Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE READ CAREFULLY WHAT I INDICATE BELOW (I put the pictures bigger as you indicated) This work is for tomorrow, all the information is below.

PLEASE READ CAREFULLY WHAT I INDICATE BELOW (I put the pictures bigger as you indicated)

This work is for tomorrow, all the information is below.

-I would appreciate if you can answer them all (at the end)

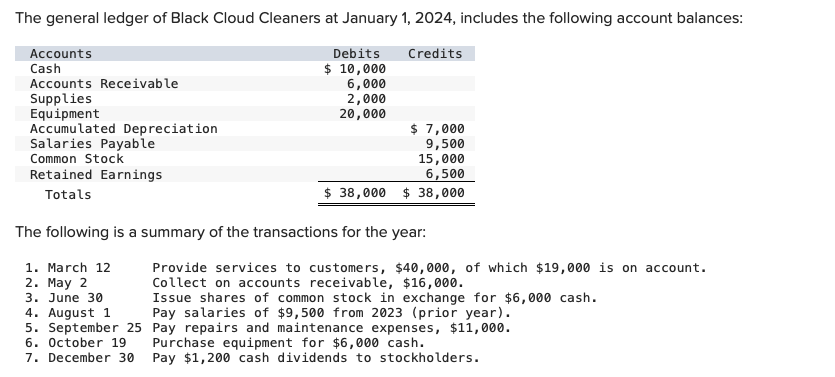

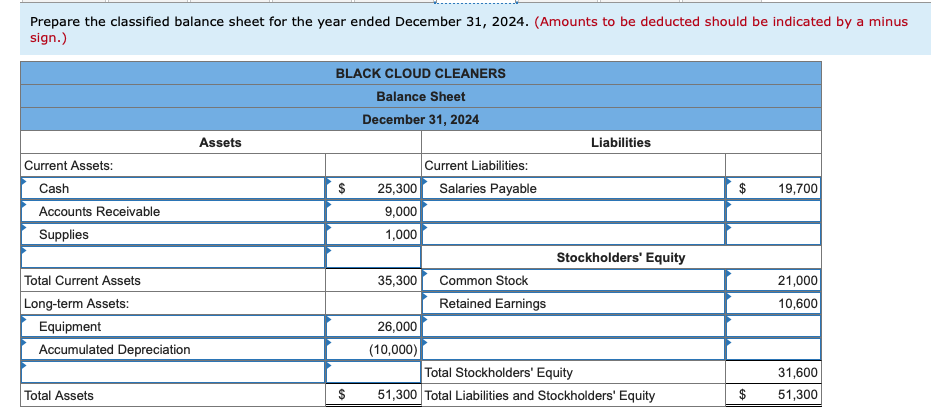

Using picture 1 as the main to get the information to answer the pictures below. Thank you.

Picture 1 below (WHERE I GOT THE INFORMATION)

Hope this helps to answer all the questions that are in blank AT THE END, it will help a lot!

