Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please refer to NATURE BROS. LTD. Case Study #13 on page 533 of the textbook and answer the following questions: : 1. Summarize the

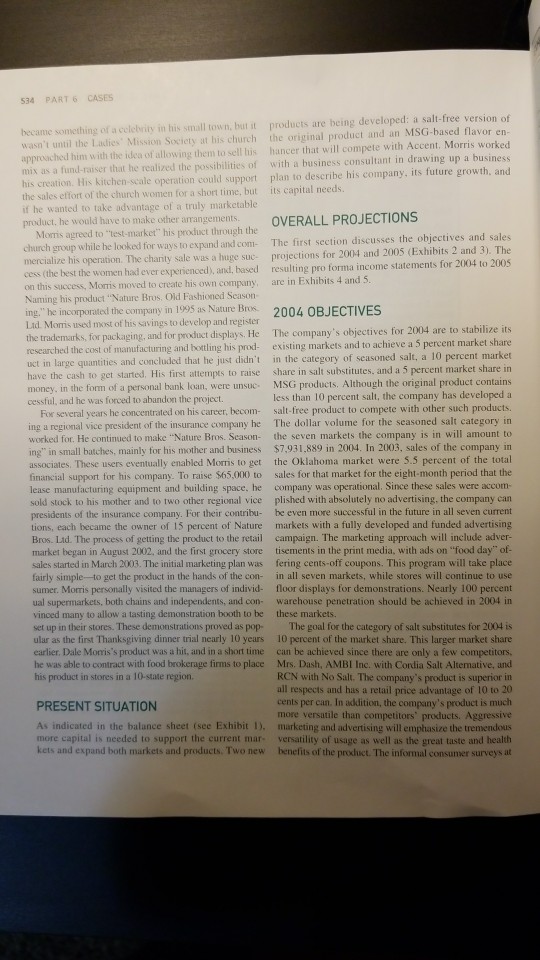

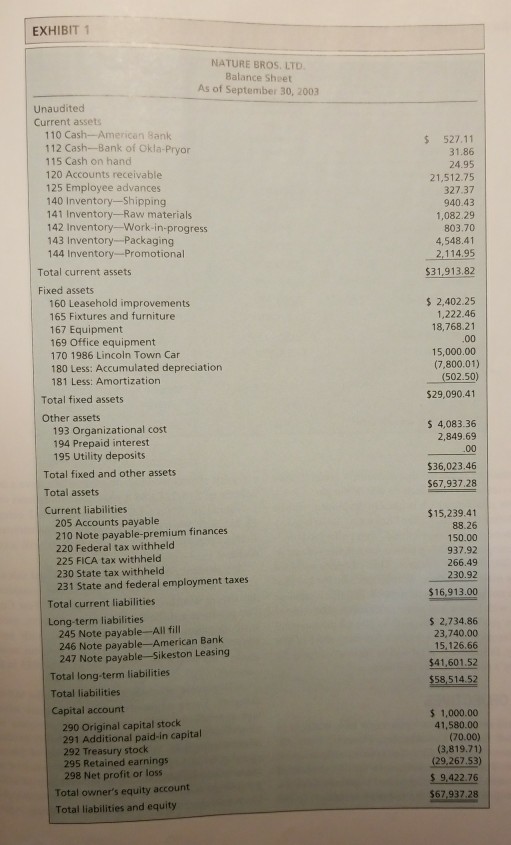

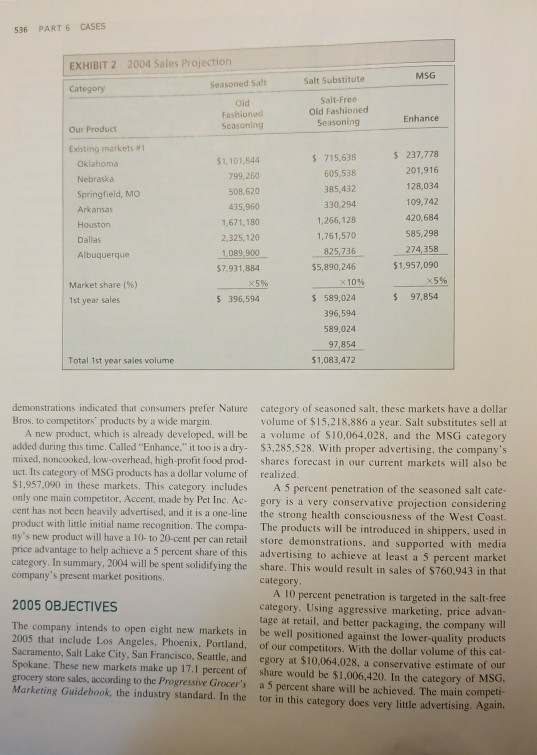

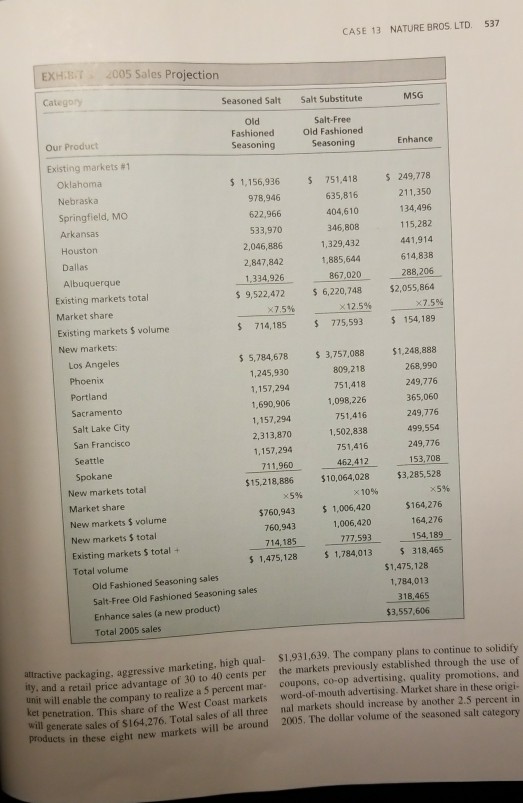

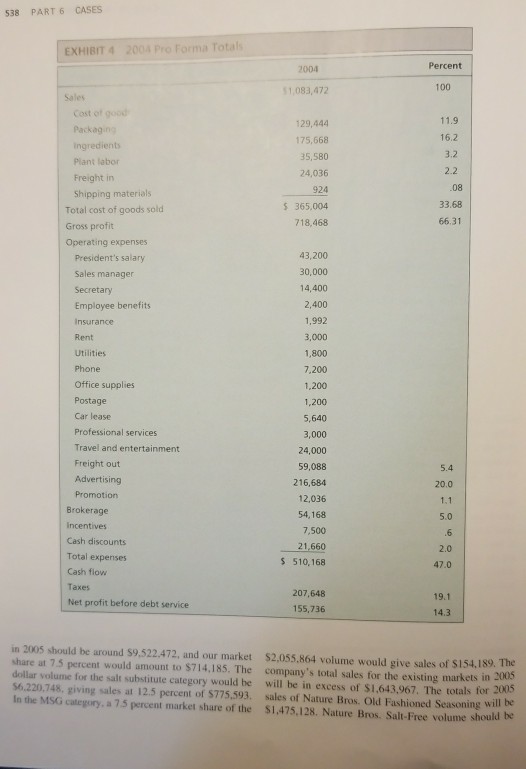

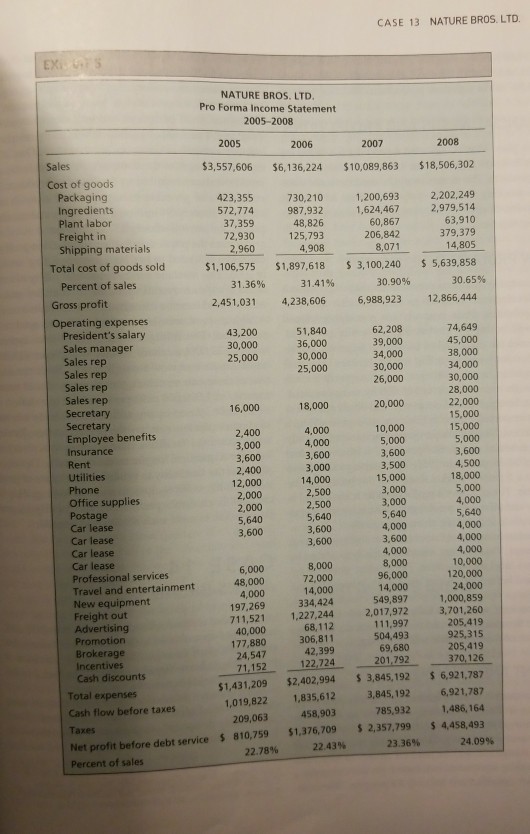

Please refer to "NATURE BROS. LTD." Case Study #13 on page 533 of the textbook and answer the following questions: : 1. Summarize the information presented regarding the present and proposed products. Briefly describe the company's 2004 and 2005 objectives. 2. After reviewing this material, make a list of additional information which should be supplied to support the sales projections. 3. Comment on objectives: Are they reasonable, optimistic, or conservative? What marketing mix would best support this growth rate? 4. Evaluate the information supplied regarding a new product development and physical assets in light of the pro forma income statements Morris developed. 5. Is the capital sought appropriate for the circumstances? If more information is needed, state what it is and how it could be obtained. 6. What sources should Morris approach for this amount of capital? 7. Based on the current balance sheet, how much equity should he give up for the investment? CASE 13 NATURE BROS. LTD. BACKGROUND Thanksgiving Day 1993 is the day that Dale Morris re- members as the "public debut" of his creation, a new seasoned salt mix. Although he was a salesman by tem- perament and career, his hobby was cooking. Having experimented with both traditional home cooking and more exotic gourmet cooking, Morris had developed an appreciation for many herbs and spices. He had also done a lot of reading about the health hazards of the typ- ical American diet. When his mother learned that she had high blood pressure, Morris decided it was time for some action. He created a low-salt seasoning mix, based on a nutritive yeast extract, that could be used to replace salt in most cases. This Thanksgiving dinner, prepared for 25 family members and friends, would be his final testing ground. He used his mix in all the recipes except the pumpkin pie everything from the turkey and dress- ing to the vegetables and even the rolls. As the meal pro- gressed, the verdict was unanimously in favor of his se- cret ingredient, although he had a hard time convincing them that it was his invention and was only 10 percent salt. Everyone wanted a sample to try at home. Over the next two years, Morris perfected his product. Experiments in new uses led to "tasting parties" for friends and neighbors, and the holiday season found the Morris kitchen transformed into a miniature assembly line producing gift-wrapped bottles of the mix. Morris Source: This case was modified by Sergey Anokhin of the Weather- head School of Management, Case Western Reserve University, as a basis for classroom discussion rather than to illustrate either effective or ineffective handling of an administrative situation. The name of the company and the names of its officers have been disguised. Sup- port for the development of this case was provided by the Centre for International Business Studies, University of Manitoba, Canada. *Market size estimates are based on two decades of average growth rate for the human nutrition salt market, with some corrections to reflect the growing share of salt substitutes in total consumption of salt-like substances. 