Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE PROVIDE THROUGH EXPLANATIONS AND THE FORMULAS USED [IN EXCEL] - A property is purchased for $3,500,000 (assume this is the all-in cost with closing

PLEASE PROVIDE THROUGH EXPLANATIONS AND THE FORMULAS USED [IN EXCEL]

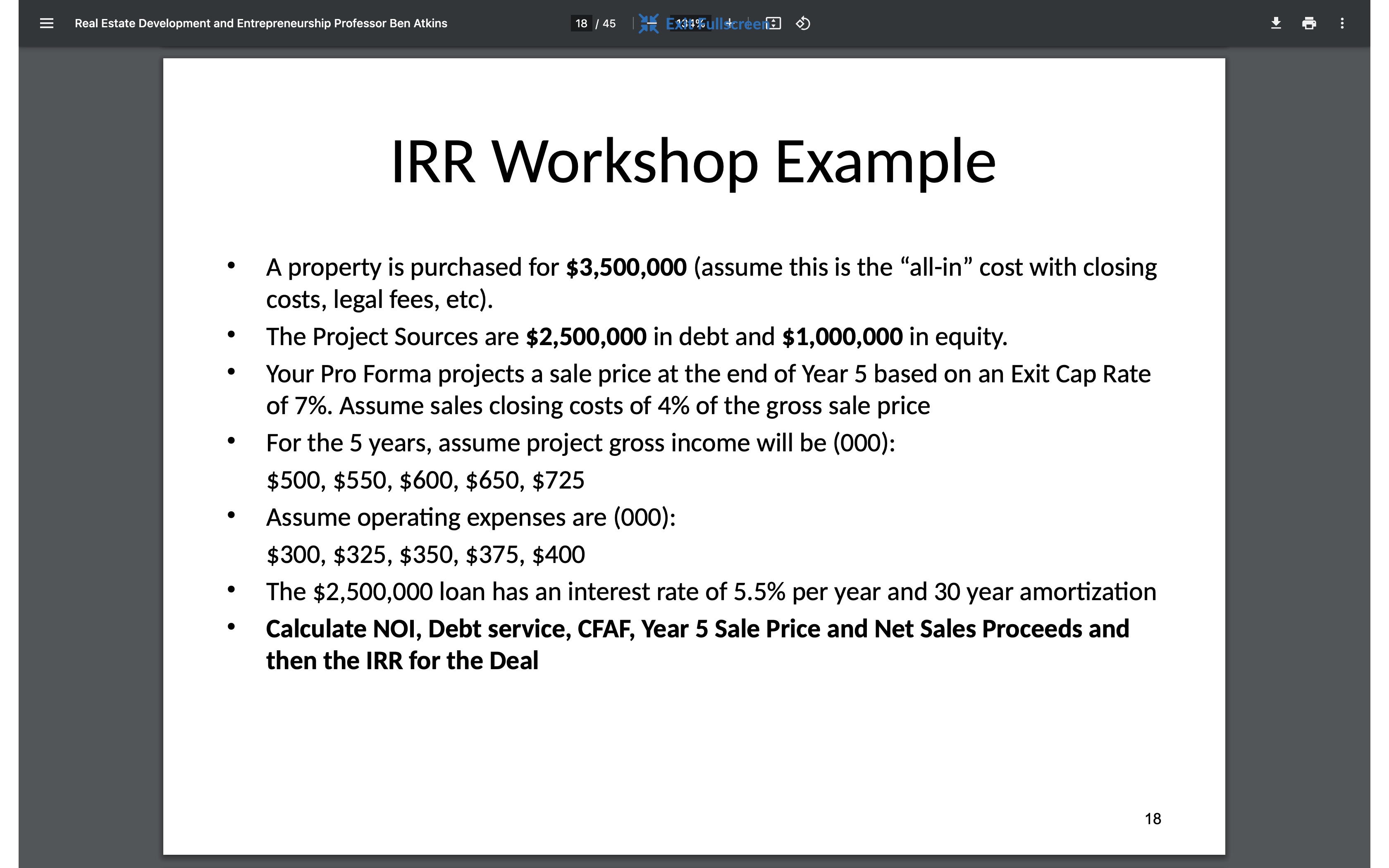

- A property is purchased for $3,500,000 (assume this is the "all-in" cost with closing costs, legal fees, etc). - The Project Sources are $2,500,000 in debt and $1,000,000 in equity. - Your Pro Forma projects a sale price at the end of Year 5 based on an Exit Cap Rate of 7%. Assume sales closing costs of 4% of the gross sale price - For the 5 years, assume project gross income will be (000): $500,$550,$600,$650,$725 - Assume operating expenses are (000): $300,$325,$350,$375,$400 - The $2,500,000 loan has an interest rate of 5.5% per year and 30 year amortization - Calculate NOI, Debt service, CFAF, Year 5 Sale Price and Net Sales Proceeds and then the IRR for the DealStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started