Please refer to the following images. Open them in a separate tab to get a larger picture.

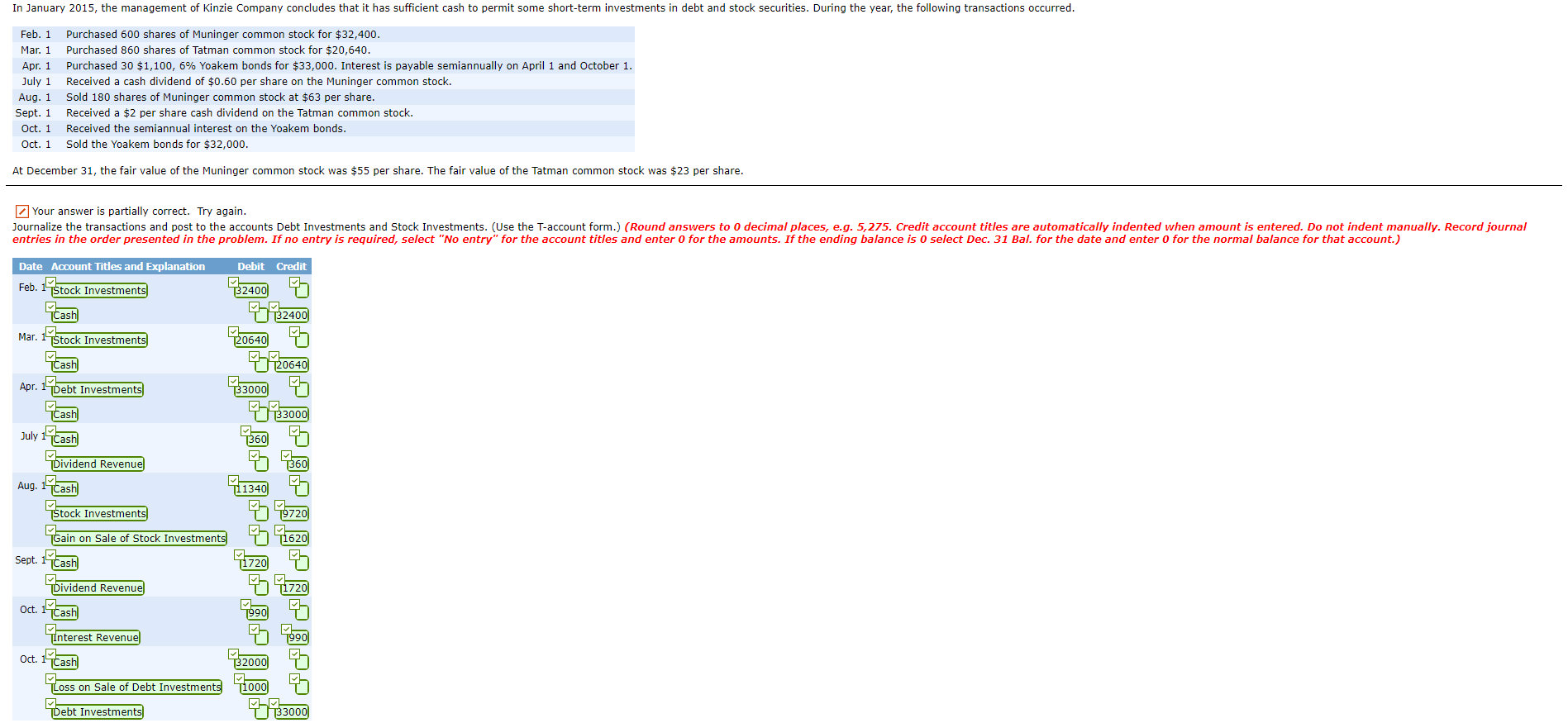

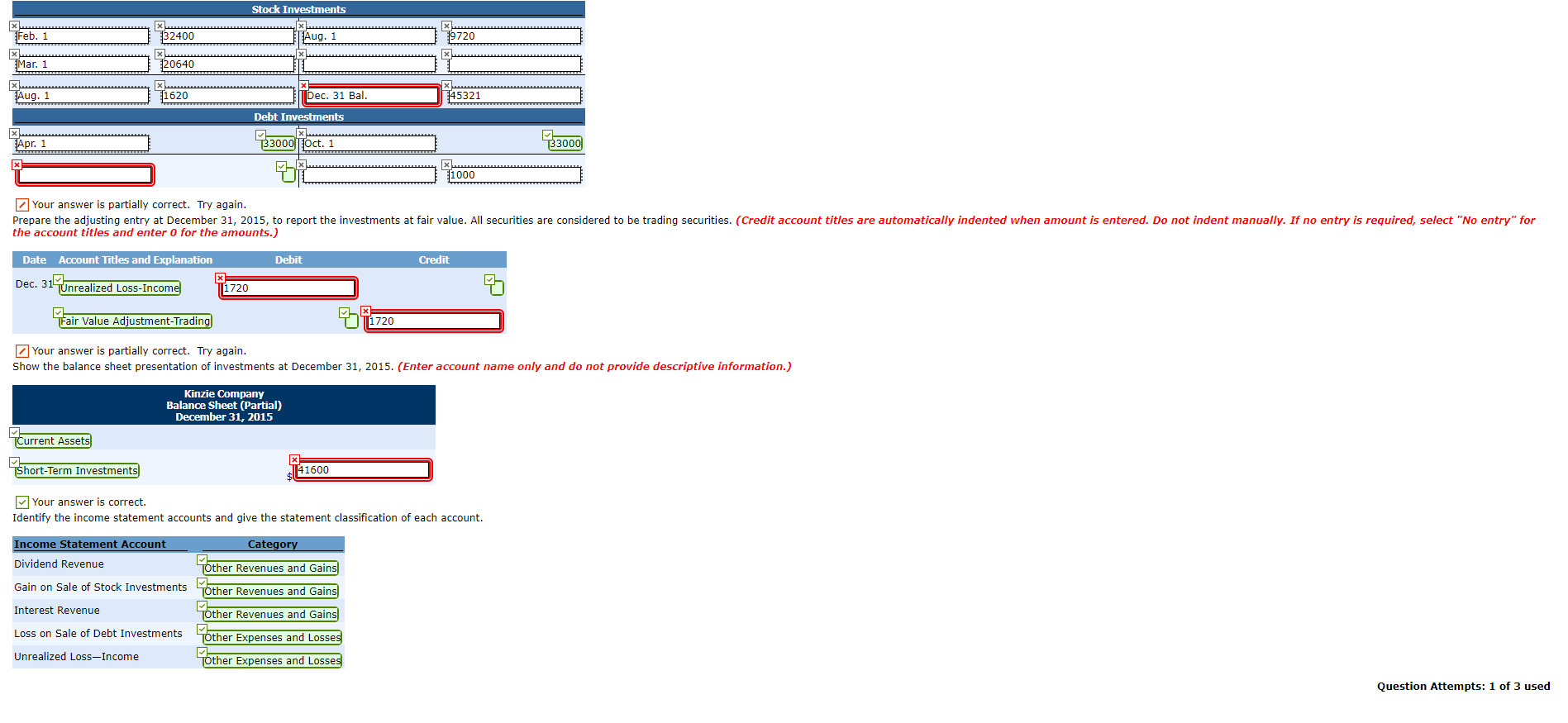

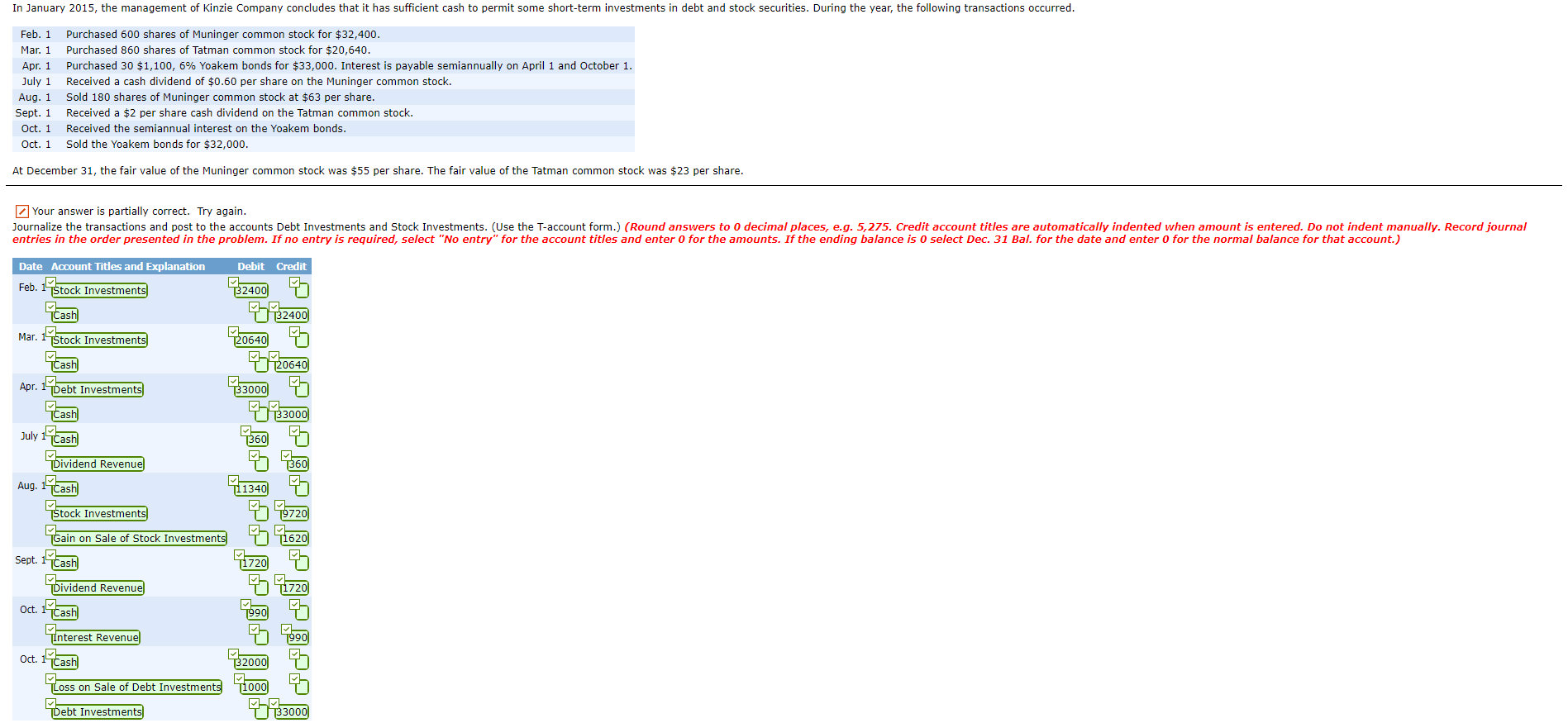

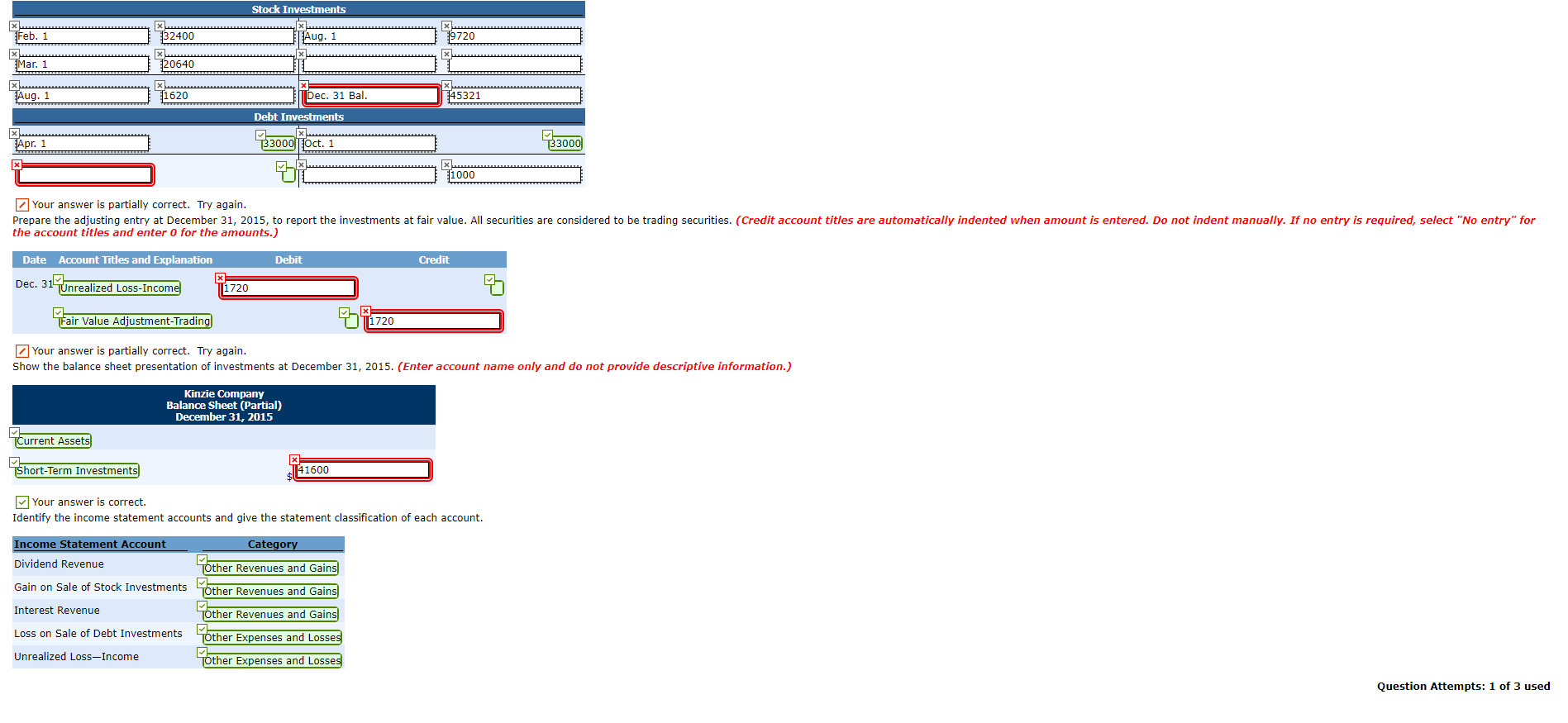

In January 2015, the management of Kinzie Company concludes that it has sufficient cash to permit some short-term investments in debt and stock securities. During the year, the following transactions occurred Feb. 1 Mar. 1 Apr. 1 July 1 Aug. 1 Sept. 1 Oct. 1 Oct. 1 Purchased 600 shares of Muninger common stock for $32,400 Purchased 860 shares of Tatman common stock for $20,640 Purchased 30 $1,100, 696 Yoakem bonds for $33,000. Interest is payable semiannually on April 1 and October 1 Received a cash dividend of $0.60 per share on the Muninger common stock. Sold 180 shares of Muninger common stock at $63 per share