Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please quickly Hame Sports sells sports merchandise. It has two product lines: snow sporting equipment and a sports clothing line. It has been brought to

please quickly

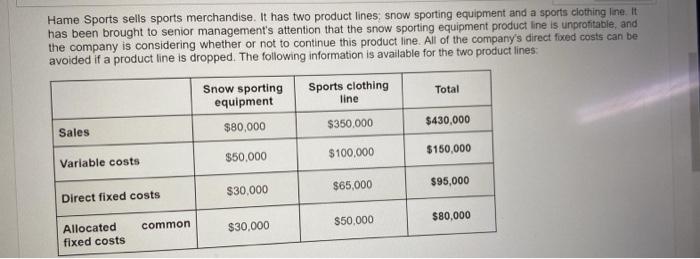

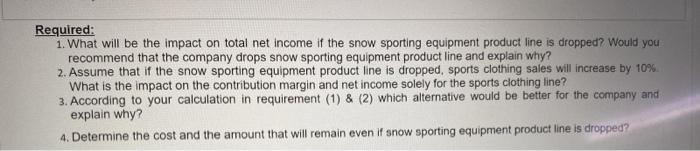

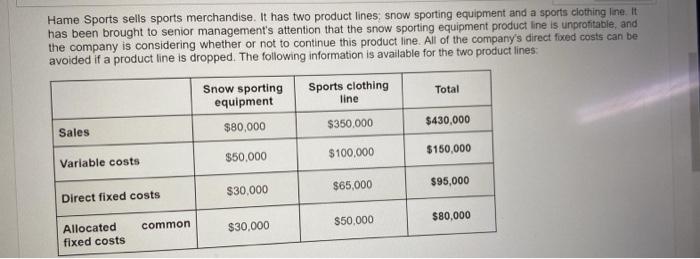

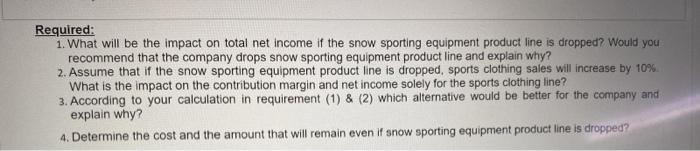

Hame Sports sells sports merchandise. It has two product lines: snow sporting equipment and a sports clothing line. It has been brought to senior management's attention that the snow sporting equipment product line is unprofitable, and the company is considering whether or not to continue this product line. All of the company's direct foxed costs can be avoided if a product line is dropped. The following information is available for the two product lines: Snow sporting Sports clothing Total equipment line Sales $80,000 $350,000 $430,000 Variable costs $50,000 $100,000 $150,000 $30,000 $65.000 $95,000 Direct fixed costs $80,000 common $30,000 $50,000 Allocated fixed costs Required: 1. What will be the impact on total net income if the snow sporting equipment product line is dropped? Would you recommend that the company drops snow sporting equipment product line and explain why? 2. Assume that if the snow sporting equipment product line is dropped, sports clothing sales will increase by 10% What is the impact on the contribution margin and net income solely for the sports clothing line? 3. According to your calculation in requirement (1) & (2) which alternative would be better for the company and explain why? 4. Determine the cost and the amount that will remain even if snow sporting equipment product line is dropped

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started