Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please quick i updated nothing more in the question really a. Answer (Show your calculation below): Global Company Local Com 5. b. Which company has

please quick

i updated

nothing more in the question really

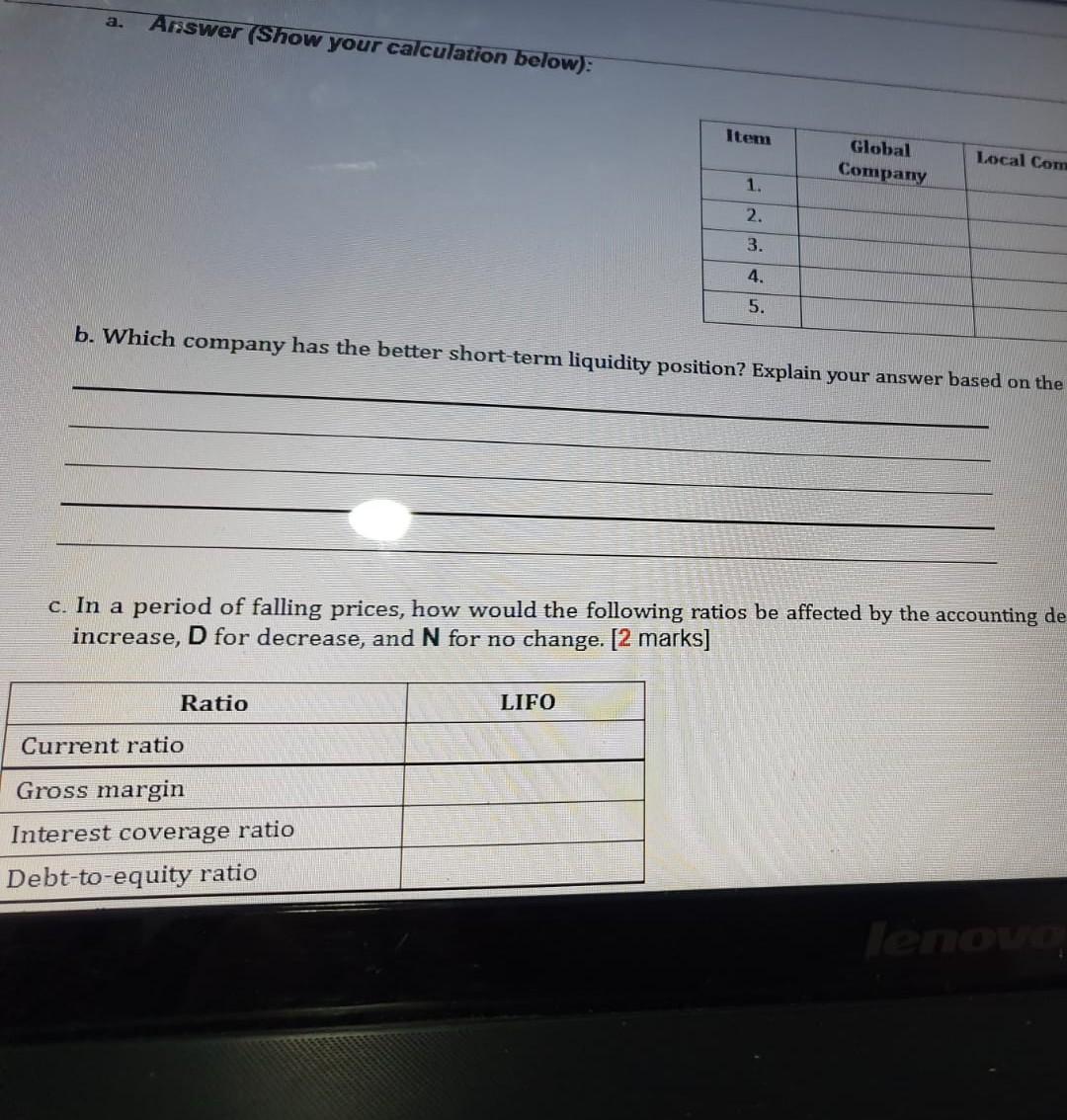

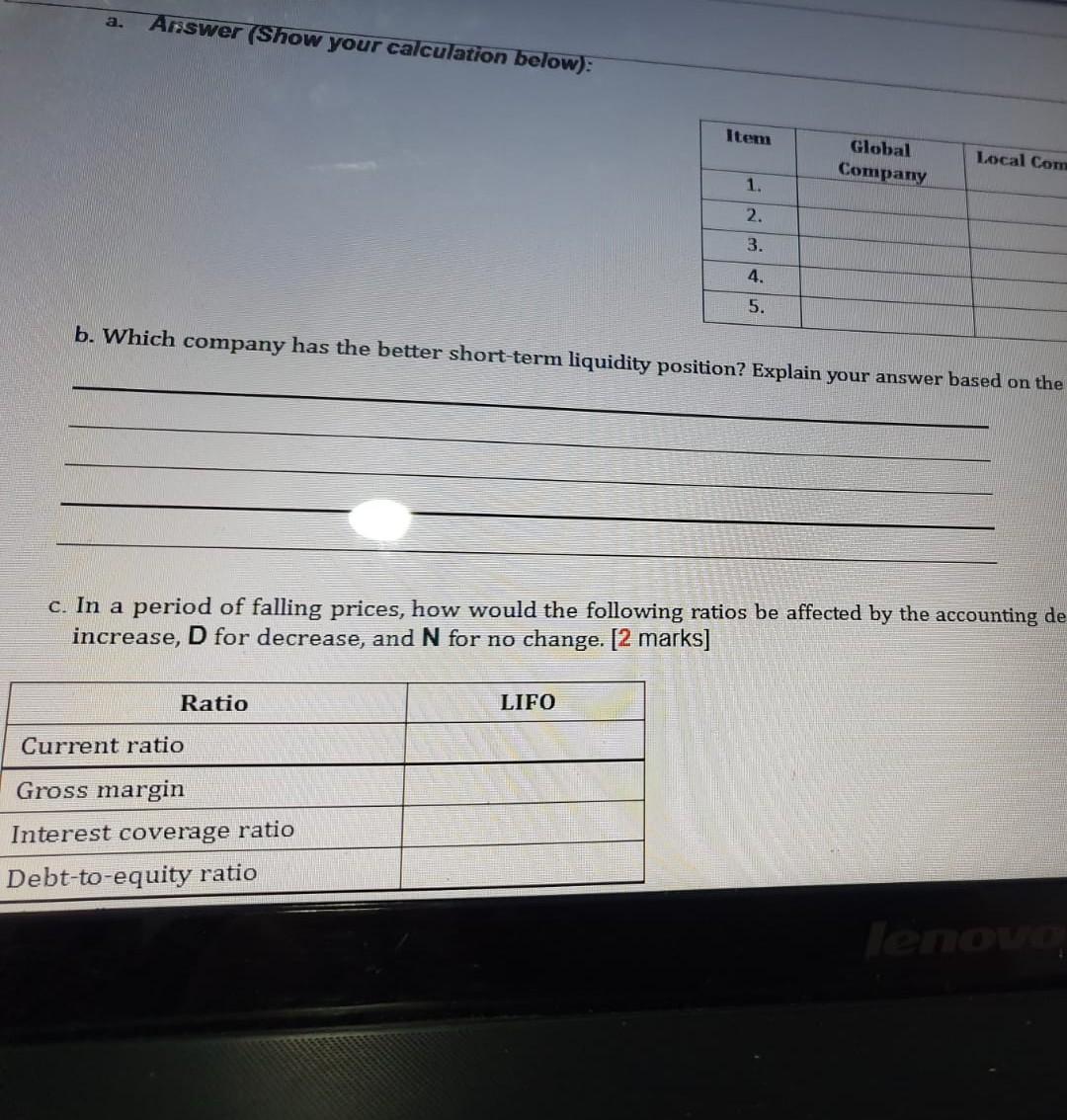

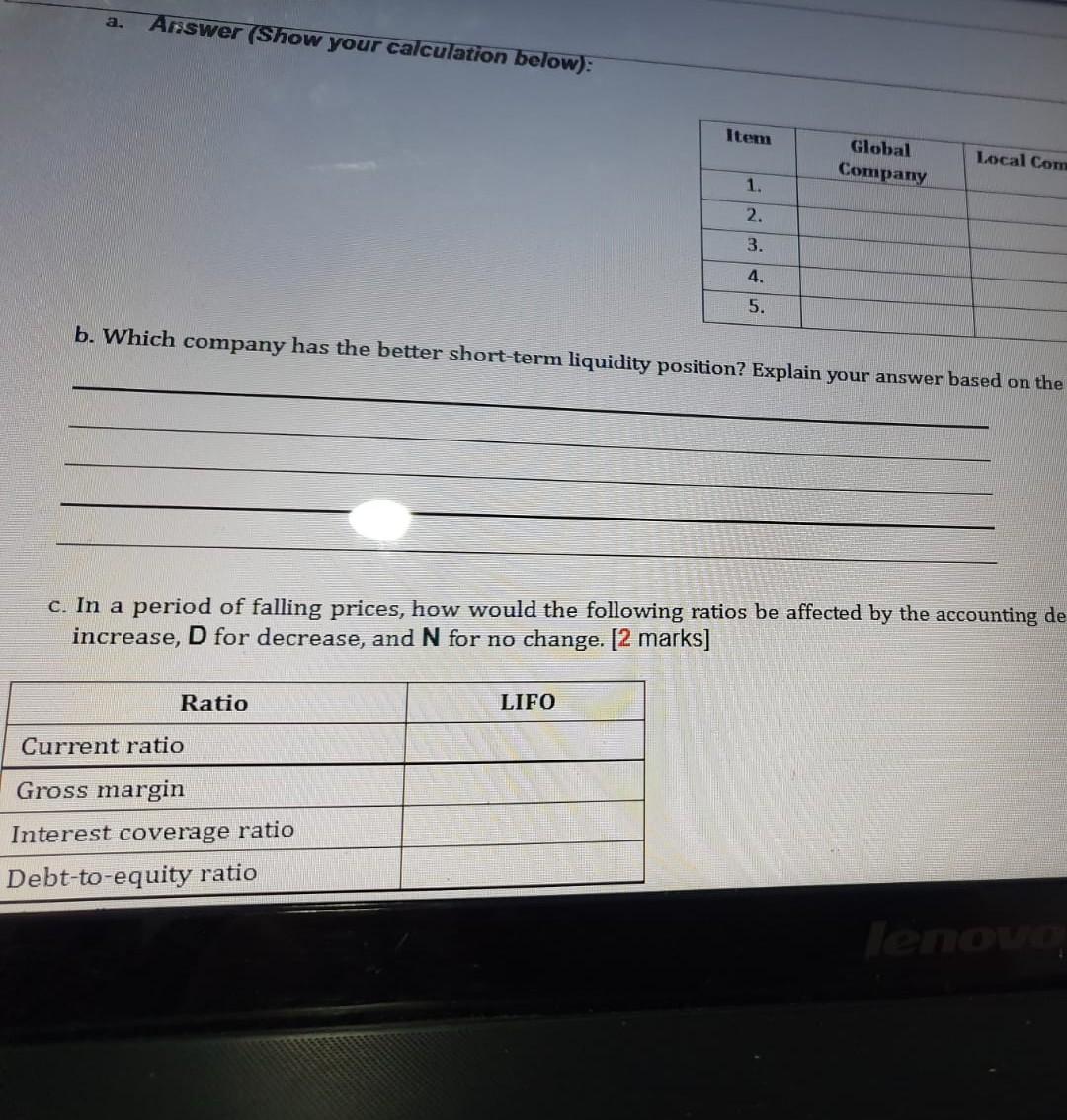

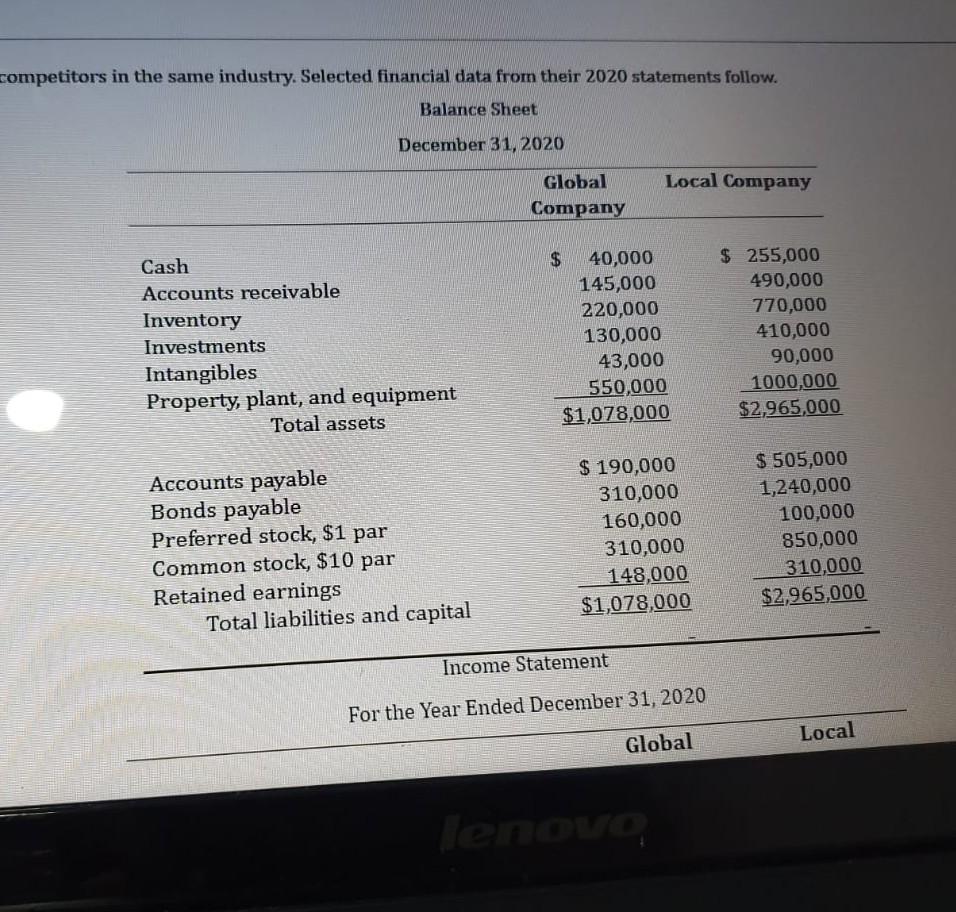

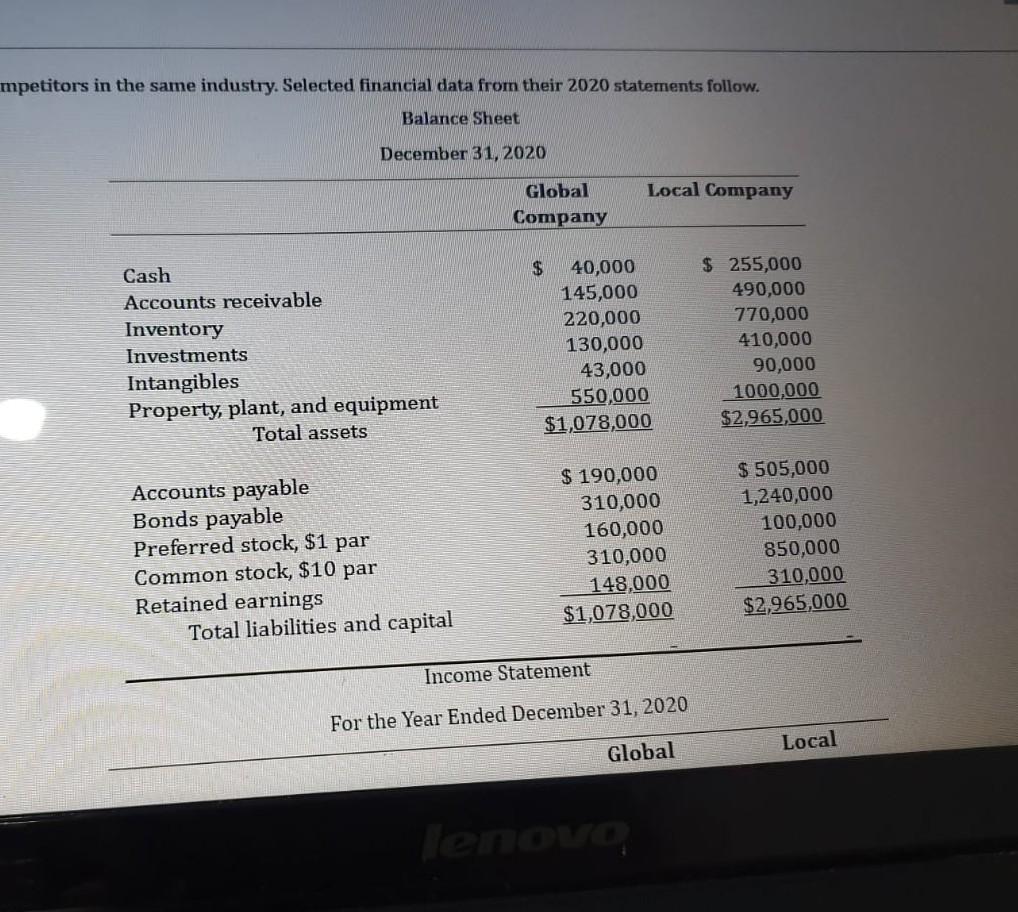

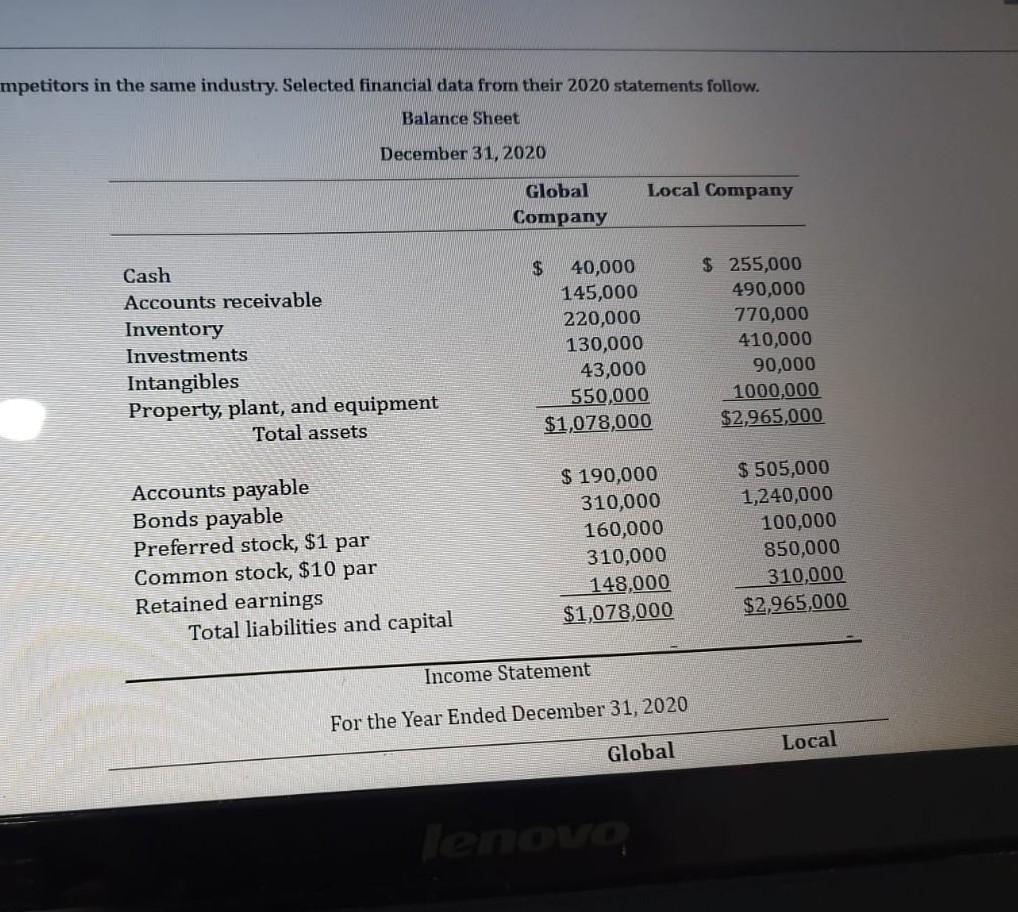

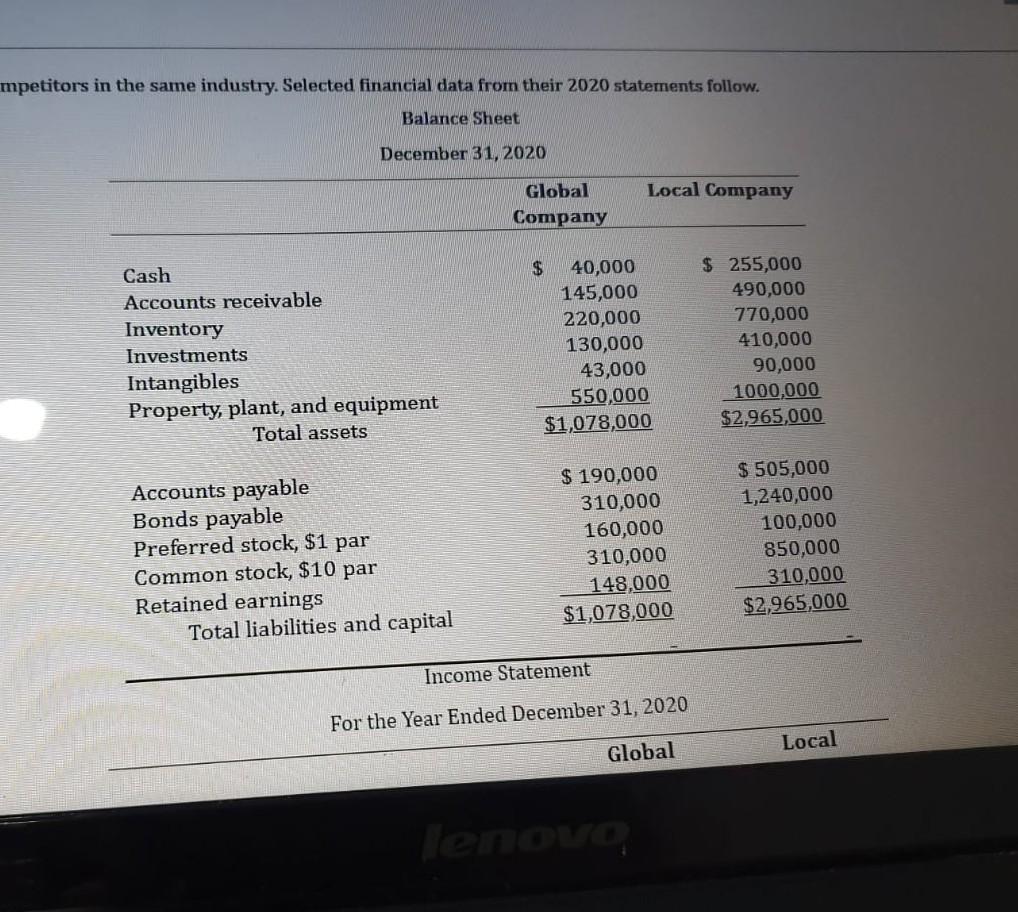

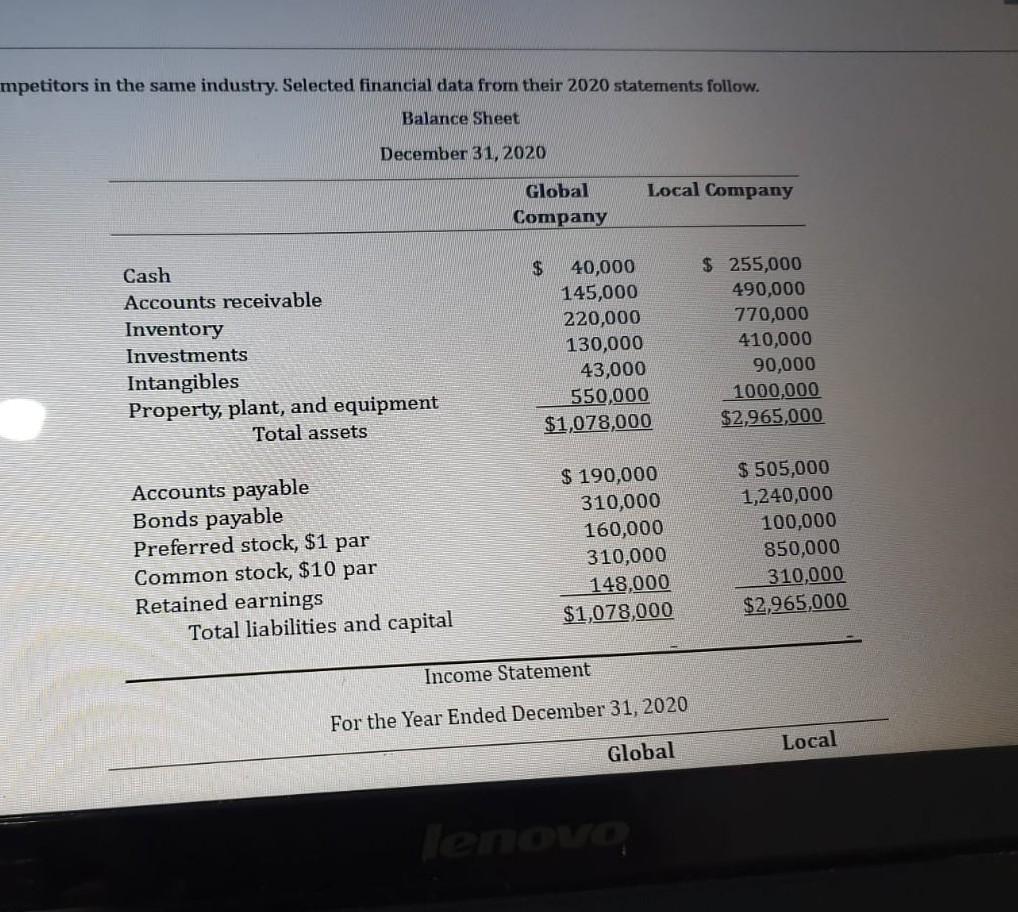

a. Answer (Show your calculation below): Global Company Local Com 5. b. Which company has the better short-term liquidity position? Explain