Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please, read the following case study and give details for the answer. Apple: The iPhone Turns 10. so What's Next? IN 2017. THE 10TH ANNIVERSARY

Please, read the following case study and give details for the answer.

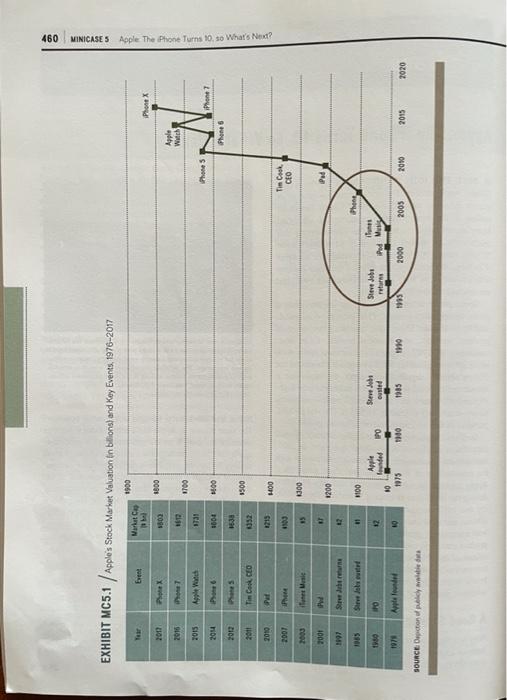

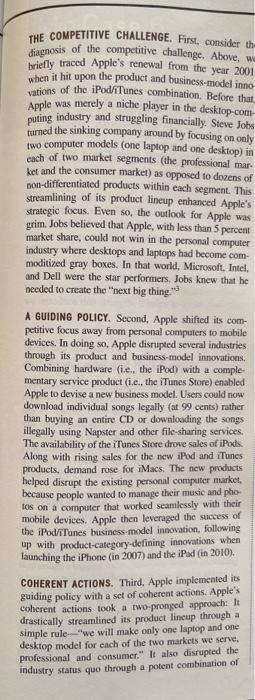

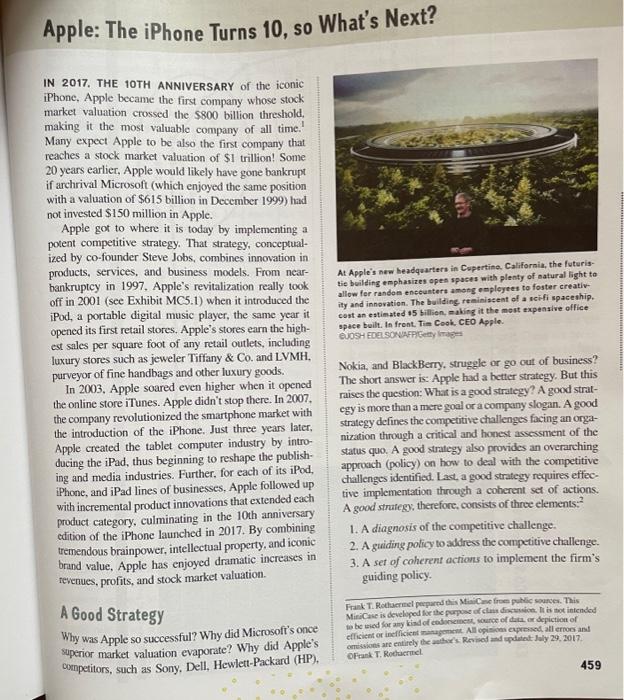

Apple: The iPhone Turns 10. so What's Next? IN 2017. THE 10TH ANNIVERSARY of the iconic iPhone, Apple became the first company whose stock market valuation crossed the $800 billion threshold, making it the most valuable company of all time.' Many expect Apple to be also the first company that reaches a stock market valuation of $1 trillion! Some 20 years earlier, Apple would likely have gone bankrupt if archival Microsoft (which enjoyed the same position with a valuation of $615 billion in December 1999) had not invested $150 million in Apple. Apple got to where it is today by implementing a potent competitive strategy. That strategy, conceptual- ized by co-founder Steve Jobs, combines innovation in products, services, and business models. From near- hankruptcy in 1997, Apple's revitalization really took off in 2001 (see Exhibit MC5.1) when it introduced the iPod, a portable digital music player, the same year it opened its first retail stores. Apple's stores earn the high- est sales per square foot of any retail outlets, including luxury stores such as jeweler Tiffany & Co. and LVMH, purveyor of fine handbags and other luxury goods. In 2003, Apple soared even higher when it opened the online store iTunes. Apple didn't stop there. In 2007, the company revolutionized the smartphone market with the introduction of the iPhone. Just three years later, Apple created the tablet computer industry by intro- ducing the iPad, thus beginning to reshape the publish- ing and media industries. Further, for each of its iPod, iPhone, and iPad lines of businesses, Apple followed up with incremental product innovations that extended each product category, culminating in the 10th anniversary edition of the iPhone launched in 2017. By combining tremendous brainpower, intellectual property, and iconic brand value, Apple has enjoyed dramatic increases in tevenues, profits, and stock market valuation. At Apple's new headquarters in Cupertino, California, the futuris- tie building emphasizes open spaces with plenty of natural light to allow for randon encounters among employees to foster creativ- ity and innovation. The building, reminiscent of a sci-fi spaceship. cost an estimated 15 billion, making it the most expensive office space built. In front. Tim Cook CEO Apple JOSH EDELSONFPIetyg Nokia, and BlackBerry, struggle or go out of business? The short answer is: Apple had a better strategy. But this raises the question: What is a good strategy? A good strat- egy is more than a mere goal or a company slogan. A good strategy defines the competitive challenges facing an orga- nization through a critical and honest assessment of the status quo. A good strategy also provides an overarching approach (policy) on how to deal with the competitive challenges identified. Last, a good strategy requires effec- tive implementation through a coherent set of actions. A good strategy, therefore, consists of three elements: 1. A diagnosis of the competitive challenge. 2. A guiding policy to address the competitive challenge. 3. A set of coherent actions to implement the firm's guiding policy A Good Strategy Why was Apple so successful? Why did Microsoft's once superior market valuation evaporate? Why did Apple's competitors, such as Sony, Dell , Hewlett-Packard (HP), Frank T. Rocharmeleopard this Minimere publicades. This MiniCase is developed for the purpose classico is tot intended to be used for any kind of dance source of data or depiction of efficient or inefficient. All opinions expressed all errors and omissions are entirely the author's Revised and update July 29, 2017 Oak T. Rocurmel 459 460 EXHIBIT MC5.1 / aplo's Stock Market Valuation in billiona) and Key Events, 1976-2017 1900 brent Phone X 2012 Phone X 1000 3302 Apple Watch MINICASE 5 Apple The Phone Turns 10.30 What's Next? 2015 1700 2015 731 Phone 5 iPhone 7 2014 1004 100 Phone 6 1538 1500 2011 Tim Cook CEO 2010 1400 2007 Phone 1903 Tim Cook CEO 2003 e Mesi #5 1300 2001 w Pad 1200 1997 12 1055 Sir Boboite 11 1980 FO 17 MOO Apple landet 10 1975 PO Steve Jobs ounted Steve Jobs returns Pod Murs 