534 PART 6 CASES became something of a celebrity in his small town, but it wasn't until the Ladies' Mission Society at his church approached him with the idea of allowing them to sell his mix as a fund-raiser that he realized the possibilities of his creation. His kitchen-scale operation could support the sales effort of the church women for a short time, but if he wanted to take advantage of a truly marketable product, he would have to make other arrangements. Morris agreed to "test-market" his product through the church group while he looked for ways to expand and com- mercialize his operation. The charity sale was a huge suc- cess (the best the women had ever experienced), and, based on this success, Morris moved to create his own company, Naming his product "Nature Bros. Old Fashioned Season- ing," he incorporated the company in 1995 as Nature Bros. Lid. Morris used most of his savings to develop and register the trademarks, for packaging, and for product displays. He researched the cost of manufacturing and bottling his prod- uct in large quantities and concluded that he just didn't have the cash to get started. His first attempts to raise money, in the form of a personal bank loan, were unsuc- cessful, and he was forced to abandon the project. For several years he concentrated on his career, becom- ing a regional vice president of the insurance company he worked for. He continued to make "Nature Bros. Season- ing" in small batches, mainly for his mother and business. associates. These users eventually enabled Morris to get financial support for his company. To raise $65,000 to lease manufacturing equipment and building space, he sold stock to his mother and to two other regional vice presidents of the insurance company. For their contribu- tions, each became the owner of 15 percent of Nature Bros. Ltd. The process of getting the product to the retail market began in August 2002, and the first grocery store sales started in March 2003. The initial marketing plan was fairly simple-to get the product in the hands of the con- sumer. Morris personally visited the managers of individ- ual supermarkets, both chains and independents, and con- vinced many to allow a tasting demonstration booth to be set up in their stores. These demonstrations proved as pop- ular as the first Thanksgiving dinner trial nearly 10 years earlier. Dale Morris's product was a hit, and in a short time he was able to contract with food brokerage firms to place his product in stores in a 10-state region. products are being developed: a salt-free version of the original product and an MSG-based flavor en- hancer that will compete with Accent. Morris worked with a business consultant in drawing up a business plan to describe his company, its future growth, and its capital needs. PRESENT SITUATION As indicated in the balance sheet (see Exhibit 1), more capital is needed to support the current mar- kets and expand both markets and products. Two new OVERALL PROJECTIONS The first section discusses the objectives and sales projections for 2004 and 2005 (Exhibits 2 and 3). The resulting pro forma income statements for 2004 to 2005 are in Exhibits 4 and 5. 