Question

please provide the following calculations: consider the following cash flow statement. a. What were the company's cumulative earnings over these four quarters? What were its

please provide the following calculations:

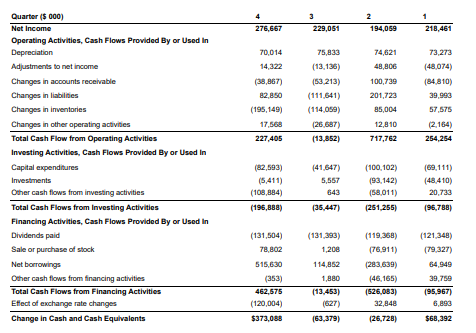

- consider the following cash flow statement.

a. What were the company's cumulative earnings over these four quarters? What were its cumulative cash flows from operating activities?

b. What fraction of the cash from operating activities was used for investment over the four quarters?

c. What fraction of the cash from operating activities was used for financing activities over the four quarters?

2. In December 2018, General Electric (GE) had a book value of equity of $51.4

billion, 8.8 billion shares outstanding, and a market price of $8.09 per share. GE also had cash of $70.4 billion, and total debt of $110.2 billion.

a. What was GE's market capitalization? What was GE's market-to-book ratio?

b. What was GE's book debt-equity ratio? What was GE's market debt-equity ratio?

c. What was GE's enterprise value?

3. In December 2018, Apple had cash of $86.59 billion, current assets of $141.25

billion, and current liabilities of $108.36 billion. It also had inventories of $4.99

billion.

a. What was Apple's current ratio?

b. What was Apple's quick ratio?

c. In January 2019, Hewlett-Packard had a quick ratio of 0.55 and a current ratio of

0.78. What can you say about the asset liquidity of Apple relative to Hewlett-Packard?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started