Answered step by step

Verified Expert Solution

Question

1 Approved Answer

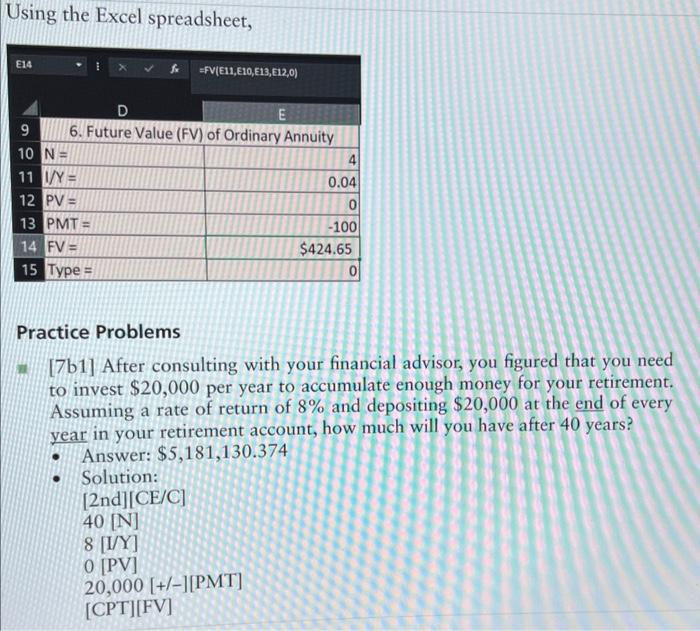

please put in an excel table like the example shown. Using the Excel spreadsheet, Practice Problems * [7b1] After consulting with your financial advisor, you

please put in an excel table like the example shown.

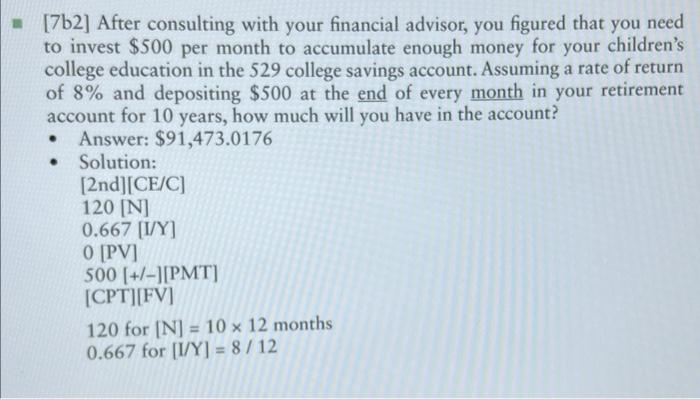

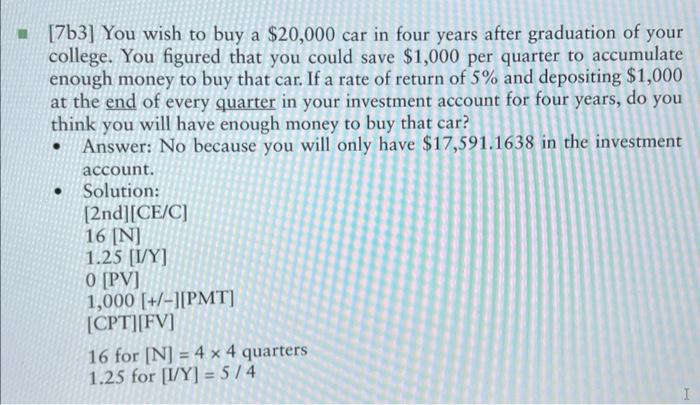

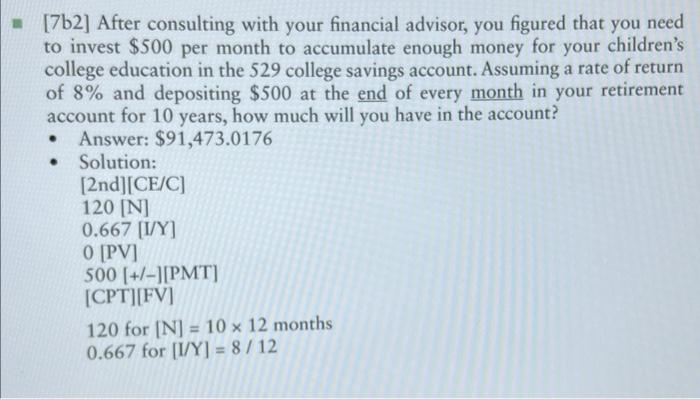

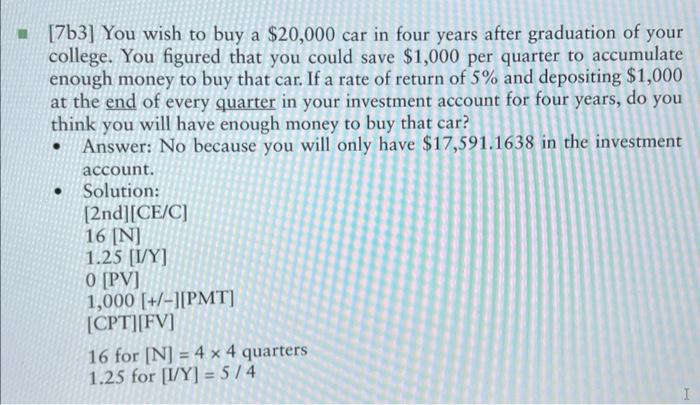

Using the Excel spreadsheet, Practice Problems * [7b1] After consulting with your financial advisor, you figured that you need to invest $20,000 per year to accumulate enough money for your retirement. Assuming a rate of return of 8% and depositing $20,000 at the end of every year in your retirement account, how much will you have after 40 years? - Answer: $5,181,130.374 - Solution: [2nd][CE/C] 40[N] 8[I/Y] 0 [PV] 20,000[+/][PMT] [CPT][FV] [7b2] After consulting with your financial advisor, you figured that you need to invest $500 per month to accumulate enough money for your children's college education in the 529 college savings account. Assuming a rate of return of 8% and depositing $500 at the end of every month in your retirement account for 10 years, how much will you have in the account? - Answer: $91,473.0176 - Solution: [2nd][CE/C] 120[N] 0.667[I/Y] 0 [PV] 500[+1][PMT] [CPT][FV] 120 for [N]=1012 months 0.667 for [I/Y]=8/12 [7b3] You wish to buy a $20,000car in four years after graduation of your college. You figured that you could save $1,000 per quarter to accumulate enough money to buy that car. If a rate of return of 5% and depositing $1,000 at the end of every quarter in your investment account for four years, do you think you will have enough money to buy that car? - Answer: No because you will only have $17,591.1638 in the investment account. - Solution: [2nd][CE/C] 16[N] 1.25[I/Y] 0 [PV] 1,000[+/][PMT] [CPT][FV] 16 for [N]=44 quarters 1.25 for [I/Y]=5/4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started