Please provide the answers with detailed formula. Please do provide the cell reference from where the numbers will be derived for better understanding. And kindly post the answers in the same format of the picture posted below.Thanks !

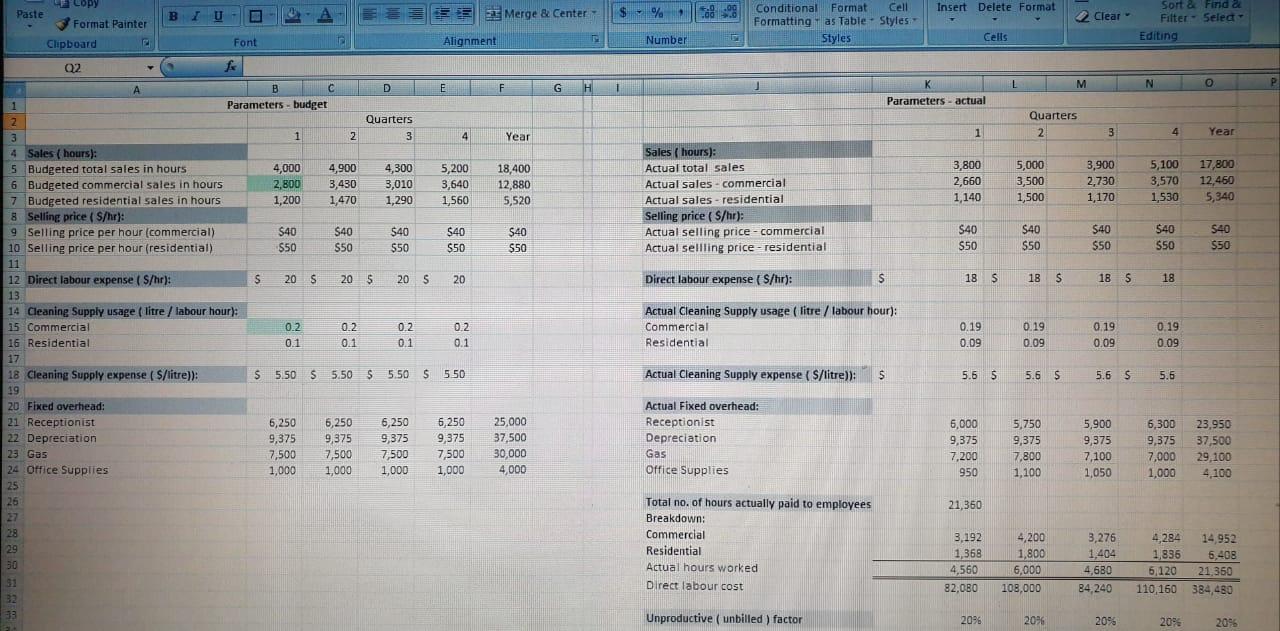

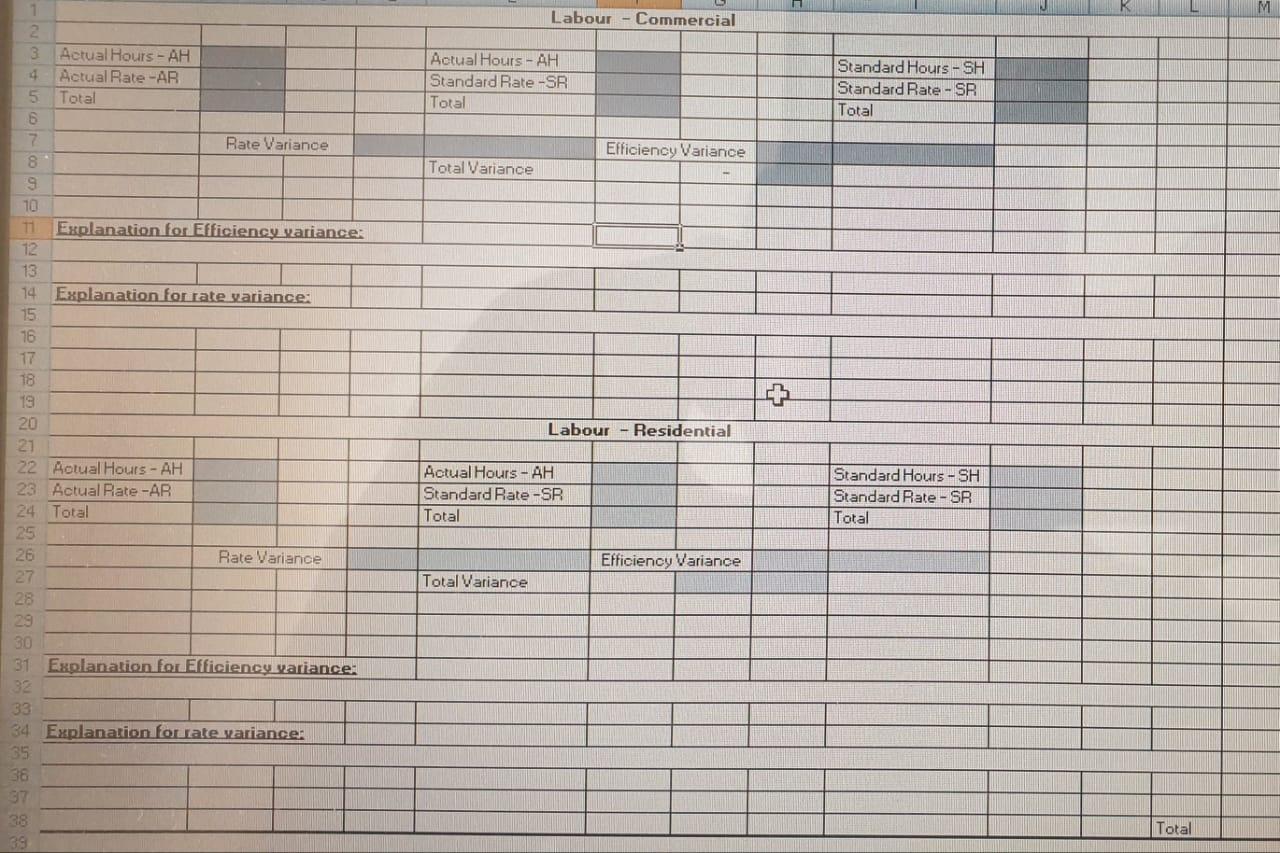

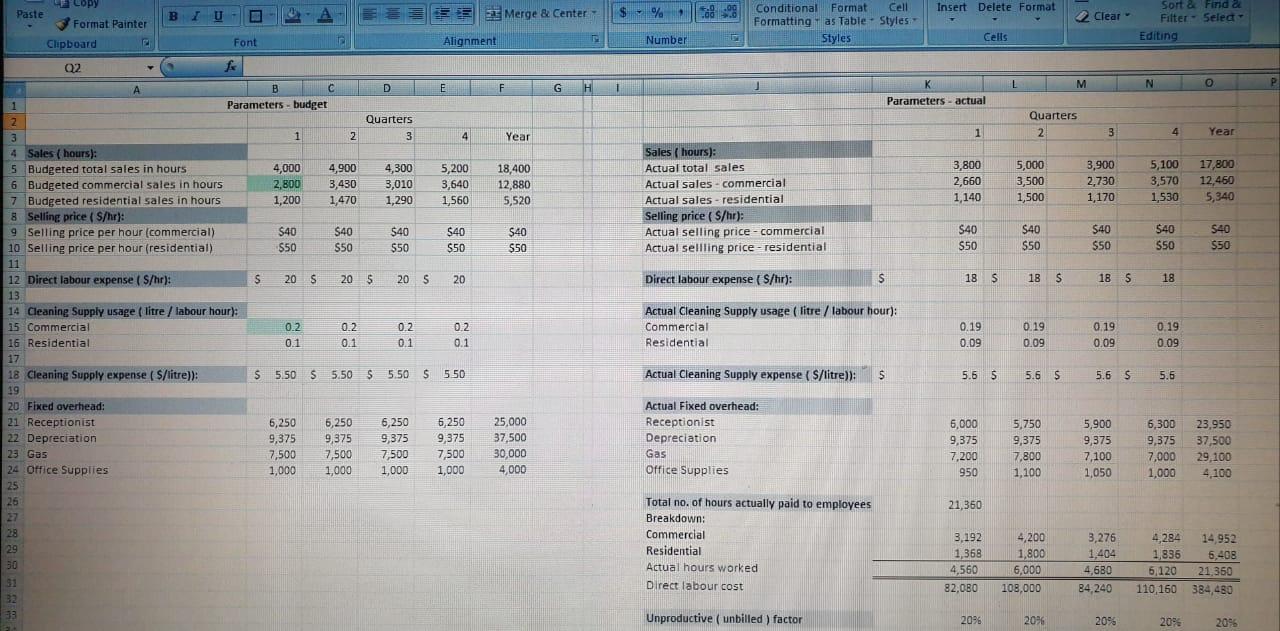

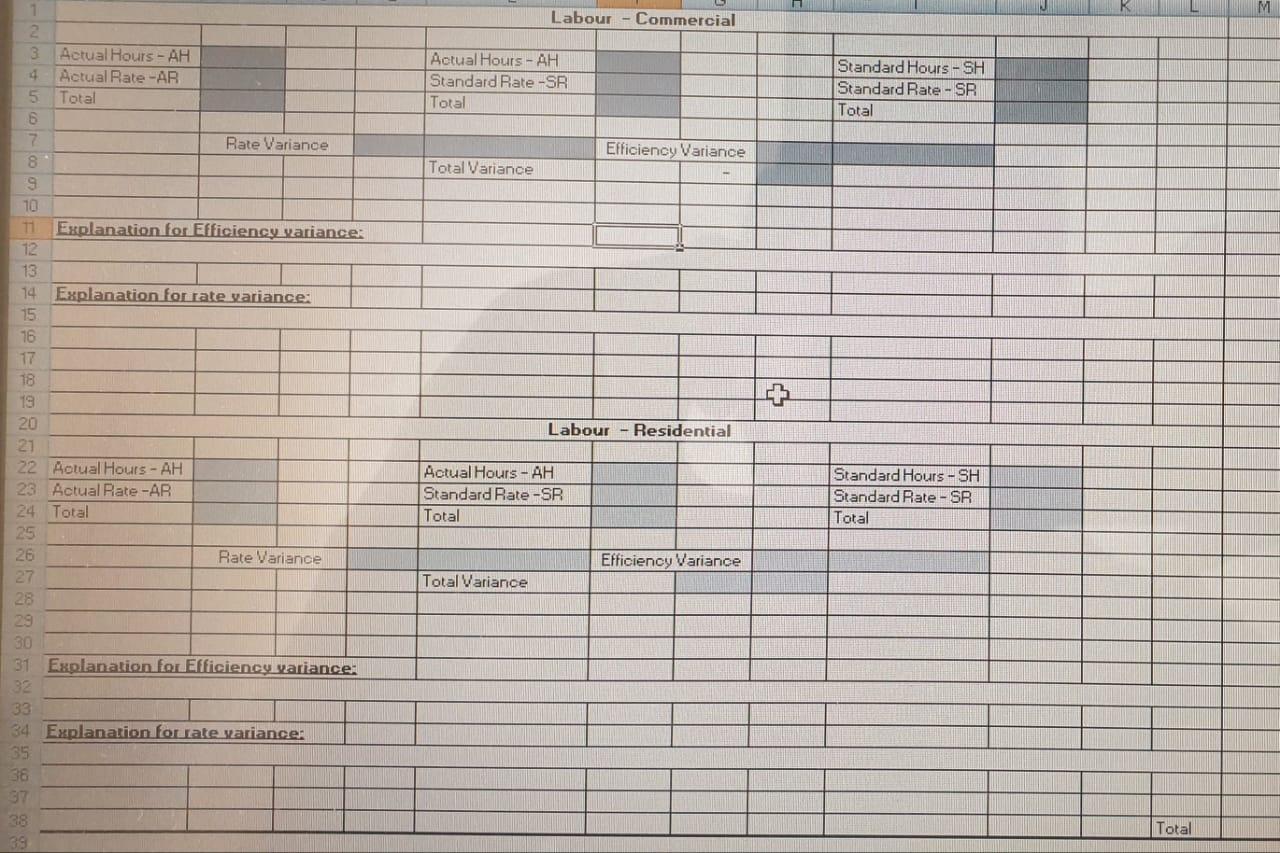

Insert Delete Format B 1 Merge & Center - $ - % Clear a copy Paste Format Painter Clipboard Conditional Format Cell Formatting as Table - Styles Styles Sort & Find a Filter - Select Editing Font Alignment Number Cells 02 G H 1 1 M F N O Parameters - actual Quarters 2 1 Year 4 3 Year 18,400 12,880 5,520 Sales ( hours): Actual total sales Actual sales - commercial Actual sales - residential Selling price ( S/hr): Actual selling price-commercial Actual sellling price - residential 3,800 2,660 1,140 5,000 3,500 1,500 3,900 2,730 1,170 5,100 3,570 1.530 17,800 12,460 5,340 $40 $50 $40 $50 $40 $50 $40 $50 540 S50 540 $50 Direct labour expense (S/hr): s 18 S 18 S 18 5 18 B C D E E 1 Parameters - budget 2 Quarters 3 1 2 3 4 4 Sales (hours): 5 Budgeted total sales in hours 4,000 4,900 4,300 5,200 6 Budgeted