Received a $2 per share cash dividend on the Tatman common stock. Received the semiannual interest on the Yoakem bonds Sold the Yoakem bonds for $32,000 At December 31, the fair value of the Muninger common stock was $55 per share. The fair value of the Tatman common stock was $23 per share Your answer is partially correct. Try again Journalize the transactions and post to the accounts Debt Investments and Stock Investments. (Use the T-account form.) (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. If the ending balance is 0 select Dec. 31 Bal. for the date and enter 0 for the normal balance for that account.) Date Account Titles and Explanation Debit Credit tock Investments 2400 e2400 as Mar. 1 Stock Investments 064 as 064 33000 Apr. 1bebt Investmen as 3000 760 % July as te 2720 2720 720001 ?) ividend Revenue Aug as 1340 tock Investments ain on Sale of Stock Investment 620 Sept. 720 as ividend Revenue Oct as nterest Revenue Oct. as s?00 oss on Sale of Debt Investment ebt Investment 3000 In January 2015, the management of Kinzie Company concludes that it has sufficient cash to permit some short-term investments in debt and stock securities. During the year, the following transactions occurred Feb. 1 Mar. 1 Apr. 1 July 1 Aug. 1 Sept. 1 Oct. 1 Oct. 1 Purchased 600 shares of Muninger common stock for $32,400 Purchased 860 shares of Tatman common stock for $20,640 Purchased 30 $1,100, 696 Yoakem bonds for $33,000. Interest is payable semiannually on April 1 and October 1 Received a cash dividend of $0.60 per share on the Muninger common stock. Sold 180 shares of Muninger common stock at $63 per share Received a $2 per share cash dividend on the Tatman common stock. Received the semiannual interest on the Yoakem bonds Sold the Yoakem bonds for $32,000 At December 31, the fair value of the Muninger common stock was $55 per share. The fair value of the Tatman common stock was $23 per share Your answer is partially correct. Try again Journalize the transactions and post to the accounts Debt Investments and Stock Investments. (Use the T-account form.) (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. If the ending balance is 0 select Dec. 31 Bal. for the date and enter 0 for the normal balance for that account.) Date Account Titles and Explanation Debit Credit tock Investments 2400 e2400 as Mar. 1 Stock Investments 064 as 064 33000 Apr. 1bebt Investmen as 3000 760 % July as te 2720 2720 720001 ?) ividend Revenue Aug as 1340 tock Investments ain on Sale of Stock Investment 620 Sept. 720 as ividend Revenue Oct as nterest Revenue Oct. as s?00 oss on Sale of Debt Investment ebt Investment 3000