Question

Please read the attached WSJ article. Then, remembering that the article was written at the end of 1992 answer the following questions. If you accept

Please read the attached WSJ article. Then, remembering that the article was written at the end of 1992 answer the following questions.

If you accept Mr. Craig's estimates on the long term growth rate and the 1994 P-E ratio, what is the required rate of return on equity of Maybelline stock?

Is Mr. Craig's willingness to pay for Maybelline stock today consistent with the required rate of return on equity implicit in his estimates (the company does not pay dividends)? Compute what should be his indifference price.

Managers, Lured by That Maybelline Magic , Scramble to Buy the Cosmetics Maker's Shares By John R. Dorfman

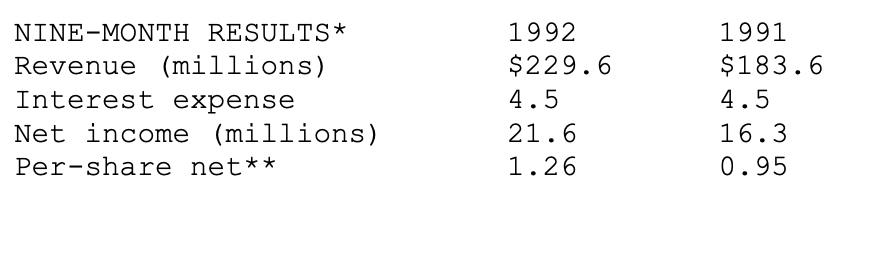

"Maybe it's the small-stock frenzy; maybe it's Maybelline. The cosmetics maker's initial public offering starts trading today, and the shares are widely expected to surge by day's end. Money managers have been falling all over themselves to get their hands on this IPO. "It's a good company. We like the prospects," says Jim Craig, manager of Janus Fund, who fears he'll be unable to build a position at a decent price. "The problem is that it's coming public in the silly season" when just about any IPO stock shoots up in price. "You could bring Joe's Garage public now at a premium," he says. Mr. Craig accepts the widespread estimate that Maybelline can earn $1.10 a share this year, $1.40 next year and perhaps $1.70 in 1994. He puts long-term profit growth at about 18% a year and says he thinks the stock in a year might sell for 18 times estimated 1994 profit, or about 30 1/2. "So what do I pay for 30 1/2 in a year?" he asks. "Do I pay 22? Damn right I pay 22. Do I pay 28? No." In response to demand, lead underwriter Merrill Lynch yesterday set the offering price at 23 1/2, up from a planned range of 20 to 22. The offering was set for 4,650,000 shares, instead of the 3,650,000 originally planned. The clamor to buy Maybelline shares is a feather in the cap of buyout firm Wasserstein Perella, which through partnerships it controls will own about 73% of the stock after the offering. Wasserstein Perella also gets a sweetener: The newly public company will pay it $1.5 million a year for "intellectual property" rights to the Maybelline name. Money managers say Maybelline is growing nicely, has highly regarded management and has excellent relations with discount chains such as Wal-Mart Stores and Kmart. Revlon, still closely held but rumored to be considering a stock offering soon after a recent try fizzled, is considered the industry power in drugstores. Cover Girl, a Procter & Gamble brand, is strong in supermarkets. But Maybelline's discountstore niche is a hot one; more and more cosmetics are being bought at discount stores. The mass-market cosmetics industry can also be divided up another way: by body part. "Maybelline owns the eyes; Cover Girl owns the face; Revlon owns the nails," says PaineWebber analyst Andrew Shore. At 17 times estimated 1993 earnings of $1.40, he says Maybelline shares are "a great deal for investors." 3 Mark R. Goldstein, manager of Manhattan Fund, calls it "a reasonably attractive deal." Maybelline is "a world-wide brand name," he says. "I like dominant brands." Other bulls point to the job Maybelline has done of improving operations in the two years since Wasserstein Perella bought the company from Schering-Plough. Products were trimmed to about 550 from about 700, a successful line of cosmetics for black women was launched, Yardley of London bath products was acquired, and advertising was increased. "They've gained market share at the expense of Procter & Gamble and other people," says industry consultant Allan Mottus. He says that if Maybelline gets drawn into an ad war, its opponents may have deeper pockets. But by the same token, he says, Maybelline someday may be a takeover candidate. Brent W. Clum, analyst with the T. Rowe Price Associates mutual fund family in Baltimore, sees Maybelline as "nicely positioned" and says earnings could grow 18% to 20% a year through a combination of unit growth, price increases and a reduction in the debt burden. But, he says, "They're certainly not giving it away.” Bears say that Maybelline may be a good company but that the price is high at about 21 times estimated 1992 earnings, and the company's debt will still be considerably more than its equity. Some question whether Maybelline can achieve the growth enthusiasts foresee. "It's a mature industry," says one manager who attended the company's road show but isn't buying. Moreover, at some point Wasserstein Perella will presumably sell more shares, threatening the price of the stock then outstanding. Carol Coles, president of consultant Mitchell & Co. in Waltham, Mass., says most cosmetics companies sell for two to three times book value, or assets minus liabilities, per share. Maybelline will be selling for nearly five times book value. "It's a great deal for the company," Ms. Coles says. --- Small stocks that pay few if any dividends have been investors' favorites since Nov. 1, finds James P. Kalil of Compu-Val Investments in Wilmington, Del. Yesterday he screened more than 2,800 stocks. The top-performing one-fifth rose an average of 26%; they have an average market value of $618 million and pay only 1% in annual dividends. By contrast, stocks in the bottom fifth, which were down 7% on average, tend to be larger, just below $2 billion in market value, and pay an average of 4% in dividends. These numbers "show a distinct speculative force moving the market," Mr. Kalil says. --- Maybelline in Profile NINE-MONTH RESULTS* 1992 1991 Revenue (millions) $229.6 $183.6 Interest expense 4.5 4.5 Net income (millions) 21.6 16.3 Per-share net** 1.26 0.95 4 *Through Sept. 30 **Pro forma, as if pending stock offering had occurred Jan. 1, 1991. Assumes 17.2 million shares outstanding."

NINE-MONTH RESULTS* Revenue (millions) Interest expense Net income (millions) Per-share net** 1992 $229.6 4.5 21.6 1.26 1991 $183.6 4.5 16.3 0.95

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the required rate of return on equity and Mr Craigs willingness to pay for Maybelline s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started