Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE READ!!! PLEASE ANSWER NUMBERS 6-9. THIS IS MY 3RD TIME POSTING AND THE SAME PERSON IS NOT DOING WHAT IS IT SO PLEASE DO

PLEASE READ!!! PLEASE ANSWER NUMBERS 6-9. THIS IS MY 3RD TIME POSTING AND THE SAME PERSON IS NOT DOING WHAT IS IT SO PLEASE DO NOT RESPOND. NEED 6-9 ANSWERED!

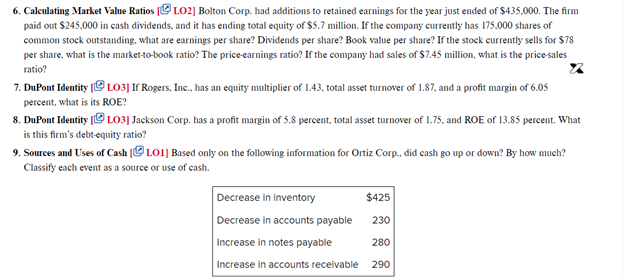

6. Calculating Market Value Ratios [@ LO2] Bolton Corp. had additions to retained earnings for the year just ended of $435.000. The firm paid out $245,000 in cash dividends, and it has ending total equity of $5.7 million. If the company currently has 175,000 shares of common stock outstanding, what are earnings per share? Dividends per share? Book value per share? If the stock currently sells for $78 per share, what is the market-to-book ratio? The price-earnings ratio? If the company had sales of $7.45 million, what is the price-sales ratio? 7. DuPont Identity [ LO3] If Rogers, Inc., has an equity multiplier of 1.43, total asset turnover of 1.87, and a profit margin of 6.05 percent, what is its ROE? 8. DuPont Identity [@ LO3] Jackson Corp. has a profit margin of 5.8 percent, total asset turnover of 1.75, and ROE of 13.85 percent. What is this firm's debt-equity ratio? 9. Sources and Uses of Cash [ LO1] Based only on the following information for Ortiz Corp., did cash go up or down? By how much? Classify each event as a source or use of cashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started