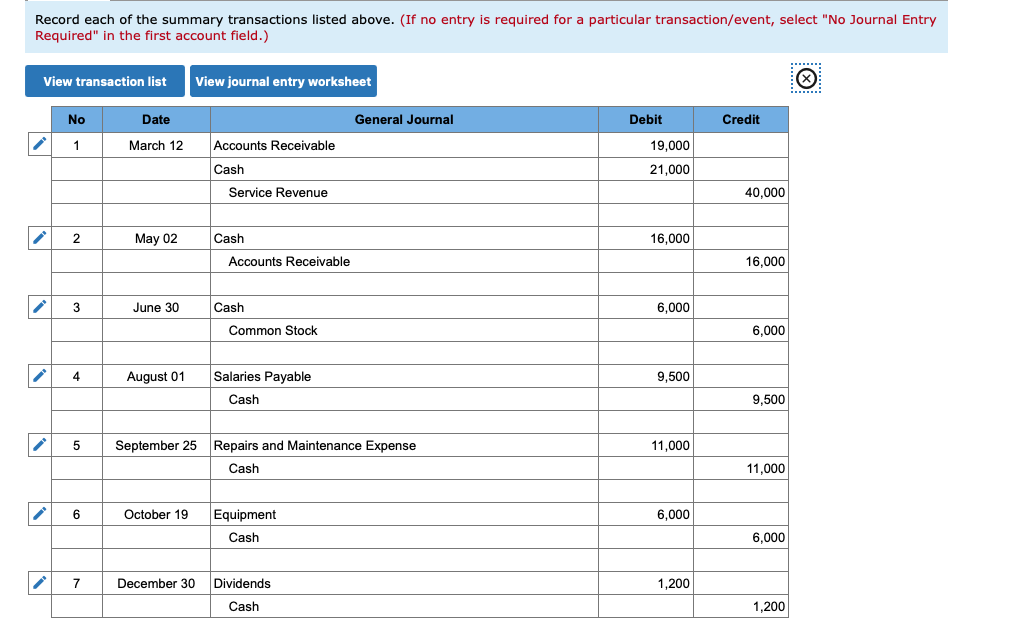

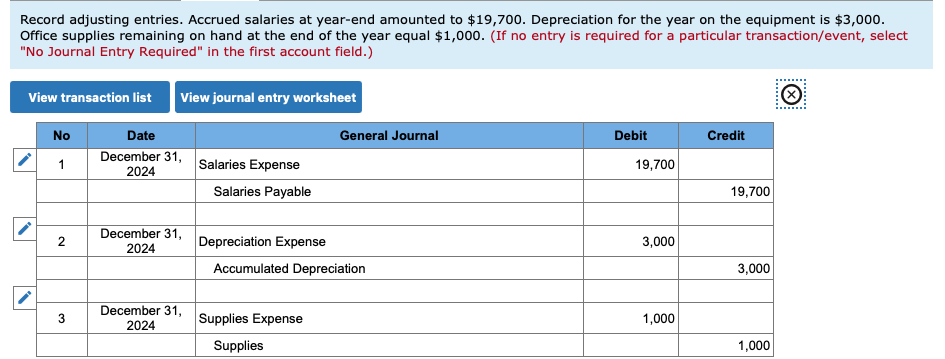

