Question

Please record EXCEL FORMULAS Answer this question in a sheet that you name Swap . A firm has a five-year obligation ($80 million notional principal)

Please record EXCEL FORMULAS

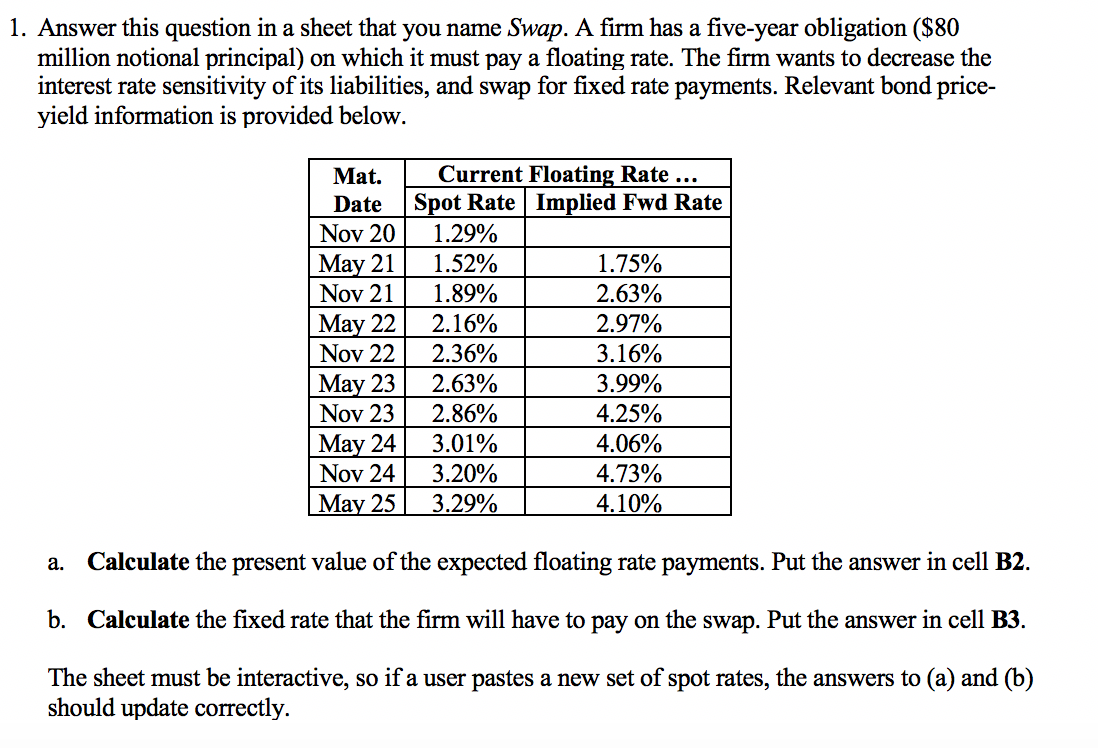

Answer this question in a sheet that you name Swap. A firm has a five-year obligation ($80 million notional principal) on which it must pay a floating rate. The firm wants to decrease the interest rate sensitivity of its liabilities, and swap for fixed rate payments. Relevant bond price-yield information is provided below.

| Mat. Date | Current Floating Rate | |

| Spot Rate | Implied Fwd Rate | |

| Nov 20 | 1.29% |

|

| May 21 | 1.52% | 1.75% |

| Nov 21 | 1.89% | 2.63% |

| May 22 | 2.16% | 2.97% |

| Nov 22 | 2.36% | 3.16% |

| May 23 | 2.63% | 3.99% |

| Nov 23 | 2.86% | 4.25% |

| May 24 | 3.01% | 4.06% |

| Nov 24 | 3.20% | 4.73% |

| May 25 | 3.29% | 4.10% |

a. Calculate the present value of the expected floating rate payments. Put the answer in cell B2.

b. Calculate the fixed rate that the firm will have to pay on the swap. Put the answer in cell B3.

The sheet must be interactive, so if a user pastes a new set of spot rates, the answers to (a) and (b) should update correctly.

1. Answer this question in a sheet that you name Swap. A firm has a five-year obligation ($80 million notional principal) on which it must pay a floating rate. The firm wants to decrease the interest rate sensitivity of its liabilities, and swap for fixed rate payments. Relevant bond price- yield information is provided below. Mat. Date Nov 20 May 21 Nov 21 May 22 Nov 22 May 23 Nov 23 May 24 Nov 24 May 25 Current Floating Rate ... Spot Rate Implied Fwd Rate 1.29% 1.52% 1.75% 1.89% 2.63% 2.16% 2.97% 2.36% 3.16% 2.63% 3.99% 2.86% 4.25% 3.01% 4.06% 3.20% 4.73% 3.29% 4.10% a. Calculate the present value of the expected floating rate payments. Put the answer in cell B2. b. Calculate the fixed rate that the firm will have to pay on the swap. Put the answer in cell B3. must be interactive, so if a user pastes a new set of spot rates, the answers to (a) and (b) should update correctly. 1. Answer this question in a sheet that you name Swap. A firm has a five-year obligation ($80 million notional principal) on which it must pay a floating rate. The firm wants to decrease the interest rate sensitivity of its liabilities, and swap for fixed rate payments. Relevant bond price- yield information is provided below. Mat. Date Nov 20 May 21 Nov 21 May 22 Nov 22 May 23 Nov 23 May 24 Nov 24 May 25 Current Floating Rate ... Spot Rate Implied Fwd Rate 1.29% 1.52% 1.75% 1.89% 2.63% 2.16% 2.97% 2.36% 3.16% 2.63% 3.99% 2.86% 4.25% 3.01% 4.06% 3.20% 4.73% 3.29% 4.10% a. Calculate the present value of the expected floating rate payments. Put the answer in cell B2. b. Calculate the fixed rate that the firm will have to pay on the swap. Put the answer in cell B3. must be interactive, so if a user pastes a new set of spot rates, the answers to (a) and (b) should update correctly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started