Answered step by step

Verified Expert Solution

Question

1 Approved Answer

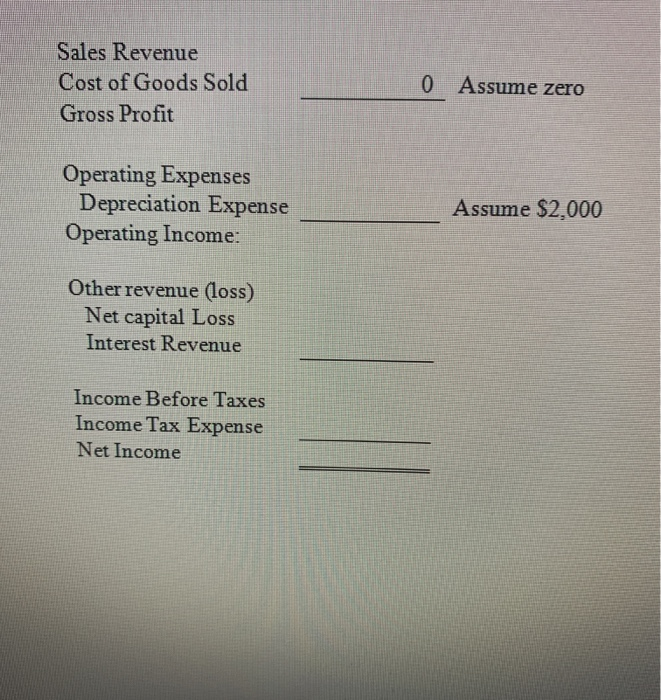

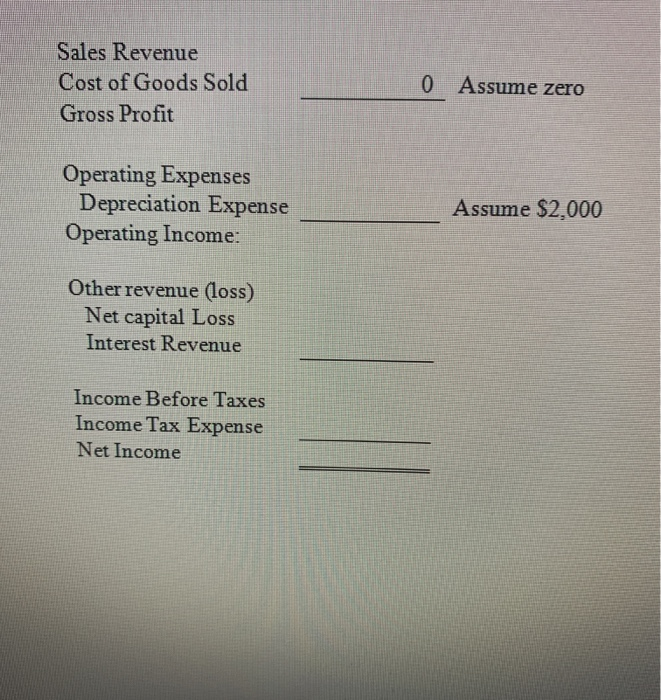

please refer to the question posted below. please prepare an income statement based on facts provided. there is a template provided of to formulate it.

please refer to the question posted below. please prepare an income statement based on facts provided. there is a template provided of to formulate it.

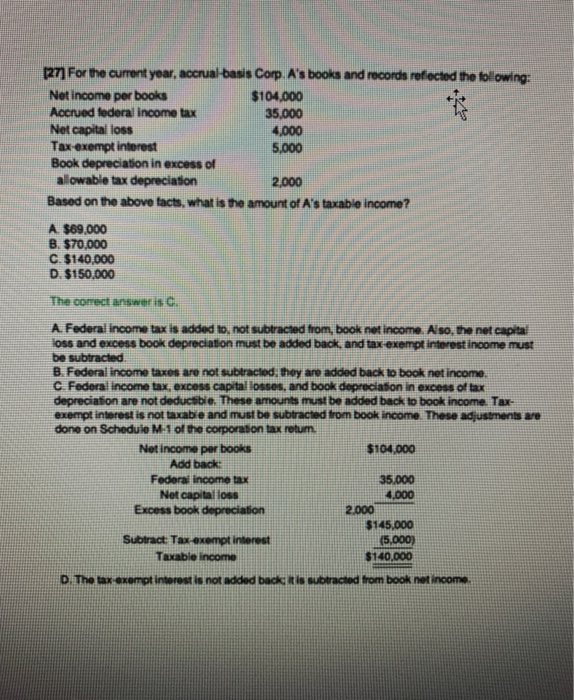

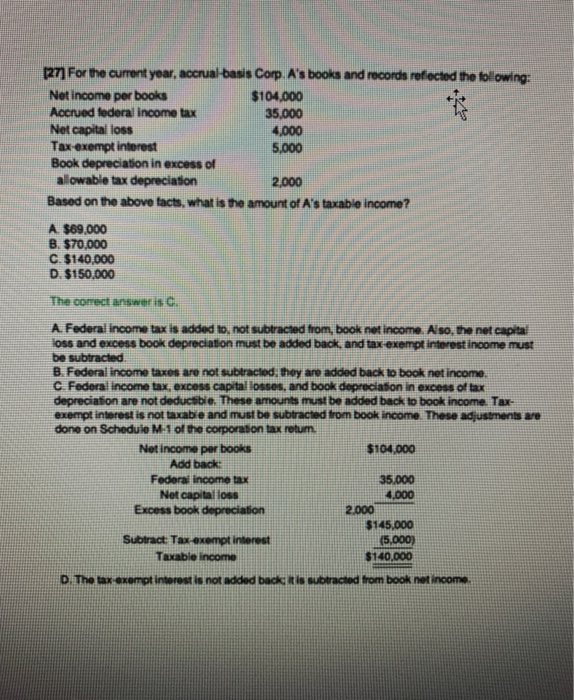

2.000 (27) For the current year, accrual refected the following: Net income per books $104,000 Accrued federal income tax 35,000 Net capital loss 4,000 Tax exempt interest 5.000 Book depreciation in excess of alowable tax depreciation Based on the above facts, what is the amount of A's taxable income? A. $69.000 B. $70,000 C. $140.000 D. $150,000 The correct answer is c. A. Federal income tax is added to, not subtracted from, book net income. Also, the net capital loss and excess book depreciation must be added back, and tax exempt interest income must be subtracted B. Federal income taxes are not subtracted, they are added back to book net income. C. Federal income tax, excess capital losses, and book depreciation in excess of tax depreciation are not deductible. These amounts must be added back to book income. Tax- exempt interest is not taxable and must be subtracted from book income. These adjustments done on Schedule M-1 of the corporation tax retum. Net income per books $104,000 Add back Federal income tax 35.000 Net capital loss Excess book depreciation 2.000 $145,000 Subtract Tax exempt interest (5,000) $140.000 D. The tax exempt interest is not added back tis subtracted from book net in 4.000 incos Sales Revenue Cost of Goods Sold Gross Profit 0 Assume zero Operating Expenses Depreciation Expense Operating Income: Assume $2.000 Other revenue (loss) Net capital Loss Interest Revenue Income Before Taxes Income Tax Expense Net Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started