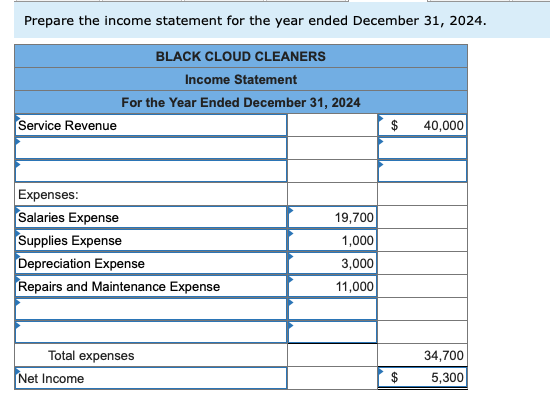

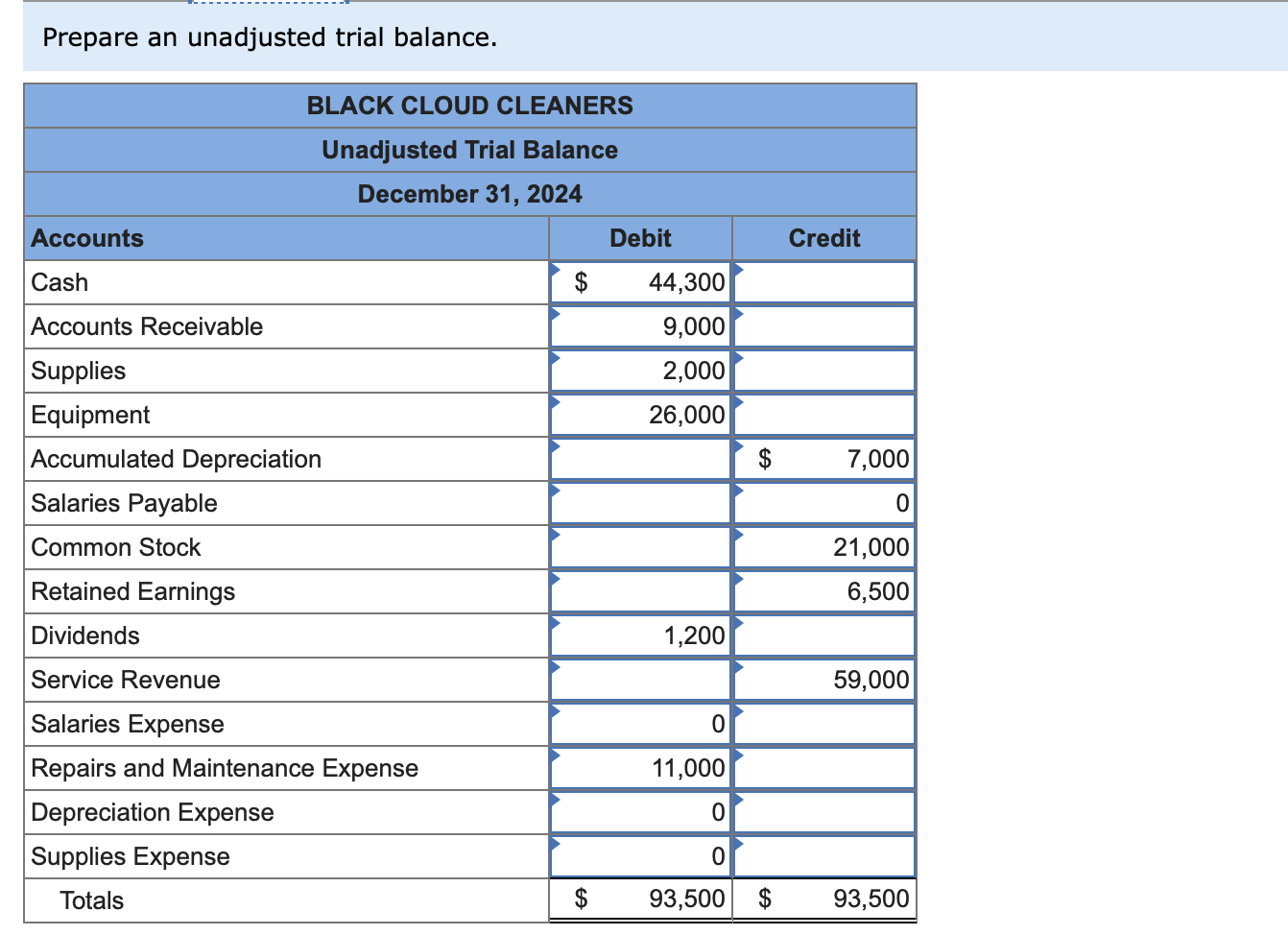

