Question

Please refer to Bay City Electronics case study below and report your findings after analyzing the case. Answer as comprehensively as possible the questions after

Please refer to Bay City Electronics case study below and report your findings after analyzing the case. Answer as comprehensively as possible the questions after each case summary.

Case: Bay City Electronics

Financial analysis of new products at Bay City Electronics had always been rather informal. Bill Roberts, who founded the rm in 1970, knew residential electronics because he had worked for almost seven years for another rm specializing in home security systems. But he had never been trained in nancial analysis. In fact, all he knew was what the bank had asked for every time he went to discuss his line of credit. Bay City had about 45 full-time employees (plus a seasonal factory workforce) and did in the neighborhood of $18 million in sales. His products all related to home security and were sold by his sales manager, who worked with a group of manufacturers reps, who in turn called on wholesalers, hardware and department store chains, and other large retailers. He did some consumer advertising, but not much.

Bill was inventive, however, and had built the business primarily by coming up with new techniques. His latest device was a remote-controlled electronic closure for any door in the home. The closure was effected by a special ringing of the telephone: For example, if a user wanted to leave a back door open until 9:00 p.m., it was simple to call the house at 9:00 and wait for 10 rings, after which the electronic device would switch the door to a locked position. A similar call would reopen the door.

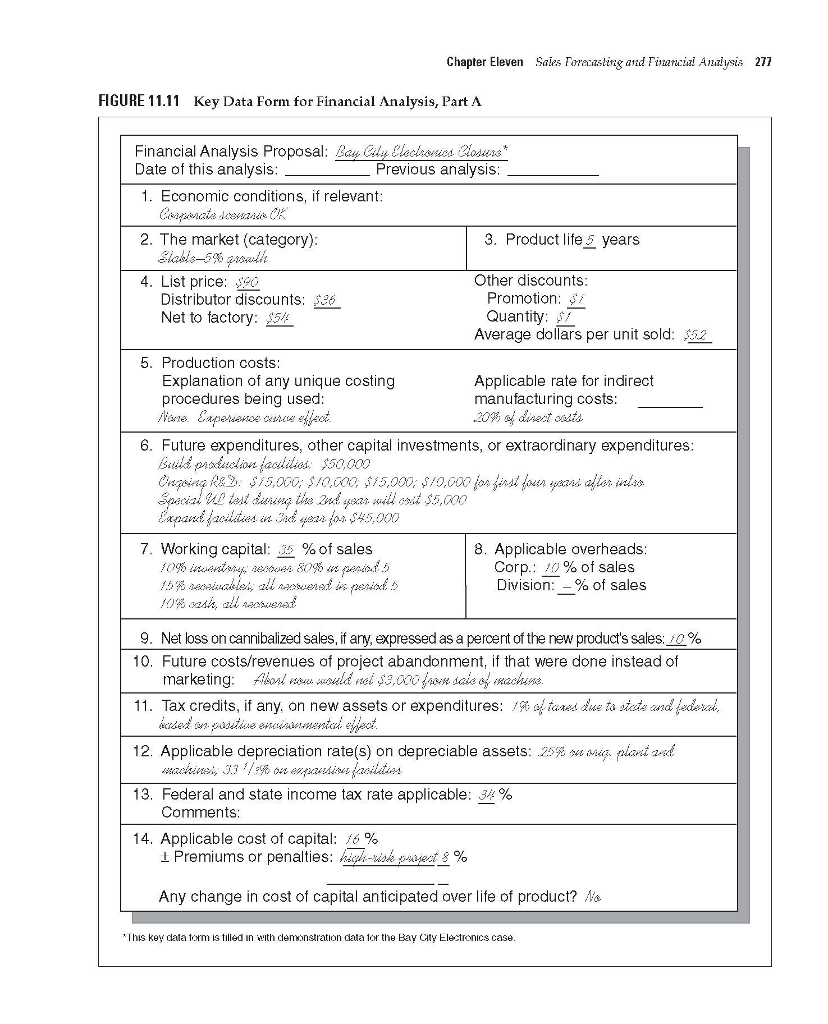

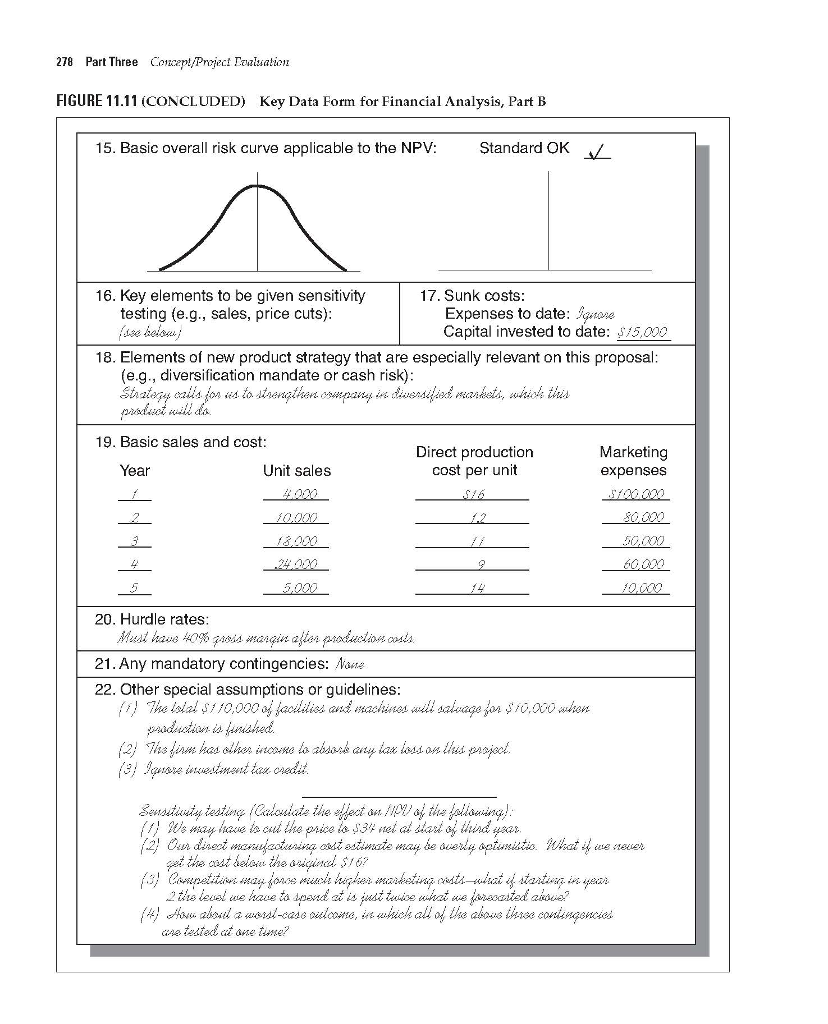

