Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE PROVIDE THE ANSWERS TO THE QUESTION NO.3, 4, 5 (A) & 5(B) BASED ON THE GIVEN PREVOIUS ANSWERS. Billy Wuski is looking over the

PLEASE PROVIDE THE ANSWERS TO THE QUESTION NO.3, 4, 5 (A) & 5(B) BASED ON THE GIVEN PREVOIUS ANSWERS.

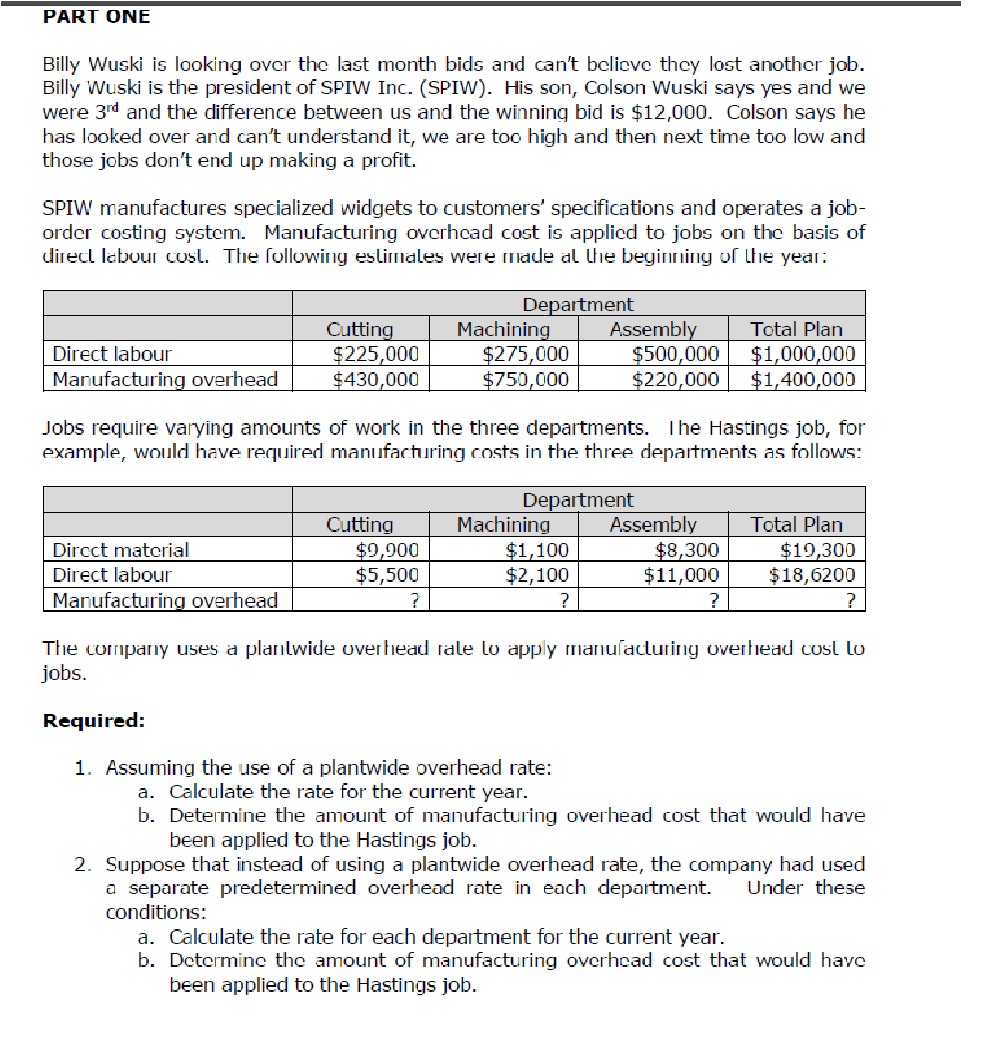

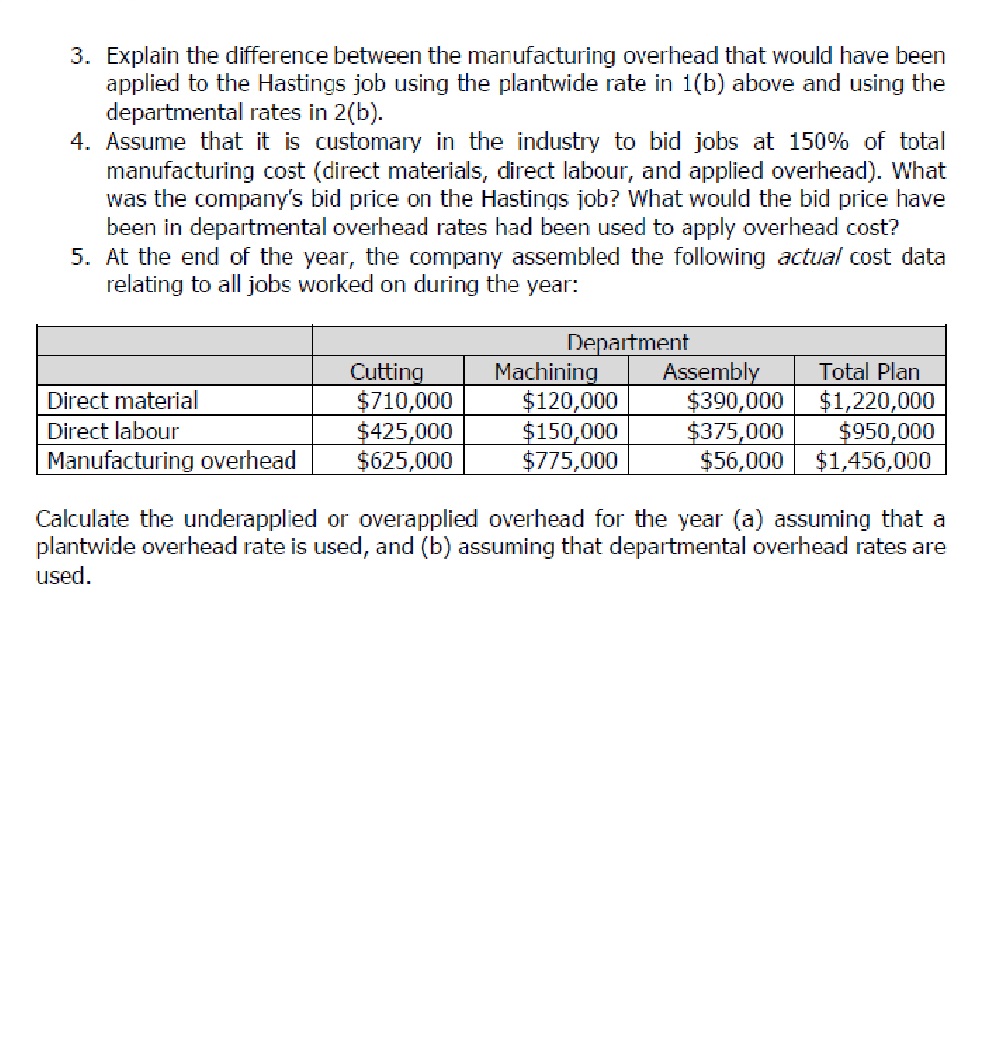

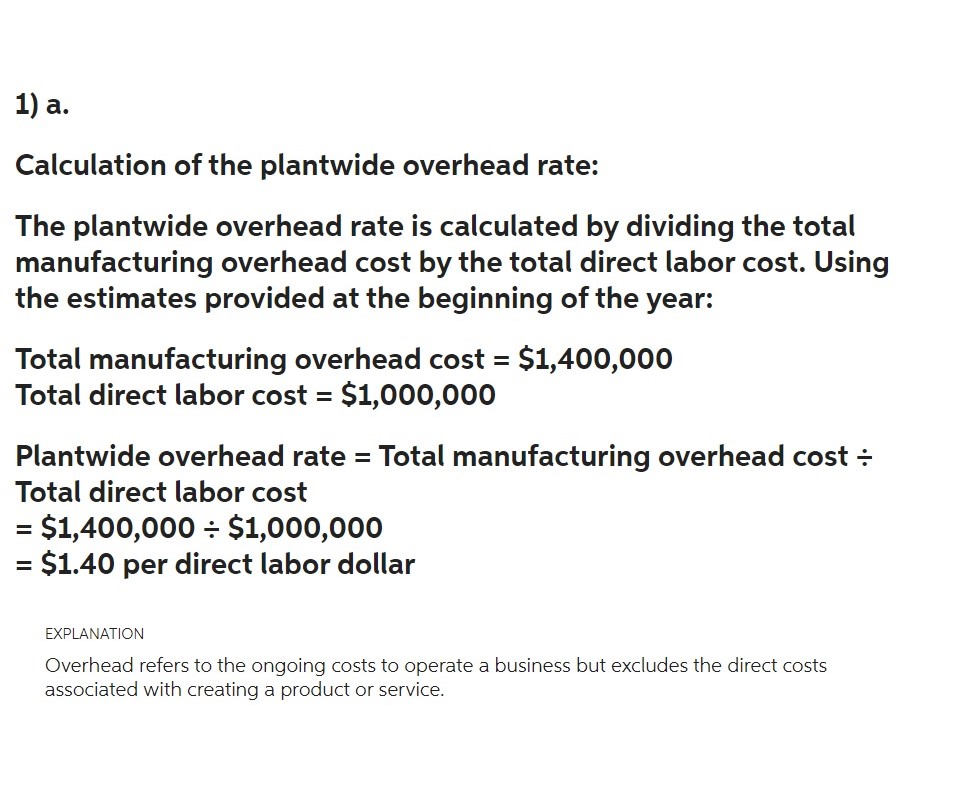

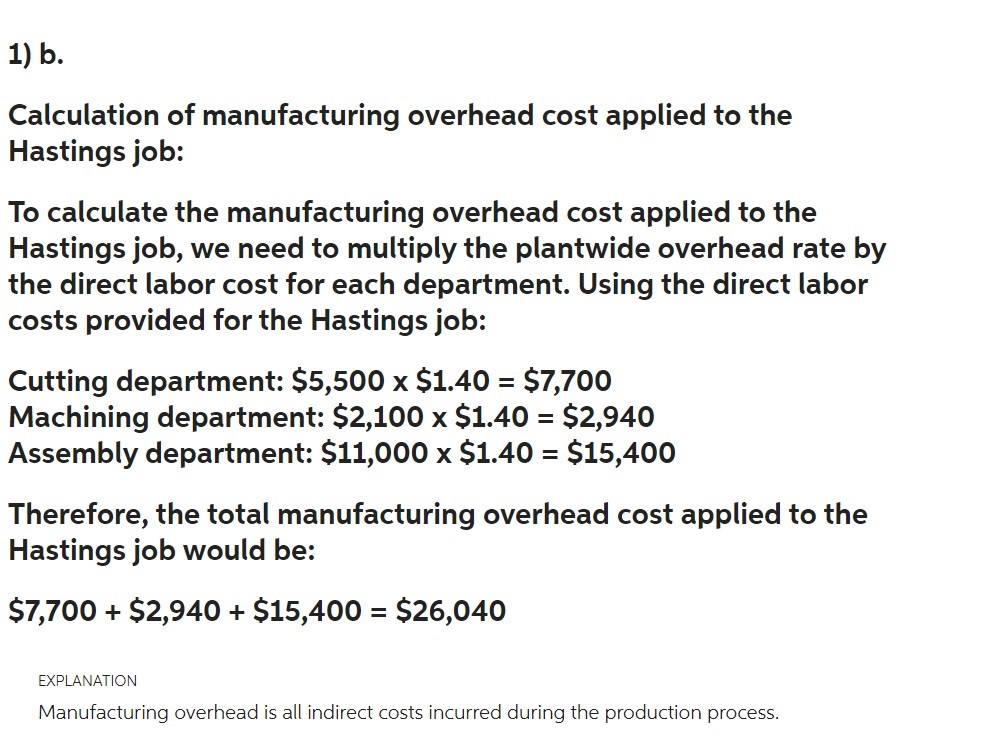

Billy Wuski is looking over the last month bids and can't believe they lost another job. Billy Wuski is the president of SPIW Inc. (SPIW). His son, Colson Wuski says yes and we were 3rd and the difference between us and the winning bid is $12,000. Colson says he has looked over and can't understand it, we are too high and then next time too low and those jobs don't end up making a profit. SPIW manufactures specialized widgets to customers' specifications and operates a joborder costing system. Manufacturing overhcad cost is applied to jobs on the basis of direcl labour cosl. The following eslirnales were rrlade al the beginning of the yeari: Jobs require varying amounts of work in the three departments. I he Hastings job, for example, would have required manufacturing costs in the three departments as follows: The corrpaniy uses a planilwide uverhead rale