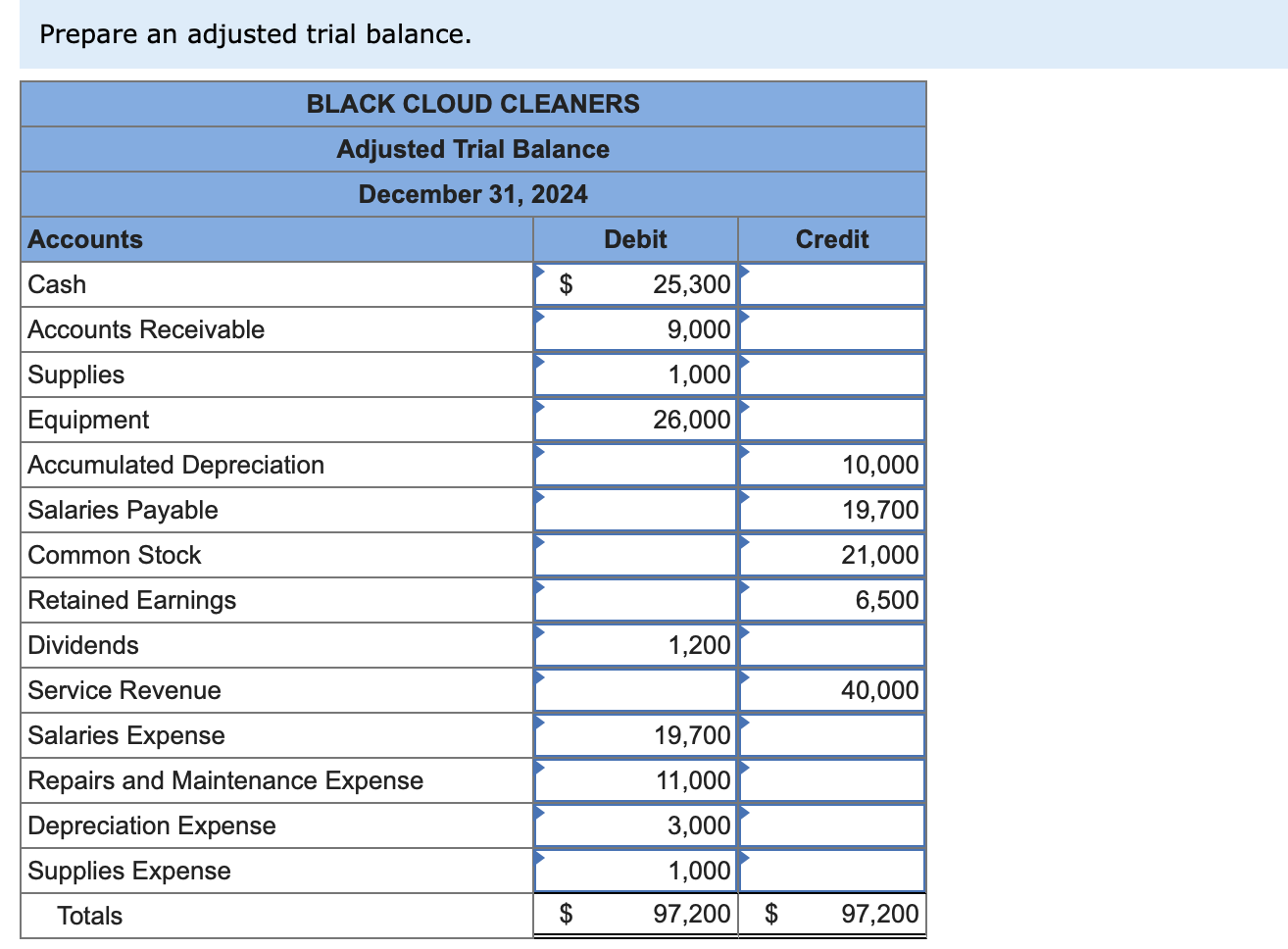

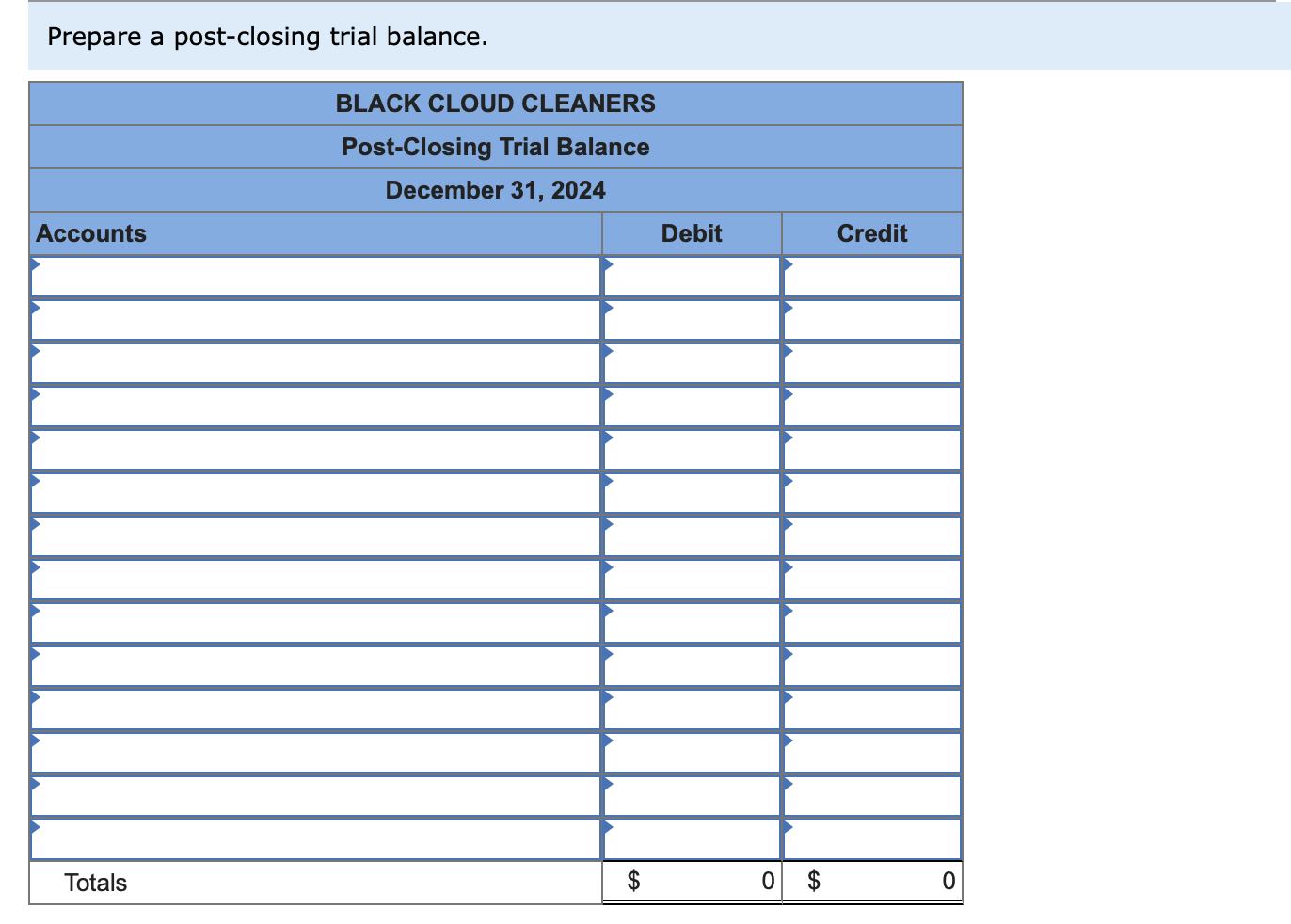

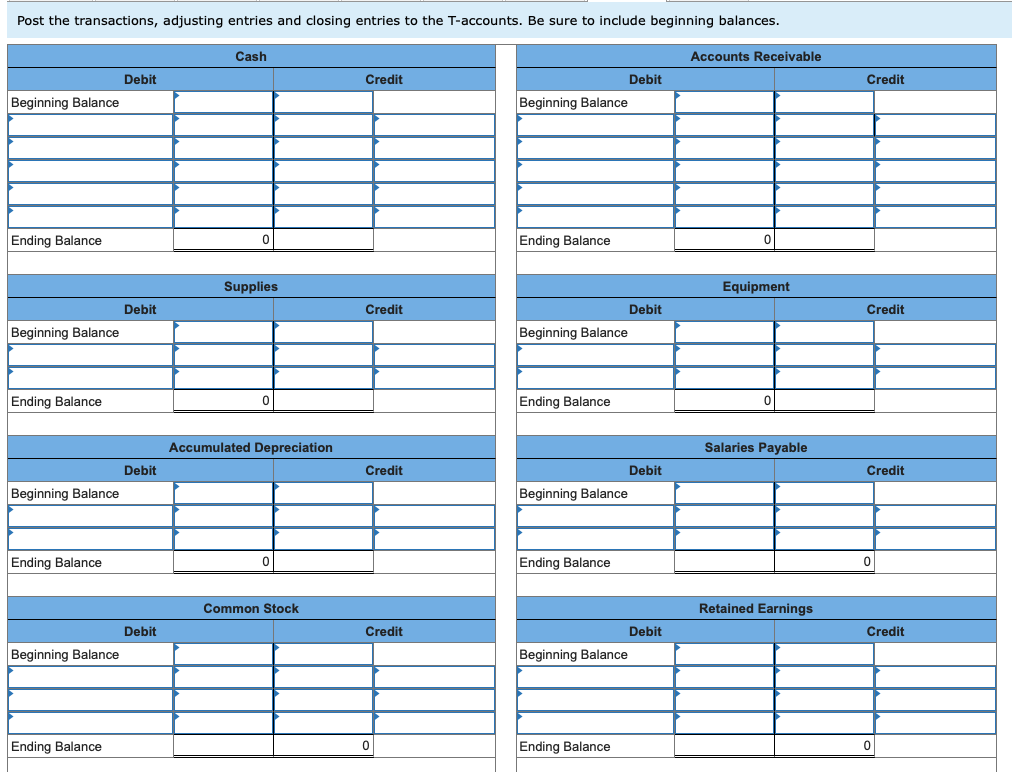