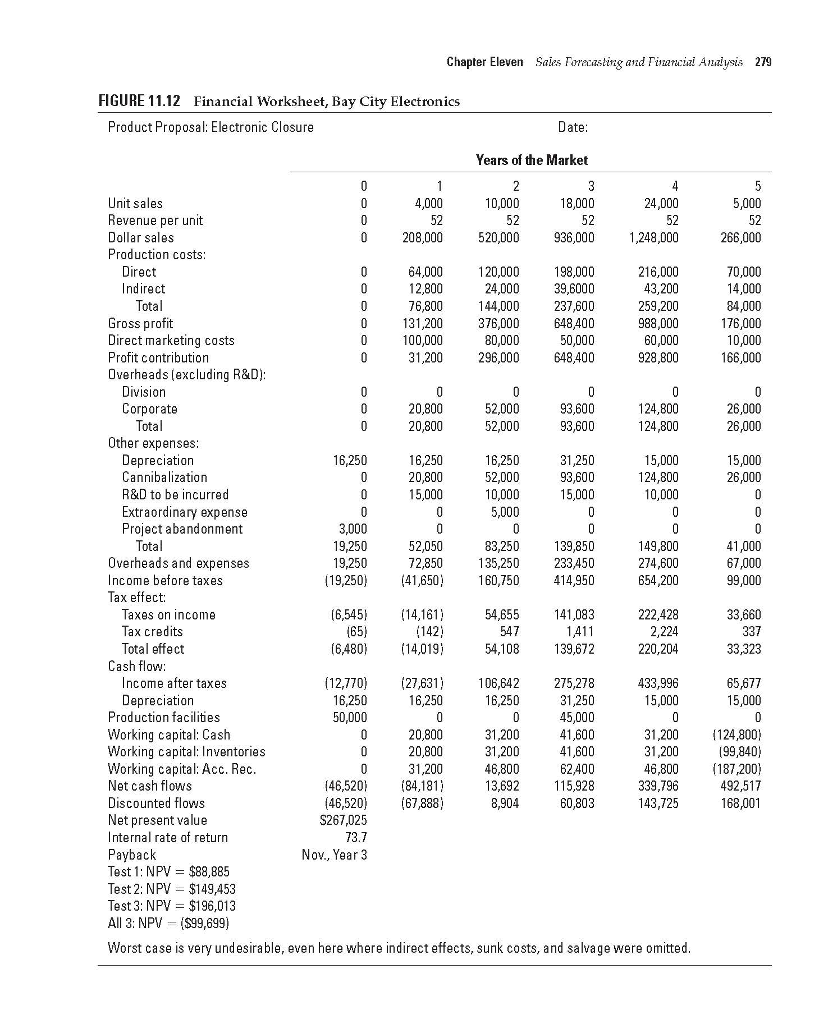

The bank liked the idea but wanted Bill to do a better job of nancial analysis, so the loan ofcer asked him to use the forms shown in the Bay City Appendix as Figure 11.11 and Figure 11.12. After some effort, Bill was able to ll out the key data form, Figure 11.11, and his work is reproduced here. To date, Bay City had spent $85,000 in expense money for supplies and labor developing the closure and had invested $15,000 in a machine (asset). If the company decided to go ahead, it would have to invest $50,000 more in a new facility, continue R&D to validate and improve the product, andif things went according to expectationsinvest another $45,000 in year 3 to expand production capability.

He also had to ll out the nancial worksheet, Figure 11.12; for this he used a friend of the family who had studied nancial analysis in college. The friend had relied on a summary of how to do this, and this summary is attached. He also warned Bill that there were lots of judgment calls in that calculation, so dont get into an argument with the people at the bank about details.

While waiting for his appointment at the bank, Bill spent some time just thinking about his situation. Did the numbers look good? Where were the shaky parts that the banker might give him trouble on? Most of all, he was curious about whether a friend of his at the LazyBoy chair rm in Monroe had to do the same thing, and would 3M require the same type of form from his daughter, who now worked for them? Frankly, he didnt feel he personally had learned much about his situation from the exercise and was already wondering whether there werent better ways for him to go about reassuring the bank that their loan was a good proposition.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started