2004 OBJECTIVES The company's objectives for 2004 are to stabilize its existing markets and to achieve a 5 percent market share in the category of seasoned salt, a 10 percent market share in salt substitutes, and a 5 percent market share in MSG products. Although the original product contains less than 10 percent salt, the company has developed a salt-free product to compete with other such products. The dollar volume for the seasoned salt category in the seven markets the company is in will amount to $7,931,889 in 2004. In 2003, sales of the company in the Oklahoma market were 5.5 percent of the total sales for that market for the eight-month period that the company was operational. Since these sales were accom- plished with absolutely no advertising, the company can be even more successful in the future in all seven current markets with a fully developed and funded advertising campaign. The marketing approach will include adver- tisements in the print media, with ads on "food day" of- fering cents-off coupons. This program will take place in all seven markets, while stores will continue to use floor displays for demonstrations. Nearly 100 percent warehouse penetration should be achieved in 2004 in these markets. The goal for the category of salt substitutes for 2004 is 10 percent of the market share. This larger market share can be achieved since there are only a few competitors, Mrs. Dash, AMBI Inc. with Cordia Salt Alternative, and RCN with No Salt. The company's product is superior in all respects and has a retail price advantage of 10 to 20 cents per can. In addition, the company's product is much more versatile than competitors' products. Aggressive marketing and advertising will emphasize the tremendous versatility of usage as well as the great taste and health benefits of the product. The informal consumer surveys at EXHIBIT 1 Unaudited. Current assets 110 Cash-American Bank 112 Cash-Bank of Okla-Pryor 115 Cash on hand NATURE BROS. LTD. Balance Sheet As of September 30, 2003 120 Accounts receivable 125 Employee advances 140 Inventory-Shipping 141 Inventory-Raw materials 142 Inventory-Work-in-progress 143 Inventory-Packaging 144 Inventory-Promotional Total current assets. Fixed assets 160 Leasehold improvements 165 Fixtures and furniture 167 Equipment 169 Office equipment 170 1986 Lincoln Town Car 180 Less: Accumulated depreciation. 181 Less: Amortization Total fixed assets Other assets 193 Organizational cost 194 Prepaid interest 195 Utility deposits Total fixed and other assets Total assets Current liabilities 205 Accounts payable 210 Note payable-premium finances 220 Federal tax withheld 225 FICA tax withheld 230 State tax withheld 231 State and federal employment taxes Total current liabilities Long-term liabilities 245 Note payable-All fill 246 Note payable-American Bank 247 Note payable-Sikeston Leasing Total long-term liabilities Total liabilities Capital account 290 Original capital stock 291 Additional paid-in capital 292 Treasury stock 295 Retained earnings 298 Net profit or loss. Total owner's equity account Total liabilities and