Question

Record the adjustments in the first two preformatted worksheets to the appropriate columns. 1). Purchased inventories of $460,000, on account, terms 2/15, n45. 2). Had

Record the adjustments in the first two preformatted worksheets to the appropriate columns.

1). Purchased inventories of $460,000, on account, terms 2/15, n45.

2). Had sales of merchandise of $1,478,000, cost of sales were $640,000. Terms of the sale were 3/10, n30.

3). Paid the purchases made in #1, 11 days after purchase.

4). Merchandise was returned to Bed Bath & Beyond. It was sold for $93,000 and its cost was $62,000. The items were returned to merchandise and cash was refunded.

5). Purchased various insurance policies, October 1, 2017, $58,800, paying cash. These policies covered Bed Bath & Beyond for 12 months from date of purchase. (Topic 2)

6). Bed Bath & Beyond was paid for the merchandise sold in #2, 8 days after sale.

7). Gift certificates for Bed Bath & Beyond merchandise were sold to customers, sales prices $48,000, cash. (Topic 2)

8). Buildings were purchased, $8,520. $520 cash was paid and a long-term note was issued for the remainder.

9). Bed Bath & Beyond returned inventories that were defective. The cost was $178,000, payment had not been made so accounts payable was reduced.

10). Paid wages, $493,000.

11). Other comprehensive loss in the statement of retained earnings needed to be adjusted. This was increased to $720 and assume the other account in this transaction is Accumulated other comprehensive loss in the shareholders' equity section of the balance sheet.

12). It is March 3, 2018. Record the insurance expired from #5. (Topic 2)

13). An analysis of accounts receivable indicates that 5% is estimated to be uncollectible. Assume the approach used by this company is to multiply accounts receivable by the percentage, with that amount being bad debt expense.

14). Assume Bed Bath & Beyond uses the first-in, first-out (FIFO) cost flow assumption for valuing inventories. The beginning inventory and a sample of purchases were used to value inventories. These amounts were: beginning inventory (3/15/17) 58,042 units @ $47.05 each; purchase 3/19/17, 6,000 units @ $48 each; purchase 5/6/17, 11,500 units @ $49 each; purchase 6/9/17, 8,000 units @ $52 each; purchase 8/21/17, 11,000 units @ $54 each; purchase 9/12/17, 6,000 units @ $55 each; purchase 1/5/18, 19,000 units @ $57 each. Forty three thousand (43,000) units were on hand at March 3, 2018. Value the ending inventory (not cost of goods sold) and adjust the total to the ending inventory value accordingly. (transactions concluded on next page)

15). Declared and paid a $36,000 cash dividend on common stock.

16). After the adjustment of inventories was made in #14, a comparison to market value (lower of cost or market)was made. "Market" value is $2,250,000

17). Assume the end of the fiscal year, January 31, 2015, falls mid-week, on a Wednesday. The year-end adjustment for accrued wages is made. Accrued wages is $155,000. (Topic 2)

18). The corporate tax returns were filed and provision for income taxes is increased $6,000. A liability is also recorded.

19). Depreciation is recorded on Property and Equipment, $83,000. Accumulated depreciation is netted withProperty and equipment on the balance sheet, so decrease net property and equipment. (Topic 2)

20). "Prepaid expenses and other current assets" includes supplies which have an unadjusted balance of $160,000. A physical count of supplies reveals that the actual balance at year end is $170,000. Accounts are adjusted accordingly. (Topic 2)

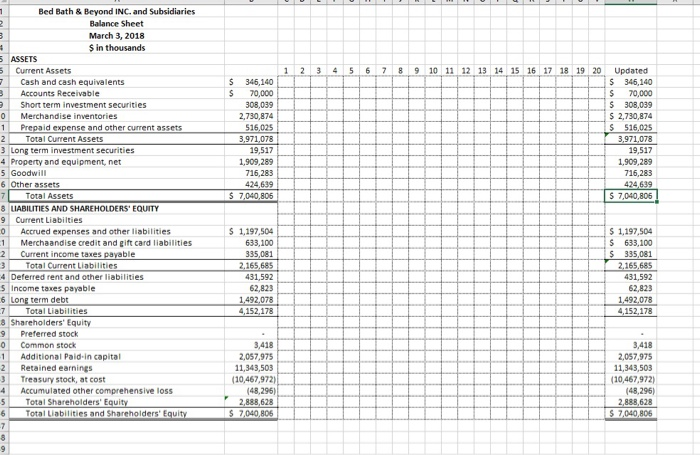

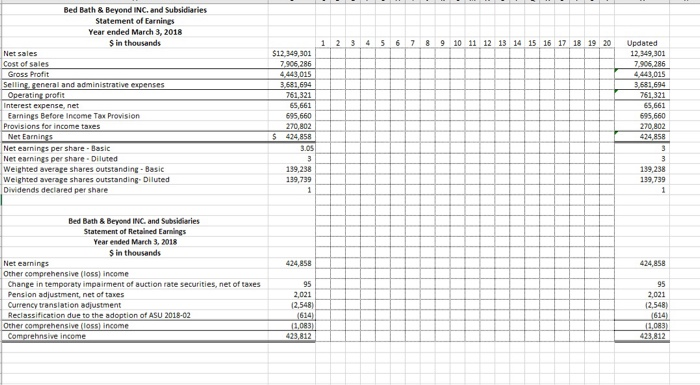

1 2 3 # 5 ASSETS 5 Current Assets 7 3 Accounts Receivable 3 Short term investment securities 0 Merchandise inventories 1 Prepaid expense and other current assets 2 Total Current Assets 3 Long term investment securities 4 Property and equipment, net 5 Goodwill 6 Other assets 7 Total Assets 8 LIABILITIES AND SHAREHOLDERS' EQUITY 9 Current Liabilties 0 -1 Bed Bath & Beyond INC. and Subsidiaries Balance Sheet March 3, 2018 $ in thousands 1 2 3 4 Deferred rent and other liabilities 5 Income taxes payable 6 Long term debt 7 Total Liabilities 8 Shareholders' Equity 9 Preferred stock Common stock -5 6 Cash and cash equivalents Additional Paid-in capital 2 Retained earnings -3 Treasury stock, at cost 4 Accumulated other comprehensive loss -7 8 9 Accrued expenses and other ilitie Merchaandise credit and gift card liabilities Current income taxes payable Total Current Liabilities Total Shareholders' Equity Total Liabilities and Shareholders' Equity $ 346,140 70,000 308,039 2,730,874 516,025 3,971,078 19,517 1,909,289 716,283 424,639 $ 7,040,806 1,197,504 633,100 335,081 2,165,685 431,592 62,823 1,492,078 4,152,178 3,418 2,057,975 11,343,503 (10,467,972) (48,296) 2,888,628 $ 7,040,806 1 2 3 4 5 un 2 6 7 M M 8 B 9 10 11 12 13 14 15 16 17 18 19 20 Updated $ 346,140 70,000 $ $ 308,039 $ 2,730,874 $ 516,025 3,971,078 19,517 1,909,289 716,283 424,639 $ 7,040,806 $ 1,197,504 $ 633,100 $ 335,081 2,165,685 431,592 62,823 1,492,078 4,152,178 3,418 2,057,975 11,343,503 (10,467,972) (48,296) 2,888,628 $ 7,040,806

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To record the adjustments in the first two preformatted worksheets lets create a table with appropri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started