Please read the full article from WSJ "What's the Beef? Food-Inflation Fears"

This article either describes a) a shift in demand, OR b) a shift in supply, OR c) Both.

a) THE ARTICLE DESCRIBES A CHANGE IN DEMAND:

- DESCRIBE the event (or events) causing it and whether each demand changing event is increasing or decreasing demand. Also describe how you would show any identified demand change(s) on a graph (and ideally also show it on a graph).

- Describe how THIS DEMAND CHANGE ALONE impacted, a) equilibrium price, and b) equilibrium quantity (i.e., did each increase or decrease). Ideally also draw a supply and demand diagram showing this.

1

b) THE ARTICLE DESCRIBES A CHANGE IN SUPPLY:

- DESCRIBE the event (or events) causing it and whether each Supply changing event is increasing or decreasing Supply. Also describe how you would show any identified Supply change(s) on a graph (and ideally also show it on a graph).

- Describe how THIS SUPPLY CHANGE ALONE impacted, a) equilibrium price, and b) equilibrium quantity (i.e., did each increase or decrease). Ideally also draw a supply and Supply diagram showing this.

c) Now, combine the two events. Explain how THE COMBINATION OF THE TWO EVENTS change Equilibrium price. Explain how THE COMBINATION OF THE TWO EVENTS changed Equilibrium Quantity. Again, ideally draw a third supply and demand diagram showing this.