equity $ 527.11 31.86 24.95 21,512.75 327.37 940.43 1,082.29 803.70 4,548.41 2,114.95 $31,913.82 $ 2,402.25 1,222.46 18,768.21 .00 15,000.00 (7,800.01) (502.50) $29,090.41 $ 4,083.36 2,849.69 .00 $36,023.46 $67,937.28 $15,239.41 88.26 150.00 937.92 266.49 230.92 $16,913.00 $ 2,734.86 23,740.00 15,126.66 $41,601.52 $58,514.52 $1,000.00 41,580.00 (70.00) (3,819.71) (29,267.53) $ 9,422.76 $67,937.28 536 PART 6 CASES EXHIBIT 2 2004 Sales Projection Category Our Product Existing markets #1 Oklahoma Nebraska Springfield, MO Arkansas Houston Dallas, Albuquerque Market share (%) 1st year sales Total 1st year sales volume Seasoned Salt Old Fashioned Seasoning $1,101,844 799,260 508,620 435,960 1,671,180 2,325,120 1,089,900 $7,931,884 X5% $ 396,594 demonstrations indicated that consumers prefer Nature Bros. to competitors' products by a wide margin. A new product, which is already developed, will be added during this time. Called "Enhance," it too is a dry- mixed, noncooked, low-overhead, high-profit food prod- uct. Its category of MSG products has a dollar volume of $1,957,090 in these markets. This category includes only one main competitor, Accent, made by Pet Inc. Ac- cent has not been heavily advertised, and it is a one-line product with little initial name recognition. The compa- ny's new product will have a 10- to 20-cent per can retail price advantage to help achieve a 5 percent share of this category. In summary, 2004 will be spent solidifying the company's present market positions. 2005 OBJECTIVES The company intends to open eight new markets in 2005 that include Los Angeles, Phoenix, Portland, Sacramento, Salt Lake City, San Francisco, Seattle, and Spokane. These new markets make up 17.1 percent of grocery store sales, according to the Progressive Grocer's Marketing Guidebook, the industry standard. In the Salt Substitute Salt-Free Old Fashioned Seasoning $ 715,638 605,538 385,432 330,294 1,266,128 1,761,570 825,736 $5,890,246. x 10% $ 589,024 396,594 589,024 97,854 $1,083,472 MSG $ Enhance $ 237,778 201,916 128,034 109,742 420,684 585,298 274,358 $1,957,090 x5% 97,854 category of seasoned salt, these markets have a dollar volume of $15,218,886 a year. Salt substitutes sell at a volume of $10,064,028, and the MSG category $3,285,528. With proper advertising, the company's shares forecast in our current markets will also be realized. A 5 percent penetration of the seasoned salt cate- gory is a very conservative projection considering the strong health consciousness of the West Coast. The products will be introduced in shippers, used in store demonstrations, and supported with media advertising to achieve at least a 5 percent market share. This would result in sales of $760,943 in that category. A 10 percent penetration is targeted in the salt-free category. Using aggressive marketing, price advan- tage at retail, and better packaging, the company will be well positioned against the lower-quality products of our competitors. With the dollar volume of this cat- egory at $10,064,028, a conservative estimate of our share would be $1,006,420. In the category of MSG, a 5 percent share will be achieved. The main competi- tor in this category does very little advertising. Again. EXHIBIT Category 2005 Sales Projection Our Product