Question: Use the following data to calculate the variances in the following questions. Standard Cost Profile Lab Treatment SU #12 Expected Treatments= 1,000 Standard Cost Profile

Use the following data to calculate the variances in the following questions.

Standard Cost Profile

Lab Treatment SU #12

Expected Treatments= 1,000

Standard Cost Profile Lab Treatment SU #12 Expected Treatments= 1,000

Actual Month Cost

Lab Treatment SU #12

Actual Treatments = 1,100

| |||

|---|---|---|---|

Calculate the following variances and indicate whether each variance is favorable or unfavorable:

1.1. Efficiency Variance – Labor

1.2. Efficiency Variance – Supplies

1.3. Price Variance – Labor

1.4. Price Variance – Supplies

1.5. Volume Variance

1.6. Total Variance

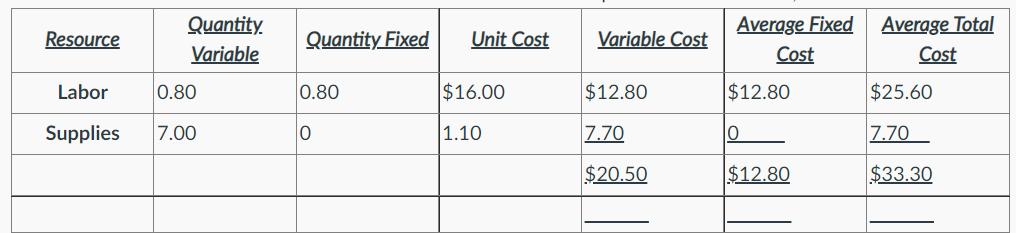

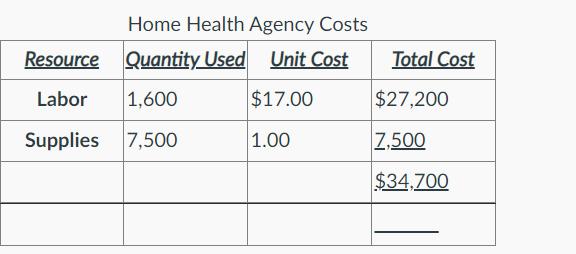

Resource Quantity. Variable Labor 0.80 Supplies 7.00 Quantity Fixed 0.80 0 Unit Cost $16.00 1.10 Variable Cost $12.80 7.70 $20.50 Average Fixed Cost $12.80 O $12.80 Average Total Cost $25.60 7.70 $33.30 Home Health Agency Costs Resource Quantity Used Unit Cost Labor 1,600 $17.00 Supplies 7,500 1.00 Total Cost $27,200 7,500 $34,700

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

1 Efficiency Variance Labor Labor efficiency variance Standard unit cost of ... View full answer

Get step-by-step solutions from verified subject matter experts