Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE READ BEFORE ANSWERING: Right click on image and open image in new tab if text is too blurry / not clear enough. Please type

PLEASE READ BEFORE ANSWERING:

Right click on image and open image in new tab if text is too blurry / not clear enough.

Please type out your answer or use Excel as it is easier to read than handwriting.

Read ALL information carefully and ANSWER ALL PARTS.

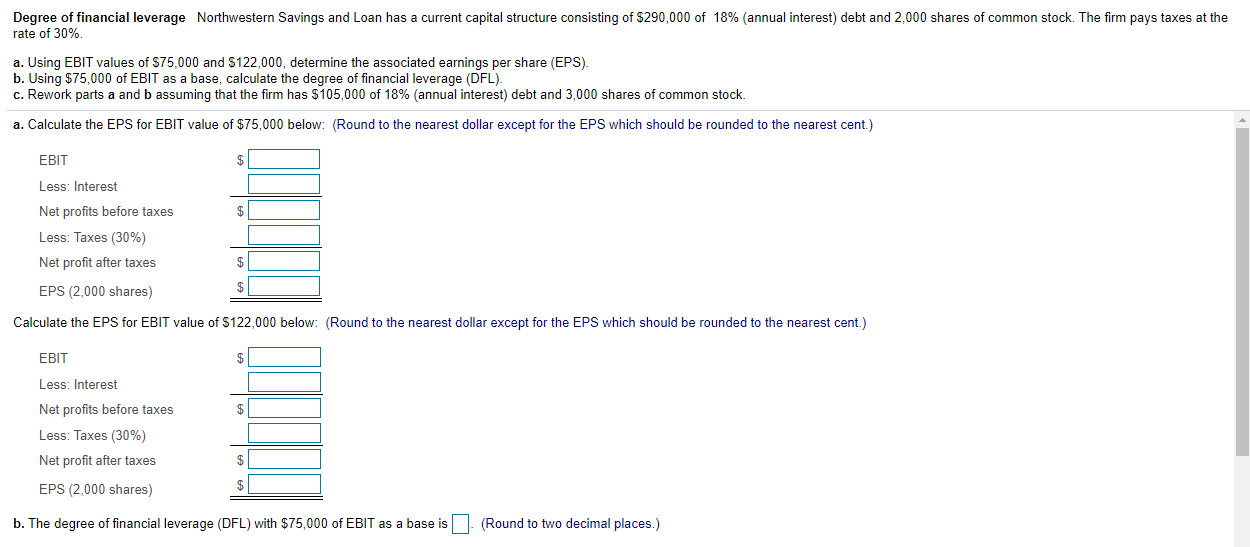

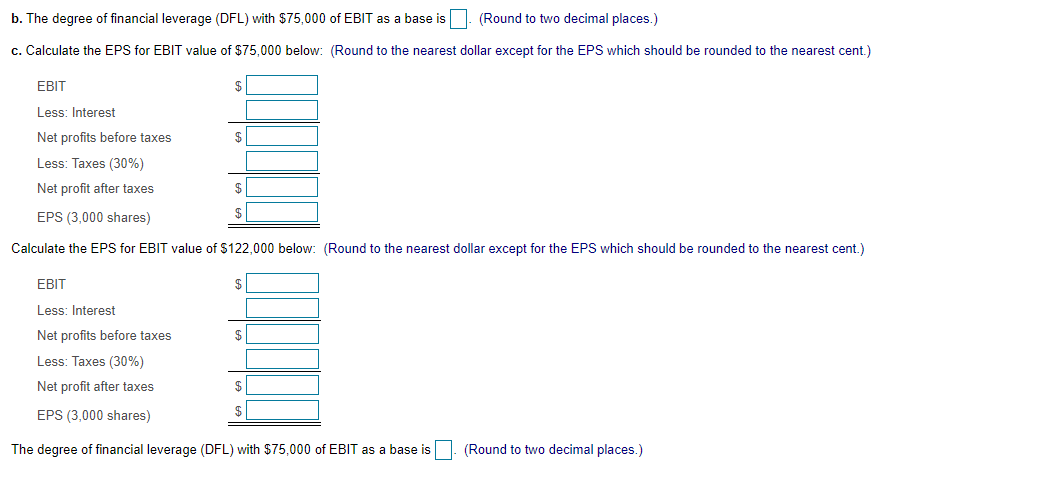

Degree of financial leverage Northwestern Savings and Loan has a current capital structure consisting of $290,000 of 18% (annual interest) debt and 2,000 shares of common stock. The firm pays taxes at the rate of 30% a. Using EBIT values of $75,000 and $122,000, determine the associated earnings per share (EPS). b. Using $75,000 of EBIT as a base, calculate the degree of financial leverage (DFL). c. Rework parts a and b assuming that the firm has $105,000 of 18% (annual interest) debt and 3,000 shares of common stock. a. Calculate the EPS for EBIT value of $75,000 below: (Round to the nearest dollar except for the EPS which should be rounded to the nearest cent.) EBIT Less: Interest Net profits before taxes $ Less: Taxes (30%) Net profit after taxes $ EPS (2,000 shares) Calculate the EPS for EBIT value of $122,000 below: (Round to the nearest dollar except for the EPS which should be rounded to the nearest cent.) EBIT Less: Interest Net profits before taxes Less: Taxes (30%) Net profit after taxes $ EPS (2,000 shares) b. The degree of financial leverage (DFL) with $75,000 of EBIT as a base is (Round to two decimal places.) b. The degree of financial leverage (DFL) with $75,000 of EBIT as a base is (Round to two decimal places.) c. Calculate the EPS for EBIT value of $75,000 below: (Round to the nearest dollar except for the EPS which should be rounded to the nearest cent.) EBIT $ Less: Interest $ Net profits before taxes Less: Taxes (30%) Net profit after taxes $ EPS (3,000 shares) $ Calculate the EPS for EBIT value of $122,000 below: (Round to the nearest dollar except for the EPS which should be rounded to the nearest cent.) EBIT Less: Interest $ Net profits before taxes Less: Taxes (30%) Net profit after taxes EPS (3,000 shares) $ The degree of financial leverage (DFL) with $75,000 of EBIT as a base is (Round to two decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started