your answer based on the c. In a period of falling prices, how would the following ratios be affected by the accounting de increase, D for decrease, and N for no change. [2 marks] LIFO Ratio Current ratio Gross margin Interest coverage ratio Debt-to-equity ratio lenovo Item 1. 2. 3. 4. a. Answer (Show your calculation below): Global Company Local Com 5. b. Which company has the better short-term liquidity position? Explain your answer based on the c. In a period of falling prices, how would the following ratios be affected by the accounting de increase, D for decrease, and N for no change. [2 marks] LIFO Ratio Current ratio Gross margin Interest coverage ratio Debt-to-equity ratio lenovo Item 1. 2. 3. 4. a. Answer (Show your calculation below): Global Company Local Com 5. b. Which company has the better short-term liquidity position? Explain your answer based on the c. In a period of falling prices, how would the following ratios be affected by the accounting de increase, D for decrease, and N for no change. [2 marks] LIFO Ratio Current ratio Gross margin Interest coverage ratio Debt-to-equity ratio lenovo Item 1. 2. 3. 4. competitors in the same industry. Selected financial data from their 2020 statements follow. Balance Sheet December 31, 2020 Global Local Company Company Cash $ $ 255,000 Accounts receivable 490,000 Inventory 770,000 Investments 410,000 Intangibles 90,000 1000,000 Property, plant, and equipment Total assets $2,965,000 $ 505,000 Accounts payable 