Question

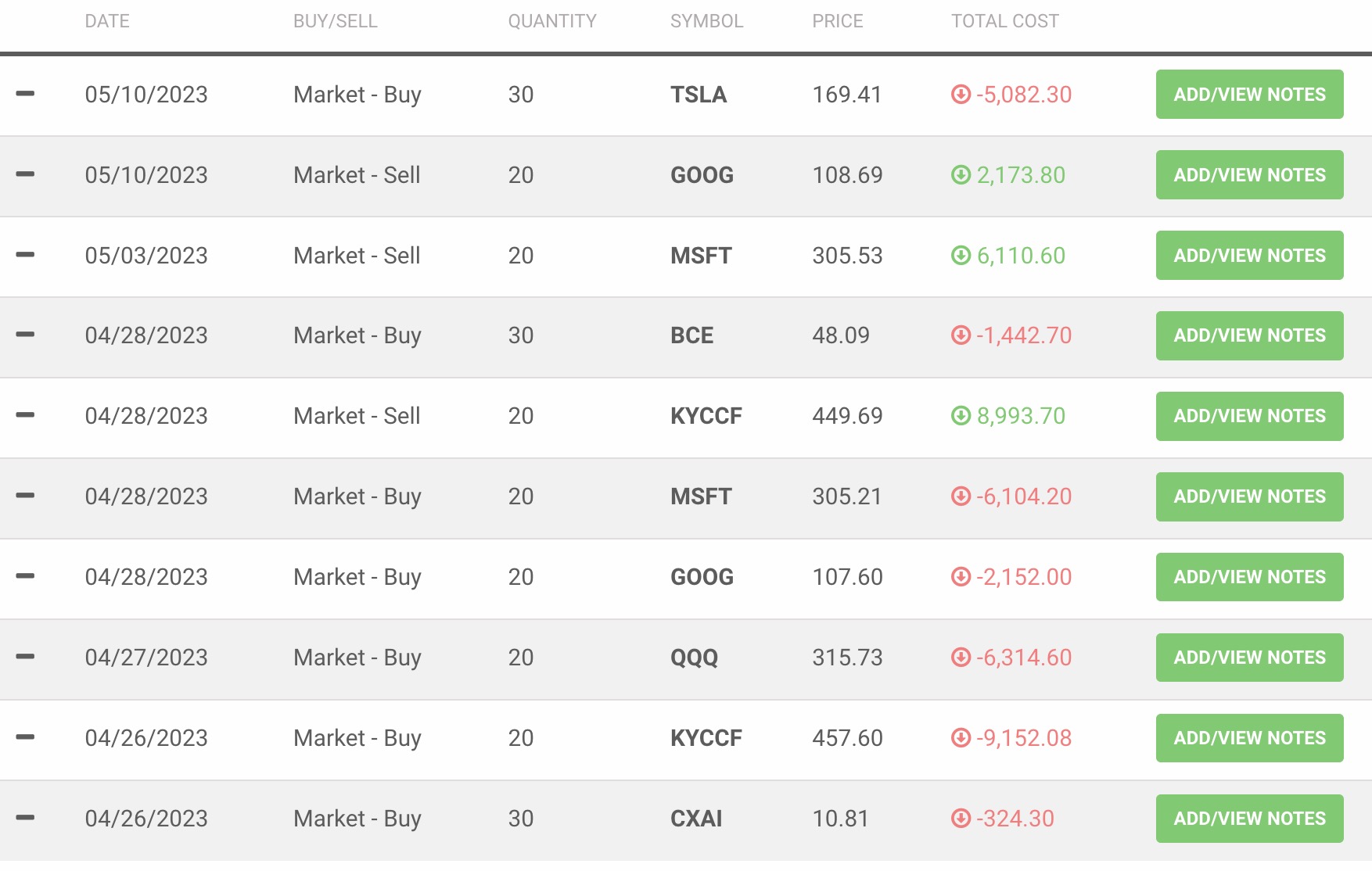

Please refer to the data I gave for account balance and transaction history and analyze the following 1. reviewing the portfolio you have built and

Please refer to the data I gave for account balance and transaction history and analyze the following

1. reviewing the portfolio you have built and traded in the last 5 weeks, what lessons have you learned?

3. weighing risk-reward for your portfolio;

4. a quantitative analysis of your portfolio gains/losses: (realized or unrealized) and how you realized realized gains/losses?

5. your summary and outlook for your portfolio investment strategy for the coming 4weeks.

6. If you were given another opportunity to build your portfolio, please pick two stocks and one ETF for your portfolio in the past 5 weeks.