Existing markets #1 Oklahoma Nebraska Springfield, MO Arkansas Houston Dallas Albuquerque Existing markets total Market share Existing markets $ volume New markets: Los Angeles Phoenix Portland Sacramento Salt Lake City San Francisco Seattle Spokane New markets total Market share New markets $ volume New markets $ total Existing markets $ total + Total volume Seasoned Salt Old Fashioned Seasoning. $ 1,156,936 978,946 622,966 533,970 2,046,886 2,847,842 1,334,926 $ 9,522,472 $ 714,185 x7.5% $ 5,784,678 1,245,930 1,157,294 1,690,906 1,157,294 2,313,870 1,157,294 711,960 $15,218,886 Old Fashioned Seasoning sales Salt-Free Old Fashioned Seasoning sales Enhance sales (a new product) Total 2005 sales $760,943 760,943 714,185 $ 1,475,128 attractive packaging, aggressive marketing, high qual- ity, and a retail price advantage of 30 to 40 cents per unit will enable the company to realize a 5 percent mar- ket penetration. This share of the West Coast markets will generate sales of $164.276. Total sales of all three products in these eight new markets will be around x5% Salt Substitute Salt-Free Old Fashioned Seasoning CASE 13 NATURE BROS. LTD. S 751,418 635,816 404,610 346,808 1,329,432 1,885,644 867,020 $ 6,220,748 x12.5% $ 775,593 $ 3,757,088 809,218 751,418 1,098,226 751,416 1,502,838 751,416 462,412 $10,064,028 X 10% $ 1,006,420 1,006,420 777,593 $ 1,784,013 MSG Enhance $ 249,778 211,350 134,496 115,282 441,914 614,838 288,206 $2,055,864 x7.5% $ 154,189 $1,248,888 268,990 249,776 365,060 249,776 499,554 249,776 153,708 $3,285,528 x5% $164,276 164,276 154,189 $ 318,465. $1,475,128 1,784,013 318,465 $3,557,606 537 the markets previously established through the use of $1,931,639. The company plans to continue to solidify coupons, co-op advertising, quality promotions, and word-of-mouth advertising. Market share in these origi- nal markets should increase by another 2.5 percent in 2005. The dollar volume of the seasoned salt category 538 PART 6 CASES EXHIBIT 4 2004 Pro Forma Totals Sales Cost of good Packaging Ingredients Plant labor Freight in Shipping materials Total cost of goods sold Gross profit Operating expenses President's salary Sales manager Secretary Employee benefits Insurance Rent Utilities Phone Office supplies Postage Car lease Professional services Travel and entertainment Freight out Advertising Promotion: Brokerage Incentives Cash discounts Total expenses Cash flow Taxes Net profit before debt service in 2005 should be around $9,522,472, and our market share at 7.5 percent would amount to $714.185. The dollar volume for the salt substitute category would be $6.220,748, giving sales at 12.5 percent of $775,593. In the MSG category, a 7.5 percent market share of the 2004 $1,083,472 129,444 175,668 35,580 24,036 924 $365,004 718,468 43,200 30,000 14,400 2,400 1,992 3,000 1,800 7,200 1,200 1,200 5,640 3,000 24,000 59,088 216,684 12,036 54,168 7,500 21,660 $ 510,168 207,648 155,736 Percent 100 11.9 16.2 3.2 2.2 .08 33.68 66.31 5.4 20.0 1.1 5.0 .6 2.0 47.0 19.1 14.3 $2,055,864 volume would give sales of $154,189. The company's total sales for the existing markets in 2005 will be in excess of $1,643,967. The totals for 2005 $1,475,128. Nature Bros. Salt-Free volume should be sales of Nature Bros. Old Fashioned Seasoning will