Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please READ the question CAREFULLY and answer ALL PARTS of the question CORRECTLY. Please SHOW your work and DO NOT use Excel. Please DOUBLE CHECK

Please READ the question CAREFULLY and answer ALL PARTS of the question CORRECTLY. Please SHOW your work and DO NOT use Excel. Please DOUBLE CHECK your work BEFORE posting the solution. Any WRONG OR MISSING answers will be DOWNVOTED. Thank you!

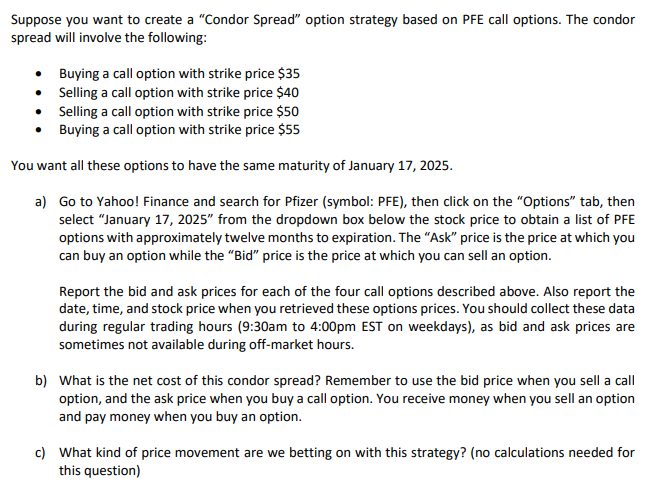

Suppose you want to create a "Condor Spread" option strategy based on PFE call options. The condor spread will involve the following: - Buying a call option with strike price $35 - Selling a call option with strike price $40 - Selling a call option with strike price $50 - Buying a call option with strike price $55 You want all these options to have the same maturity of January 17, 2025. a) Go to Yahoo! Finance and search for Pfizer (symbol: PFE), then click on the "Options" tab, then select "January 17, 2025" from the dropdown box below the stock price to obtain a list of PFE options with approximately twelve months to expiration. The "Ask" price is the price at which you can buy an option while the "Bid" price is the price at which you can sell an option. Report the bid and ask prices for each of the four call options described above. Also report the date, time, and stock price when you retrieved these options prices. You should collect these data during regular trading hours (9:30am to 4:00pm EST on weekdays), as bid and ask prices are sometimes not available during off-market hours. b) What is the net cost of this condor spread? Remember to use the bid price when you sell a call option, and the ask price when you buy a call option. You receive money when you sell an option and pay money when you buy an option. c) What kind of price movement are we betting on with this strategy? (no calculations needed for this question)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started