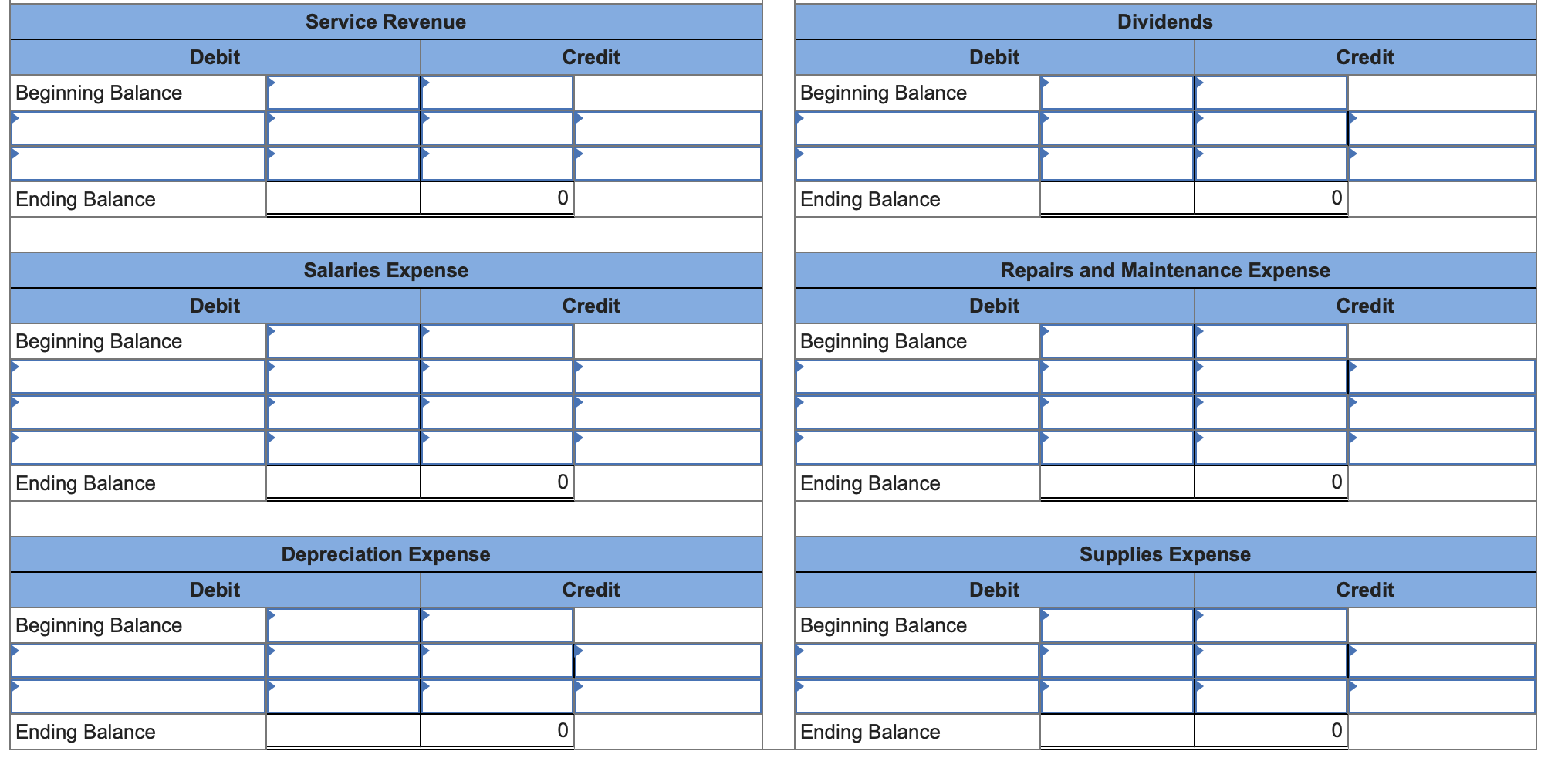

THE INFORMATION THAT NEEDS TO BE ANSWERED IS THIS ONE BELOW

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started