Answered step by step

Verified Expert Solution

Question

1 Approved Answer

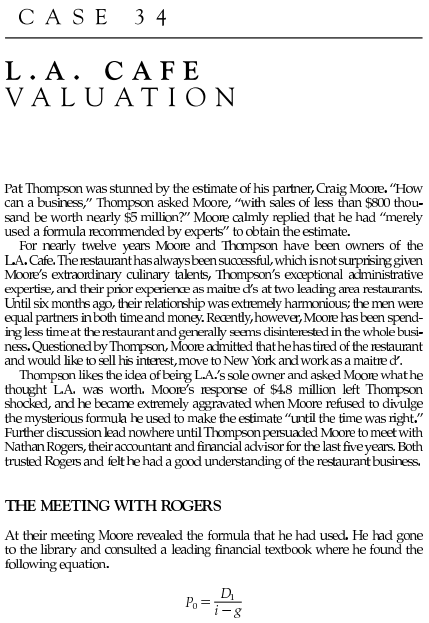

Please read the story and help me answer these two questions! I made sure to give you the charts and any info you might need!

Please read the story and help me answer these two questions! I made sure to give you the charts and any info you might need!

THE TWO QUESTIONS ARE BELOW:

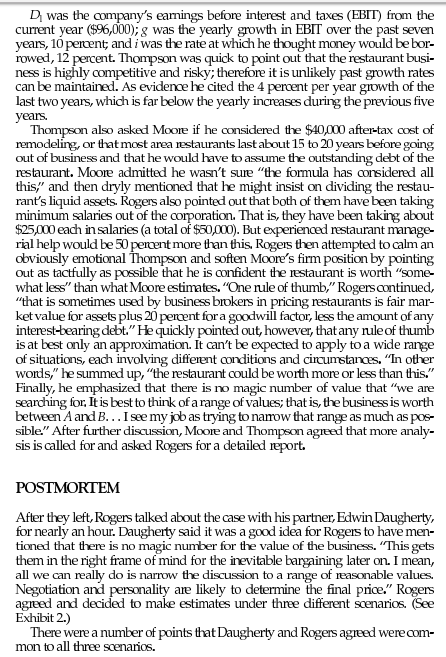

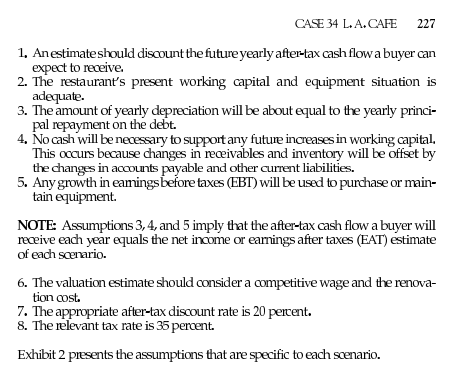

FIRST QUESTION). the current liquidation value of the business assuming the assets can be sold at 75 percent of book all debt is paid off at 100 percent of book.

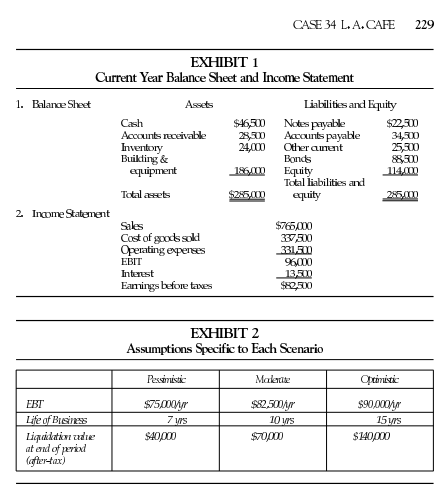

SECOND QUESTION). Estimate the value of the restaurant in each of the three scenarios.

Please show your work! thank you!

P.S (please specify what you mean about visible comments)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started