Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide the CORRECT answer to this question. Please read the question CAREFULLY and DOUBLE CHECK your work BEFORE posting it. Thank you! Pro forma.

Please provide the CORRECT answer to this question. Please read the question CAREFULLY and DOUBLE CHECK your work BEFORE posting it. Thank you!

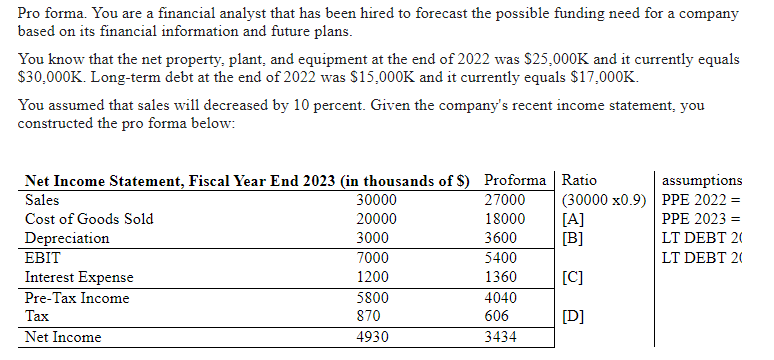

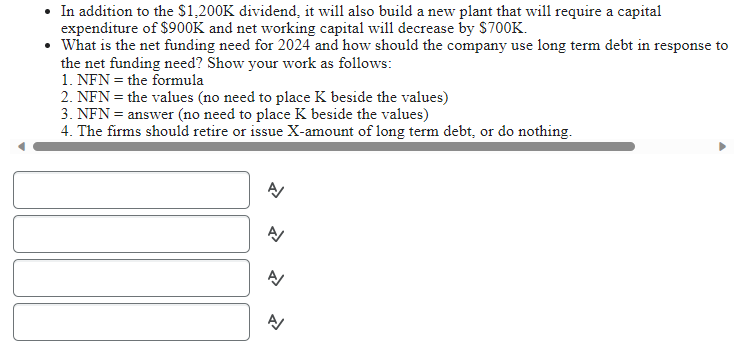

Pro forma. You are a financial analyst that has been hired to forecast the possible funding need for a company based on its financial information and future plans. You know that the net property, plant, and equipment at the end of 2022 was $25,000K and it currently equals $30,000K. Long-term debt at the end of 2022 was $15,000K and it currently equals $17,000K. You assumed that sales will decreased by 10 percent. Given the company's recent income statement, you constructed the pro forma below: - In addition to the $1,200K dividend, it will also build a new plant that will require a capital expenditure of $900K and net working capital will decrease by $700K. - What is the net funding need for 2024 and how should the company use long term debt in response to the net funding need? Show your work as follows: 1. NFN= the formula 2. NFN= the values (no need to place K beside the values) 3. NFN = answer (no need to place K beside the values) 4. The firms should retire or issue X-amount of long term debt, or do nothingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started