Please refer to data table and requirements for your answer as necessary.

Right click on image and open image in new tab if text is too blurry or not clear.

Please type out your answer or use Excel as it is easier to read than handwriting.

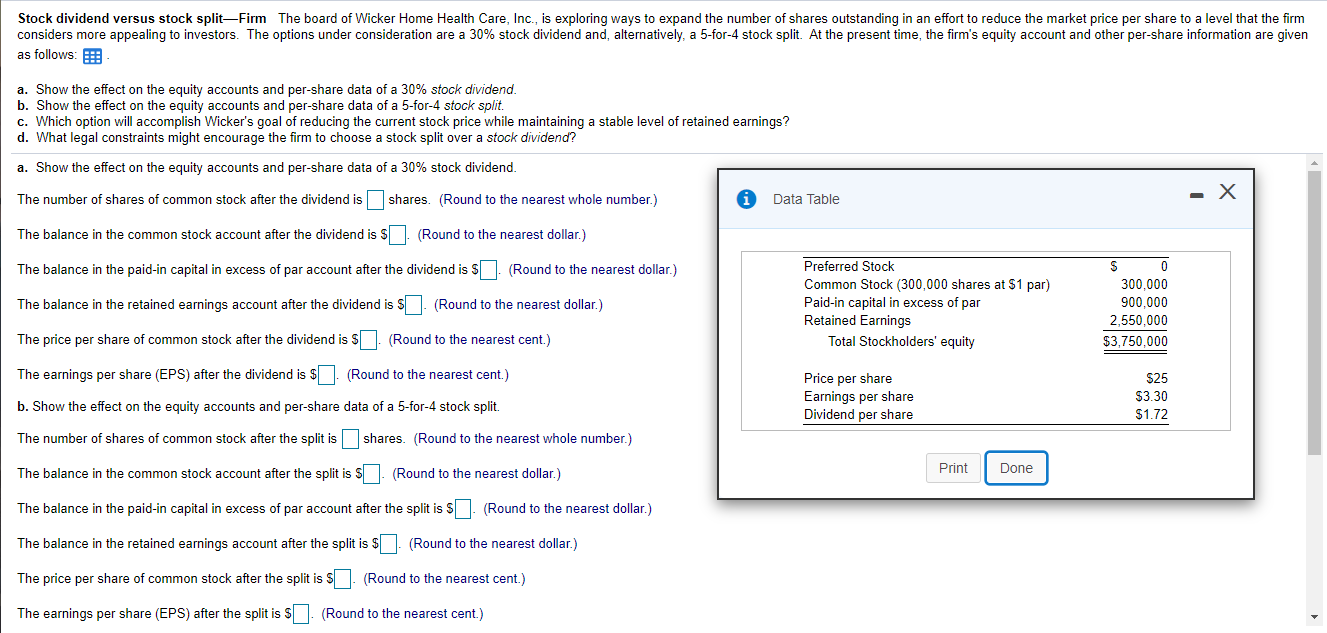

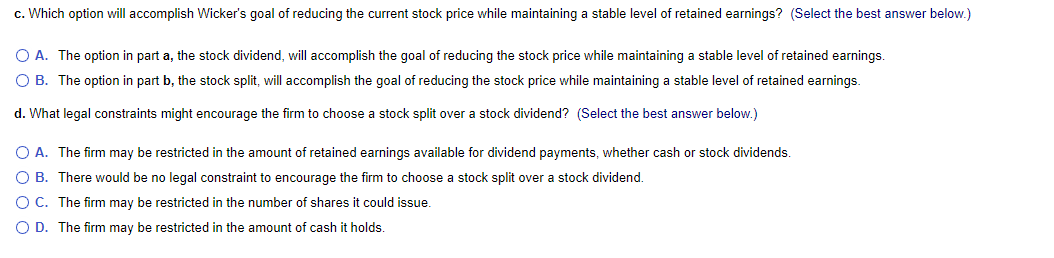

Stock dividend versus stock splitFirm The board of Wicker Home Health Care, Inc., is exploring ways to expand the number of shares outstanding in an effort to reduce the market price per share to a level that the firm considers more appealing to investors. The options under consideration are a 30% stock dividend and, alternatively, a 5-for-4 stock split. At the present time, the firm's equity account and other per-share information are given as follows: a. Show the effect on the equity accounts and per-share data of a 30% stock dividend. b. Show the effect on the equity accounts and per-share data of a 5-for-4 stock split. c. Which option will accomplish Wicker's goal of reducing the current stock price while maintaining a stable level of retained earnings? d. What legal constraints might encourage the firm to choose a stock split over a stock dividend? a. Show the effect on the equity accounts and per-share data of a 30% stock dividend. The number of shares of common stock after the dividend is shares. (Round to the nearest whole number.) Data Table The balance in the common stock account after the dividend is $. (Round to the nearest dollar.) The balance in the paid-in capital in excess of par account after the dividend is $. (Round to the nearest dollar.) The balance in the retained earnings account after the dividend is s (Round to the nearest dollar.) Preferred Stock Common Stock (300,000 shares at $1 par) Paid-in capital in excess of par Retained Earnings Total Stockholders' equity S 0 300.000 900,000 2,550,000 $3,750,000 The price per share of common stock after the dividend is $. (Round to the nearest cent.) The earnings per share (EPS) after the dividend is $. (Round to the nearest cent.) b. Show the effect on the equity accounts and per-share data of a 5-for-4 stock split. Price per share Earnings per share Dividend per share $25 $3.30 $1.72 The number of shares of common stock after the split is shares. (Round to the nearest whole number.) The balance in the common stock account after the split is $. (Round to the nearest dollar.) Print Done The balance in the paid-in capital in excess of par account after the split is $. (Round to the nearest dollar.) The balance in the retained earnings account after the split is $. (Round to the nearest dollar.) The price per share of common stock after the split is $. (Round to the nearest cent.) The earnings per share (EPS) after the split is $. (Round to the nearest cent.) c. Which option will accomplish Wicker's goal of reducing the current stock price while maintaining a stable level of retained earnings? (Select the best answer below.) O A. The option in part a, the stock dividend, will accomplish the goal of reducing the stock price while maintaining a stable level of retained earnings. O B. The option in part b, the stock split, will accomplish the goal of reducing the stock price while maintaining a stable level of retained earnings d. What legal constraints might encourage the firm to choose a stock split over a stock dividend? (Select the best answer below.) O A. The firm may be restricted in the amount of retained earnings available for dividend payments, whether cash or stock dividends. O B. There would be no legal constraint to encourage the firm to choose a stock split over a stock dividend. O C. The firm may be restricted in the number of shares it could issue. OD. The firm may be restricted in the amount of cash it holds