Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please refer to the picture attached 1. Given its forecast, how much long-term debt will the company have to issue in 2019? 2. How much

Please refer to the picture attached

1. Given its forecast, how much long-term debt will the company have to issue in 2019?

2. How much will be the total forecasted balance of Fixed Assets for 2019?

3. How much is the increase in total assets?

4. How much is the full capacity sales?

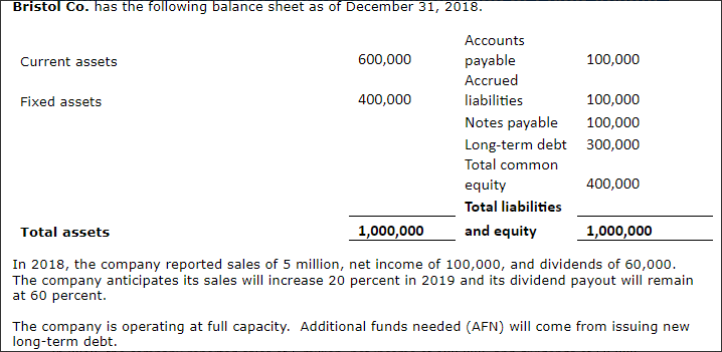

Bristol Co. has the following balance sheet as of December 31, 2018. Current assets Fixed assets Total assets Accounts 600,000 payable 100,000 Accrued 400,000 liabilities 100,000 Notes payable 100,000 Long-term debt 300,000 Total common equity 400,000 Total liabilities 1,000,000 and equity 1,000,000 In 2018, the company reported sales of 5 million, net income of 100,000, and dividends of 60,000. The company anticipates its sales will increase 20 percent in 2019 and its dividend payout will remain at 60 percent. The company is operating at full capacity. Additional funds needed (AFN) will come from issuing new long-term debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started