Please read the instructions carefully

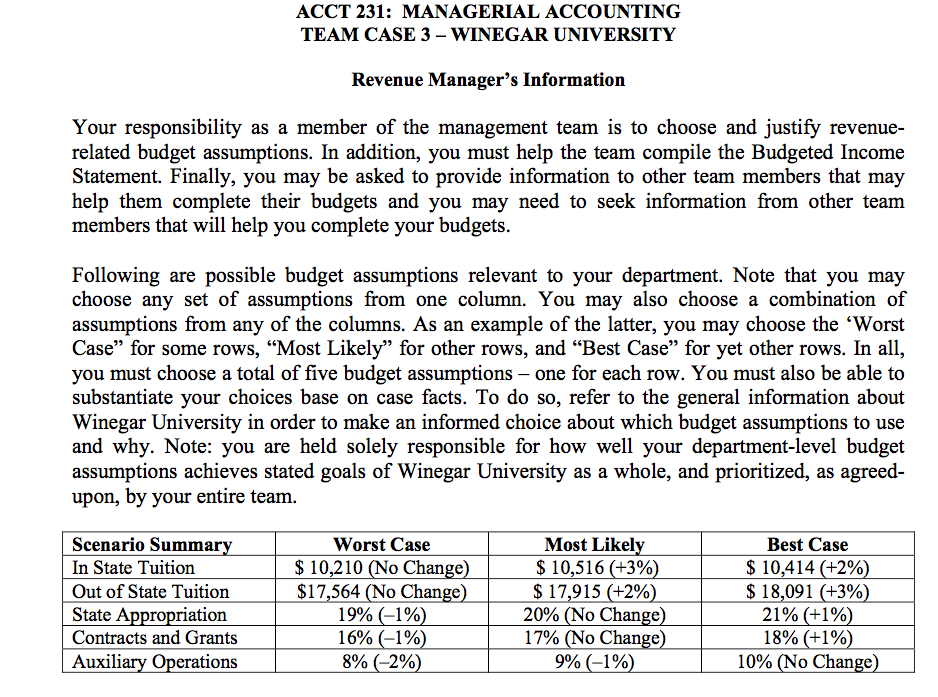

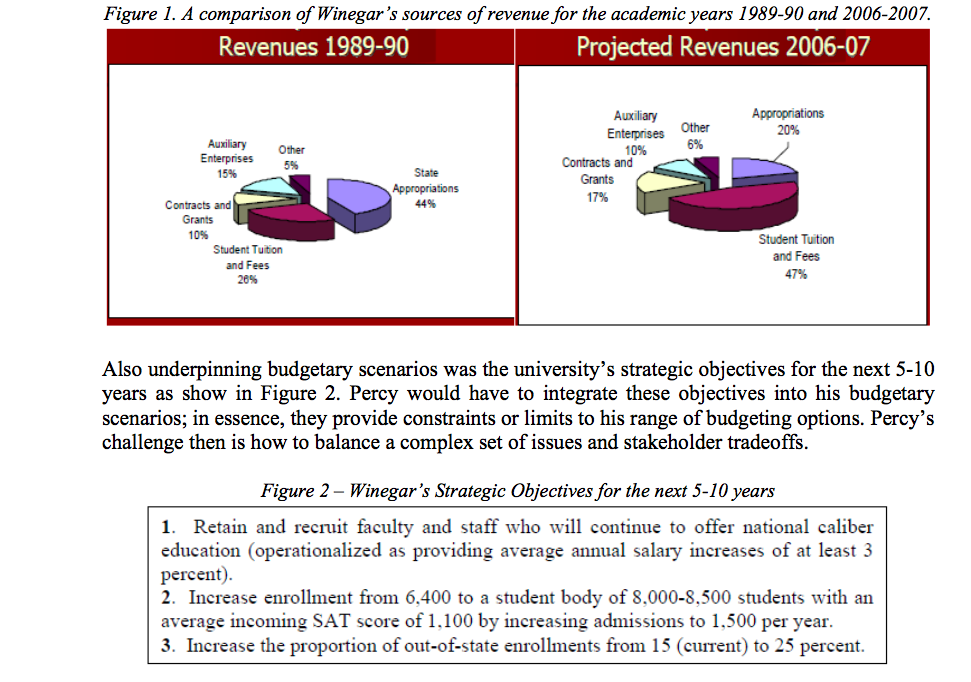

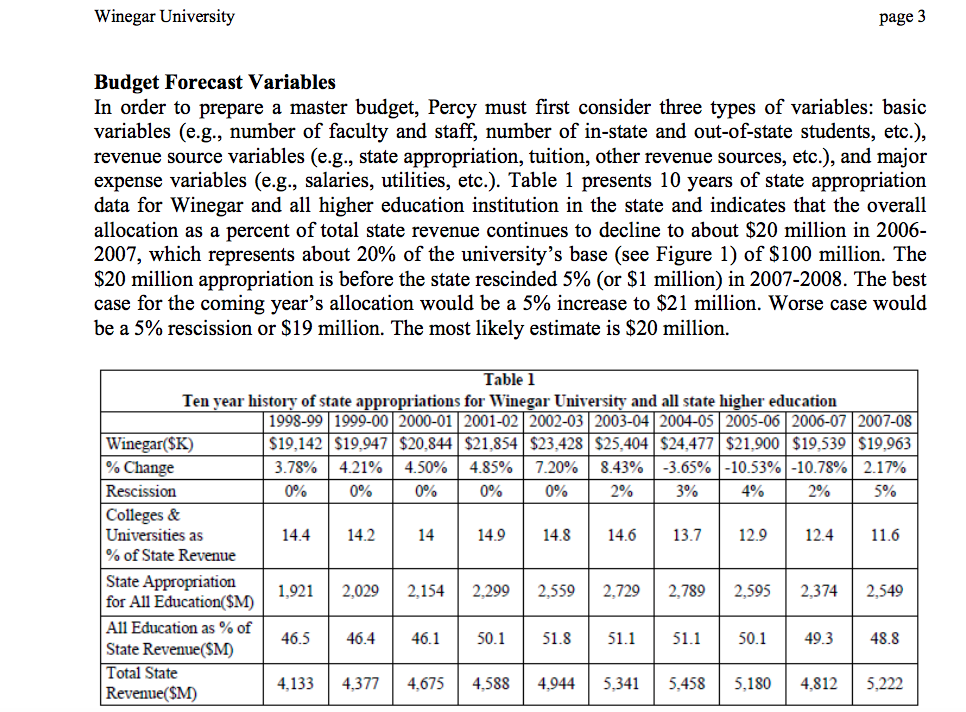

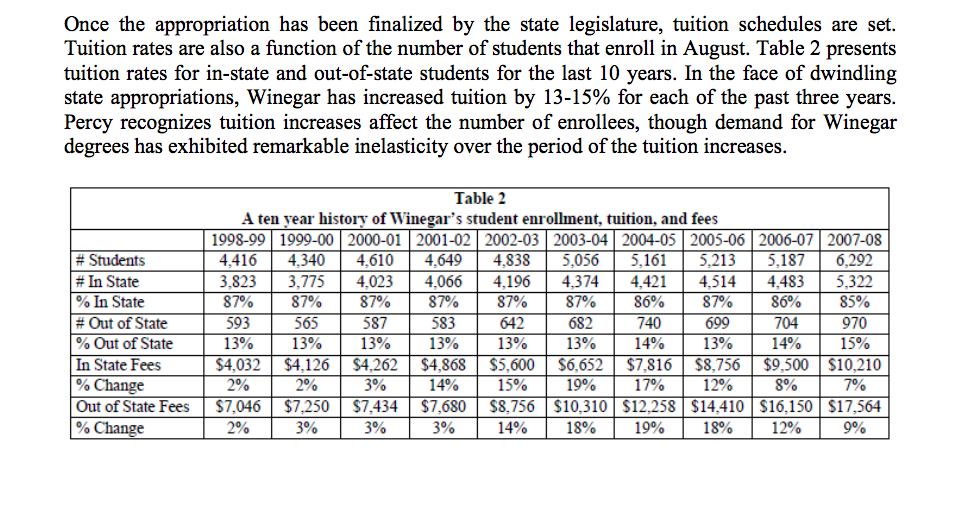

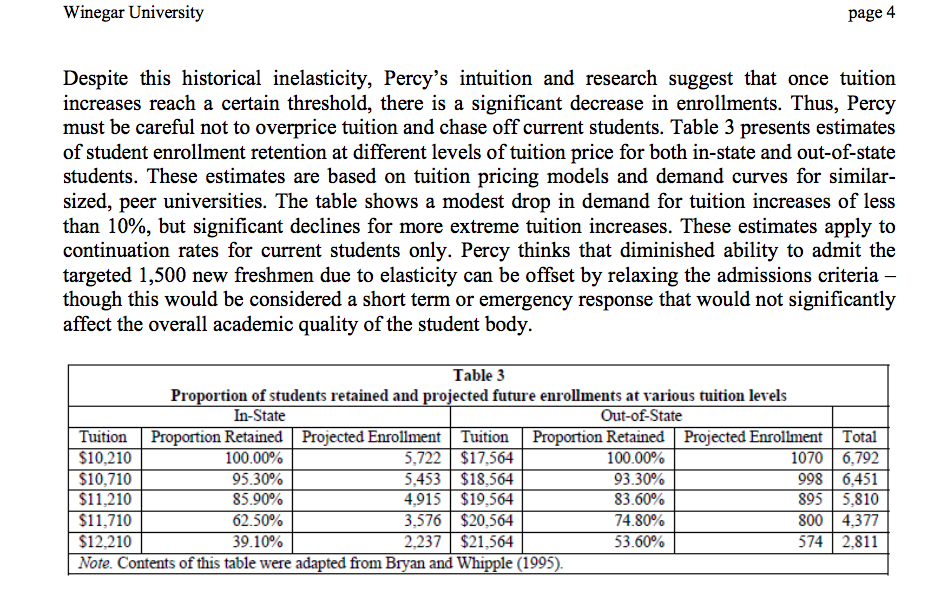

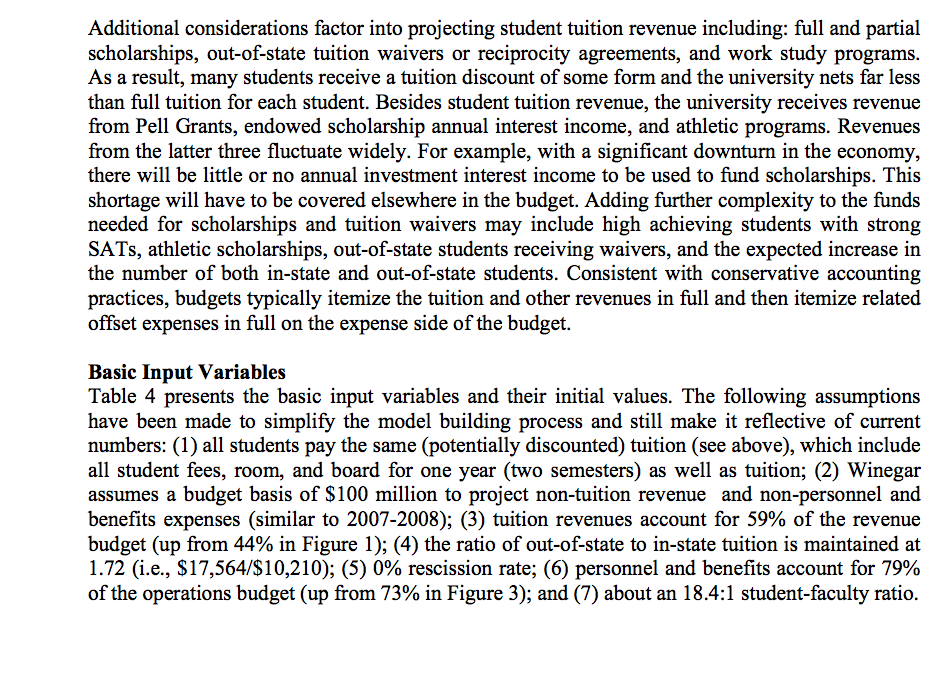

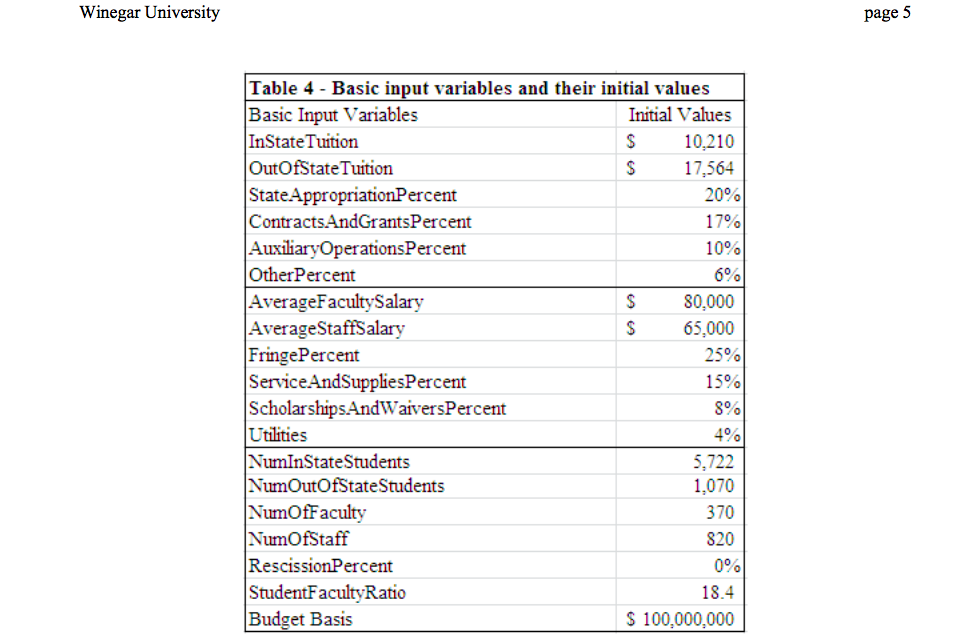

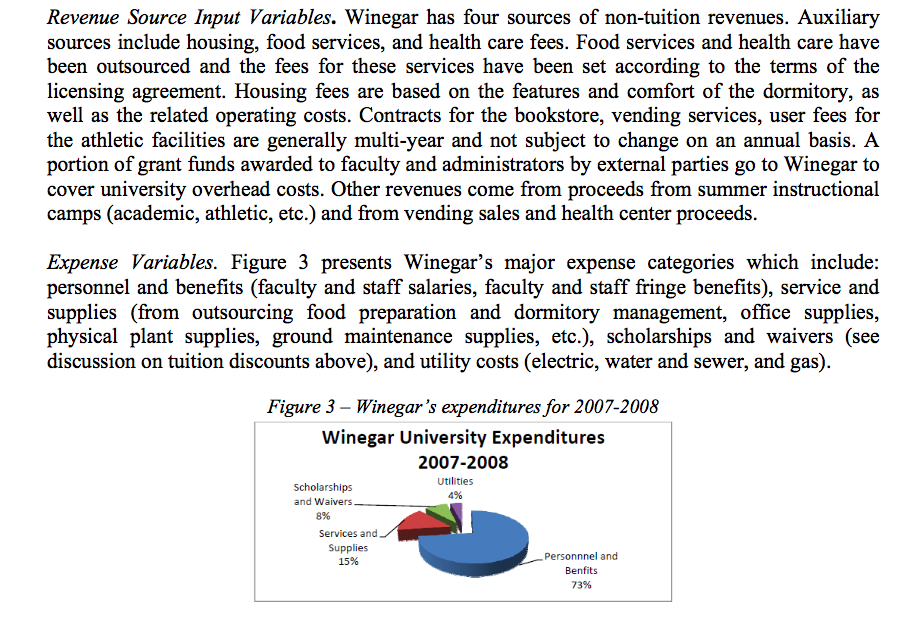

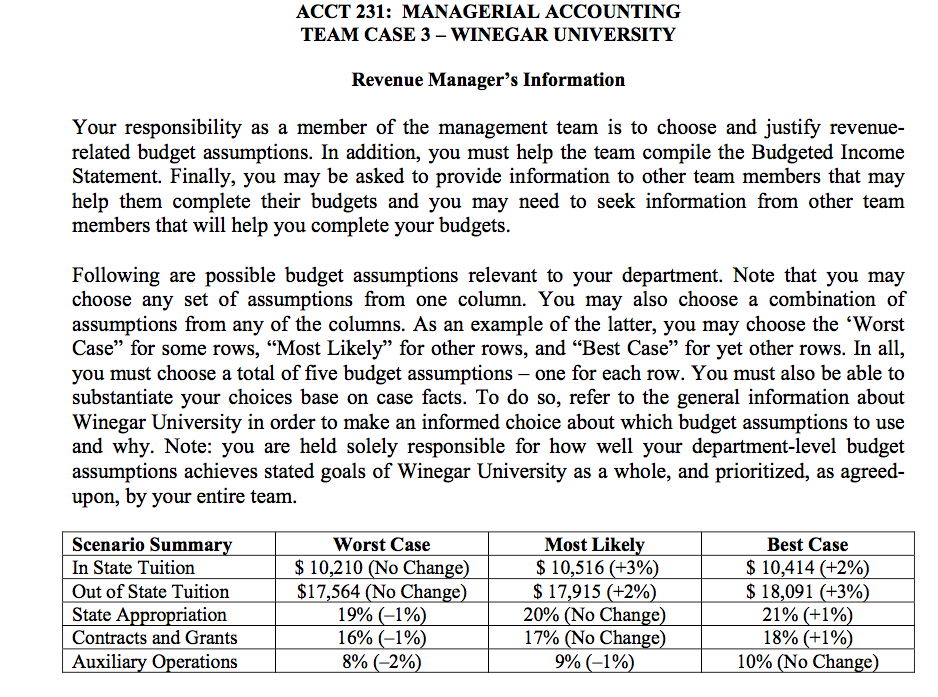

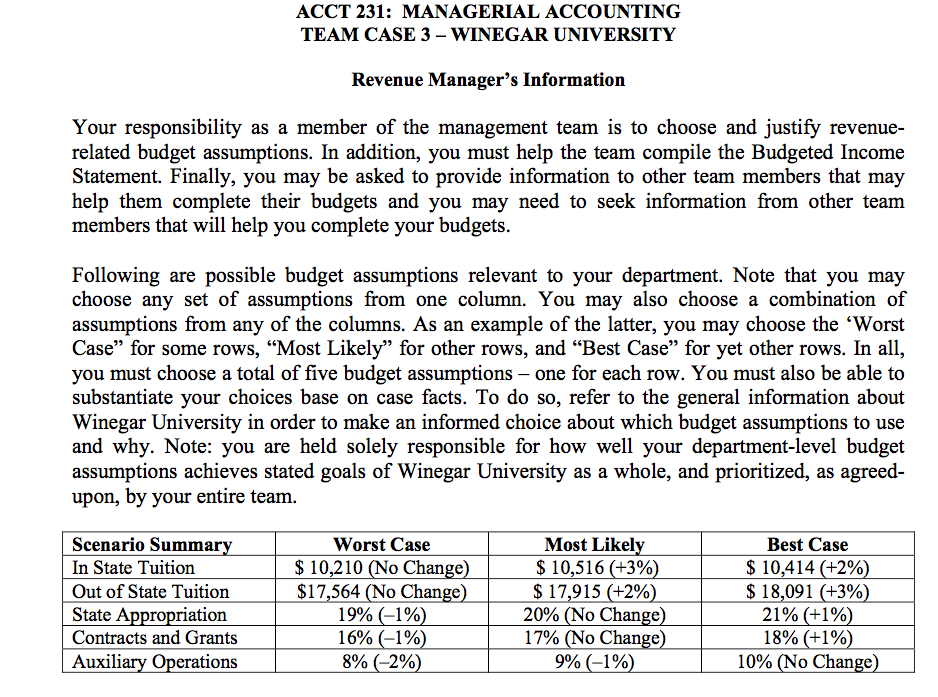

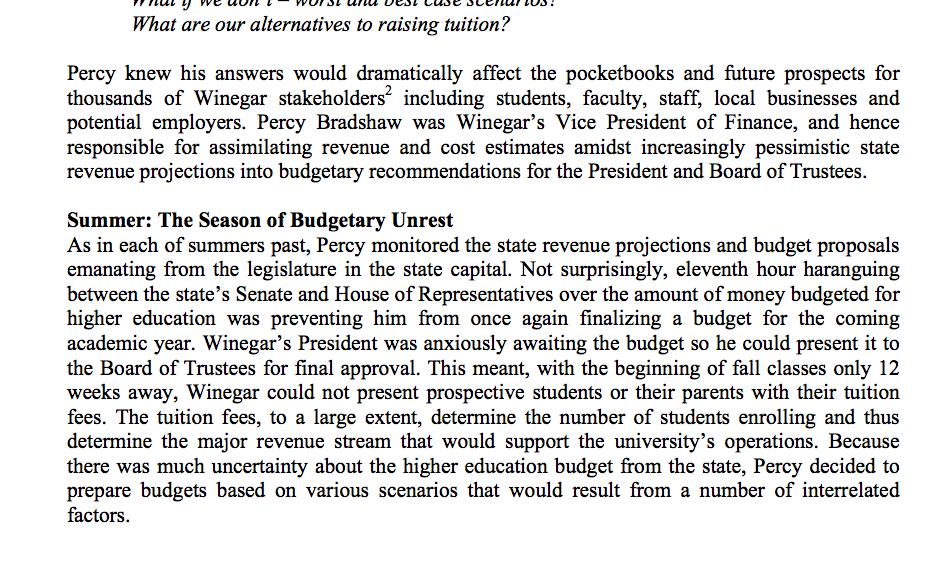

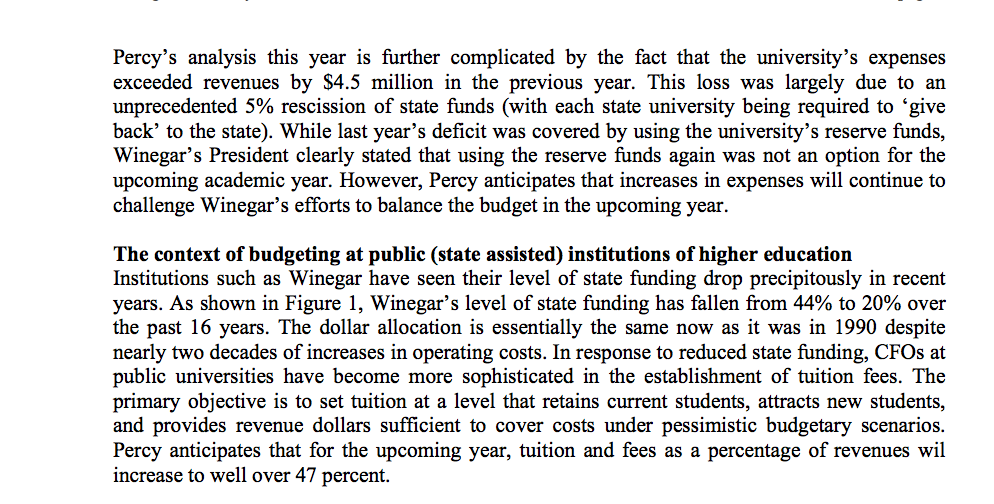