1,240,000 Bonds payable 100,000 Preferred stock, $1 par 850,000 Common stock, $10 par 310,000 Retained earnings $2,965,000 Local 40,000 145,000 220,000 130,000 43,000 550,000 $1,078,000 $ 190,000 310,000 160,000 310,000 148,000 $1,078,000 Income Statement For the Year Ended December 31, 2020 Global Total liabilities and capital mpetitors in the same industry. Selected financial data from their 2020 statements follow. Balance Sheet December 31, 2020 Global Local Company Company Cash $ $ 255,000 Accounts receivable 490,000 Inventory 770,000 Investments 410,000 90,000 Intangibles 1000,000 Property, plant, and equipment Total assets $2,965,000 $ 505,000 Accounts payable 1,240,000 Bonds payable 100,000 Preferred stock, $1 par 850,000 Common stock, $10 par 310,000 Retained earnings $2,965,000 Local 40,000 145,000 220,000 130,000 43,000 550,000 $1,078,000 $ 190,000 310,000 160,000 310,000 148,000 $1,078,000 Income Statement For the Year Ended December 31, 2020 Global lenovo Total liabilities and capital a. Answer (Show your calculation below): Global Company Local Com 5. b. Which company has the better short-term liquidity position? Explain your answer based on the c. In a period of falling prices, how would the following ratios be affected by the accounting de increase, D for decrease, and N for no change. [2 marks] LIFO Ratio Current ratio Gross margin Interest coverage ratio Debt-to-equity ratio lenovo Item 1. 2. 3. 