Please provide the work you did to get each answer. thank you

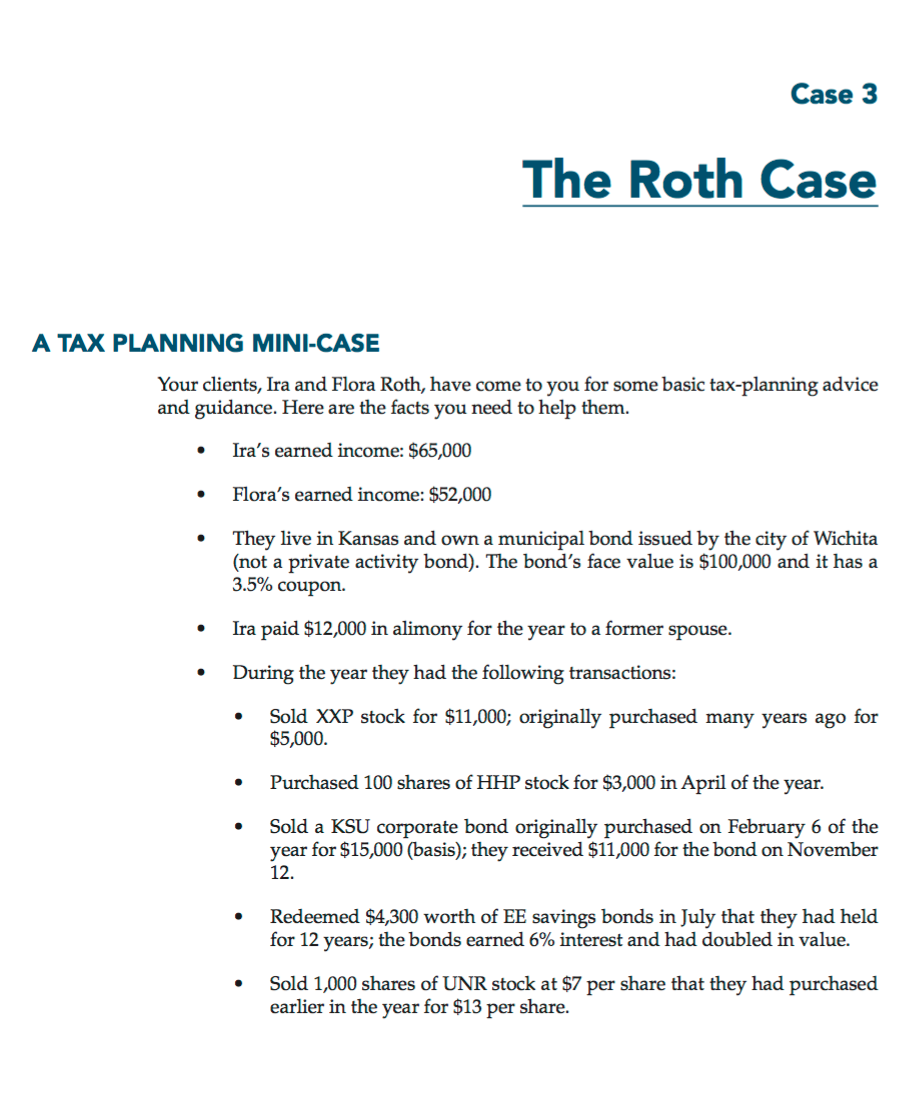

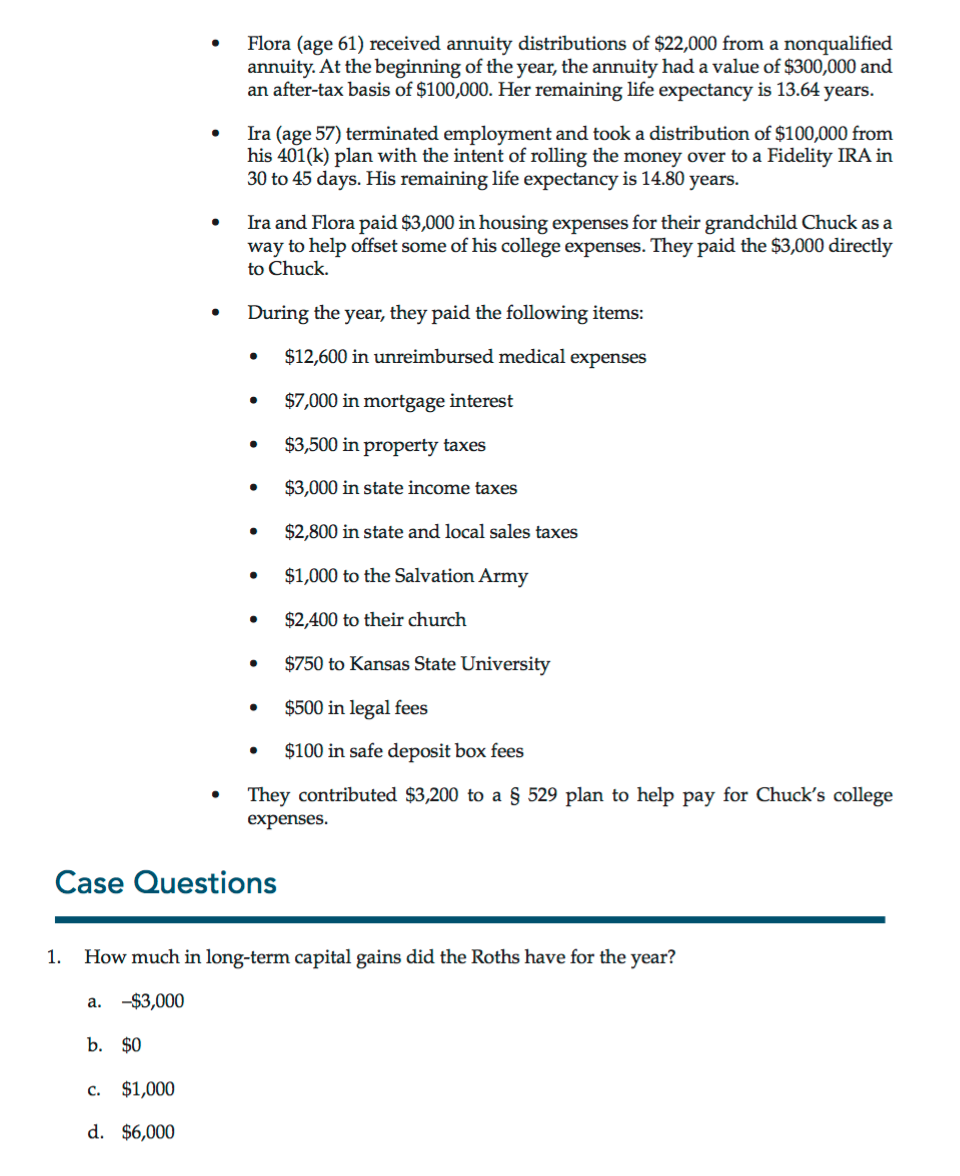

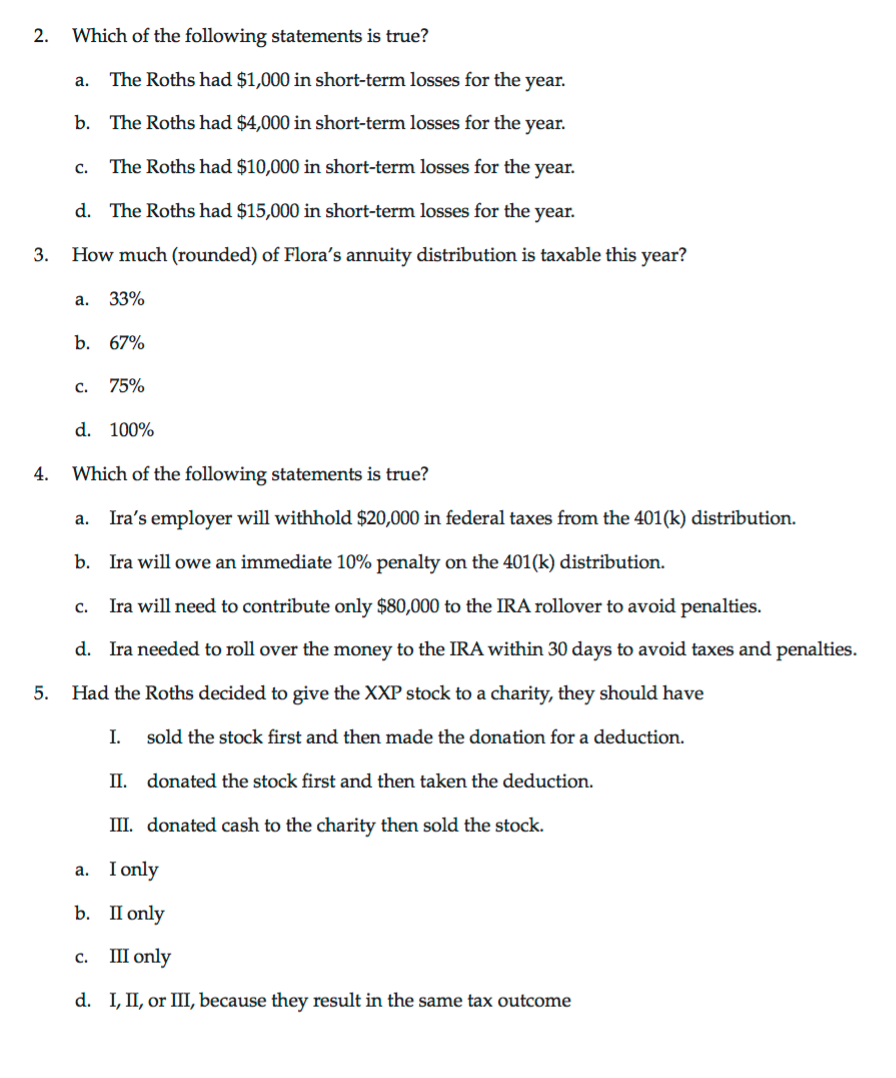

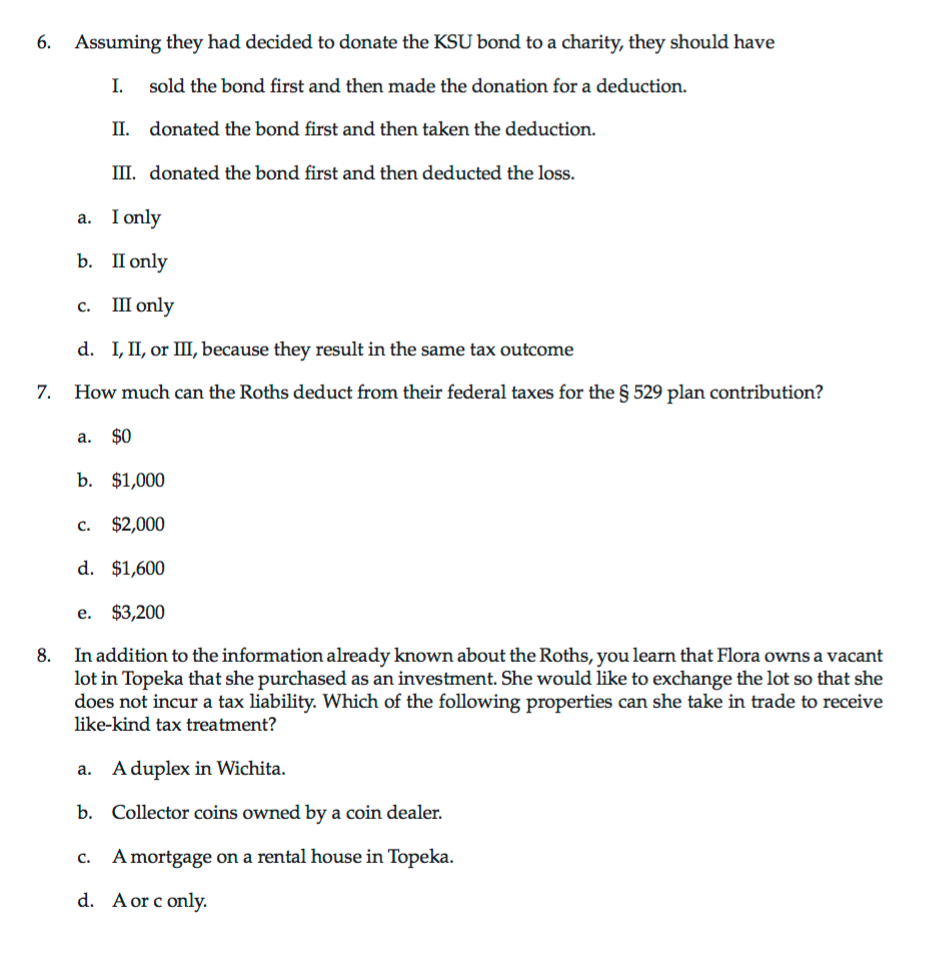

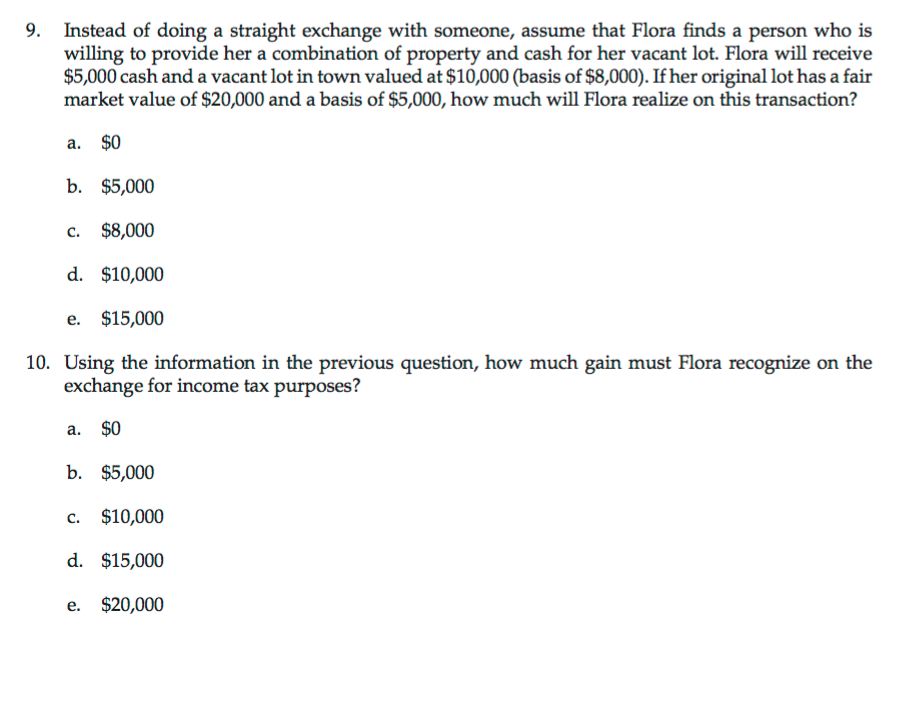

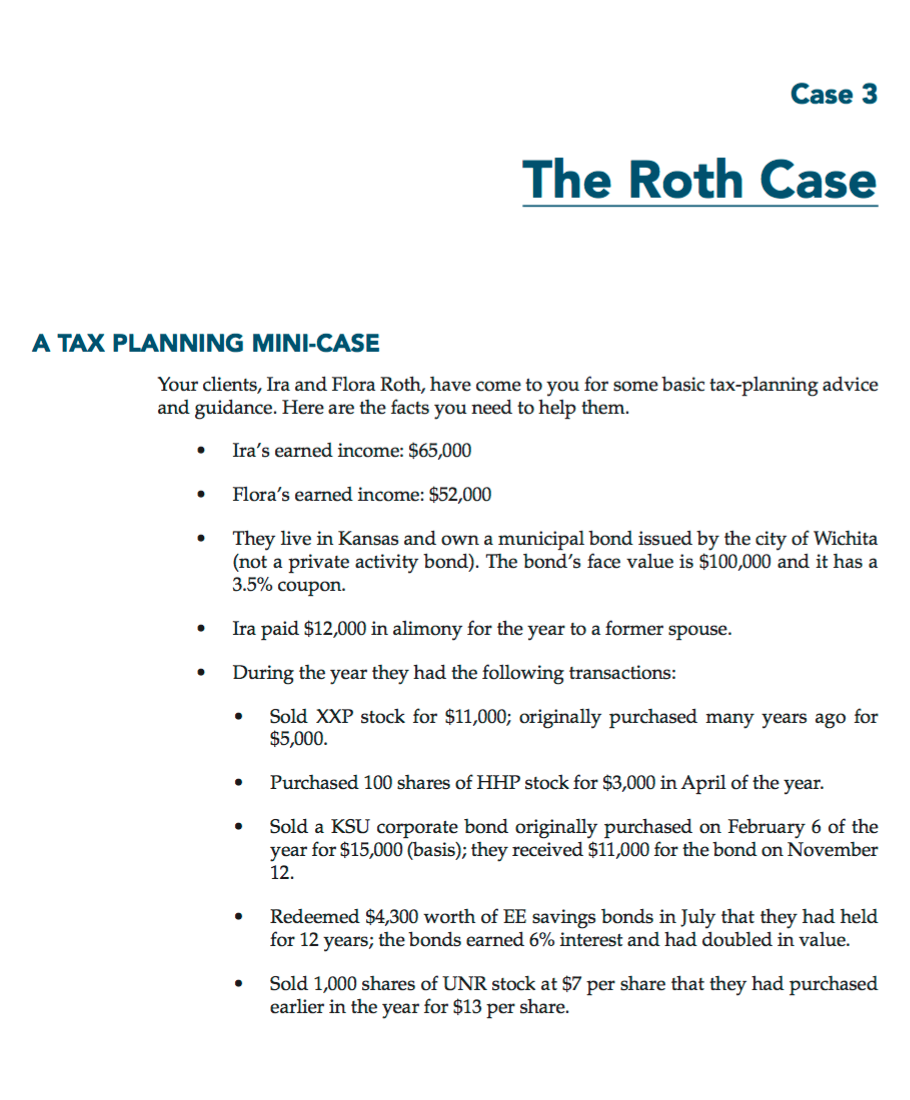

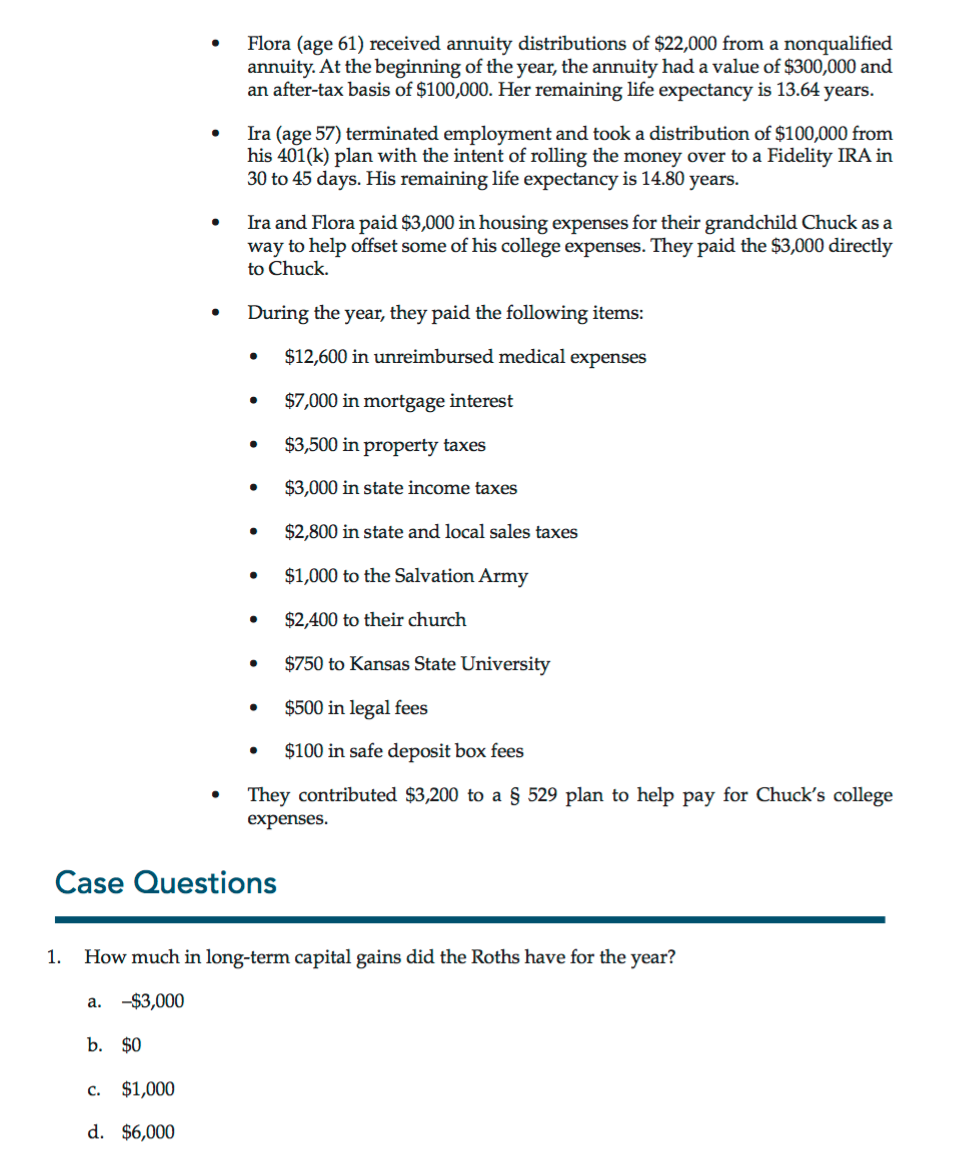

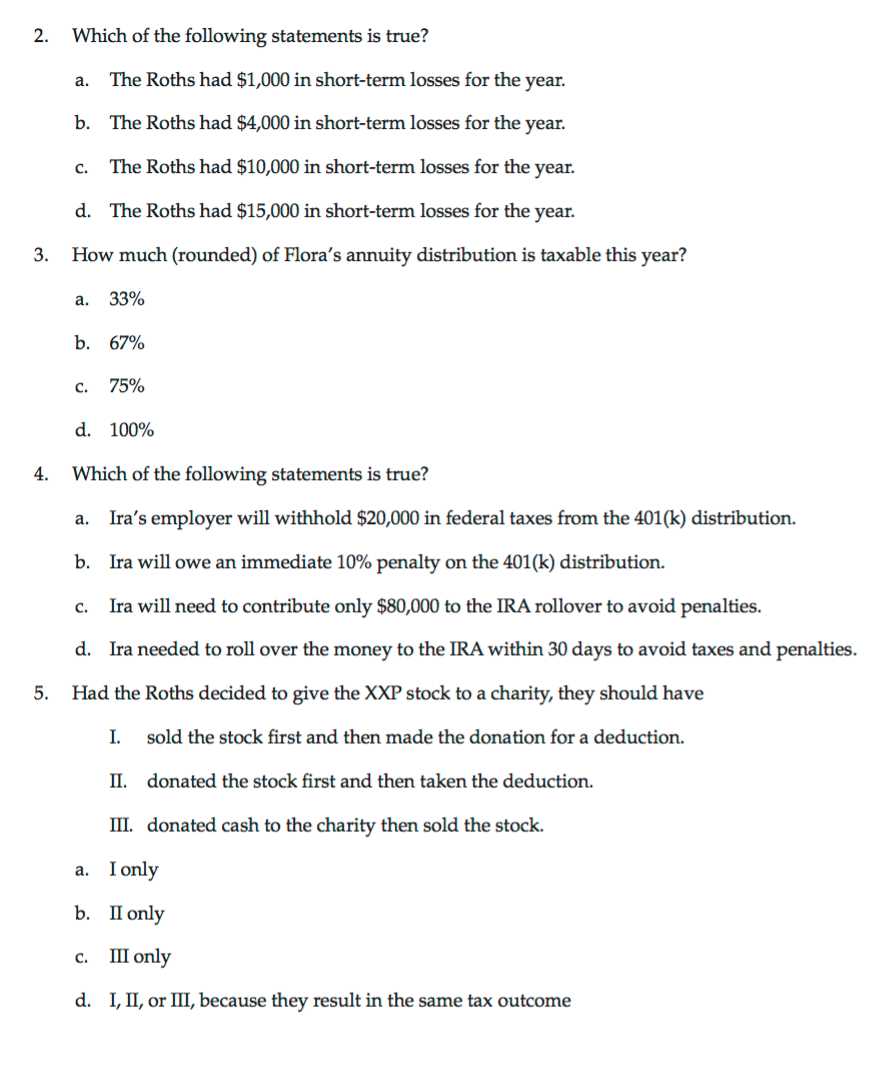

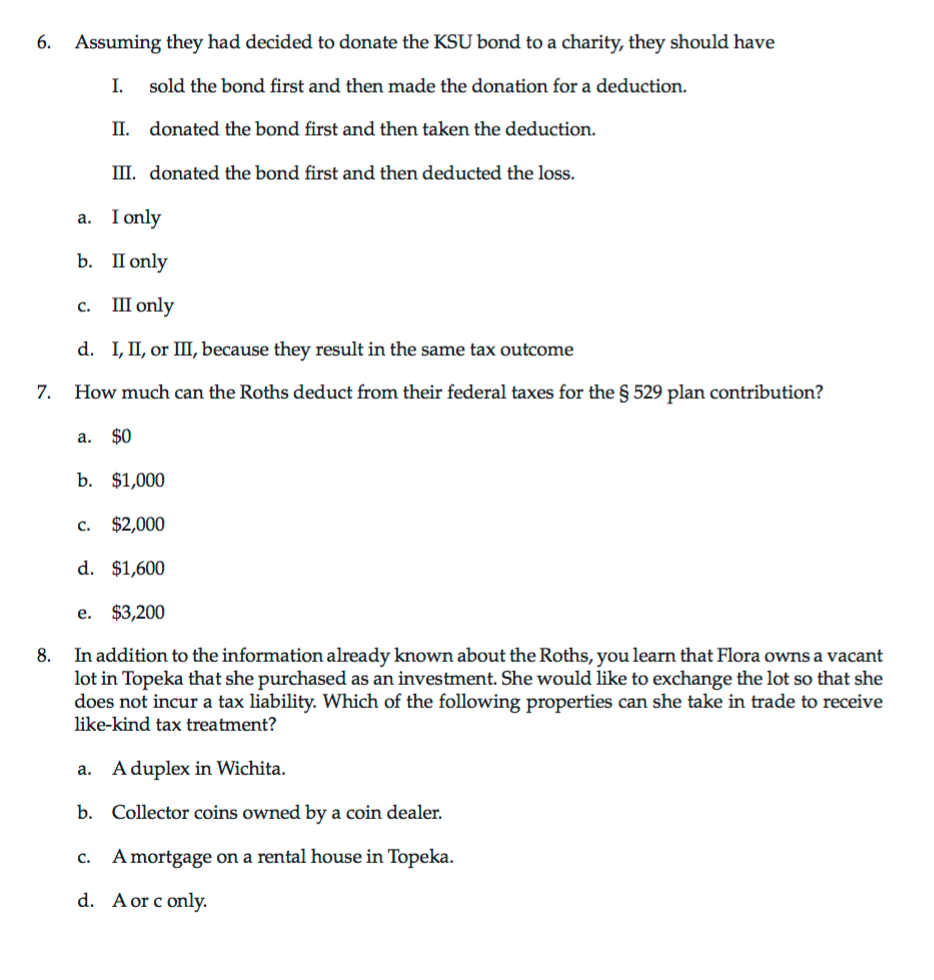

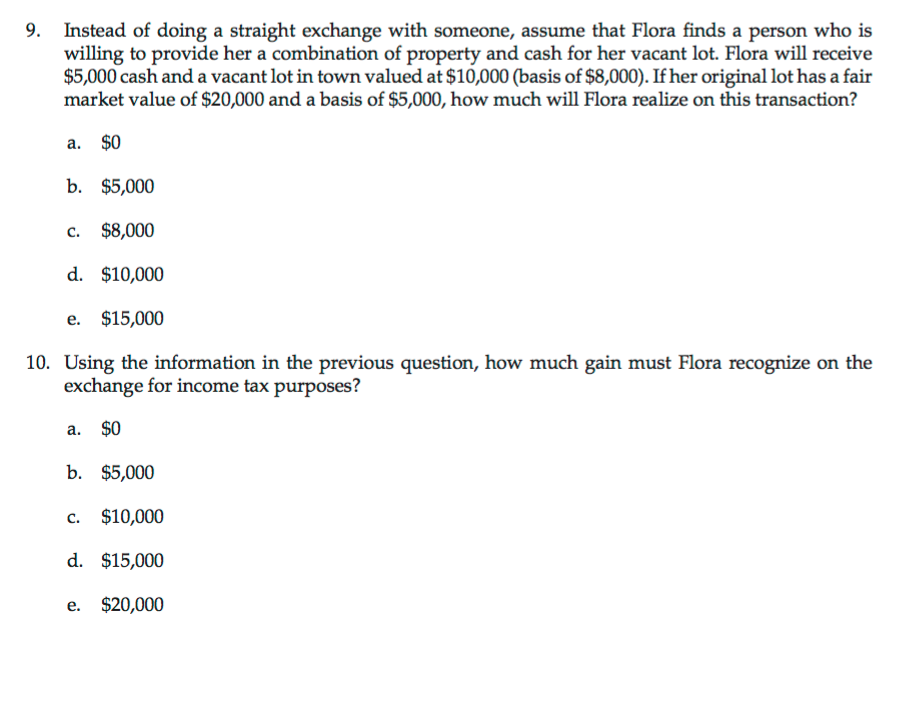

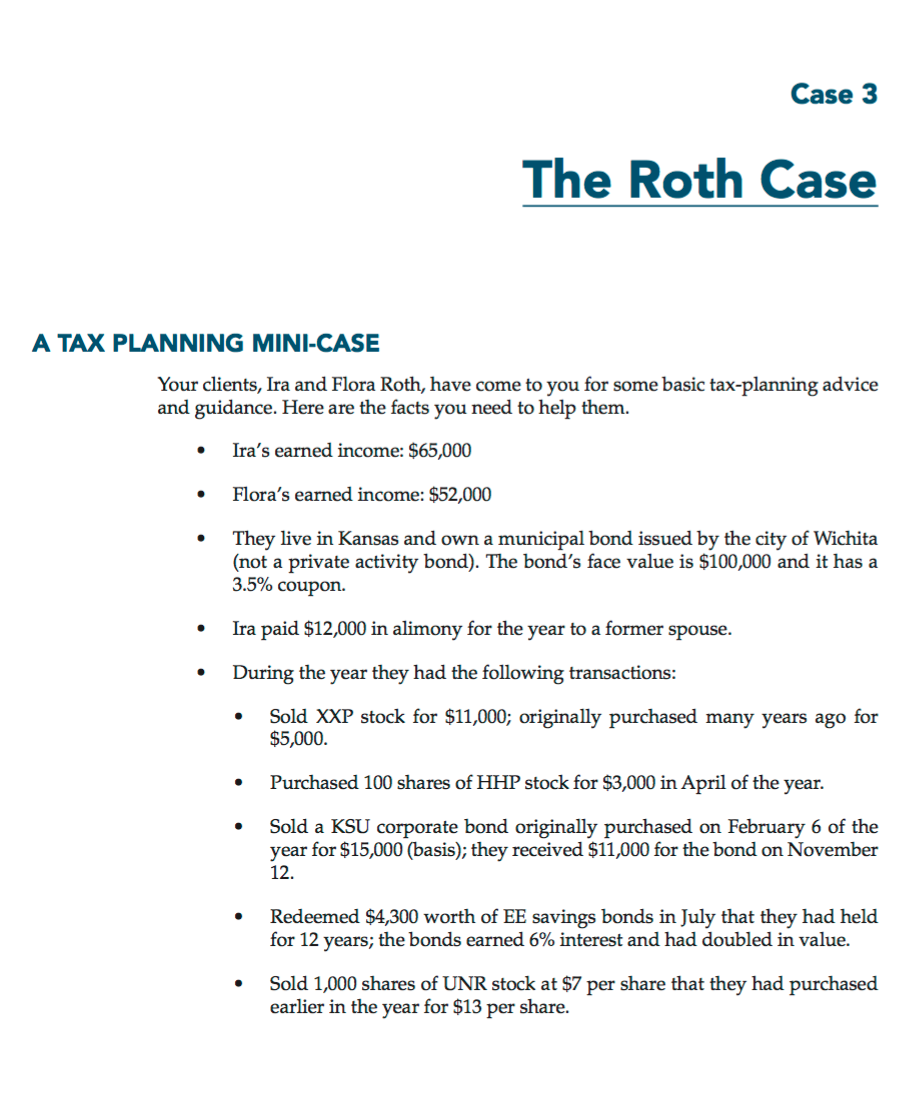

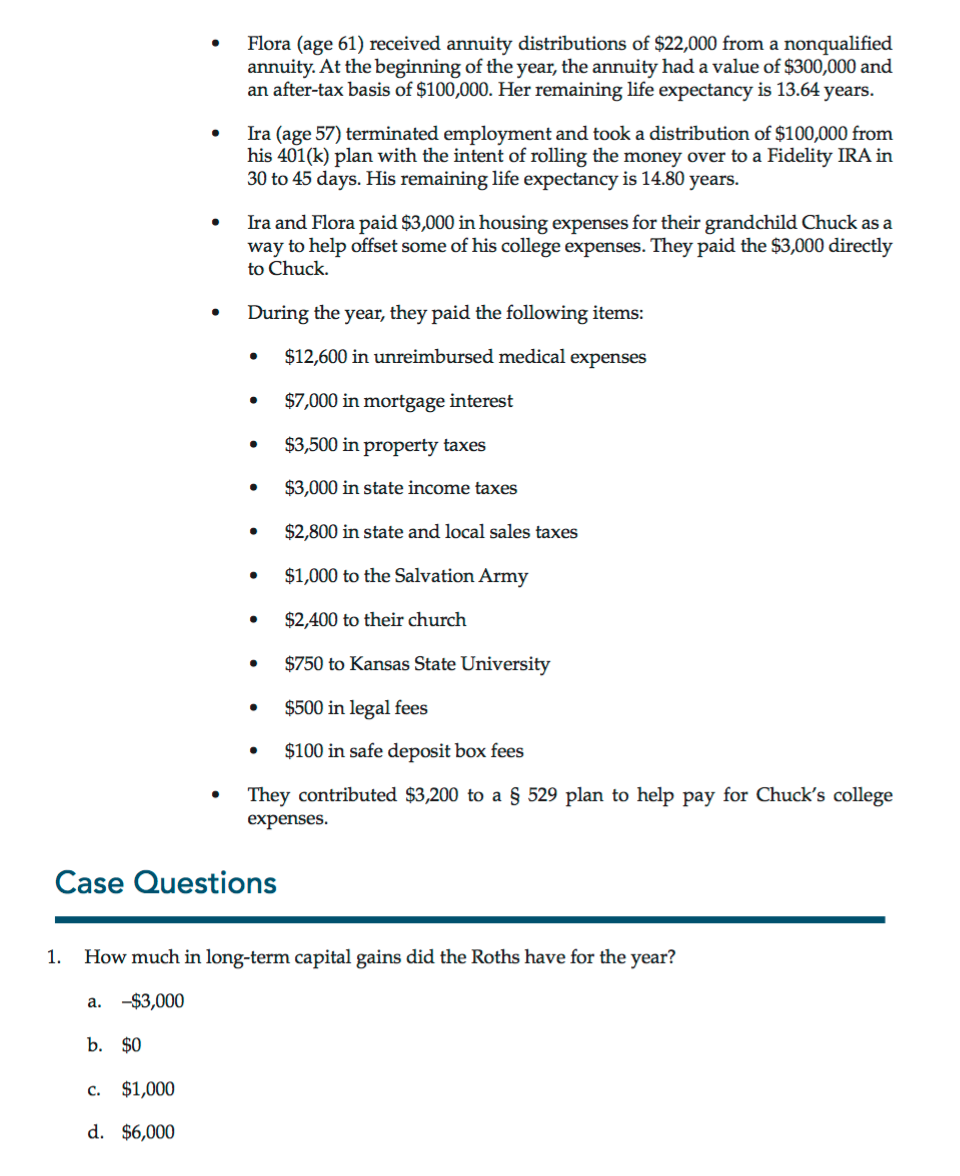

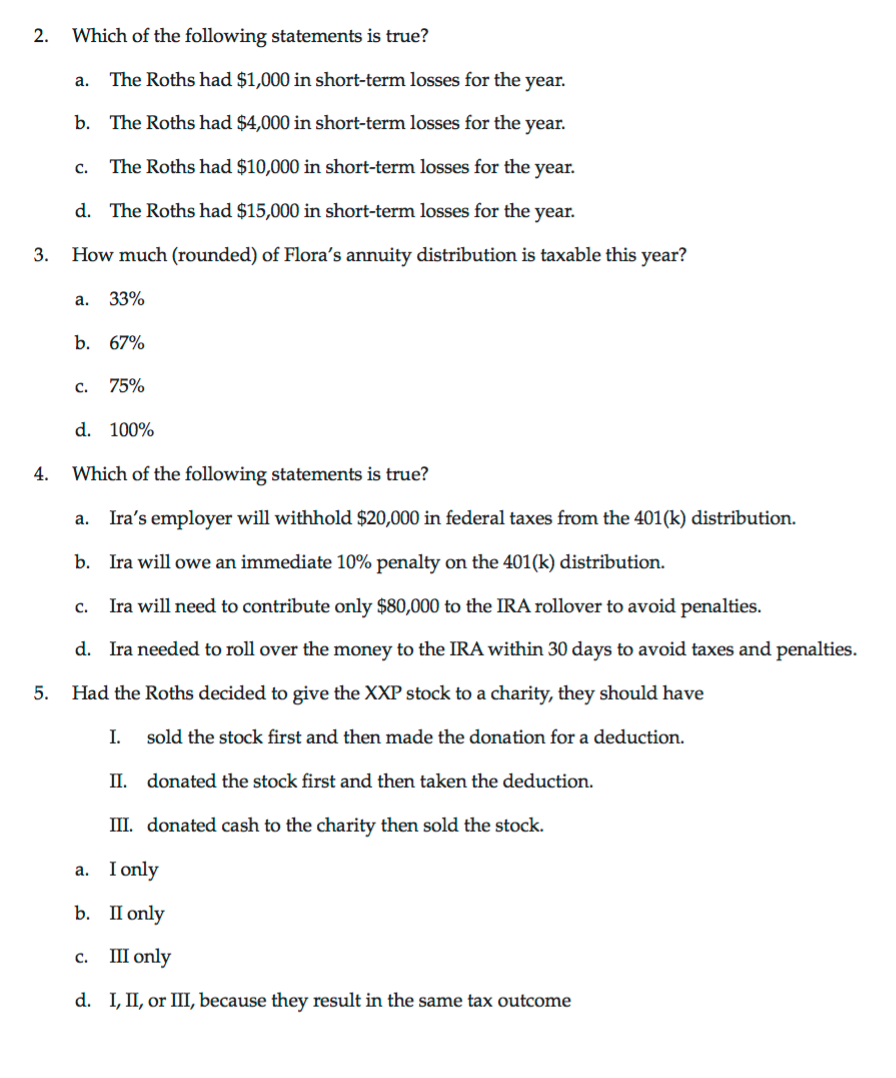

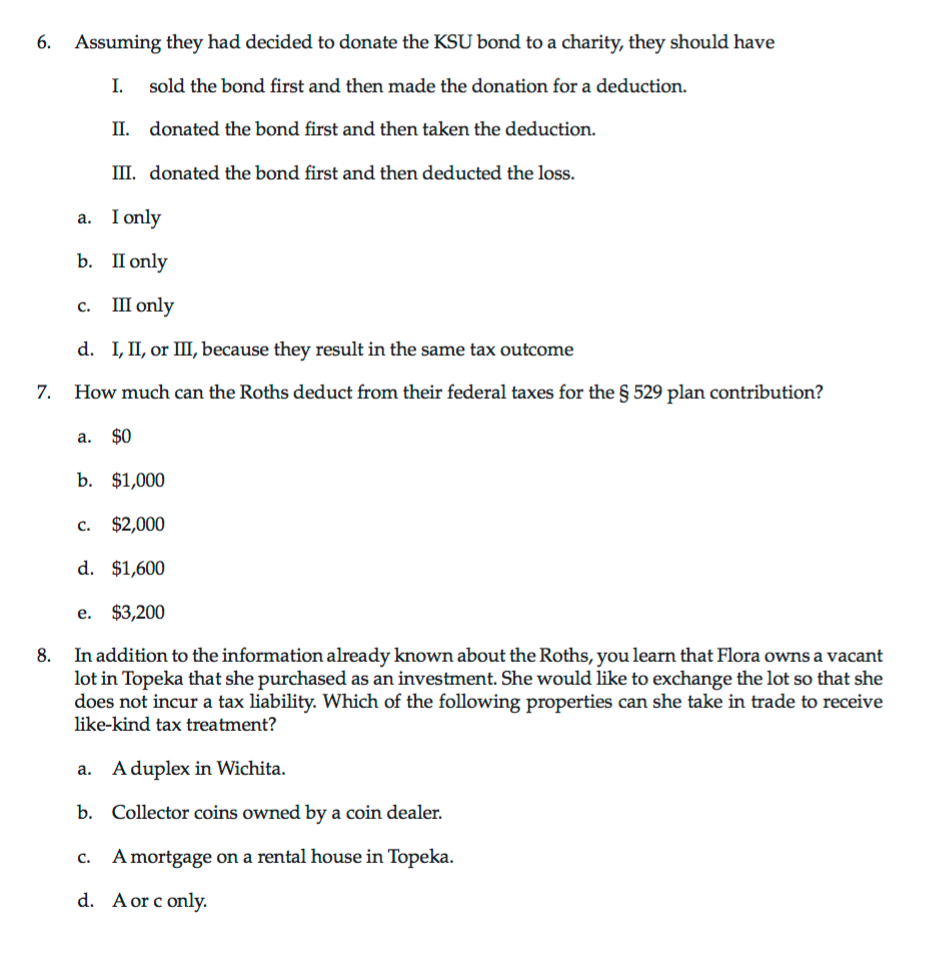

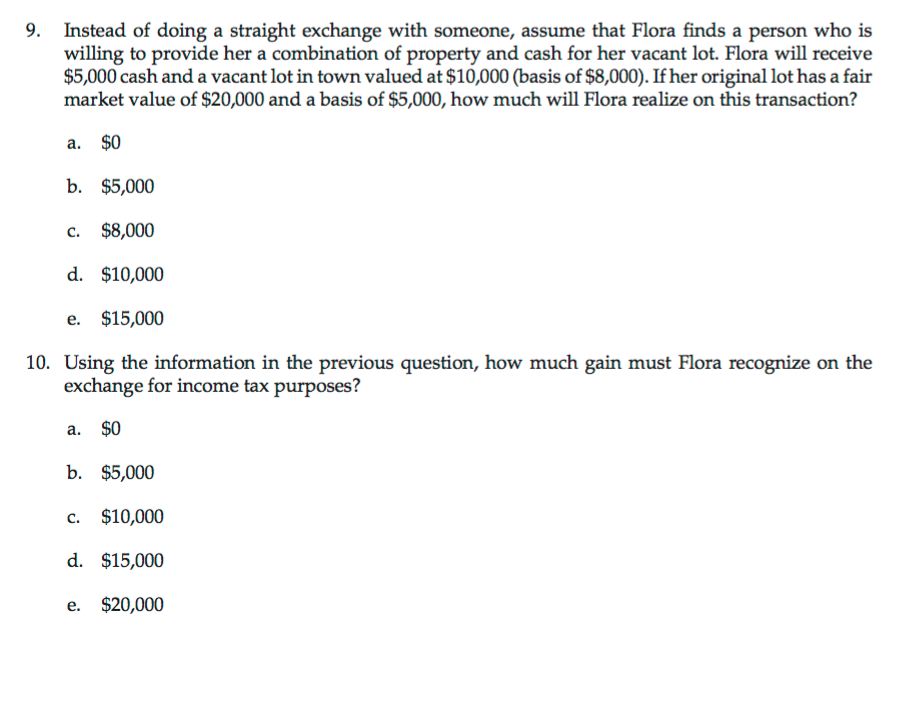

