Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide the answer with explanation Additional information Miss Maxwell has other sources of income that place in the highest federal income tax bracket of

please provide the answer with explanation

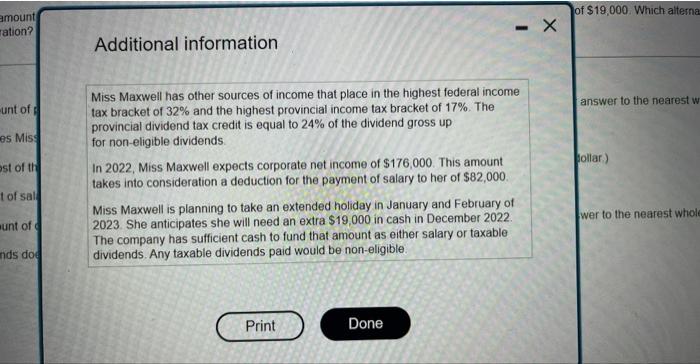

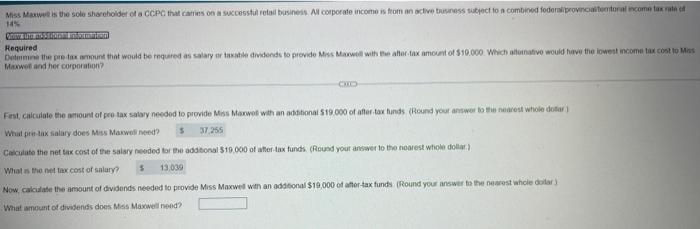

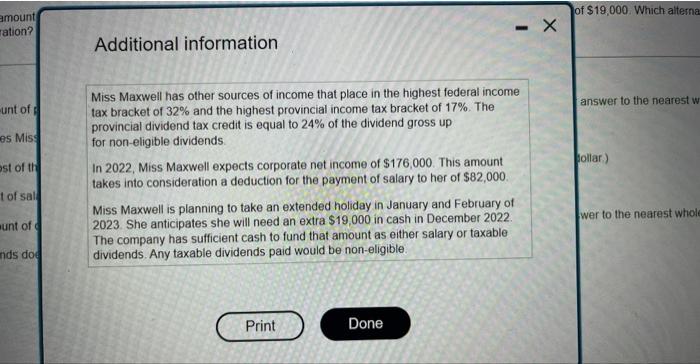

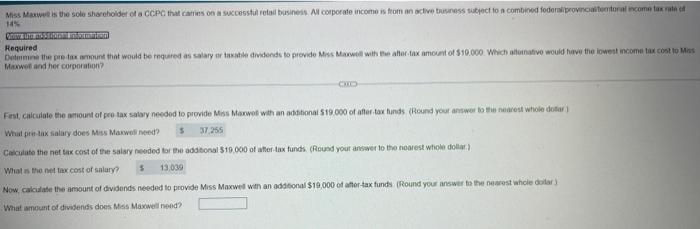

Additional information Miss Maxwell has other sources of income that place in the highest federal income tax bracket of 32% and the highest provincial income tax bracket of 17%. The provincial dividend tax credit is equal to 24% of the dividend gross up for non-eligible dividends In 2022, Miss Maxwell expects corporate net income of $176,000. This amount takes into consideration a deduction for the payment of salary to her of $82,000. Miss Maxwell is planning to take an extended holiday in January and February of 2023 She anticipates she will need an extra $19,000 in cash in December 2022. The company has sufficient cash to fund that amount as either salary or taxable dividends. Any taxable dividends paid would be non-eligible. Hequired Manwet and her corporation? What prithax falary does Miss Manwoli Need? Cerculife the net tak cest of the saisy needed tar the addeconal 519,000 of aher-tax funds (Feund yout answer to the nearest whole doltar. What is the ney tax cest of salary? Now calcidate the armount of dividends needed to provide Miss Maxwel wath an oddsonal $19,000 of aftor fax funds (Roumd your answer fe the neacest ahicle dolar ) What ampurit of divelends does Miss Maxoveli nend

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started