be EX S Sales Cost of goods Packaging Ingredients Plant labor Freight in Shipping materials. Total cost of goods sold Percent of sales Gross profit Operating expenses President's salary Sales manager Sales rep Sales rep Sales rep Sales rep Secretary Secretary Employee benefits Insurance Rent Utilities Phone Office supplies Postage Car lease Car lease Car lease Car lease Professional services. Travel and entertainment New equipment Freight out Advertising Promotion Brokerage Incentives Cash discounts NATURE BROS. LTD. Pro Forma Income Statement 2005-2008 Total expenses Cash flow before taxes 2005 $3,557,606 423,355 572,774 37,359 72,930 2,960 $1,106,575 31.36% 2,451,031 43,200 30,000 25,000 16,000 2,400 3,000 3,600 2,400 12,000 2,000 2,000 5,640 3,600 40,000 177,880 2006 $6,136,224 24,547 71,152 $1,431,209 1,019,822 Taxes 209,063 Net profit before debt service $ 810,759 Percent of sales 22.78% 730,210 987,932 48,826 125,793 4,908 $1,897,618 31.41% 4,238,606 51,840 36,000 30,000 25,000 18,000 4,000 4,000 3,600 3,000 6,000 48,000 4,000 197,269 711,521 1,227,244 14,000 2,500 2,500 5,640 3,600 3,600 8,000 72,000 14,000 334,424 68,112 306,811 42,399 122,724 $2,402,994 1,835,612 458,903 $1,376,709 CASE 13 NATURE BROS. LTD. 2007 $10,089,863 22.43% 1,200,693 1,624,467 60,867 206,842 8,071 $ 3,100,240 30.90% 6,988,923 62,208 39,000 34,000 30,000 26,000 20,000 10,000 5,000 3,600 3,500 15,000 3,000 3,000 5,640 4,000 3,600 4,000 8,000 96,000 14,000 549,897 2,017,972 111,997 504,493 69,680 201,792 $ 3,845,192 3,845,192 785,932 $ 2,357,799 23.36% 2008 $18,506,302 2,202,249 2,979,514 63,910 379,379 14,805 $ 5,639,858 30.65% 12,866,444 74,649 45,000 38,000 34,000 30,000 28,000 22,000 15,000 15,000 5,000 3,600 4,500 18,000 5,000 4,000 5,640 4,000 4,000 4,000 10,000 120,000 24,000 1,000,859 3,701,260 205,419 925,315 205,419 370,126 $ 6,921,787 6,921,787 1,486,164 $ 4,458,493 24.09% 540 PART 6 CASES $1,784,013. The sales of Enhance, our MSG product, should be $318,465. This will give us a total sales volume of $3,557.606 for all three products in 2005. FINANCIAL NEEDS AND PROJECTIONS In this plan, Morris indicated a need for $100.000 eq- uity infusion to expand sales, increase markets, and add new products. The money would be used to secure ware- house stocking space, do cooperative print advertising, give point-of-purchase display allowances, and pay op- erating expenses. NEW PRODUCT DEVELOPMENT The company plans to continue an ongoing research. and development program to introduce new and win- ning products. Four products are already developed that will be highly marketable and easily produced. Personnel are dedicated to building a large and profit- able company and attracting quality brokers. The next new product targets a different market segment but can be brought online for about $25,000 by using our exist- ing machinery, types of containers, and display pieces. A highly respected broker felt that the product would be a big success. The broker previously represented the only major producer of a similar product, Pet Inc., which had sales of $4.36 million in 1985. The company can achieve at least a 5 percent market share with this product in the first year. The company's product will be at least equal in quality and offer a 17 percent price