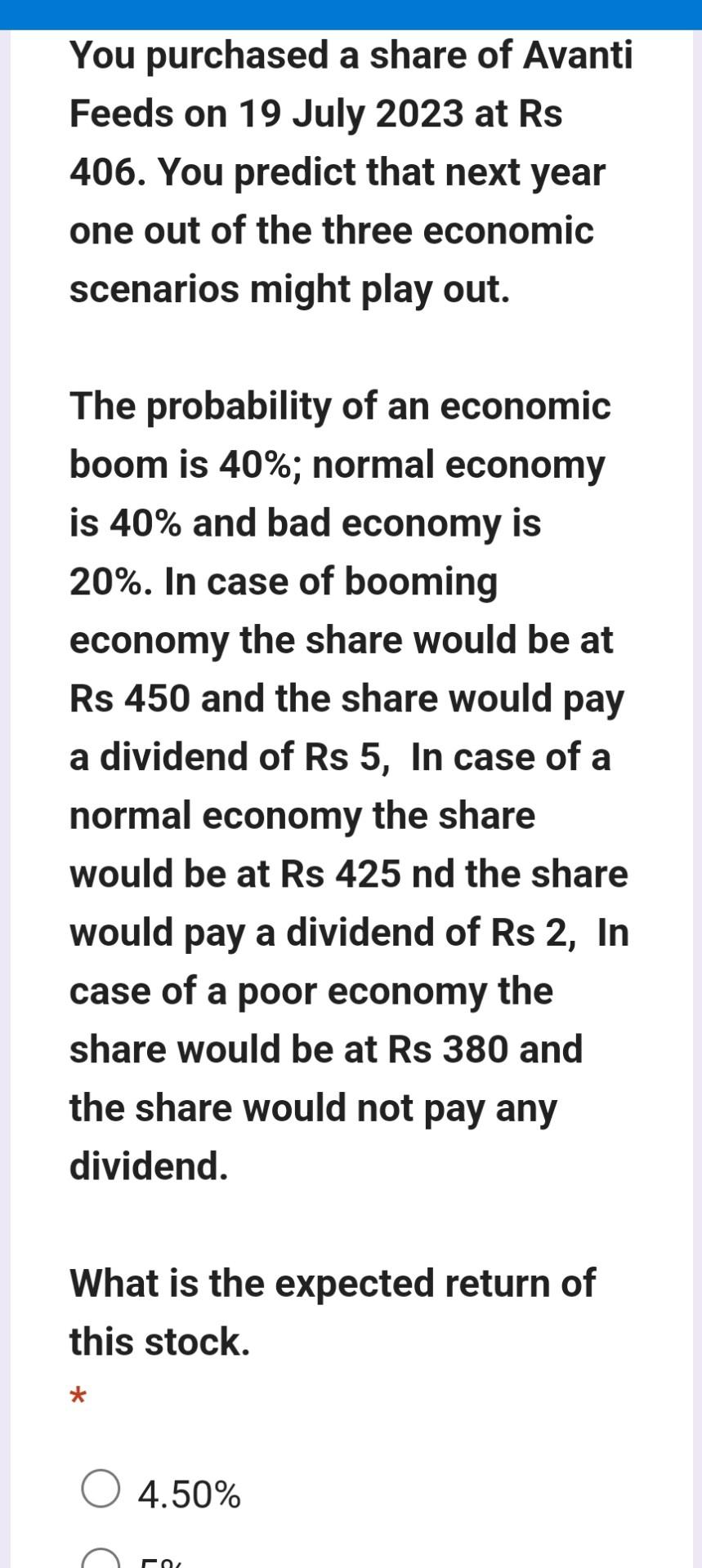

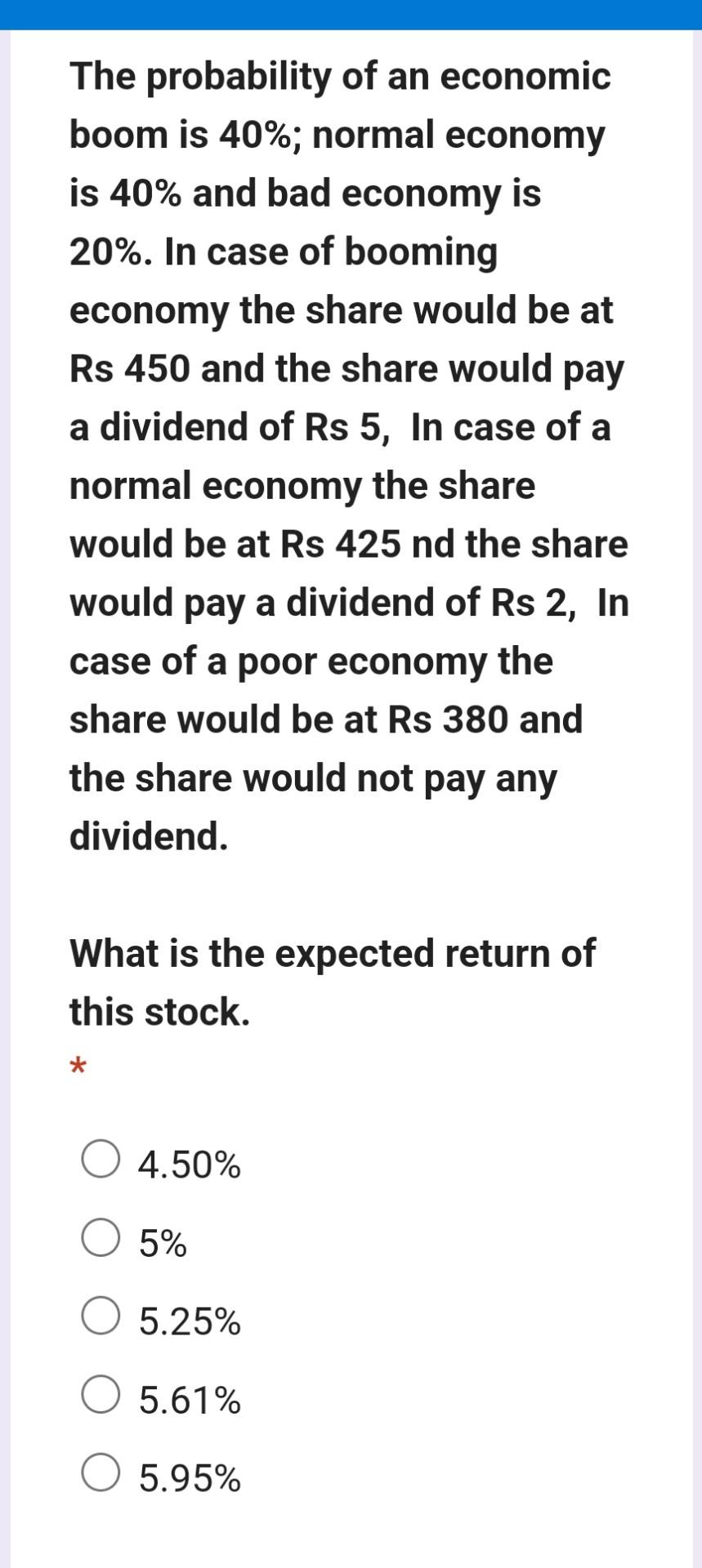

What is the expected return of this stock. 4.50% 5% 5.25% 5.61% 5.95% Find the arithmetic mean of a stock that generates a return of 2%,3%,2%,1%. and 4% over a working week. Find the holding period return and annualize it. * 2% and 180% 1.50% and 150% 2% and 150% 2.5% and 210% 1.65% and 125% Find the expected return of a I've invited you to fill out a form: Return on a single asset Find the arithmetic mean and the geometric mean of an asset whose closing prices are as follows: 1% and 0.97% 2% and 1.97% 2.09% and 1.99% 1.5% and 1.5% 1.70% and 1.60% Feeds on 19 July 2023 at Rs 406. You predict that next year one out of the three economic scenarios might play out. The probability of an economic boom is 40%; normal economy is 40% and bad economy is 20%. In case of booming economy the share would be at Rs 450, In case of a normal economy the share would be at Rs 425 , In case of a poor economy the share would be at Rs 380. What is the expected return of this stock. 4% 4.50% 4.92% 5.25% period return and annualize it. * 2% and 180% 1.50% and 150% 2% and 150% 2.5% and 210% 1.65% and 125% Find the expected return of a share that has a 25% probability of generating a 6% return; 50% probability of generating a 5% return; 25% probability of generating a 2% return. * 4% 4.5% 5% 5.2% 5.5% Feeds on 19 July 2023 at Rs 406. You predict that next year one out of the three economic scenarios might play out. The probability of an economic boom is 40%; normal economy is 40% and bad economy is 20%. In case of booming economy the share would be at Rs 450 and the share would pay a dividend of Rs 5, In case of a normal economy the share would be at Rs 425 nd the share would pay a dividend of Rs 2 , In case of a poor economy the share would be at Rs 380 and the share would not pay any dividend. What is the expected return of this stock. 4.50% The probability of an economic boom is 40%; normal economy is 40% and bad economy is 20%. In case of booming economy the share would be at Rs 450 and the share would pay a dividend of Rs 5 , In case of a normal economy the share would be at Rs 425 nd the share would pay a dividend of Rs 2 , In case of a poor economy the share would be at Rs 380 and the share would not pay any dividend. What is the expected return of this stock. 4.50% 5% 5.25% 5.61% 5.95% The probability of an economic boom is 40%; normal economy is 40% and bad economy is 20%. In case of booming economy the share would be at Rs 450 and the share would pay a dividend of Rs 5, In case of a normal economy the share would be at Rs 425nd the share would pay a dividend of Rs 2 , In case of a poor economy the share would be at Rs 380 and the share would not pay any dividend. What is the expected return of this stock. 4.50% 5% 5.25% 5.61% 5.95%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started