Answered step by step

Verified Expert Solution

Question

1 Approved Answer

********** Please provide step by step solution and workings for better understanding********** ABC Corporation is considering a new product introduction. The details of this project

********** Please provide step by step solution and workings for better understanding**********

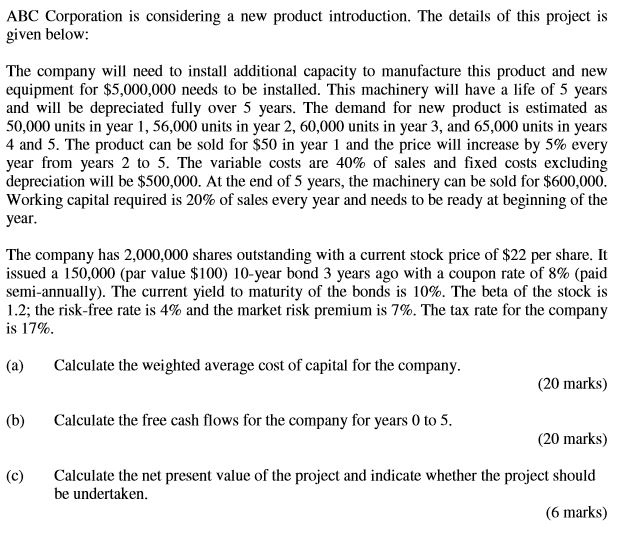

ABC Corporation is considering a new product introduction. The details of this project is given below: The company will need to install additional capacity to manufacture this product and new equipment for $5,000,000 needs to be installed. This machinery will have a life of 5 years and will be depreciated fully over 5 years. The demand for new product is estimated as 50,000 units in year 1, 56,000 units in year 2, 60,000 units in year 3, and 65,000 units in years 4 and 5. The product can be sold for $50 in year 1 and the price will increase by 5% every year from years 2 to 5. The variable costs are 40% of sales and fixed costs excluding depreciation will be $500,000. At the end of 5 years, the machinery can be sold for $600,000 year Working capital required is 20% of sales every year and needs to be ready at beginning of the year. The company has 2,000,000 shares outstanding with a current stock price of $22 per share. It issued a 150,000 (par value $100) 10-year bond 3 years ago with a coupon rate of 8% (paid semi-annually). The current yield to maturity of the bonds is 10%. The beta of the stock is 12: the risk-free rate is 4% and the market risk premium is 7%. The tax rate for the company is 17%. (a) Calculate the weighted average cost of capital for the company (b) Calculate the free cash flows for the company for years 0 to 5 (c) Calculate the net present value of the project and indicate whether the project should be undertakenStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started