Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE READ THE POSTED SCREENSHOTS BELOW. THE CHOSEN COMPANY IS (TARGET) The first task is for you to develop a proposal for your project, specifically

PLEASE READ THE POSTED SCREENSHOTS BELOW. THE CHOSEN COMPANY IS (TARGET)

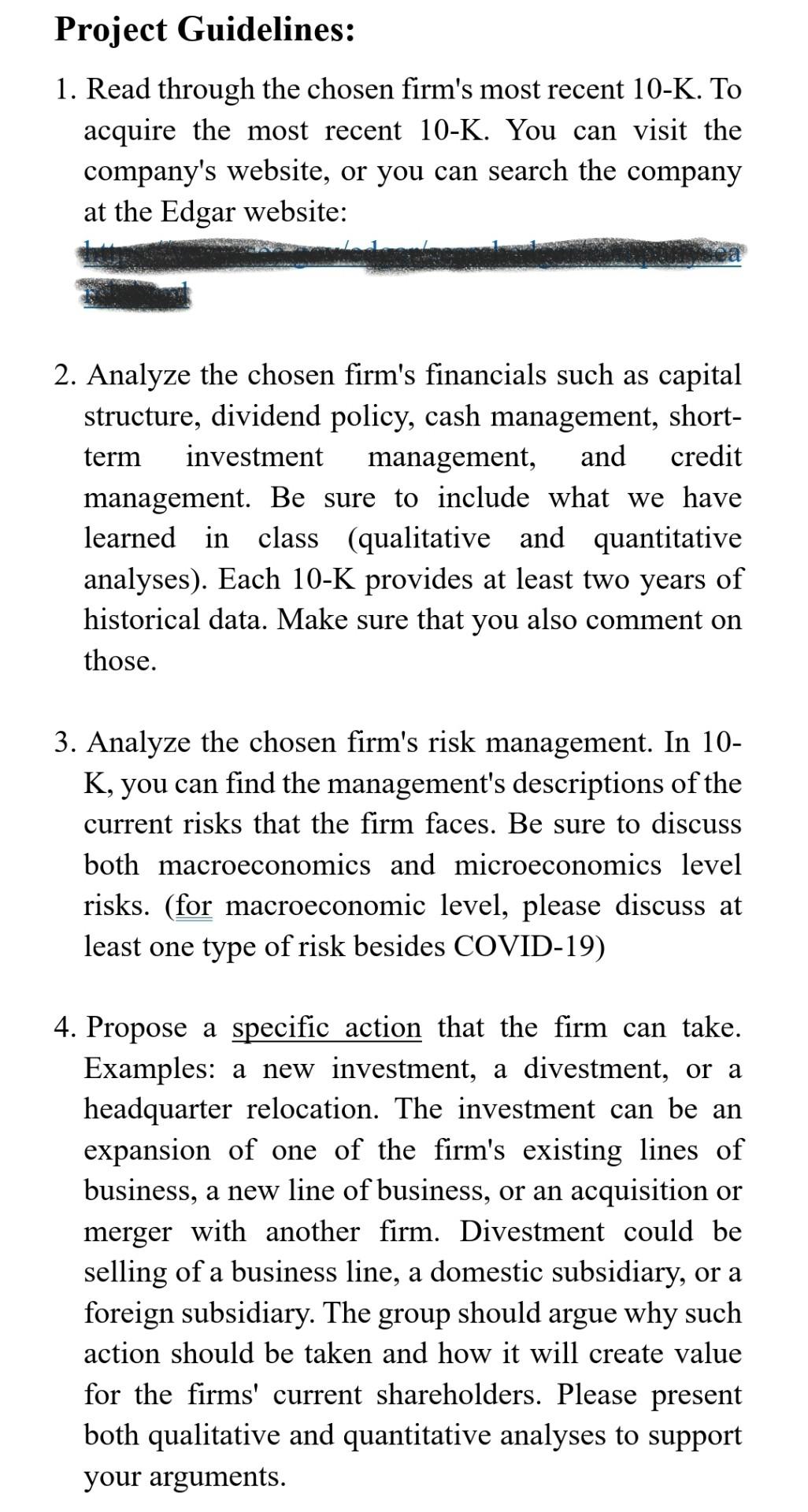

The first task is for you to develop a proposal for your project, specifically for the specific action that you think the firm can take. For the proposal, you should do enough research to know if it is feasible for the firm. For example, the proposal that the firm that does not pay dividends should stop paying dividends is not feasible. The ideas should not be for actions already taken. For example, you should not propose that eBay should sell Skype subsidiary because it already happened. Project Guidelines: 1. Read through the chosen firm's most recent 10-K. To acquire the most recent 10-K. You can visit the company's website, or you can search the company at the Edgar website: 2. Analyze the chosen firm's financials such as capital structure, dividend policy, cash management, short- term investment management, and credit management. Be sure to include what we have learned in class (qualitative and quantitative analyses). Each 10-K provides at least two years of historical data. Make sure that you also comment on those. 3. Analyze the chosen firm's risk management. In 10- K, you can find the management's descriptions of the current risks that the firm faces. Be sure to discuss both macroeconomics and microeconomics level risks. (for macroeconomic level, please discuss at least one type of risk besides COVID-19) 4. Propose a specific action that the firm can take. Examples: a new investment, a divestment, or a headquarter relocation. The investment can be an expansion of one of the firm's existing lines of business, a new line of business, or an acquisition or merger with another firm. Divestment could be selling of a business line, a domestic subsidiary, or a foreign subsidiary. The group should argue why such action should be taken and how it will create value for the firms' current shareholders. Please present both qualitative and quantitative analyses to support your arguments. a The first task is for you to develop a proposal for your project, specifically for the specific action that you think the firm can take. For the proposal, you should do enough research to know if it is feasible for the firm. For example, the proposal that the firm that does not pay dividends should stop paying dividends is not feasible. The ideas should not be for actions already taken. For example, you should not propose that eBay should sell Skype subsidiary because it already happened. Project Guidelines: 1. Read through the chosen firm's most recent 10-K. To acquire the most recent 10-K. You can visit the company's website, or you can search the company at the Edgar website: 2. Analyze the chosen firm's financials such as capital structure, dividend policy, cash management, short- term investment management, and credit management. Be sure to include what we have learned in class (qualitative and quantitative analyses). Each 10-K provides at least two years of historical data. Make sure that you also comment on those. 3. Analyze the chosen firm's risk management. In 10- K, you can find the management's descriptions of the current risks that the firm faces. Be sure to discuss both macroeconomics and microeconomics level risks. (for macroeconomic level, please discuss at least one type of risk besides COVID-19) 4. Propose a specific action that the firm can take. Examples: a new investment, a divestment, or a headquarter relocation. The investment can be an expansion of one of the firm's existing lines of business, a new line of business, or an acquisition or merger with another firm. Divestment could be selling of a business line, a domestic subsidiary, or a foreign subsidiary. The group should argue why such action should be taken and how it will create value for the firms' current shareholders. Please present both qualitative and quantitative analyses to support your arguments. a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started