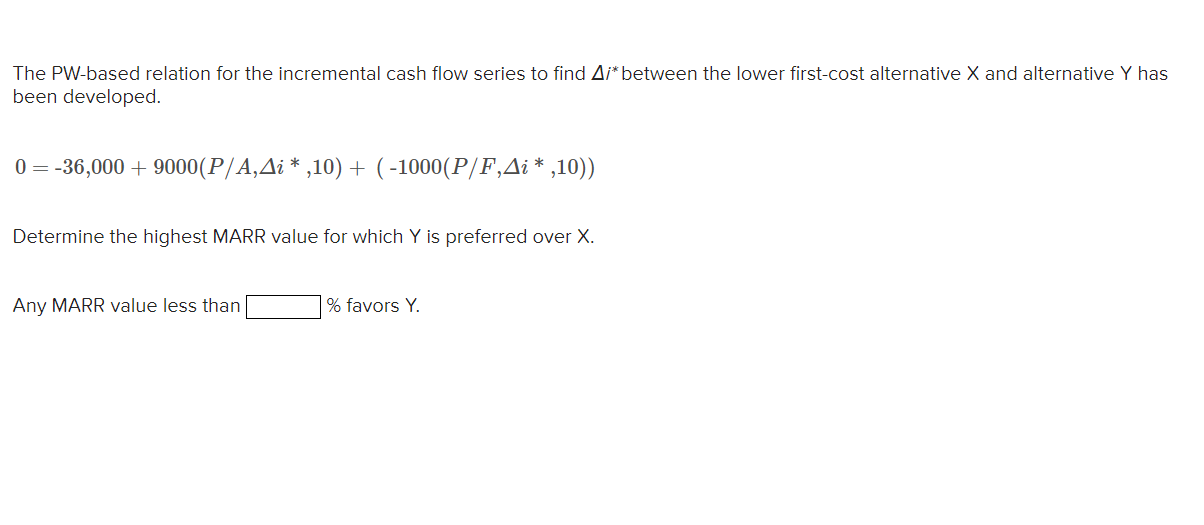

Question

PLEASE READ!! read problem carefully, take note of methods used (MARR) and show work and explain. i have asked for help on here multiple times

PLEASE READ!! read problem carefully, take note of methods used (MARR) and show work and explain. i have asked for help on here multiple times and no one has given me a good answer or work or explanation. ITS ASKING FOR THE PERCENTAGE SO PLEASE ACTUALLY WORK AND SOLVE FOR THAT. DONT JUST SO SOME RANDOM CALCULATIONS AAND GIVE ME WHATEVER NUMBER YOUVE GOTTEN.ACTUALLY READ AND PAY ATTENTION TO WHAT ITS ASKING FOR AND DO THE WORK FOR IT!! i need help with this problem and actually reading it and paying attention to what its asking instead of giving some random arbitrary answer would be greatly appreciated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started