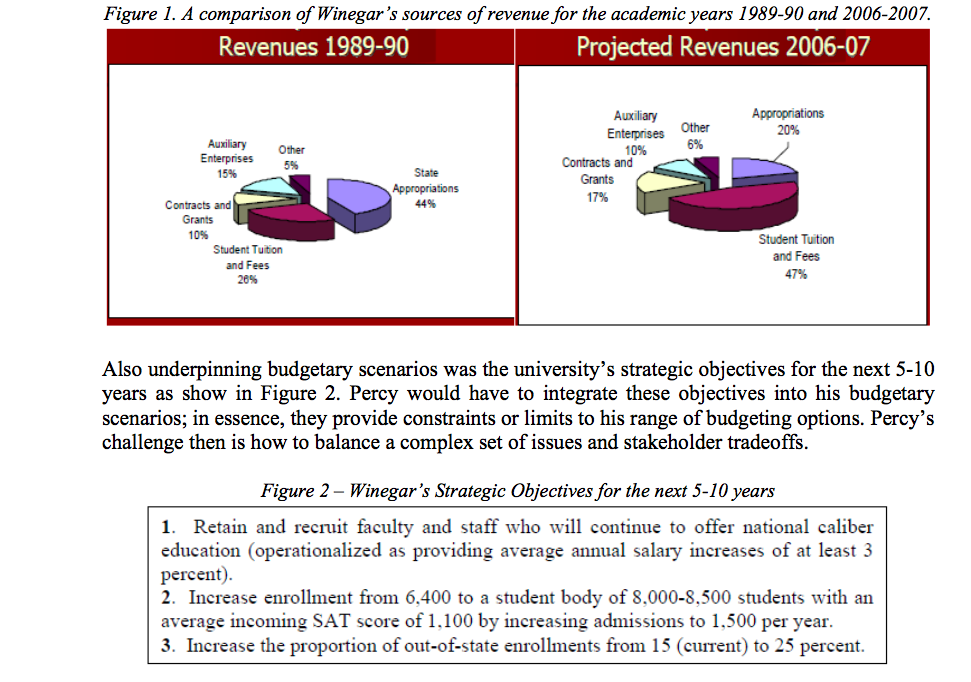

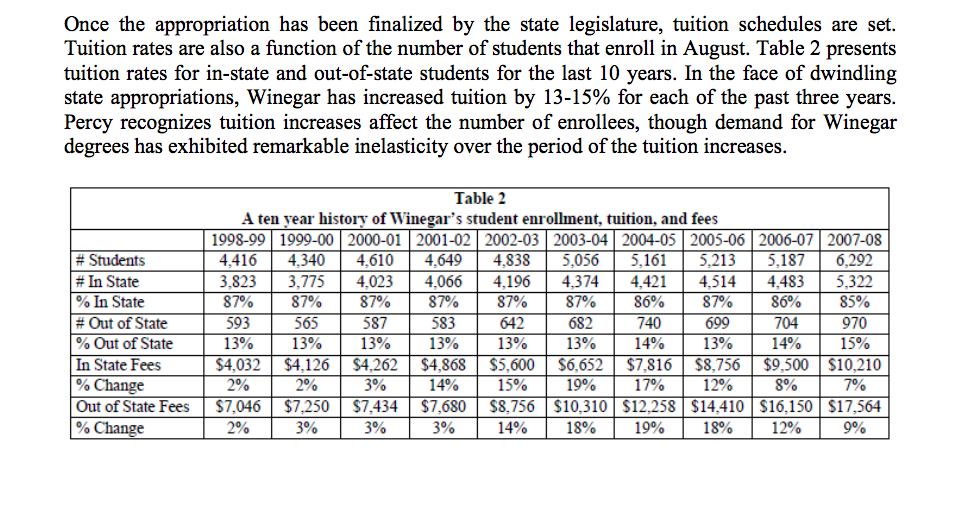

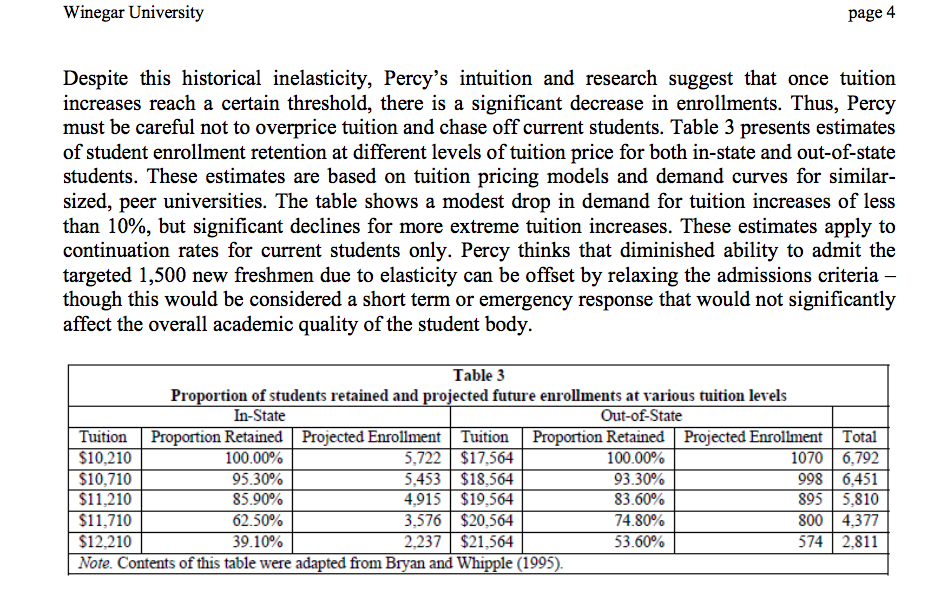

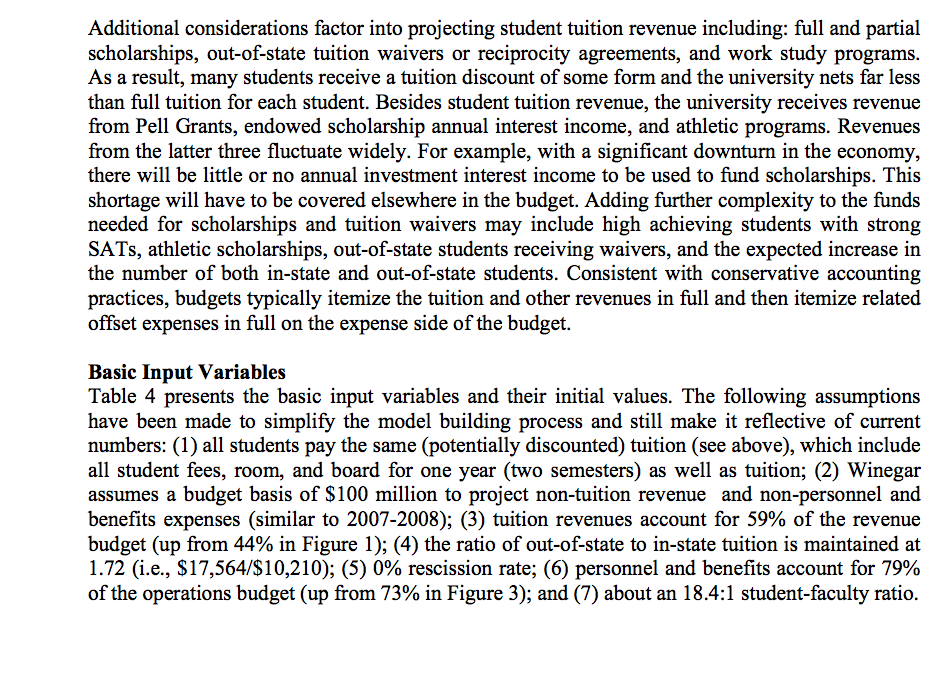

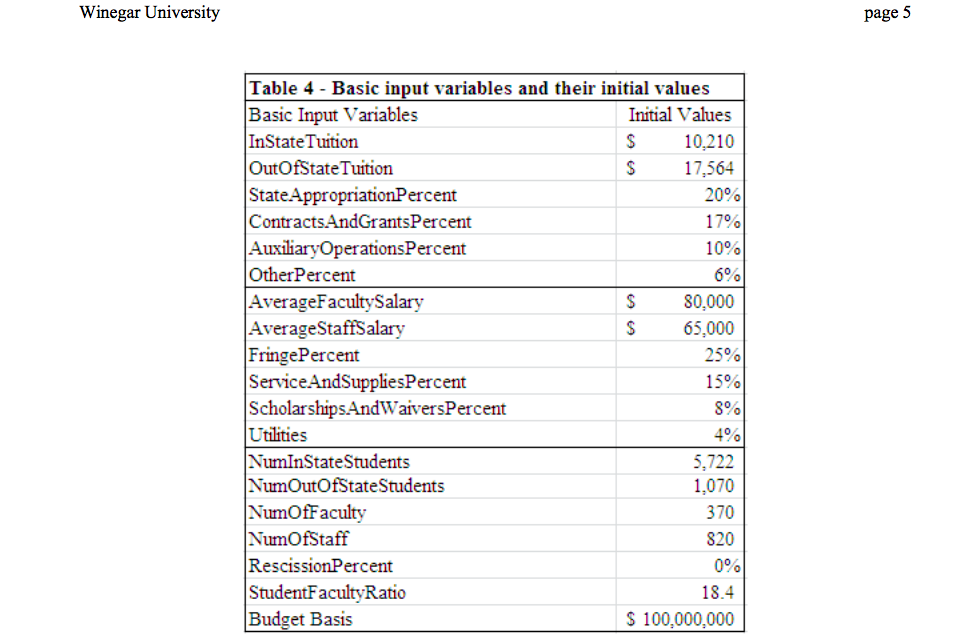

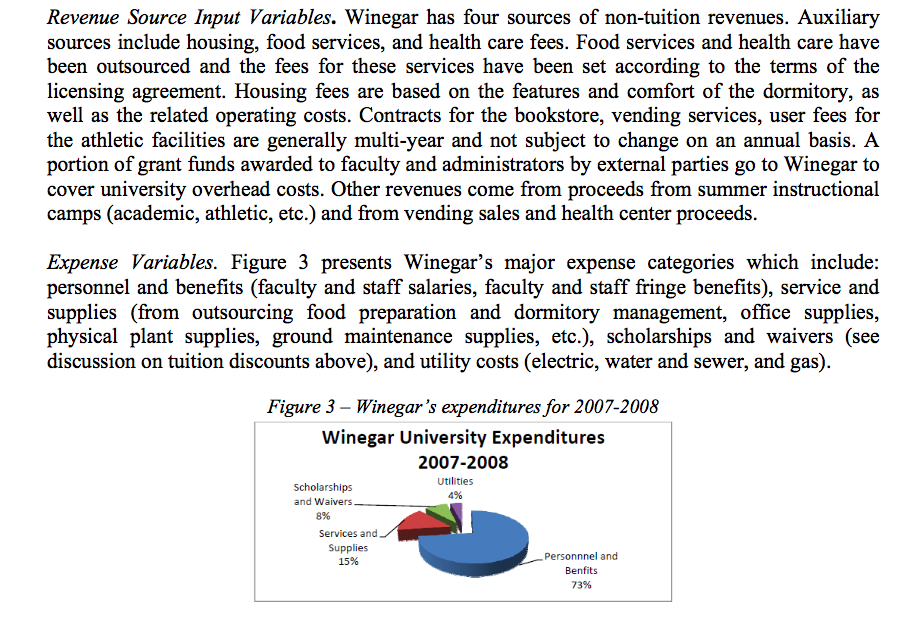

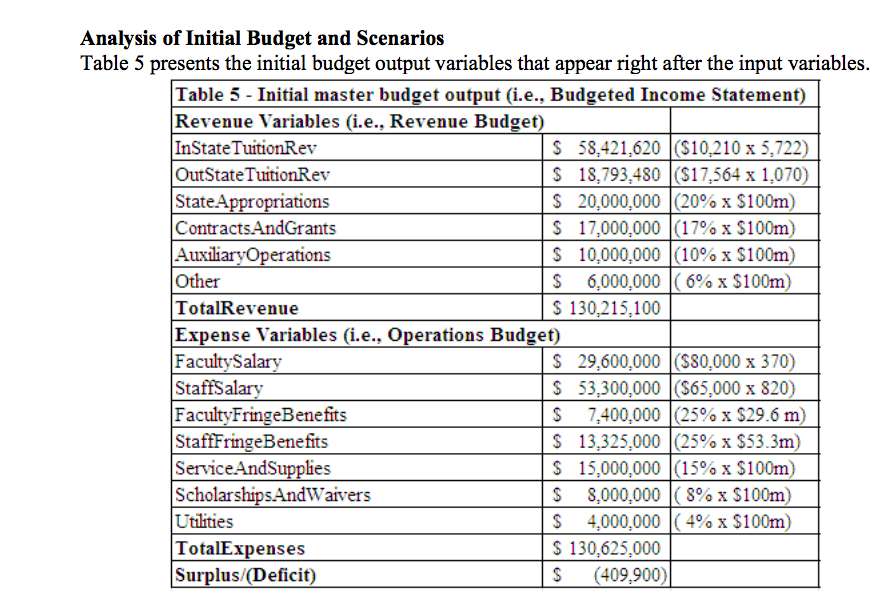

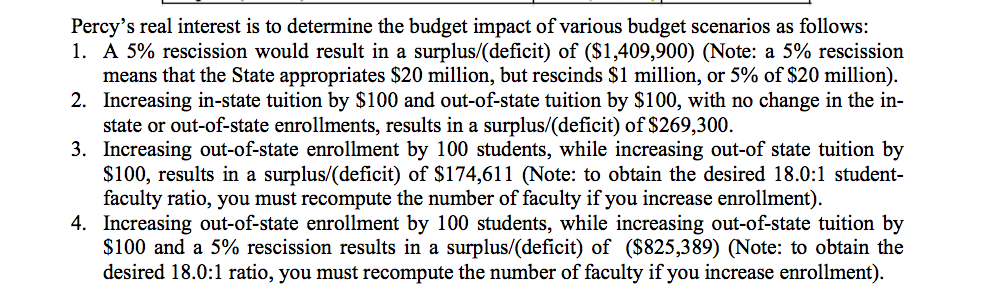

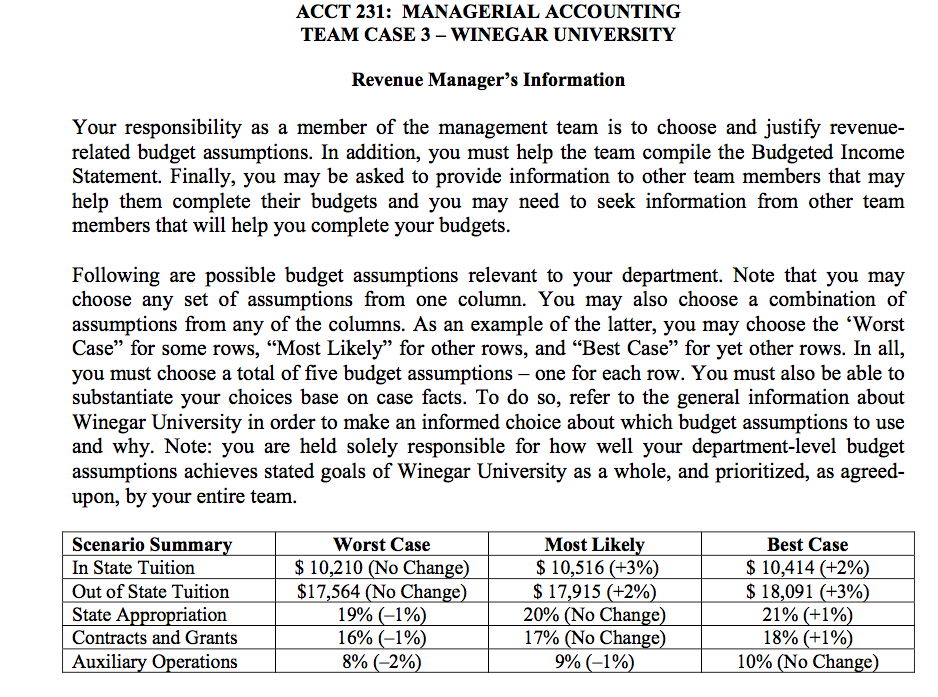

ACCT 231: MANAGERIAL ACCOUNTING TEAM CASE 3 WINEGAR UNIVERSITY Revenue Manager's Information Your responsibility as a member of the management team is to choose