Case3 The Roth Case A TAX PLANNING MINI-CASE Your clients, Ira and Flora Roth, have come to you for some basic tax-planning advice and guidance. Here are the facts you need to help them. Ira's earned income: $65,000 Flora's earned income: $52,003 They live inKansas andowna municipalbondissuedbylecityofWiclta (not a private activity bond). The band's face value is $100M and it has a 3.5% coupon. Ira paid $12,000 in alimony for the year to a former spouse. During the year theyhad thefollmving transactions: Sold XXP stock for $11,001; originally purchased many years ago for $5,000- BirchasedlsharezofllPstockforpmmAprofteyear. Sold a KSU corporate bond originaJJy purchased on February 6 of the year for $15,000 (basis); they received $11,000 for the bond on Nevember 12. Redeemed $4,300worthofEEsavingr-bondsinlulythat1eyhadheld for 12years;1ebondseamed6% interestandhaddOubledmvalue. Sold 1,0005hamofUNRstockaw7pershare1atieyhadpurchased earlier in the year for $13 per share. Flora (age 61) received annuity distributions of $22,000 from a nonqualiecl annuity. At the beginning of the year, the annuity had a value of $300,000 and an after-tax basis of $100,000. Her remaining life expectancy is 13.64 years. Ira (age 57) terminated employment and took a distribution of $100030 from his401(k) plan withthe intent ofrolling themoney over to a Fidelity