Thank you

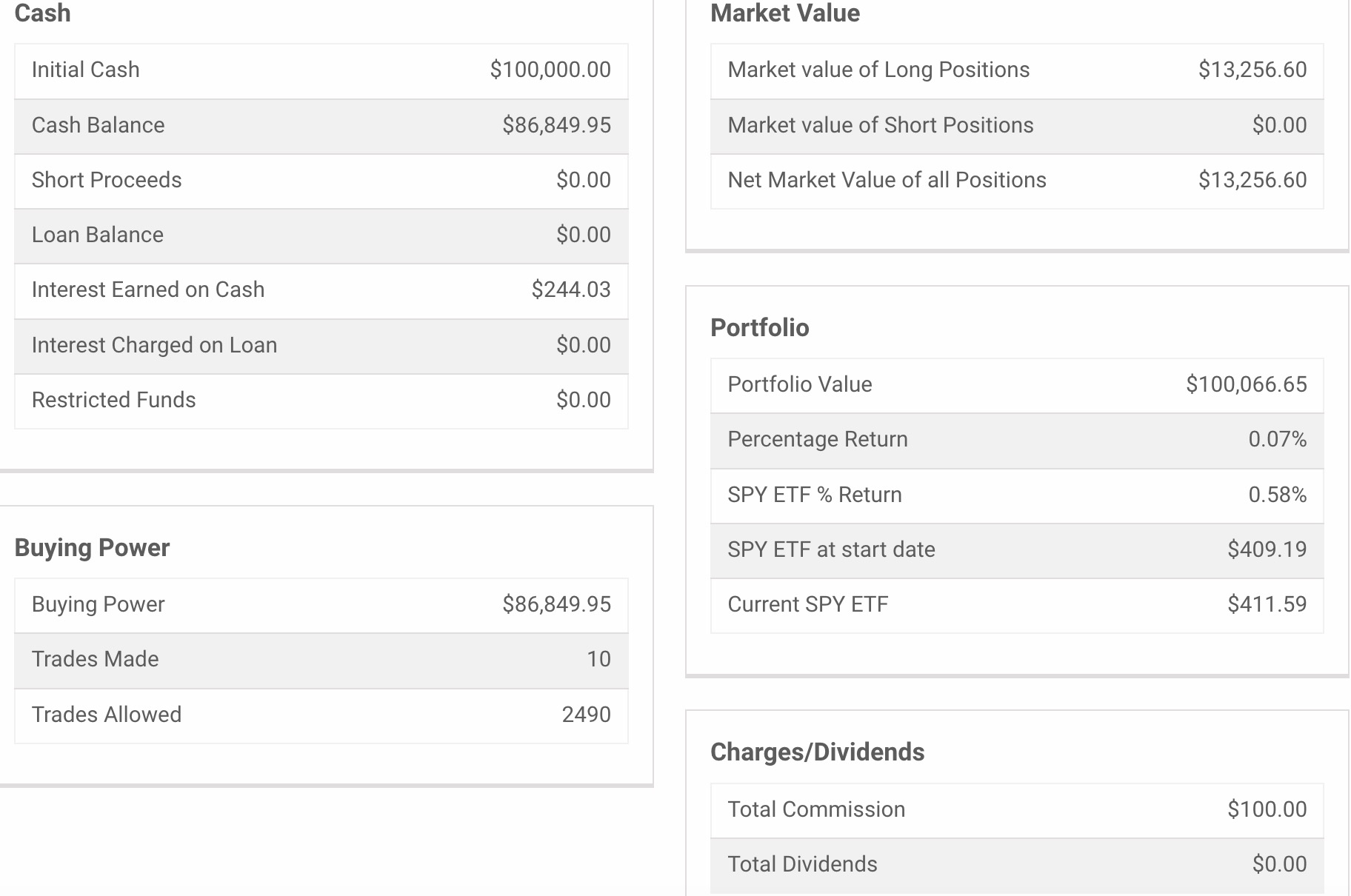

Cash \begin{tabular}{|lr|} \hline Initial Cash & $100,000.00 \\ \hline Cash Balance & $86,849.95 \\ \hline Short Proceeds & $0.00 \\ \hline Loan Balance & $0.00 \\ \hline Interest Earned on Cash & $044.03 \\ \hline Interest Charged on Loan & $0.00 \\ \hline Restricted Funds & $ \\ \hline \end{tabular} Buying Power \begin{tabular}{|lr|} \hline Buying Power & $86,849.95 \\ \hline Trades Made & 10 \\ \hline Trades Allowed & 2490 \\ \hline \end{tabular} Market Value \begin{tabular}{|lr|} \hline Market value of Long Positions & $13,256.60 \\ \hline Market value of Short Positions & $0.00 \\ \hline Net Market Value of all Positions & $13,256.60 \\ \hline \end{tabular} Portfolio \begin{tabular}{|lr|} \hline Portfolio Value & $100,066.65 \\ \hline Percentage Return & 0.07% \\ \hline SPY ETF \% Return & 0.58% \\ \hline SPY ETF at start date & $409.19 \\ \hline Current SPY ETF & $411.59 \\ \hline \end{tabular} Charges/Dividends \begin{tabular}{|lr|} \hline Total Commission & $100.00 \\ \hline Total Dividends & $0.00 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started