commercial sales in hours 2,800 3,430 3,010 3,640 7 Budgeted residential sales in hours 1,200 1,470 1,290 1,560 8 Selling price ( S/hr): 9 Selling price per hour (commercial) $40 $40 $40 $40 10 Selling price per hour (residential) $50 $50 $50 $50 11 12 Direct labour expense (S/hr): S 20 S 205 20 S 20 13 14 Cleaning Supply usage (litre / labour hour): 15 Commercial 0.2 0.2 0.2 02 16 Residential 0.1 0.1 0.1 0.1 17 18 Cleaning Supply expense (S/litre)); $ 5.50 $ 5.50 $ 5.50 $ 5.50 19 20 Fixed overhead: 21 Receptionist 6,250 6,250 6,250 6,250 22 Depreciation 9,375 9,375 9,375 9,375 23 Gas 7,500 7,500 7,500 7,500 24 Office Supplies 1,000 1,000 1,000 1,000 25 26 Actual Cleaning Supply usage (litre / labour hour): Commercial Residential 0.19 0.09 0.19 0.09 0.19 0.09 0.19 0.09 Actual Cleaning Supply expense (S/litre)); S 5.6 5 5.6 S 5.6 S 5.6 25,000 37,500 30,000 4,000 Actual Fixed overhead: Receptionist Depreciation Gas Office Supplies 6,000 9,375 7,200 950 5,750 9,375 7.800 1,100 5,900 9,375 7,100 1,050 6,300 9,375 7,000 1,000 23,950 37,500 29,100 4,100 21,360 28 29 30 Total no. of hours actually paid to employees Breakdown: Commercial Residential Actual hours worked Direct labour cost 3,192 1,368 4,560 