IRAin 30 to 45 days. His remaining life expectancy is 14.80 years. Ira and Flora paid $3,000 in housing expenses for their grandchild Chuck as a waytohelpoffsetsomeofhiscoegeexpmsesheypaid te$3,000 directly to Chuck. During the year, theypaid the following items: ' $12,600 in unreimbursed medical expenses 0 $7,000 in mortgage interest $3500 inproperty taxes ' $3,000 in state income taxes 0 $2,800instateandlocalsalestaxes II $1,000 to the Salvation Army ' $2,400 to their church - $750 to Kansas State University . $500 in legal fees ' $100 in safe deposit box fees They contributed $3,200 to in 529 plan to help pay for Chuck's college expenses. Case Questions 1. a. $3,000 b. $0 c. $1,000 d. $6,000 How much in long-term capital gains did the Roths have for the year? Which of the following statements is true? a. The Roths had $1,000 in short-term losses for the year. b. The Roths had $4,000 in short-term losses for the year. c. The Roths had $10,000 in short-term losses for the year. d. The Roths had $15,000 in shortm losses for the year. How much (rounded) of Flora's annuity distribution is taxable this year? a. 33% b. 67% c. 75% d. 100% Which of the following statements is true? a. Ira's employer will withhold $20,000 in federal taxes from the 401(k) distribution. b. Ira will owe an immediate 10% penalty on the 4010:) distribution. 