4. a. Answer (Show your calculation below): Global Company Local Com 5. b. Which company has the better short-term liquidity position? Explain your answer based on the c. In a period of falling prices, how would the following ratios be affected by the accounting de increase, D for decrease, and N for no change. [2 marks] LIFO Ratio Current ratio Gross margin Interest coverage ratio Debt-to-equity ratio lenovo Item 1. 2. 3. 4. a. Answer (Show your calculation below): Global Company Local Com 5. b. Which company has the better short-term liquidity position? Explain your answer based on the c. In a period of falling prices, how would the following ratios be affected by the accounting de increase, D for decrease, and N for no change. [2 marks] LIFO Ratio Current ratio Gross margin Interest coverage ratio Debt-to-equity ratio lenovo Item 1. 2. 3. 4. competitors in the same industry. Selected financial data from their 2020 statements follow. Balance Sheet December 31, 2020 Global Local Company Company Cash $ $ 255,000 Accounts receivable 490,000 Inventory 770,000 Investments 410,000 Intangibles 90,000 1000,000 Property, plant, and equipment Total assets $2,965,000 $ 505,000 Accounts payable 1,240,000 Bonds payable 100,000 Preferred stock, $1 par 850,000 Common stock, $10 par 310,000 Retained earnings $2,965,000 Local 40,000 145,000 220,000 130,000 43,000 550,000 $1,078,000 $ 190,000 310,000 160,000 310,000 148,000 $1,078,000 Income Statement For the Year Ended December 31, 2020 Global Total liabilities and capital mpetitors in the same industry. Selected financial data from their 2020 statements follow. Balance Sheet December 31, 2020 Global Local Company Company Cash $ $ 255,000 Accounts receivable 490,000 Inventory 770,000 Investments 410,000 90,000 Intangibles 1000,000 Property, plant, and equipment Total assets $2,965,000 $ 505,000 Accounts payable 1,240,000 Bonds payable 100,000 Preferred stock, $1 par 850,000 Common stock, $10 par 310,000 Retained earnings $2,965,000 Local 40,000 145,000 220,000 130,000 43,000 550,000 $1,078,000 $ 190,000 310,000 160,000 310,000 148,000 $1,078,000 Income Statement For the Year Ended December 31, 2020 Global lenovo Total liabilities and capitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started