82,080 4,200 1,800 6,000 3,276 1,404 4,680 84,240 4 284 14,952 1,836 6,408 6,120 21,350 110,160 384,480 108,000 32 38 Unproductive (unbilled ) factor 2096 20% 20% 2095 2095 Labour - Commercial Actual Hours - AH Standard Rate -SR Total Standard Hours -SH Standard Rate - SR Total Efficiency Variance 1 2 3 Actual Hours - AH 4 Actual Rate -AR 5 Total 6 7 Rate Variance 8 9 10 11 Explanation for Efficiency variance: 12 13 14 Explanation for rate variance: 15 Total Variance Labour - Residential 17 18 19 20 21 22 Actual Hours - AH 23 Actual Rate -AR 24 Total 25 26 27 Actual Hours -AH Standard Rate -SR Total Standard Hours - SH Standard Rate - SR Total Rate Variance Efficiency Variance Total Variance 29 30 31 Explanation for Efficiency variance: 32 33 34 Explanation for rate variance: 35 38 37 38 39 Total Insert Delete Format B 1 Merge & Center - $ - % Clear a copy Paste Format Painter Clipboard Conditional Format Cell Formatting as Table - Styles Styles Sort & Find a Filter - Select Editing Font Alignment Number Cells 02 G H 1 1 M F N O Parameters - actual Quarters 2 1 Year 4 3 Year 18,400 12,880 5,520 Sales ( hours): Actual total sales Actual sales - commercial Actual sales - residential Selling price ( S/hr): Actual selling price-commercial Actual sellling price - residential 3,800 2,660 1,140 5,000 3,500 1,500 3,900 2,730 1,170 5,100 3,570 1.530 17,800 12,460 5,340 $40 $50 $40 $50 $40 $50 $40 $50 540 S50 540 $50 Direct labour expense (S/hr): s 18 S 18 S 18 5 18 B C D E E 1 Parameters - budget 2 Quarters 3 1 2 3 4 4 Sales (hours): 5 Budgeted total sales in hours 4,000 4,900 4,300 5,200 6 Budgeted commercial sales in hours 2,800 3,430 3,010 3,640 7 Budgeted residential sales in hours 1,200 1,470 1,290 1,560 8 Selling price ( S/hr): 9 Selling price per hour (commercial) $40 $40 $40 $40 10 Selling price per hour (residential) $50 $50 $50 $50 11 12 Direct labour expense (S/hr): S 20 S 205 20 S 20 13 14 Cleaning Supply usage (litre / labour hour): 15 Commercial 0.2 0.2 0.2 02 16 Residential 0.1 0.1 0.1 0.1 17 18 Cleaning Supply expense (S/litre)); $ 5.50 $ 5.50 $ 5.50 $ 5.50 19 20 Fixed overhead: 21 Receptionist 6,250 6,250 6,250 6,250 22 Depreciation 9,375 9,375 9,375 9,375 23 Gas 7,500 7,500 7,500 7,500 24 Office Supplies 1,000 1,000 1,000 1,000 25 26 Actual Cleaning Supply usage (litre / labour hour): Commercial Residential 0.19 0.09 0.19 0.09 0.19 0.09 0.19 0.09 Actual Cleaning Supply expense (S/litre)); S 5.6 5 5.6 S 5.6 S 5.6 25,000 37,500 30,000 4,000 Actual Fixed overhead: Receptionist Depreciation Gas Office Supplies 6,000 9,375 7,200 950 5,750 9,375 7.800 1,100 5,900 9,375 7,100 1,050 6,300 9,375 7,000 1,000 23,950 37,500 29,100 4,100 21,360 28 29 30 Total no. of hours actually paid to employees Breakdown: Commercial Residential Actual hours worked Direct labour cost 3,192 1,368 4,560 82,080 4,200 1,800 6,000 3,276 1,404 4,680 84,240 4 284 14,952 1,836 6,408 6,120 21,350 110,160 384,480 108,000 32 38 Unproductive (unbilled ) factor 2096 20% 20% 2095 2095 Labour - Commercial Actual Hours - AH Standard Rate -SR Total Standard Hours -SH Standard Rate - SR Total Efficiency Variance 1 2 3 Actual Hours - AH 4 Actual Rate -AR 5 Total 6 7 Rate Variance 8 9 10 11 Explanation for Efficiency variance: 12 13 14 Explanation for rate variance: 15 Total Variance Labour - Residential 17 18 19 20 21 22 Actual Hours - AH 23 Actual Rate -AR 24 Total 25 26 27 Actual Hours -AH Standard Rate -SR Total Standard Hours - SH Standard Rate - SR Total Rate Variance Efficiency Variance Total Variance 29 30 31 Explanation for Efficiency variance: 32 33 34 Explanation for rate variance: 35 38 37 38 39 Total