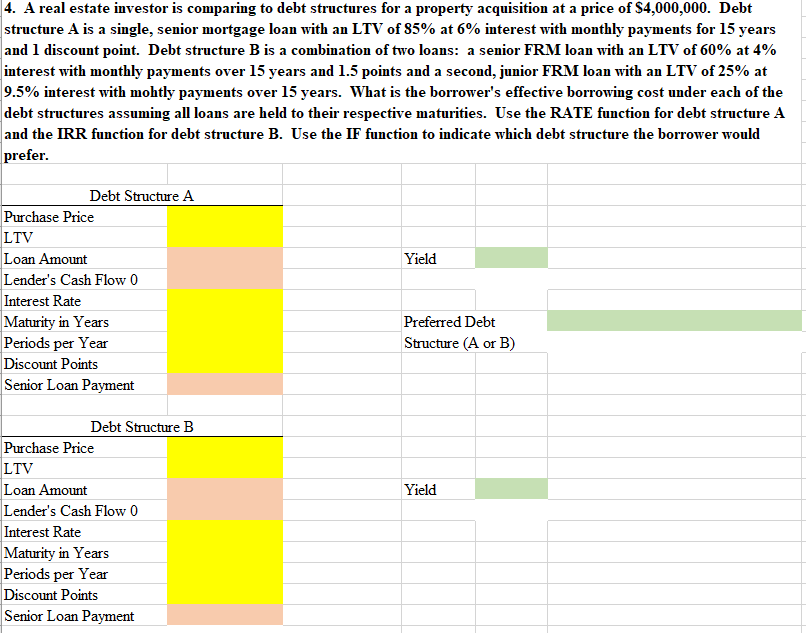

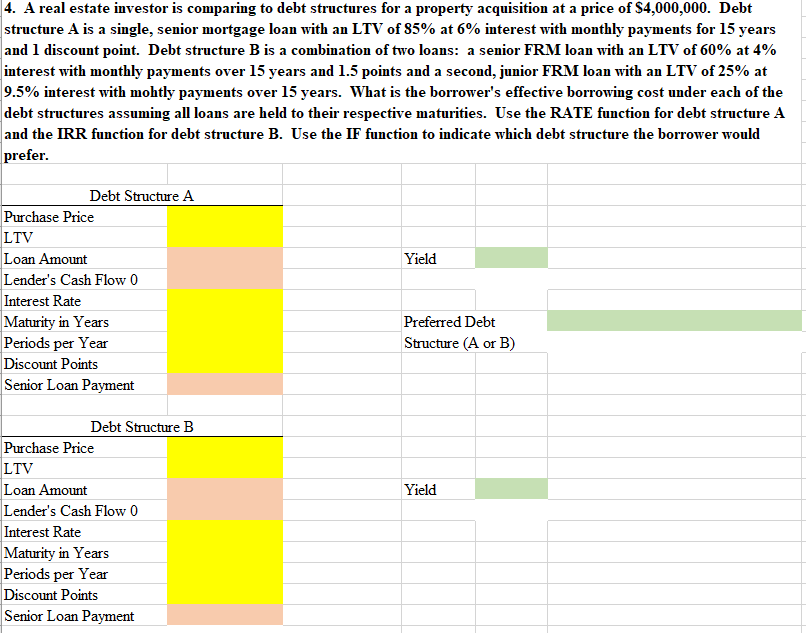

Please provide the excel function formula with the answer (answer is in the green highlight cell)

4. A real estate investor is comparing to debt structures for a property acquisition at a price of $4,000,000. Debt structure A is a single, senior mortgage loan with an LTV of 85% at 6% interest with monthly payments for 15 years and 1 discount point. Debt structure B is a combination of two loans: a senior FRM loan with an LTV of 60% at 4% interest with monthly payments over 15 years and 1.5 points and a second, junior FRM loan with an LTV of 25% at 9.5% interest with mohtly payments over 15 years. What is the borrower's effective borrowing cost under each of the debt structures assuming all loans are held to their respective maturities. Use the RATE function for debt structure A and the IRR function for debt structure B. Use the IF function to indicate which debt structure the borrower would prefer. Yield Debt Structure A Purchase Price LTV Loan Amount Lender's Cash Flow 0 Interest Rate Maturity in Years Periods per Year Discount Points Senior Loan Payment Preferred Debt Structure (A or B) Yield Debt Structure B Purchase Price LTV Loan Amount Lender's Cash Flow 0 Interest Rate Maturity in Years Periods per Year Discount Points Senior Loan Payment 4. A real estate investor is comparing to debt structures for a property acquisition at a price of $4,000,000. Debt structure A is a single, senior mortgage loan with an LTV of 85% at 6% interest with monthly payments for 15 years and 1 discount point. Debt structure B is a combination of two loans: a senior FRM loan with an LTV of 60% at 4% interest with monthly payments over 15 years and 1.5 points and a second, junior FRM loan with an LTV of 25% at 9.5% interest with mohtly payments over 15 years. What is the borrower's effective borrowing cost under each of the debt structures assuming all loans are held to their respective maturities. Use the RATE function for debt structure A and the IRR function for debt structure B. Use the IF function to indicate which debt structure the borrower would prefer. Yield Debt Structure A Purchase Price LTV Loan Amount Lender's Cash Flow 0 Interest Rate Maturity in Years Periods per Year Discount Points Senior Loan Payment Preferred Debt Structure (A or B) Yield Debt Structure B Purchase Price LTV Loan Amount Lender's Cash Flow 0 Interest Rate Maturity in Years Periods per Year Discount Points Senior Loan Payment