Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please READ the question CAREFULLY and answer ALL PARTS of the question CORRECTLY. Please SHOW your work and DO NOT use Excel. DOUBLE CHECK your

Please READ the question CAREFULLY and answer ALL PARTS of the question CORRECTLY. Please SHOW your work and DO NOT use Excel. DOUBLE CHECK your work BEFORE posting the solution. Any WRONG OR MISSING answers will be DOWNVOTED. Thank you!

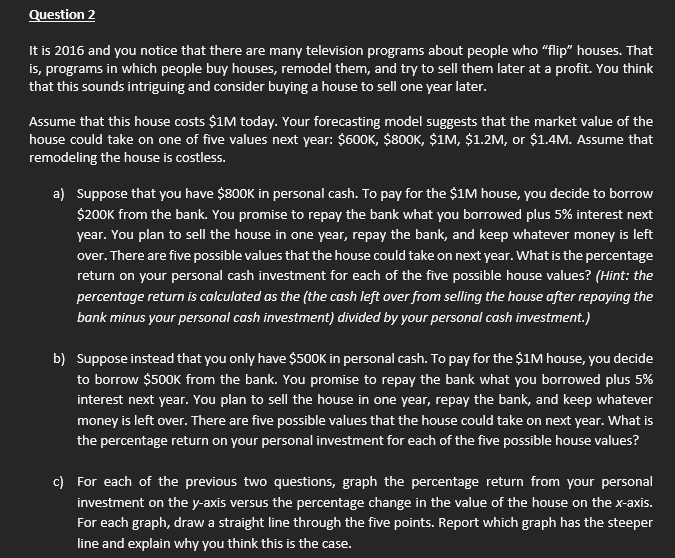

is 2016 and you notice that there are many television programs about people who "flip" houses. That 5 , programs in which people buy houses, remodel them, and try to sell them later at a profit. You think hat this sounds intriguing and consider buying a house to sell one year later. Issume that this house costs $1M today. Your forecasting model suggests that the market value of the ouse could take on one of five values next year: $600K,$800K,$1M,$1.2M, or $1.4M. Assume that emodeling the house is costless. a) Suppose that you have $800K in personal cash. To pay for the $1M house, you decide to borrow \$200K from the bank. You promise to repay the bank what you borrowed plus 5\% interest next year. You plan to sell the house in one year, repay the bank, and keep whatever money is left over. There are five possible values that the house could take on next year. What is the percentage return on your personal cash investment for each of the five possible house values? (Hint: the percentage return is calculated as the (the cash left over from selling the house after repaying the bank minus your personal cash investment) divided by your personal cash investment.) b) Suppose instead that you only have $500K in personal cash. To pay for the $1M house, you decide to borrow $500K from the bank. You promise to repay the bank what you borrowed plus 5\% interest next year. You plan to sell the house in one year, repay the bank, and keep whatever money is left over. There are five possible values that the house could take on next year. What is the percentage return on your personal investment for each of the five possible house values? c) For each of the previous two questions, graph the percentage return from your personal investment on the y-axis versus the percentage change in the value of the house on the x-axis. For each graph, draw a straight line through the five points. Report which graph has the steeper line and explain why you think this is the caseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started