Answered step by step

Verified Expert Solution

Question

1 Approved Answer

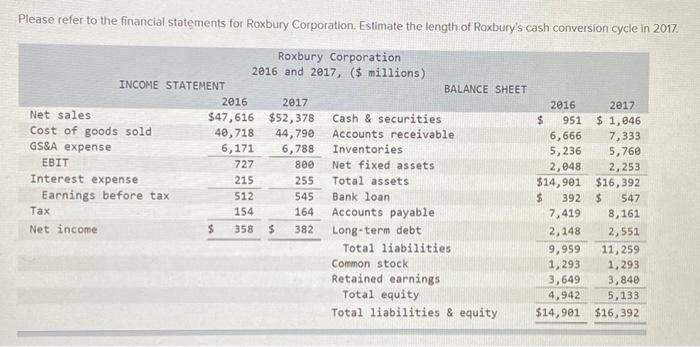

Please refer to the financial statements for Roxbury Corporation. Estimate the length of Roxbury's cash conversion cycle in 2017. INCOME STATEMENT Net sales Cost

Please refer to the financial statements for Roxbury Corporation. Estimate the length of Roxbury's cash conversion cycle in 2017. INCOME STATEMENT Net sales Cost of goods sold GS&A expense EBIT Interest expense Earnings before tax Tax Net income Roxbury Corporation 2016 and 2017, ($ millions) 2016 $47,616 40,718 6,171 727 215 $ 2017 $52,378 Cash & securities 44,790 Accounts receivable 6,788 Inventories 800 Net fixed assets 255 Total assets 545 Bank loan 164 382 512 154 358 $ BALANCE SHEET Accounts payable Long-term debt Total liabilities Common stock Retained earnings Total equity Total liabilities & equity $ 2016 2017 951 $ 1,046 6,666 5,236 2,048 $14,901 7,333 5,760 2,253 $16,392 $ 392 $ 547 7,419 8,161 2,148 2,551 9,959 1,293 3,649 4,942 5,133 $14,901 $16,392 11,259 1,293 3,840

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Cash Years inventory Year...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started