1:. Ira will need to contribute only $00,000 to the IRA rollover to avoid paralties. d. Ira needed to roll over the money to the IRA within 30 days to avoid taxes and penalties. Had the Roths decided togivetheXXPatock toa charity,they should have I. sold the stock firstand then made the donationfora deduction. I]. donated the stock rst and then taken the deduction. III. donated cash to the charity then sold the stock. a. I only b. [I only c. III only (1. I, II, or III, because they result in the same tax outcome 6. Assuming they had decided to donate the KSU bond to a charity, they should have I. sold the bond rst and then made the donation for a deduction. II. donated the bond rst and then taken the deduction. II]. donated the bond rst and then deducted the loss. a. I only b. II only c. II] only d. I, II, or III, because they result in the same tax outcome 7. How much can the Roths deduct from their federal taxes for the 529 plan contribution? a. $0 b. $1,000 c. $2,000 d. $1,600 e. $3,200 8. In addition to the information already known about the Roths, you learn that Flora owns a vacant lot in Topeka that she purchased as an investment. She would like to exchange the lot so that she does not incur a tax liability. Which of the following properties can she take in trade to receive like-kind tax treatment? a. A duplex in Wichita. b. Collector coins owned by a coin dealer. c. A mortgage on a rental house in Topeka. d. A or c only. 9. Instead of doing a straight exchange with someone, assume that Flora nds a person who is willing to provide her a combination of property and cash for her vacant lot. Flora will receive $5,000 cash and a vacant lot in town valued at $10,000 (basis ammo). Ifher original lot has a fair market value of $20,000 and a basis of $5,000, how much will Flora realize on this transaction? 8.. $0 is. $5,000 c. $8,000 d. $10,000 e. $15,000 10. Using the information in the previous question, how much gain must Flora recognize on the exchange for income tax purposes? a. $0 b. $5,000 c. $10,000 d. $15,000 e. $20,000