advantage to the con- sumer, while still making an excellent profit. Another new product would require slightly different equipment. This product would be initially produced by a private-label manufacturer. The product would be es- tablished before any major machinery was purchased. Many large companies use private-label manufacturers, or co-packers, as they are called in the trade. Consumer tests at demonstrations and food shows have indicated i that each of these products will be strong. pany has the capability of producing about 300,000 units a month with an additional $15,000 investment for an automatic conveyer system and a bigger prod- uct mixer. This production level would require two additional plant personnel, working one shift with no overtime. The company could double this production if needed with the addition of another shift. One of the main advantages of the company's business is the very small overhead required to produce the products. The company can generate enough product to reach sales of approximately $4 million a year while maintaining a production payroll of only $37,000 a year. To meet the previously outlined production goals, the company will need to purchase another filling machine in 2005. This machine will be capable of filling two cans at once with an overall speed of 75 cans per minute. which would increase capacity to 720,000 units a month. A higher-speed seaming machine will also need to be purchased. The filling machine would cost approxi- mately $22,000; a rebuilt seamer would cost $25,000, while a new one would cost $50,000. With the addi- tion of these two machines, the company would have a capacity of 1,020,000 units per month on one shift. By 2006, the company will have to decide whether to continue the lease or buy the property where located. and expand the facilities. The property has plenty of land for expansion for the next five years. The com- pany has the flexibility to produce other types of prod- ucts with the same equipment and can react quickly to changes in customer preferences and modify its pro- duction line to meet such demands as needed. PLANT AND EQUIPMENT The company's plant is located in a nearly new metal building in Rose. Oklahoma. The lease on the build- ing limits payments to no more than $300 per month for the next seven years. The new computer-controlled filling equipment will be paid off in two months, and the seaming equipment is leased from the company's container manufacturer for only $1 per year. The com- CASE 14 AMY'S BREAD Amy glanced at the clock and moaned. It was 3:30 A.M., time to get up and head to her Manhattan bakery, but she hadn't slept all night. She had a big decision to make. "No," she muttered to herself; she had a multi- tude of big decisions to make. Amy muttered to herself, "There are already so many days when I feel stretched past the breaking point. There are so many demands." Amy mentally ticked them off: Ensuring consistent quality, scheduling and training Source: This case study was reprinted by permission from the Case Research Journal. Copyright 2001 by Paula S. Weber. Cathleen S. Burns, James E. Weber, and the North American Case Research Association. All rights reserved.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started