and justify revenue- related budget assumptions. In addition, you must help the team compile the Budgeted Income Statement. Finally, you may be asked to provide information to other team members that may help them complete their budgets and you may need to seek information from other team members that will help you complete your budgets Following are possible budget assumptions relevant to your department. Note that you may choose any set of assumptions from one column. You may also choose a combination of assumptions from any of the columns. As an example of the latter, you may choose the "Worst Case" for some rows, "Most Likely" for other rows, and "Best Case" for yet other rows. In all, you must choose a total of five budget assumptions one for each row. You must also be able to substantiate your choices base on case facts. To do so, refer to the general information about Winegar University in order to make an informed choice about which budget assumptions to use and why. Note: you are held solely responsible for how well your department-level budget assumptions achieves stated goals of Winegar University as a whole, and prioritized, as agreed upon, by your entire team. Worst Case Most Likely Scenario Summary Best Case S In State Tuition 10,210 (No Change) 10,516 (+3%) 10,414 (+2%) S S $17,564 (No Change) 17,915 (+2% Out of State Tuition 18,091 (+3%) 21% (-1%) State Appropriation 19% (-1%) 20% (No Change) 16% (-1% 17% No Change) Contracts and Grants 18% (+1% 8% 2% 90% (-1% Auxiliary Operations 10% (No Change) ACCT 231: MANAGERIAL ACCOUNTING TEAM CASE 3 WINEGAR UNIVERSITY Revenue Manager's