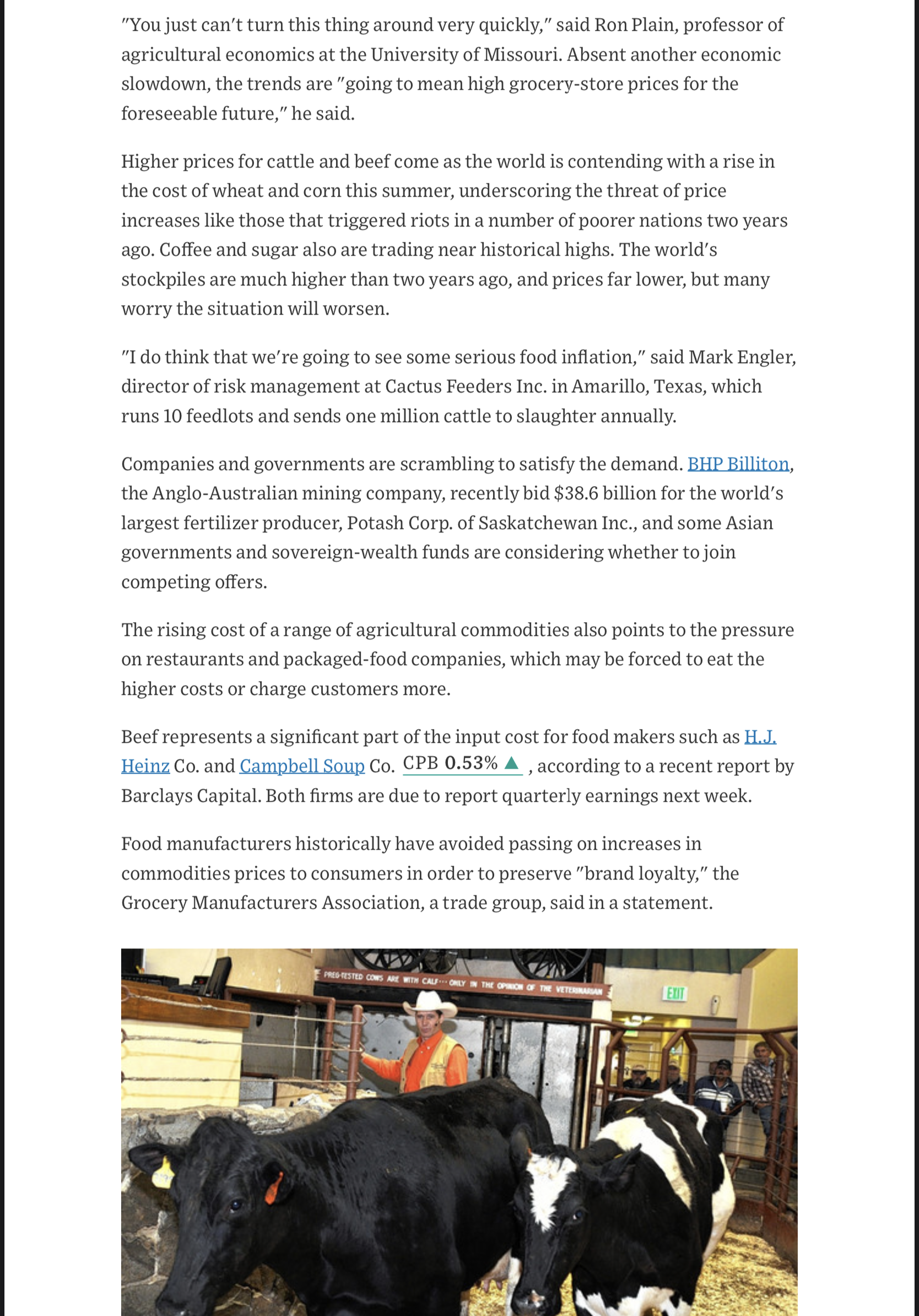

\"You just can't turn this thing around very quickly,\" said Ron Plain, professor of agricultural economics at the University of Missouri. Absent another economic slowdown, the trends are \"going to mean high grocerystore prices for the foreseeable future," he said. Higher prices for cattle and beef come as the world is contending with a rise in the cost of wheat and corn this summer, underscoring the threat of price increases like those that triggered riots in a number of poorer nations two years ago. Coffee and sugar also are trading near historical highs. The world's stockpiles are much higher than two years ago, and prices far lower, but many worry the situation will worsen. \"I do think that we're going to see some serious food ination," said Mark Engler, director of risk management at Cactus Feeders Inc. in Amarillo, Texas, which runs 10 feedlots and sends one million cattle to slaughter annually. Companies and governments are scrambling to satisfy the demand. BHRBilliton, the AngloAustralian mining company, recently bid $38.6 billion for the world's largest fertilizer producer, Potash Corp. of Saskatchewan Inc., and some Asian governments and sovereign-wealth funds are considering whether to join competing offers. The rising cost of a range of agricultural commodities also points to the pressure on restaurants and packagedfood companies, which may be forced to eat the higher costs or charge customers more. Beef represents a signicant part of the input cost for food makers such as H..L Heinz Co. and Campbelioup Co. CPB 053% A , according to a recent report by Barclays Capital. Both rms are due to report quarterly earnings next week. Food manufacturers historically have avoided passing on increases in commodities prices to consumers in order to preserve \"brand loyalty,\" the Grocery Manufacturers Association, a trade group, said in a statement. THE WALL STREET JOURNAL. 1 of 1 SUBSCRIBE SIGN IN What's the Beef? Food-Inflation Fears By Liam Pleven Updated Aug. 25, 2010 12:01 am ET SHARE A TEXT Cattle prices are soaring toward records, pushing up the cost of beef in grocery stores and adding to the risk of a broader wave of food inflation. The gains are being fueled by rising appetites globally and a dwindling U.S. herd. Purchases of U.S. beef around the world have surged as emerging economies become more prosperous. At the same time, ranchers hit in recent years by drought and the financial crisis have cut the number of cattle to the lowest level in decades. The rally has driven up the futures market for cattle by 11% since early July to reach the brink of the $1-a-pound mark, just shy of the $1.04 record set in 2008. Prices dipped 0.3% Tuesday, to settle at 99.475 cents a pound, after rising for the previous 11 trading sessions. Consumers already are paying more, with the retail price of choice beef up 4% in July from December, according to U.S. Department of Agriculture data. Further increases may be in the offing; last week alone wholesale prices climbed 3.2%. WSJ NEWSLETTER I would also like to receive updates and special offers from Dow Notes on the Jones and affiliates. I can unsubscribe at any time. News | agree to the Privacy Policy and Cookie Notice. The news of the week in Enter your email SIGN UP context, with Tyler Blint- Welsh. While some observers said the August rally may be short-lived, they also said the fundamentals of a cattle shortage and rising demand mean prices will remain high over the longer term. Nations in Asia and elsewhere are buying more U.S. beef. Meantime, it will take at least two or three years to substantially increase the U.S. herd, taking into account the months of gestation and then calf growth. The U.S. is crucial because it is the biggest beef producer in the world