Question

Please reconcile accounting income to Division B income for tax purposes. Your client, would like you to calculate taxable income for them. They are a

Please reconcile accounting income to Division B income for tax purposes. Your client, would like you to calculate taxable income for them. They are a Canadian Controlled Corporation. The income statement for the year ended December 31, 2022, is shown below.

During your review of the working paper file and last year's tax return, you have made the following notes:

The December 31, 2022, finished goods inventory is stated net of a reserve for a possible decline in market value of $57,000.

Included in general and administrative expenses are the following transactions:

a) Donations consisting of $12,000 to registered charities.

b) A life insurance policy was taken out on the president's life to provide funding for the

company in the event of his death. Life insurance premiums on this policy amounted

to $4,600.

c) Golf membership fees of $3,200 used to meet with clients/

d) Meals and entertainment with clients of $12,000.

e) Cost of training employees about new regulations of $7,200.

f) Cost of the holiday party to which all employees were invited of $17,700.

g) Warranty provision of $28,000 (actual warranty costs of $18,000)

h) Accrued bonuses paid July 30, 2023 of $30,000.

Included in interest expense on long-term debt and other interest are the following transactions:

(a) Interest on deficient income tax instalments of $1,200.

(b) Interest on late municipal property taxes $500.

Included in other expenses are financing costs incurred to take out a loan to purchase

equipment of $10,000.

Included in other income are the following transactions:

(a) A gain on sale of fixed asset arose, as the company sold a painting. The painting cost was $12,000 in 2011 and sold for $18,000.

(b) Income from other investments includes the receipts of a cash dividend of $7,500.

6.

An examination of the capital cost allowance schedule for 2022 provided the following

opening balances for the undepreciated capital cost for each class of Dela Pia's assets: 1 (6%) — building............................................. $150,000

8 — office furniture and equipment...................... 60,000

10.1 — 2001 Honda Accord............................10,000

12 — small tools ....................................................2,000 13 — leasehold improvements .......................... 162,500

The following additional information was found in the 2022 fixed asset schedules working paper files.

1. The building which cost $997,426 in 1990 was sold for $150,000. It was the only building its sale. A new building was purchased (non used) in February 2022 for $750,000

(a) Also, in February 2022 a lot adjacent to the new building, was

purchased for $100,000 for use as a parking lot by employees and visitors. This lot was paved at a cost of $25,000. A fence was erected also in February 2022 around an outside storage area near the new building at a cost of $40,000

New office furniture was purchased for $20,000. This purchase replaced old assets which were sold for $5,000. None of the old assets was sold for more than capital cost.

Some small tools were sold for a total of $7,000. All of these tools were sold at a price less than their capital cost.

Leasehold improvements had been made to a leased warehouse at a cost of $225,000 in September 2020. The remaining length of the lease in that year was six years with two successive renewal options of three years each. Further leasehold improvements were made to this warehouse in 2022 at a cost of $21,000.

The company purchased one passenger vehicles in the year. They bought a Car $48,000. The company in turn sold the old car purchased in 2001 for $5,000.

During January 2022, an unlimited life franchise was purchased for $48,000.

Accounting gains and losses on the above asset sales netted to nil.

Required:

Prepare the requested reconciliation and compute Net Business Income for Tax Purposes, Net Income for Tax Purposes and Taxable income.

List under the heading "Omitted", with a very brief explanation why, any of the above items which were omitted from the reconciliation.

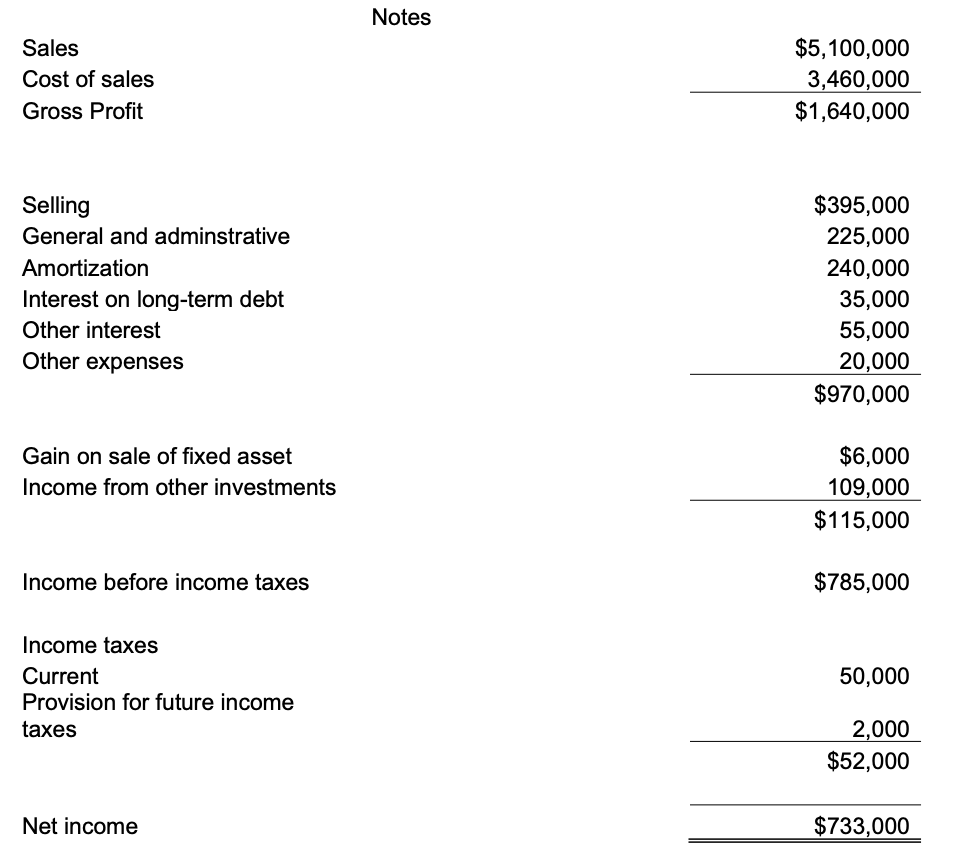

Sales Cost of sales Gross Profit Notes $5,100,000 3,460,000 $1,640,000 Selling General and adminstrative Amortization Interest on long-term debt $395,000 225,000 240,000 35,000 Other interest 55,000 Other expenses 20,000 $970,000 Gain on sale of fixed asset $6,000 Income from other investments 109,000 $115,000 Income before income taxes $785,000 Income taxes Current 50,000 Provision for future income taxes 2,000 $52,000 Net income $733,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started