lo apply manuladining overhead cosil to jobs. Required: 1. Assuming the use of a plantwide overhead rate: a. Calculate the rate for the current year. b. Determine the amount of manufacturing overhead cost that would have been applied to the Hastings job. 2. Suppose that instead of using a plantwide overhead rate, the company had used a separate predetermined overhead rate in each department. Under these conditions: a. Calculate the rate for each department for the current year. b. Determine the amount of manufacturing overhead cost that would have been applied to the Hastings job. 3. Explain the difference between the manufacturing overhead that would have been applied to the Hastings job using the plantwide rate in 1 (b) above and using the departmental rates in 2(b). 4. Assume that it is customary in the industry to bid jobs at 150% of total manufacturing cost (direct materials, direct labour, and applied overhead). What was the company's bid price on the Hastings job? What would the bid price have been in departmental overhead rates had been used to apply overhead cost? 5. At the end of the year, the company assembled the following actual cost data relating to all jobs worked on during the year: Calculate the underapplied or overapplied overhead for the year (a) assuming that a plantwide overhead rate is used, and (b) assuming that departmental overhead rates are used. 1) a. Calculation of the plantwide overhead rate: The plantwide overhead rate is calculated by dividing the total manufacturing overhead cost by the total direct labor cost. Using the estimates provided at the beginning of the year: Total manufacturing overhead cost =$1,400,000 Total direct labor cost =$1,000,000 Plantwide overhead rate = Total manufacturing overhead cost Total direct labor cost =$1,400,000$1,000,000 =$1.40 per direct labor dollar EXPLANATION Overhead refers to the ongoing costs to operate a business but excludes the direct costs associated with creating a product or service. Calculation of manufacturing overhead cost applied to the Hastings job: To calculate the manufacturing overhead cost applied to the Hastings job, we need to multiply the plantwide overhead rate by the direct labor cost for each department. Using the direct labor costs provided for the Hastings job: Cutting department: $5,500$1.40=$7,700 Machining department: $2,100$1.40=$2,940 Assembly department: $11,000$1.40=$15,400 Therefore, the total manufacturing overhead cost applied to the Hastings job would be: $7,700+$2,940+$15,400=$26,040 EXPLANATION Manufacturing overhead is all indirect costs incurred during the production process. Calculation of the predetermined overhead rate for each department: Using the estimates provided at the beginning of the year: Cutting department: Predetermined overhead rate = Estimated manufacturing overhead cost Estimated direct labor cost =$430,000$225,000 =$1.91 per direct labor dollar Machining department: Predetermined overhead rate = Estimated manufacturing overhead cost Estimated direct labor cost =$750,000$275,000 =$2.73 per direct labor dollar EXPLANATION The predetermined overhead rate for each department is calculated by dividing the estimated manufacturing overhead cost for the department by the estimated direct labor cost for the department. Calculation of manufacturing overhead cost applied to the Hastings job: Using the direct labor costs provided for the Hastings job: Cutting department: $5,500$1.91=$10,505 Machining department: $2,100$2.73=$5,733 Assembly department: $11,000$0.44=$4,840 Therefore, the total manufacturing overhead cost applied to the Hastings job would be: $10,505+$5,733+$4,840=$21,078 EXPLANATION To calculate the manufacturing overhead cost applied to the Hastings job using separate predetermined overhead rates for each department, we need to multiply the predetermined overhead rate by the direct labor cost for each departmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started