Information Your responsibility as a member of the management team is to choose and justify revenue- related budget assumptions. In addition, you must help the team compile the Budgeted Income Statement. Finally, you may be asked to provide information to other team members that may help them complete their budgets and you may need to seek information from other team members that will help you complete your budgets Following are possible budget assumptions relevant to your department. Note that you may choose any set of assumptions from one column. You may also choose a combination of assumptions from any of the columns. As an example of the latter, you may choose the "Worst Case" for some rows, "Most Likely" for other rows, and "Best Case" for yet other rows. In all, you must choose a total of five budget assumptions one for each row. You must also be able to substantiate your choices base on case facts. To do so, refer to the general information about Winegar University in order to make an informed choice about which budget assumptions to use and why. Note: you are held solely responsible for how well your department-level budget assumptions achieves stated goals of Winegar University as a whole, and prioritized, as agreed upon, by your entire team. Worst Case Most Likely Scenario Summary Best Case S In State Tuition 10,210 (No Change) 10,516 (+3%) 10,414 (+2%) S S $17,564 (No Change) 17,915 (+2% Out of State Tuition 18,091 (+3%) 21% (-1%) State Appropriation 19% (-1%) 20% (No Change) 16% (-1% 17% No Change) Contracts and Grants 18% (+1% 8% 2% 90% (-1% Auxiliary Operations 10% (No Change)