please provide worked answers to the below. Answer guide provided under questions - i want to check my own answers.

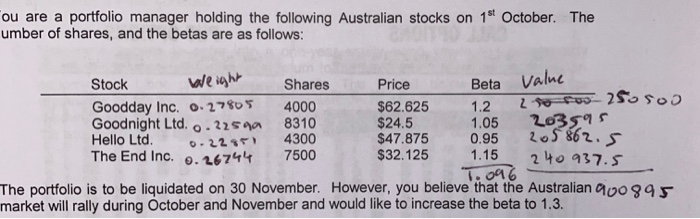

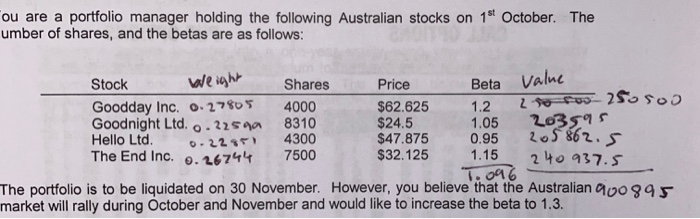

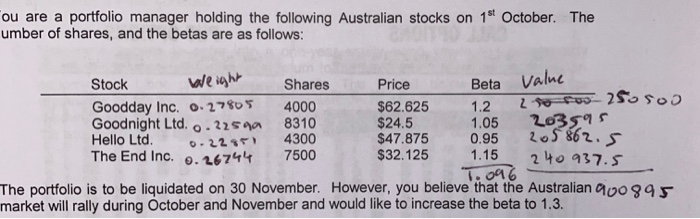

ou are a portfolio manager holding the following Australian stocks on 1st October. The umber of shares, and the betas are as follows: Beta Value Stock Weight Shares Price Goodday Inc. 0.27805 4000 $62.625 1.2 2. to roo-250500 Goodnight Ltd. o.22599 8310 $24.5 1.05 203595 Hello Ltd 0.2211 4300 $47.875 0.95 205862.5 The End Inc. 0.26744 7500 $32.125 1.15 240937.5 Too96 The portfolio is to be liquidated on 30 November. However, you believe that the Australian 900895 market will rally during October and November and would like to increase the beta to 1.3. (a) Construct transactions that will increase the beta of the portfolio to 1.3 using one or more of these December futures contracts: S&P 500 futures, which are currently trading at 151. SPI 200 futures, which are currently trading at 373. Goodday Inc. futures, which are currently trading a 394. All prices are in Australian dollars and assume all futures contracts have a contract multiplier of $250 per index point. [4 marks] Calculate portfolio beta, appropriate hedge ratio etc - see Topic 3 slides for examples on index futures hedging and market timing. Be mindful of relevant market instrument to use. No room for error in long/short hedge, if in doubt recap "rules of thumb" I offered in lecture. (b) Identify two alternative methods (other than selling securities from the portfolio or using futures) that replicates the feature strategy in Part a. Contrast each of these methods with the futures strategy. [3 marks] Think options, think synthetics. Be mindful of characteristics of intended instruments. ou are a portfolio manager holding the following Australian stocks on 1st October. The umber of shares, and the betas are as follows: Beta Value Stock Weight Shares Price Goodday Inc. 0.27805 4000 $62.625 1.2 2. to roo-250500 Goodnight Ltd. o.22599 8310 $24.5 1.05 203595 Hello Ltd 0.2211 4300 $47.875 0.95 205862.5 The End Inc. 0.26744 7500 $32.125 1.15 240937.5 Too96 The portfolio is to be liquidated on 30 November. However, you believe that the Australian 900895 market will rally during October and November and would like to increase the beta to 1.3. (a) Construct transactions that will increase the beta of the portfolio to 1.3 using one or more of these December futures contracts: S&P 500 futures, which are currently trading at 151. SPI 200 futures, which are currently trading at 373. Goodday Inc. futures, which are currently trading a 394. All prices are in Australian dollars and assume all futures contracts have a contract multiplier of $250 per index point. [4 marks] Calculate portfolio beta, appropriate hedge ratio etc - see Topic 3 slides for examples on index futures hedging and market timing. Be mindful of relevant market instrument to use. No room for error in long/short hedge, if in doubt recap "rules of thumb" I offered in lecture. (b) Identify two alternative methods (other than selling securities from the portfolio or using futures) that replicates the feature strategy in Part a. Contrast each of these methods with the futures strategy. [3 marks] Think options, think synthetics. Be mindful of characteristics of intended instruments