please provide written steps

Thank you

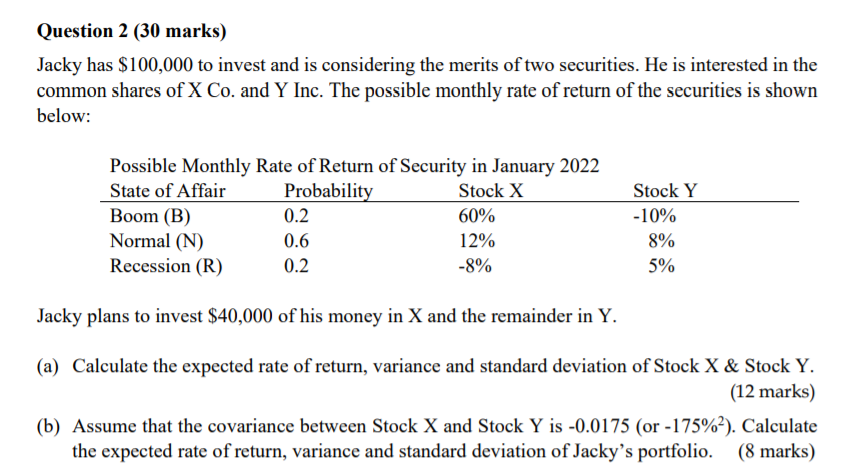

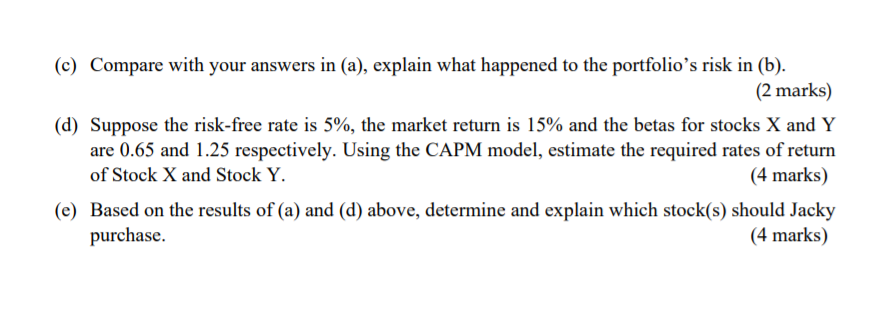

Question 2 (30 marks) Jacky has $100,000 to invest and is considering the merits of two securities. He is interested in the common shares of X Co. and Y Inc. The possible monthly rate of return of the securities is shown below: Possible Monthly Rate of Return of Security in January 2022 State of Affair Probability Stock X Boom (B) 0.2 60% Normal (N) 0.6 12% Recession (R) 0.2 -8% Stock Y -10% 8% 5% Jacky plans to invest $40,000 of his money in X and the remainder in Y. (a) Calculate the expected rate of return, variance and standard deviation of Stock X & Stock Y. (12 marks) (b) Assume that the covariance between Stock X and Stock Y is -0.0175 (or -175%-). Calculate the expected rate of return, variance and standard deviation of Jacky's portfolio. (8 marks) (c) Compare with your answers in (a), explain what happened to the portfolio's risk in (b). (2 marks) (d) Suppose the risk-free rate is 5%, the market return is 15% and the betas for stocks X and Y are 0.65 and 1.25 respectively. Using the CAPM model, estimate the required rates of return of Stock X and Stock Y. (4 marks) (e) Based on the results of (a) and (d) above, determine and explain which stock(s) should Jacky purchase. (4 marks) Question 2 (30 marks) Jacky has $100,000 to invest and is considering the merits of two securities. He is interested in the common shares of X Co. and Y Inc. The possible monthly rate of return of the securities is shown below: Possible Monthly Rate of Return of Security in January 2022 State of Affair Probability Stock X Boom (B) 0.2 60% Normal (N) 0.6 12% Recession (R) 0.2 -8% Stock Y -10% 8% 5% Jacky plans to invest $40,000 of his money in X and the remainder in Y. (a) Calculate the expected rate of return, variance and standard deviation of Stock X & Stock Y. (12 marks) (b) Assume that the covariance between Stock X and Stock Y is -0.0175 (or -175%-). Calculate the expected rate of return, variance and standard deviation of Jacky's portfolio. (8 marks) (c) Compare with your answers in (a), explain what happened to the portfolio's risk in (b). (2 marks) (d) Suppose the risk-free rate is 5%, the market return is 15% and the betas for stocks X and Y are 0.65 and 1.25 respectively. Using the CAPM model, estimate the required rates of return of Stock X and Stock Y. (4 marks) (e) Based on the results of (a) and (d) above, determine and explain which stock(s) should Jacky purchase. (4 marks)