Question

PLEASE READ AND HELP WITH BOTH STEPS! THANK YOU. This case requires that you use Excel to calculate the Net Present Value, Internal Rate of

PLEASE READ AND HELP WITH BOTH STEPS! THANK YOU.

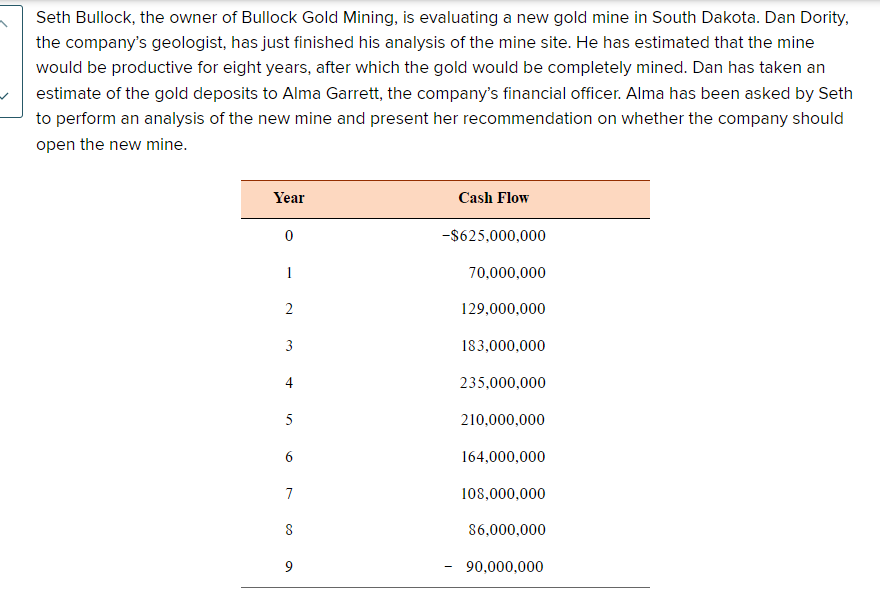

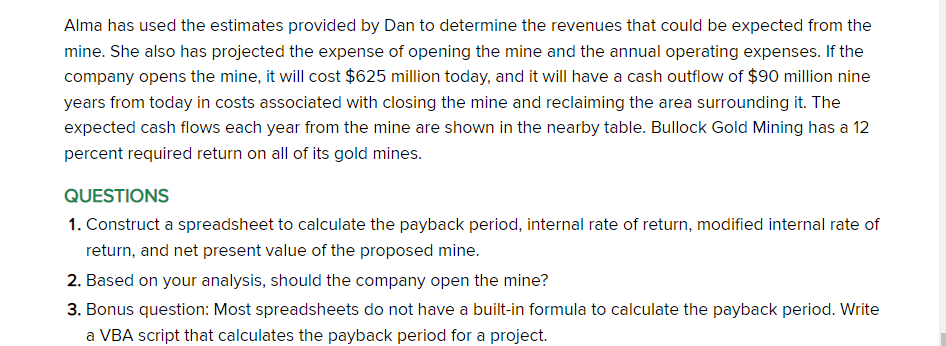

This case requires that you use Excel to calculate the Net Present Value, Internal Rate of Return, Modified Internal Rate of Return, and payback period of a project. You will need to provide answers to Steps 1 and 2 in the exercise using Excel to present your calculations (Step 3 is not required.).

For Step 1: You must use Excel functions and formulas to perform all necessary calculations. Submissions with only numbers and no formulas or functions will not receive credit for this assignment. Your submission must be neatly organized and must clearly present your work and results.

For Step 2: Submit a Microsoft Word document that:

Summarizes the problem.

Provides your analysis of the work performed in Step 1.

Recommends whether the company should open the mine based upon your analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started