Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please refer to data table and requirements for your answer as necessary. Right click on image and open image in new tab if text is

Please refer to data table and requirements for your answer as necessary.

Right click on image and open image in new tab if text is too blurry or not clear.

Please type out your answer or use Excel as it is easier to read than handwriting.

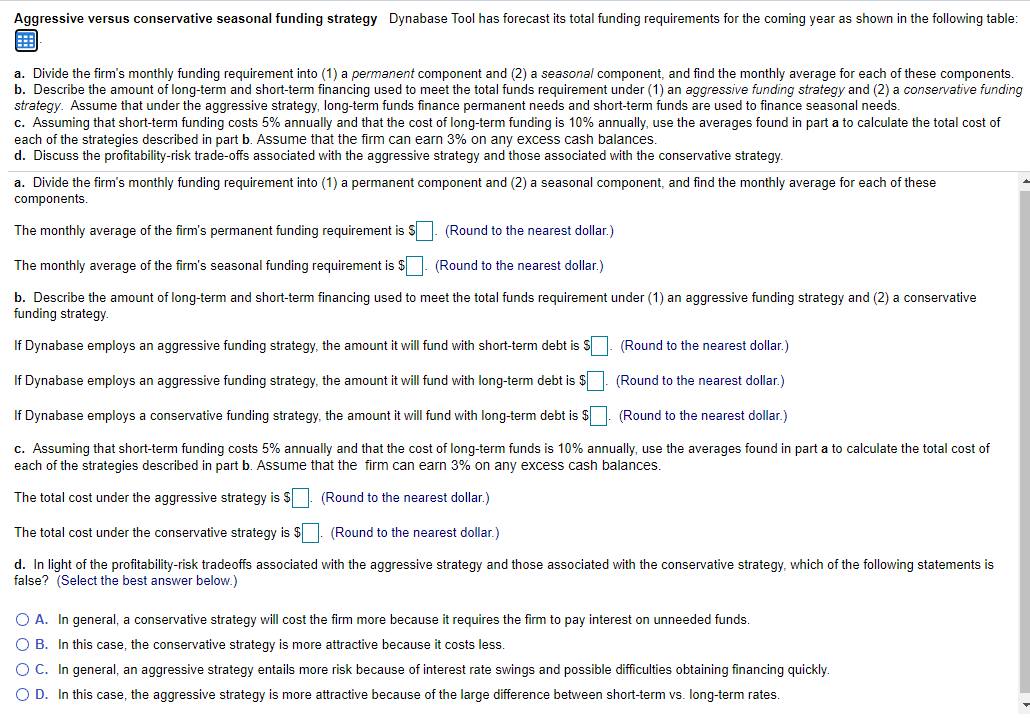

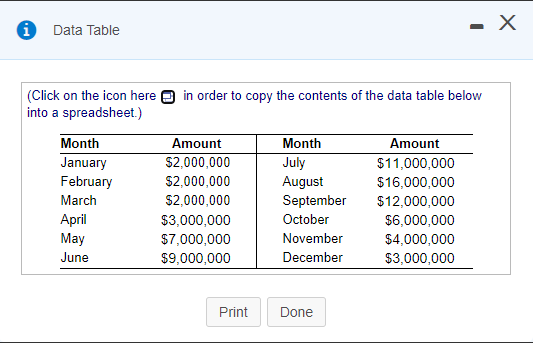

Aggressive versus conservative seasonal funding strategy Dynabase Tool has forecast its total funding requirements for the coming year as shown in the following table: a. Divide the firm's monthly funding requirement into (1) a permanent component and (2) a seasonal component, and find the monthly average for each of these components b. Describe the amount of long-term and short-term financing used to meet the total funds requirement under (1) an aggressive funding strategy and (2) a conservative funding strategy. Assume that under the aggressive strategy, long-term funds finance permanent needs and short-term funds are used to finance seasonal needs. C. Assuming that short-term funding costs 5% annually and that the cost of long-term funding is 10% annually, use the averages found in part a to calculate the total cost of each of the strategies described in part b. Assume that the firm can earn 3% on any excess cash balances. d. Discuss the profitability-risk trade-offs associated with the aggressive strategy and those associated with the conservative strategy. a. Divide the firm's monthly funding requirement into (1) a permanent component and (2) a seasonal component, and find the monthly average for each of these components. The monthly average of the firm's permanent funding requirement is $. (Round to the nearest dollar.) The monthly average of the firm's seasonal funding requirement is $. (Round to the nearest dollar.) b. Describe the amount of long-term and short-term financing used to meet the total funds requirement under (1) an aggressive funding strategy and (2) a conservative funding strategy If Dynabase employs an aggressive funding strategy, the amount it will fund with short-term debt is $ (Round to the nearest dollar.) If Dynabase employs an aggressive funding strategy, the amount it will fund with long-term debt is $. (Round to the nearest dollar.) If Dynabase employs a conservative funding strategy, the amount it will fund with long-term debt is $. (Round to the nearest dollar.) c. Assuming that short-term funding costs 5% annually and that the cost of long-term funds is 10% annually, use the averages found in part a to calculate the total cost of each of the strategies described in part b. Assume that the firm can earn 3% on any excess cash balances. The total cost under the aggressive strategy is $. (Round to the nearest dollar.) The total cost under the conservative strategy is $ . (Round to the nearest dollar.) d. In light of the profitability-risk tradeoffs associated with the aggressive strategy and those associated with the conservative strategy, which of the following statements is false? (Select the best answer below.) O A. In general, a conservative strategy will cost the firm more because it requires the firm to pay interest on unneeded funds. O B. In this case, the conservative strategy is more attractive because it costs less. O C. In general, an aggressive strategy entails more risk because of interest rate swings and possible difficulties obtaining financing quickly. OD. In this case, the aggressive strategy is more attractive because of the large difference between short-term vs. long-term rates. - X Data Table (Click on the icon here into a spreadsheet.) in order to copy the contents of the data table below Month January February March April May June Amount $2,000,000 $2,000,000 $2,000,000 $3,000,000 $7,000,000 $9,000,000 Month July August September October November December Amount $11,000,000 $16,000,000 $12,000,000 $6,000,000 $4,000,000 $3,000,000 Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started