Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please read details and provide solutions with explanations. thank you so much The following are the account balances of Miller Company and Richmond Company as

please read details and provide solutions with explanations.

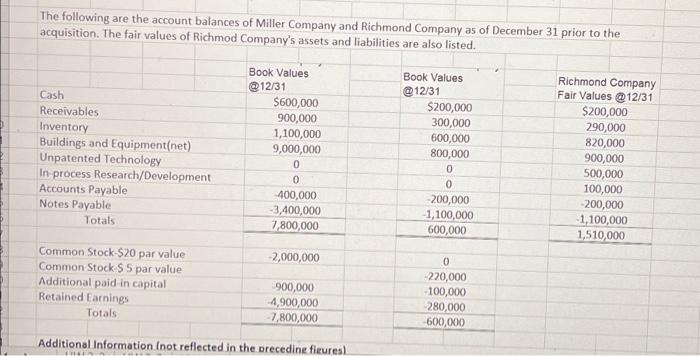

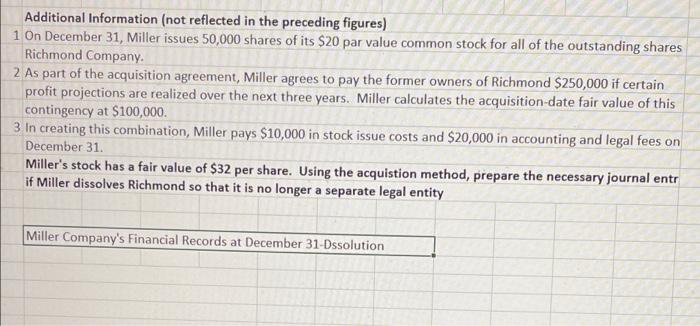

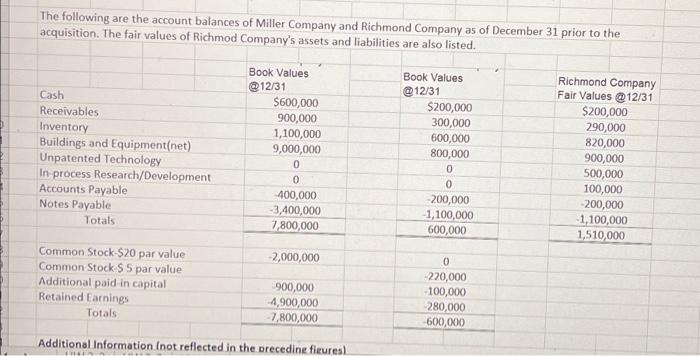

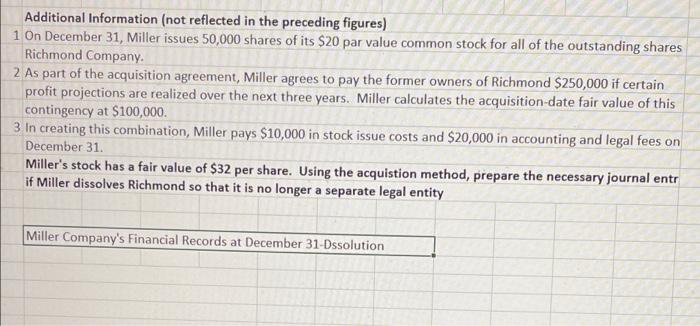

The following are the account balances of Miller Company and Richmond Company as of December 31 prior to the acquisition. The fair values of Richmod Company's assets and liabilities are also listed. Cash Receivables Inventory Buildings and Equipment(net) Unpatented Technology In process Research/Development Accounts Payable Notes Payable Totals Book Values @12/31 $600,000 900,000 1,100,000 9,000,000 0 0 400,000 -3,400,000 7,800,000 Book Values @12/31 $200,000 300,000 600,000 800,000 0 0 200,000 1,100,000 600,000 Richmond Company Fair Values @12/31 $200,000 290,000 820,000 900,000 500,000 100,000 200,000 1,100,000 1,510,000 2,000,000 Common Stock-$20 par value Common Stock S5 par value Additional paid in capital Retained Earnings Totals 900,000 -4,900,000 -7,800,000 0 -220,000 100,000 280,000 600,000 Additional information Inot reflected in the precedine fleures Additional Information (not reflected in the preceding figures) 1 On December 31, Miller issues 50,000 shares of its $20 par value common stock for all of the outstanding shares Richmond Company. 2 As part of the acquisition agreement, Miller agrees to pay the former owners of Richmond $250,000 if certain profit projections are realized over the next three years. Miller calculates the acquisition date fair value of this contingency at $100,000 3 in creating this combination, Miller pays $10,000 in stock issue costs and $20,000 in accounting and legal fees on December 31 Miller's stock has a fair value of $32 per share. Using the acquistion method, prepare the necessary journal entr if Miller dissolves Richmond so that it is no longer a separate legal entity Miller Company's Financial Records at December 31-Dssolution thank you so much

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started