1971 10 THO 1985 1919 1995 2000 2005 2010 2015 2020 SOURCE Deption des THE COMPETITIVE CHALLENGE. First consider th diagnosis of the competitive challenge. Above, we briefly traced Apple's renewal from the year 2001 when it hit upon the product and business model inno vations of the iPod/iTunes combination. Before that Apple was merely a niche player in the desktop.com puting industry and struggling financially. Steve Jobs turned the sinking company around by focusing on only two computer models (one laptop and one desktop) in cach of two market segments (the professional mar ket and the consumer market) as opposed to dozens of non-differentiated products within each segment. This streamlining of its product lineup enhanced Apple's strategic focus. Even so, the outlook for Apple was grim. Jobs believed that Apple, with less than 5 percent market share, could not win in the personal computer industry where desktops and laptops had become com- moditized gray boxes. In that world, Microsoft, Intel, and Dell were the star performers. Jobs knew that he needed to create the next big thing." A GUIDING POLICY. Second, Apple shifted its com- petitive focus away from personal computers to mobile devices. In doing so, Apple disrupted several industries through its product and business-model innovations. Combining hardware (.e., the iPod) with a comple mentary service product (i.e. the iTunes Store) enabled Apple to devise a new business model. Users could now download individual songs legally (at 99 cents) rather than buying an entire CD or downloading the songs illegally using Napster and other file-sharing services. The availability of the iTunes Store drove sales of iPods. Along with rising sales for the new iPod and iTunes products, demand rose for iMacs. The new products helped disrupt the existing personal computer market, because people wanted to manage their music and pho fos on a computer that worked seamlessly with their mobile devices. Apple then leveraged the success of the iPod/iTunes business model innovation, following up with product-category-defining innovations when launching the iPhone (in 2007) and the iPad (in 2010). COHERENT ACTIONS. Third, Apple implemented its guiding policy with a set of coherent actions. Apple's coherent actions took a two-pronged approach: It drastically streamlined its product lineup through a simple rule-- we will make only one laptop and one desktop model for each of the two markets we serve, professional and consumer." It also disrupted the industry status quo through a potent combination of product and business-model innovations, executed at planned intervals. These actions allowed Apple to cre- ate a string of temporary competitive advantages (see Exhibit MC5.1). Taken together, this allowed Apple to sustain its superior performance for over a decade, making it the most valuable company on the planet in the process. Past performance, however, is no guarantee of future performance. Microsoft was once the most valuable company in the world but has since struggled to keep up with Apple. At the same time, Microsoft, as well as Google, Samsung, Amazon, and others, are working hard to neutralize Apple's competitive advantage. The trillion-dollar question is whether Apple can continue to maintain a competitive advantage in the face of increasingly strong competition and rapidly changing industry environments. In both mobile pay- ment systems (Apple Pay launched in 2014) and music streaming (Apple Music launched in 2015), Apple was a late mover. The Apple Watch, introduced in 2015, is the first new product category Apple launched since the iPad in 2010. Although Apple continues to capture over 90 percent of profits in the smartphone industry, more than 60 percent of Apple's $220 billion revenue comes from the iPhone. Moreover, China accounts for more than 20 percent of Apple's total revenues, a mar- ket that is becoming more and more volatile for the Cupertino, California, tech company. These are press- ing issues that Apple CEO Tim Cook needs to address in order to sustain Apple's competitive advantage. 4. Apply the three-step process for developing a good strategy outlined above (diagnose the com- petitive challenge, derive a guiding policy, and implement a set of coherent actions) to Apple's situation today. Which recommendations would you have for Apple to outperform its competitors in the future? Be specific

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started